Access global indices markets with tight spreads, reliable execution, and powerful platforms for professional traders.

Trade major global indices with advanced tools, tight spreads, and powerful trading platforms.

Trade major and minor currency pairs like EUR/USD and USD/JPY with speed and confidence.

Speculate on market moves in gold, crude oil, silver, and more.

Trade leading global indices like the S&P 500, NASDAQ, and FTSE 100.

Trade global stocks with leverage and profit from price movements.

Access global markets with flexible, low-cost futures trading.

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

EURUSD

EURUSD

|

-- | -- | -- | -- |  |

Trade now |

GBPUSD

GBPUSD

|

-- | -- | -- | -- |  |

Trade now |

USDJPY

USDJPY

|

-- | -- | -- | -- |  |

Trade now |

AUDUSD

AUDUSD

|

-- | -- | -- | -- |  |

Trade now |

USDCHF

USDCHF

|

-- | -- | -- | -- |  |

Trade now |

USDCAD

USDCAD

|

-- | -- | -- | -- |  |

Trade now |

NZDUSD

NZDUSD

|

-- | -- | -- | -- |  |

Trade now |

EURGBP

EURGBP

|

-- | -- | -- | -- |  |

Trade now |

EURJPY

EURJPY

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

GOLD

GOLD

|

-- | -- | -- | -- |  |

Trade now |

SILVER

SILVER

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

US30

US30

|

-- | -- | -- | -- |  |

Trade now |

US500

US500

|

-- | -- | -- | -- |  |

Trade now |

GER40

GER40

|

-- | -- | -- | -- |  |

Trade now |

EUR50

EUR50

|

-- | -- | -- | -- |  |

Trade now |

US2000

US2000

|

-- | -- | -- | -- |  |

Trade now |

US100

US100

|

-- | -- | -- | -- |  |

Trade now |

UK100

UK100

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

AAPL

AAPL

|

-- | -- | -- | -- |  |

Trade now |

MSFT

MSFT

|

-- | -- | -- | -- |  |

Trade now |

GOOG

GOOG

|

-- | -- | -- | -- |  |

Trade now |

AMAZON

AMAZON

|

-- | -- | -- | -- |  |

Trade now |

TSLA

TSLA

|

-- | -- | -- | -- |  |

Trade now |

FB

FB

|

-- | -- | -- | -- |  |

Trade now |

NFLX

NFLX

|

-- | -- | -- | -- |  |

Trade now |

DISNEY

DISNEY

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

US30ft

US30ft

|

-- | -- | -- | -- |  |

Trade now |

US100ft

US100ft

|

-- | -- | -- | -- |  |

Trade now |

US500ft

US500ft

|

-- | -- | -- | -- |  |

Trade now |

GER40ft

GER40ft

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

EURUSD

EURUSD

|

-- | -- | -- | -- |  |

Trade now |

GBPUSD

GBPUSD

|

-- | -- | -- | -- |  |

Trade now |

USDJPY

USDJPY

|

-- | -- | -- | -- |  |

Trade now |

AUDUSD

AUDUSD

|

-- | -- | -- | -- |  |

Trade now |

USDCHF

USDCHF

|

-- | -- | -- | -- |  |

Trade now |

USDCAD

USDCAD

|

-- | -- | -- | -- |  |

Trade now |

NZDUSD

NZDUSD

|

-- | -- | -- | -- |  |

Trade now |

EURGBP

EURGBP

|

-- | -- | -- | -- |  |

Trade now |

EURJPY

EURJPY

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

GOLD

GOLD

|

-- | -- | -- | -- |  |

Trade now |

SILVER

SILVER

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

US30

US30

|

-- | -- | -- | -- |  |

Trade now |

US500

US500

|

-- | -- | -- | -- |  |

Trade now |

GER40

GER40

|

-- | -- | -- | -- |  |

Trade now |

EUR50

EUR50

|

-- | -- | -- | -- |  |

Trade now |

US2000

US2000

|

-- | -- | -- | -- |  |

Trade now |

US100

US100

|

-- | -- | -- | -- |  |

Trade now |

UK100

UK100

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

AAPL

AAPL

|

-- | -- | -- | -- |  |

Trade now |

MSFT

MSFT

|

-- | -- | -- | -- |  |

Trade now |

GOOG

GOOG

|

-- | -- | -- | -- |  |

Trade now |

AMAZON

AMAZON

|

-- | -- | -- | -- |  |

Trade now |

TSLA

TSLA

|

-- | -- | -- | -- |  |

Trade now |

FB

FB

|

-- | -- | -- | -- |  |

Trade now |

NFLX

NFLX

|

-- | -- | -- | -- |  |

Trade now |

DISNEY

DISNEY

|

-- | -- | -- | -- |  |

Trade now |

| Symbol | Bid | High | Low | Daily Change | Trend | |

|---|---|---|---|---|---|---|

US30ft

US30ft

|

-- | -- | -- | -- |  |

Trade now |

US100ft

US100ft

|

-- | -- | -- | -- |  |

Trade now |

US500ft

US500ft

|

-- | -- | -- | -- |  |

Trade now |

GER40ft

GER40ft

|

-- | -- | -- | -- |  |

Trade now |

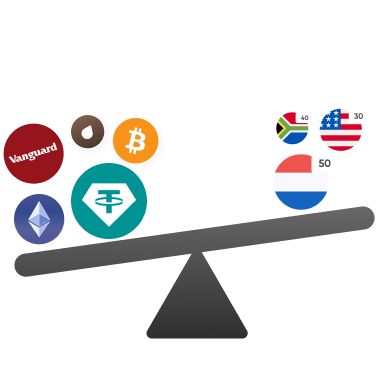

Seize trading opportunities on leading global indices with round-the-clock market access, even on weekends.

Benefit from our deep liquidity, supporting reliable execution even on larger index CFD trades.

Trade indices with competitive spreads and zero commissions.

Speculate with confidence on our award-winning web and mobile trading platforms designed for professionals.

Go long or short on global indices markets to capture opportunities in rising or falling conditions.

Analyse markets with precision using advanced charting, technical indicators, and powerful trading tools.

Trade indices CFDs with a secure, transparent, and globally trusted broker dedicated to your success.

Access real-time market insights to inform better index trading decisions and stay ahead of trends.

Select the intuitive WebTrader for fast index trading or the advanced MT5 platform for powerful features, ensuring secure, seamless access to global indices markets.

Explore hand-picked articles designed to help you trade indices smarter. Whether you’re starting out or levelling up, we’ve got the insights you need.

Indices track the performance of economies, industries, or sectors by grouping stocks. Popular indices include Dow Jones, S&P 500, DAX, and FTSE 100.

CMS Prime offers Indices CFDs with tight spreads across US, Europe, and Asia. Trade Spot or Futures with auto-roll contracts for seamless analysis and opportunities.

CFDs let you speculate on price movements without owning assets. Go long or short using leverage to capture profits from rising or falling index markets.

Indices are a financial instrument that measures the performance of a group of stocks from an exchange. They are used to track the performance of an economy, industry, or sector. Indices trading can be used as a hedge to overall stock positions or to speculate on the direction of the market.

There are no additional commission charges on all commodities products, only the spread.

Kindly refer to our Indices symbol specification table on our website or the symbol specifications on your trading terminal.

Index Futures are contracts for buying or selling a financial index to be settled at a future date. Hence, Future Indices contracts have an expiry date.

Spot Commodities have no expiry, hence there is no need to roll over the position.

Indices have fixed leverage. Kindly refer to our Indices symbol specification table on our website or the symbol specifications on your trading terminal.

Whether you’re placing your first trade or managing a full portfolio, our dedicated support team is here to back you up.

From forex trading platform walkthroughs to account queries, get expert help that’s fast, friendly, and focused on solutions – available 24/7.