Current Factors Influencing Current Crude Oil Prices:

- Oil prices saw an increase on Wednesday as market participants were concerned about potential disruptions in crude and fuel availability, prompted by Ukrainian strikes on Russian oil refineries and the possibility of the conflict between Israel and Hamas.

- Meanwhile, U.S. West Texas Intermediate (WTI) crude futures for May edged up by 8 cents, or 0.08%, to stand at $85.20 a barrel.

- Both Brent and WTI experienced a 1.66% increase in the session prior, marking their highest levels since October.

- The price increase was fueled further by a drone strike by Ukraine on an additional Russian refinery, posing a risk of further reducing Russia’s refining capabilities, which could lead to lower gasoline and diesel production. Russia is recognized as one of the top oil producers worldwide and a leading exporter of oil products.

- Geopolitical tensions are maintaining the uncertainty around possible supply interruptions, with oil prices maintaining their ascent to a five-month peak and showing signs of continuing their upward trajectory.

- Preliminary data also indicates a decline in oil inventories in the U.S., the largest consumer of oil globally, following reports on Tuesday from the American Petroleum Institute which indicated a reduction of 2.3 million barrels in crude stocks last week. This decrease surpassed the 1.5 million barrel drop anticipated by analysts in a Reuters survey.

- The U.S. is scheduled to release government inventory data at 1430

- At a meeting scheduled for Wednesday, a ministerial panel from OPEC and its allies, including Russia, collectively known as OPEC+, is not expected to propose any changes to oil output policies, according to information from five OPEC+ sources as reported by Reuters.

- The anticipation of a surge in energy demand from China is fueled by recent data indicating the first increase in manufacturing activity in half a year. The official Manufacturing Purchasing Managers’ Index (PMI) for March climbed to a surprisingly high 50.8 from 49.1 in February. This data highlighted not only a rebound in new export orders for the world’s second-largest economy, breaking an 11-month downturn, but also a deceleration in the rate of job losses.

- Expectations for energy demand growth in the US are similarly optimistic, following a report from a leading industry group that noted a recovery in production for March. The Manufacturing PMI rose to 50.3, up from 47.8 in February, marking its highest level and the first instance above 50 since September of the previous year.

Technical and Fundamental Analysis

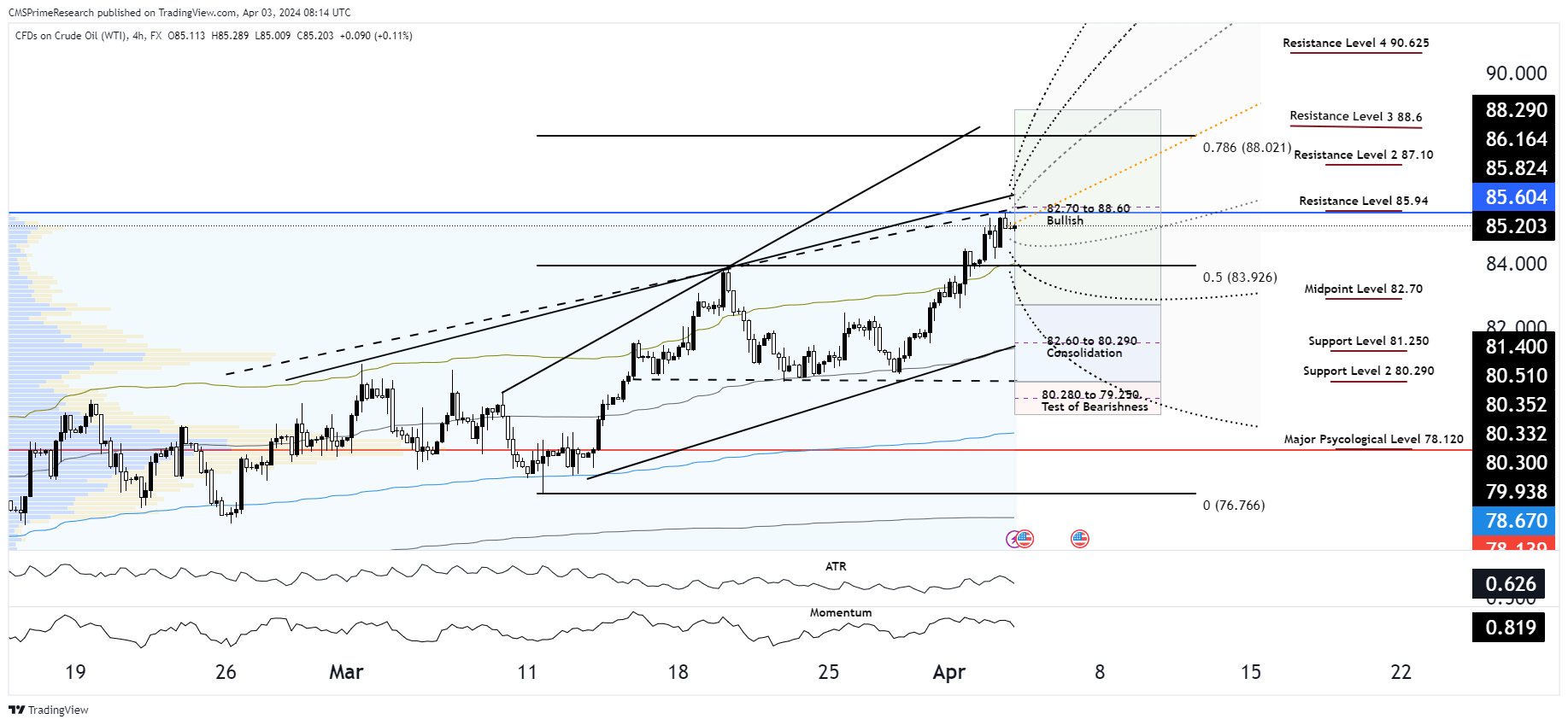

Chart Overview and Price Action

Technical Analysis:

Trend: WTI in an upward trend within an ascending channel, currently testing the upper boundary. This is indicative of bullish momentum but also suggests a potential area of resistance.

Support and Resistance:

- Immediate Resistance Levels: $87.10 (Resistance Level 2) and $88.021 (0.786 Fibonacci level).

- Key Support Levels: $81.250 (Support Level 1) and $80.290 (Support Level 2).

Moving Averages: The price is currently above both the short-term and long-term moving averages, reinforcing the bullish trend.

Momentum Indicators: Momentum is positive as indicated by the upward slope of the ATR, but caution is warranted as the price approaches resistance levels where reversals could occur.

Fundamental Analysis:

Supply Disruptions: Strikes on Russian refineries are bullish for oil prices due to potential supply constraints.

Geopolitical Tensions: The ongoing conflict in Eastern Europe and the Middle East contributes to the risk premium in oil prices, supporting the uptrend.

US Inventory Data: The reported decrease in U.S. crude inventories is a bullish signal, suggesting strong demand which may underpin higher prices.

China’s Manufacturing PMI: The increase in China’s PMI is a positive sign for demand, especially considering the country’s significant impact on global oil consumption.

Scenario Forecasts:

Bullish Scenario (50% Probability): Continued geopolitical tensions and declining US inventories push prices higher.

- Price Targets:

- First Target: $87.10 (current resistance)

- Second Target: $88.60 (upper channel boundary)

- Stretch Target: $90.625 (Resistance Level 4)

- Price Targets:

Bearish Scenario (30% Probability): A resolution to geopolitical conflicts or an unexpected increase in supply could trigger a reversal.

- Price Targets:

- First Target: $81.250 (Support Level 1)

- Second Target: $80.290 (Support Level 2)

- Stretch Target: $78.120 (Major Psychological Level)

- Price Targets:

Neutral Scenario (20% Probability): Market consolidation due to mixed signals or awaiting new catalysts.

- Price Targets: Trading within the $82.60 to $80.290 consolidation zone.

Overall Market Sentiment:

- Positive: 50% based on supply disruptions, geopolitical tensions, and strong demand signals from the US and China.

- Negative: 30% acknowledging potential bearish reversals due to market adjustments or surprise supply increases.

- Neutral: 20% reflecting the possibility of a temporary balance in market forces.

Traders and analysts should monitor upcoming inventory reports, OPEC+ meetings, and geopolitical developments closely, as these factors will heavily influence the near-term direction of oil prices.

Price analysis and Targets:($89-$81)

Strategy Overview

The strategy is designed to capitalize on the current bullish momentum while being cognizant of the potential for reversals or consolidation. Given the current price position within the ascending channel, we will use a combination of limit and stop orders to manage risk and capture potential upside or downside movements.

Bullish Bias Strategy

Entry Point: Considering the current price ($84.95) is below the immediate bullish target ($87.10), an entry point could be set slightly above the current price to capitalize on the upward trend. An entry around $85.25 could be strategic, allowing for confirmation of continued bullish momentum.

Stop-Loss: To manage risk, a stop-loss could be placed just below the lower boundary of the current bullish channel and key support level, around $82.50. This protects against unexpected downturns.

Take-Profit Targets: Set the first take-profit order at $87.10 (near the first bullish target). A second take-profit can be placed at $88.60 (upper channel boundary), with a stretch target of $90.625 if momentum persists.

Bearish Reversal Strategy

Given the bullish outlook, a bearish strategy would primarily be defensive, aimed at capitalizing on unexpected reversals.

Entry Point: Should bearish signals emerge, consider entering a short position if the price breaks below $82.60, indicating potential for a move toward bearish targets.

Stop-Loss: A stop-loss for a bearish position could be placed above the last support-turned-resistance, around $84.00, to minimize losses if the market quickly rebounds.

Take-Profit Targets: The first bearish target would be $81.250, with a secondary target at $80.290. A stretch goal could be set at $78.120 if a significant downturn occurs.

Considerations and Adjustments

Monitoring: Closely monitor oil market news, especially updates on geopolitical events, inventory reports, and OPEC+ meetings, as these could significantly impact price movements and necessitate strategy adjustments.

Flexibility: Be prepared to adjust stop-loss and take-profit orders based on market conditions. If the bullish momentum significantly exceeds expectations, revising the stretch target and managing positions to capture additional gains may be prudent.

Risk Management: Given the inherent uncertainties in oil markets, especially with geopolitical tensions, it’s crucial to manage risk through prudent position sizing and by not allocating more than a predetermined percentage of the portfolio to this single trade.

This strategy leverages the mathematical insights from the price targets and market analysis, aiming to balance risk and reward in a volatile market environment. Adjustments should be made as new information becomes available or if the market dynamics shift significantly from the current analysis.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.