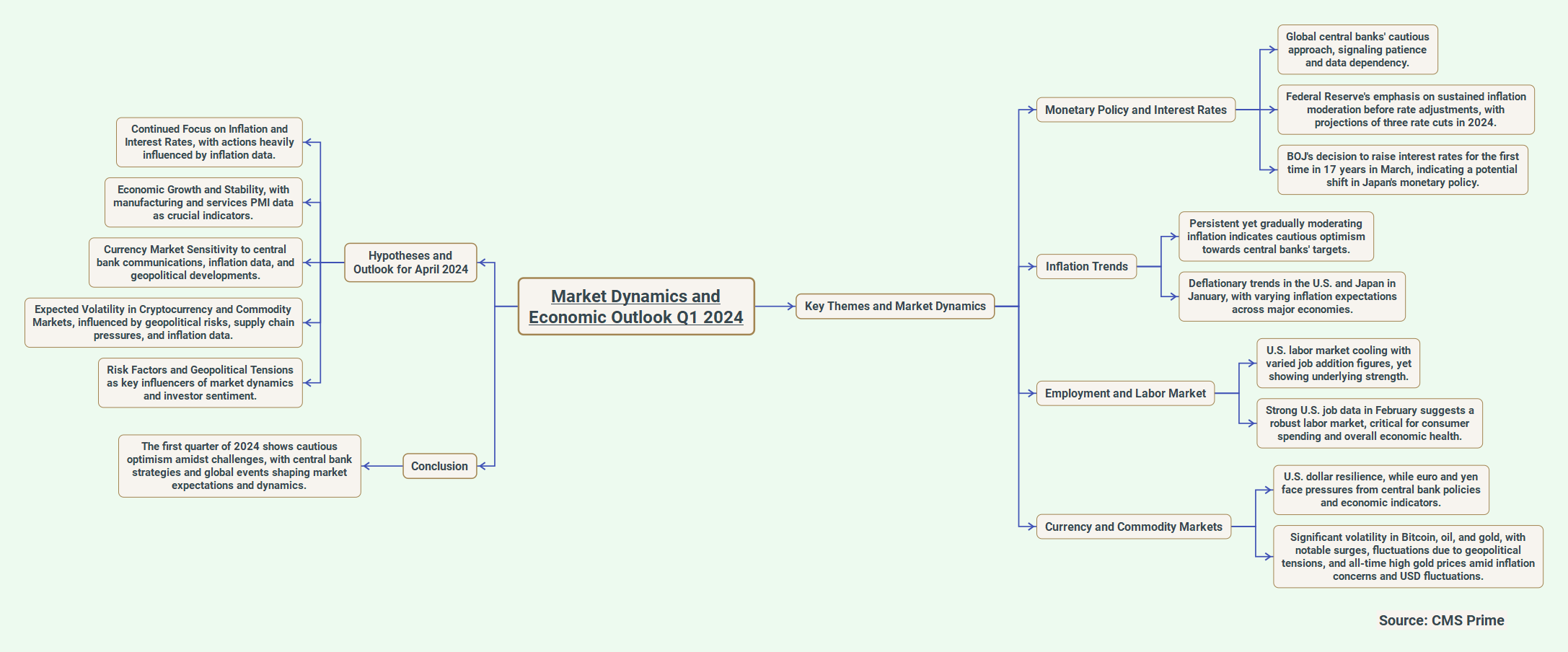

Mapping the Key Themes and Market Dynamics:

Monetary Policy and Interest Rates:

- Central banks around the world, such as the Federal Reserve, ECB and BOJ, are taking a careful approach to monetary policy, showing patience and reliance on data.

- The Federal Reserve has highlighted the importance of seeing consistent signs of inflation easing before considering any changes to interest rates, projecting three rate cuts in 2024.

- The unexpected move by the BOJ to increase interest rates for the first time in 17 years in March hints at a potential shift in Japan’s traditional monetary policy.

Inflation Trends:

- A steady but gradually decreasing inflation trend brings a sense of cautious hope towards meeting the targets set by central banks.

- Both the U.S. And Japan witnessed deflationary patterns in January, with different expectations regarding inflation across major economies.

Employment and Labor Market: The job market in the United States seems to be losing some steam, with varying numbers of new jobs being added, although it still demonstrates a solid foundation. The positive employment data from February in the U.S. Indicates a healthy job market that is crucial for consumer spending and overall economic well being.

As for the currency and commodity markets, the U.S. Dollar has shown strength compared to the euro and yen, which have been under pressure due to central bank policies and economic signals. Bitcoin, oil and gold have all seen significant fluctuations recently; Bitcoin has surged to record highs, oil prices have been unstable due to geopolitical tensions and gold prices have reached unprecedented levels amidst worries about inflation and fluctuations in the U.S. Dollar.

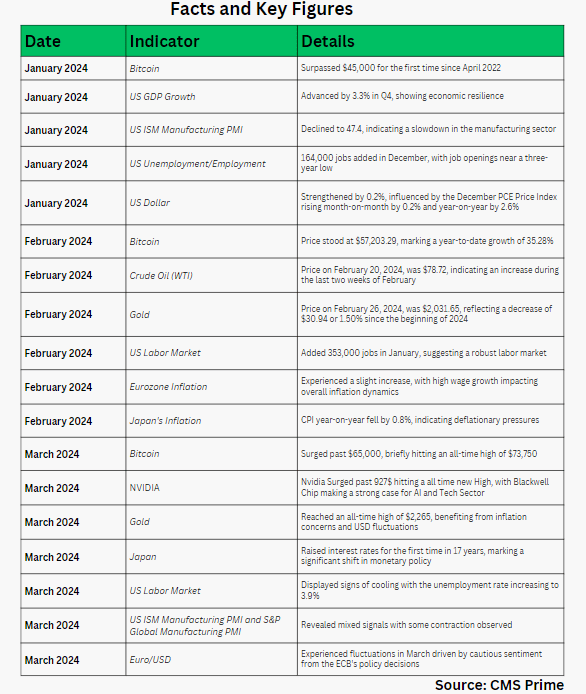

Market Sentiment Overview for January 2024:

Positive:40%,Negative: 40%,Neutral:20%

The sentiment in January appeared evenly divided between positive and negative tones. The growth of the US GDP by 3.3% in Q4 suggested economic strength, contributing to the positive outlook. However, concerns about a potential global economic slowdown, especially in China and possible stagnation in Germany, coupled with deflationary trends in the US and Japan, painted a cautious picture. The fluctuations in Bitcoin and commodities reflected investor uncertainty, leading to a balanced sentiment.

Market Sentiment for February 2024:

Positive: 50%,Negative: 30%, Neutral: 20%

February leaned slightly towards positivity. Strong job growth data from the US with an addition of 353,000 jobs in January indicated a robust labor market, typically boosting consumer spending and economic well being. Despite inflation surpassing targets, the Federal Reserve’s stance on no immediate rate cuts signaled prudence, which may have prompted some investor caution. The positive performance of technology stocks, especially Nvidia’s favorable earnings report, likely contributed to the optimistic sentiment during this period.

March Market Sentiment Update for March 2024:

Positive: 60%, Negative:25%, Neutral:15%

In March, there was a noticeable increase in positive market sentiment, with a 60% favorability rate. The record highs seen in Bitcoin and gold, along with the cautiously optimistic statements from central banks, likely boosted investor confidence. Japan’s unexpected interest rate hike after 17 years could indicate a shift towards economic recovery, usually viewed positively by markets. However, the slight uptick in unemployment to 3.9% and mixed signals from the manufacturing sector (PMI data indicating some contraction) maintained some level of pessimism among investors.

Justifications, Rationale and Narratives:

Cautious Optimism:

The prevailing narrative across the first quarter of 2024 is one of cautious optimism. Central banks’ patience and data-dependent stance, particularly the Federal Reserve and ECB, signal an era of careful navigation through inflationary pressures and economic growth needs. This cautious optimism is anchored on the gradual moderation of inflation and the anticipation of potential rate cuts in 2024, despite the existing uncertainties in global economic recovery.

Interest Rate and Inflation Dynamics:

Investors are closely monitoring inflation trends and central banks’ responses. The persistent yet moderating inflation and the strategic adjustments in interest rates, such as the BOJ’s decision to raise rates for the first time in 17 years, serve as a testament to the shifting monetary policy landscape. These factors collectively influence investor sentiment and currency market dynamics, with a keen focus on the timing and nature of rate adjustments.

Sector-Specific Movements:

The technology sector, highlighted by Nvidia’s robust performance due to strong demand for AI chips, reflects investor optimism in areas of innovation and digital transformation. Conversely, the manufacturing sector faces challenges, as indicated by mixed PMI data, suggesting sector-specific investment approaches.

- Bitcoin’s significant volatility and its surge to new highs reflect the growing interest and speculative investment in cryptocurrencies as a hedge against inflation and currency devaluation, amid economic uncertainties.

- The increasing tensions in regions like the Middle East and their effects on global trade and commodity prices, especially oil, are key factors that investors are keeping an eye on. The market stability and performances of different sectors could be affected by these tensions directly or indirectly.

- There is a growing concern about a potential economic slowdown, as indicated by mixed signals from labor markets and manufacturing sectors in major economies. This uncertainty is influencing investors to be more cautious. Balancing economic growth with managing inflation remains a significant focus.

- Technology stocks, particularly those in AI and semiconductor fields, are considered major players due to their potential for growth amid digital transformation trends. Despite challenges in manufacturing, the service sector’s resilience offers investment possibilities as well.

- The policies and communications of central banks play a crucial role in shaping market expectations and investment decisions. Speculation about rate cuts based on inflation trends and economic indicators is affecting currency movements and overall market sentiment.

- Investors interest in safe haven assets like gold, which has seen record highs, reflects concerns about inflation. This approach indicates a defensive stance in response to uncertainties in monetary policy and economic prospects.

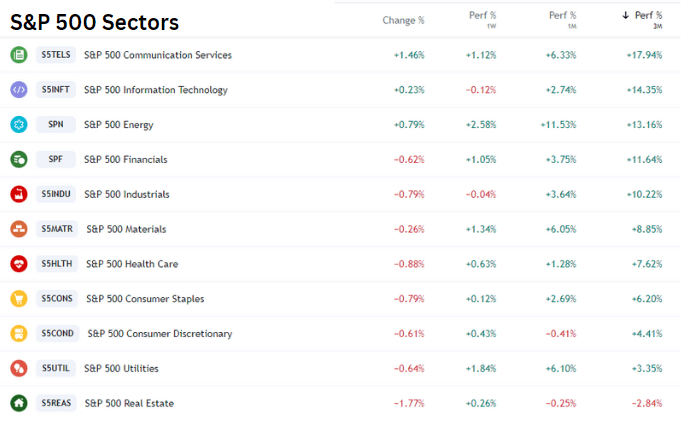

Other Sectors Performances:

The Communication Services sector recently saw a slight decline of 1.46%, indicating a short term bearish trend for the week, with a further decrease of 1.12%. However, there have been notable gains of 6.33% and 17.94% over the past 1 month and 3 month periods, suggesting a strong recovery in the medium term.In Energy, there was a short term decline of 0.79% and a more significant drop of 2.58% over the week. Despite this volatility, the sector experienced impressive growth of 11.53% in the last month and 13.16% in the last three months, reflecting overall robust performance driven by market dynamics. Financials witnessed a recent decrease of 0.62%, showing relatively less fluctuation compared to other sectors like Communication Services and Energy stocks. There was a modest gain of 1.05% over one week, while performance over one month and three months showed moderate increases of 3.75% and 11.64%, respectively, indicating stability possibly influenced by economic factors and interest rates.Industrials (XLI): The recent shift of 0.79% in this sector is similar to Energy, indicating little change over the past week ( 0.04%). However, looking at the performance over 1 month and 3 months, there is a contrast. A modest increase of 3.64% in 1 month and a more noticeable uptick of 10.22% over 3 months. This trend could hint at a gradual recovery or expansion for industrials as market conditions evolve positively.

Whats Factors to Price in the Coming Months?

1. Monetary Policy Adjustments Amid Inflation Trends

- Justification: With the Federal Reserve, ECB, and BOJ showing a cautious yet responsive stance towards inflation, the market is pricing in potential rate adjustments based on sustained evidence of inflation moderation. The first quarter has shown a gradual moderation in inflation, which, if continues, could justify expectations for policy easing or rate cuts in late 2024.

- Outlook: Investors will closely monitor central banks’ communications and inflation data. A pivotal factor will be the balance between stimulating economic growth and preventing inflation overshoots, influencing investment strategies, especially in fixed income and currency markets.

2. Technology Sector Resilience and Innovation Drive

- Justification: The robust performance of technology companies, particularly those involved in AI and semiconductors, underscores the sector’s growth potential amidst global digital transformation trends. Nvidia’s revenue forecast exceeding expectations is a case in point, highlighting investor confidence in technology as a key driver of market momentum.

- Outlook: Continued investment in and focus on technology and innovation-driven sectors are expected, with investors looking for companies that offer strong growth prospects, innovation capabilities, and resilience to broader economic pressures.

3. Cryptocurrency Market Volatility and Adoption

- Justification: Bitcoin’s significant volatility and its new all-time high reflect growing investor interest and speculative investment, amidst uncertainties in traditional markets. Cryptocurrency is increasingly viewed as a hedge against inflation and a viable investment class, despite its inherent risks.

- Outlook: The cryptocurrency market will continue to be a focal point for speculative investment and portfolio diversification. Regulatory developments and broader institutional adoption could further legitimize this asset class, influencing its volatility and market dynamics.

4. Geopolitical Risks and Commodity Market Fluctuations

- Justification: Geopolitical tensions, particularly in the Middle East, have impacted commodity markets, with oil prices showing significant fluctuations. These tensions, alongside other global uncertainties, play a critical role in shaping market sentiments and investment flows into commodities.

- Outlook: Commodity markets, especially oil and gold, will remain sensitive to geopolitical developments. Investors may increase their allocations to commodities as a hedge against geopolitical risks and inflation, closely monitoring global political landscapes for potential impacts on supply chains and pricing.

5. Global Economic Recovery and Sector-Specific Trends

- Justification: The gradual economic recovery, as evidenced by improvements in labor markets and consumer spending, combined with challenges in manufacturing sectors, suggests a complex and uneven recovery path across different economies and sectors.

- Outlook: Investors will likely adopt a more granular approach, focusing on sectors that demonstrate resilience and growth potential amidst the recovery, such as services and technology, while remaining cautious of sectors more vulnerable to ongoing economic uncertainties. This includes a keen eye on consumer behavior changes, supply chain adaptations, and sector-specific recovery indicators.

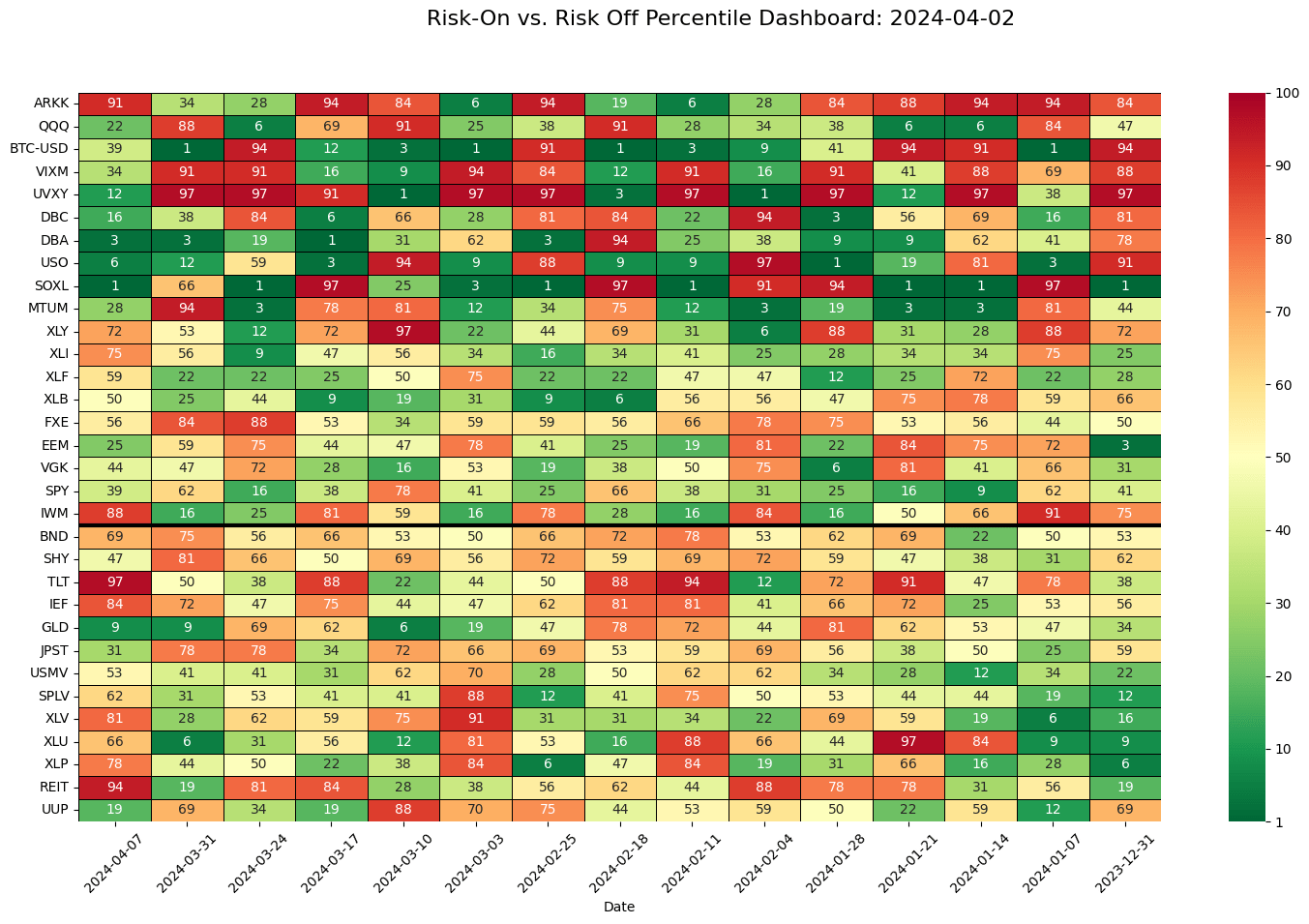

Evolution of Risk On and Risk Off Sentiments:

Overview of January to March 2024:

Early 2024 (January. Early February):

At the beginning of the year, there were indications of cautious investor sentiment, especially towards assets like ARKK, QQQ and Bitcoin as seen in the heatmap showing a ‘Risk Off’ trend. This cautious approach could be linked to concerns raised in the January regarding deflationary patterns in the US and Japan, as well as economic pressures in the Eurozone. The decision by the Federal Reserve to hold off on immediate rate cuts despite moderate inflation may have played a role in investors being more careful, reflected in elevated ‘Risk Off’ scores for assets like TLT and SHY known for their stability during uncertain times.

Mid February:

By mid February, there was a noticeable shift towards a ‘Risk On’ attitude in certain asset categories like IWM (small cap stocks) and SOXL (semiconductor ETF), indicating an increased appetite for risk taking.This change could be attributed to positive job data from the US indicating a strong job market, along with optimism surrounding Nvidia’s earnings which signals confidence in the growth potential of the technology sector.

March:

In March, the market sentiment leaned more towards taking risks, showing a positive attitude across various assets such as stocks (such as SPY and QQQ) and sectors focused on growth (like ARKK). March suggests that despite a slowdown in job opportunities, there was still strength in the economy, with robust non farm payrolls. The surge of Bitcoin to its highest value ever and the resilience displayed by the service industry may have boosted investor morale, influencing the shift towards a more risk friendly sentiment.

Looking at the current period (April 2024), the sentiment seems balanced with some preference for safer assets like TLT and GLD indicating a slight move back towards caution. At the same time, there is still confidence in technology focused assets like QQQ and SOXL, signaling ongoing trust in that sector.The current balance in the market seems to reflect how investors are absorbing the cautious optimism expressed by central banks regarding moderating inflation and getting ready for possible interest rate cuts later in the year. Additionally, the mixed sentiment could be influenced by geopolitical risks impacting commodity markets, with gold (GLD) typically performing well during uncertain times.

Comparison:

A comparison between early 2024 and the present period reveals a cyclical pattern in risk sentiment, where investors shift between ‘Risk On’ and ‘Risk Off’ modes. While there’s been a growing trend towards ‘Risk On’ sentiment, particularly in sectors focused on growth and innovation, periods of ‘Risk Off’ sentiment indicate underlying uncertainties and a precautionary approach to potential risks. The shift in market sentiment from January to April 2024 indicates that investors are navigating between confidence in specific sectors and overall market caution due to uncertainties around policies, inflation pressures and geopolitical tensions. Even as there’s a move towards riskier assets like technology stocks, the sustained interest in traditional safe havens such as gold suggests a prevailing sense of risk aversion stemming from ongoing global uncertainties.The dynamics of the market reflect a delicate balance between optimism about the growth potential of certain sectors, particularly in technology and a cautious approach due to central bank policies and global uncertainties. This nuanced dance of sentiments is expected to continue as fresh economic data emerges and geopolitical events develop. Investors are managing their positive outlook on growth with a careful approach that allows for swift adjustments in reaction to shifts in economic signals or external disruptions.

Analysis of Market Volatility:

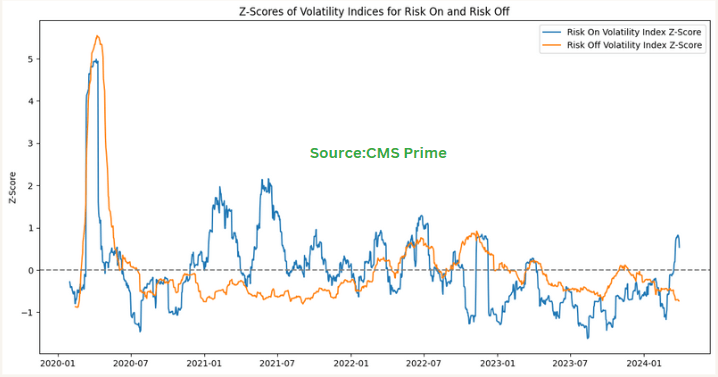

Z-Score Interpretation

Z-scores are statistical measures that describe a value’s relationship to the mean of a group of values, measured in terms of standard deviations. If the Z-score is 0, it indicates that the data point’s score is identical to the mean score. A Z-score of 1.0 would signify a value that is one standard deviation from the mean. Z-scores can be positive or negative, with a negative score indicating a value below the mean.

By the end of 2023, showed a recovery in the tech industry and a positive trend in the stock market overall. The tech sector, boosted by advancements in AI, experienced notable growth, possibly linked to reduced volatility in lower risk investments and increased optimism towards higher risk opportunities.

Moving into early 2024, the Federal Reserve hinted at potential changes in interest rate policies by considering rate cuts, leading to a surge in both stock and bond markets. This shift typically signals a more optimistic market sentiment as investors anticipate economic improvements due to lower interest rates. During the first quarter of 2024, despite strong employment numbers and stable consumer spending, concerns arose regarding inflation and global tensions. The job market data and discussions around possible rate cuts by central banks throughout 2024 may have contributed to a decline in risk aversion as depicted on the chart. However, ongoing worries about rising prices and global tensions, such as the Russia Ukraine conflict and unrest in the Middle East, may have prevented a more significant drop in market volatility associated with risk aversion.

Current Situation (Early 2024):

Lately, there seems to be an uptick in market stress or uncertainty as shown by the increase in the Risk On volatility index. This could be linked to mixed signals about the economy and central banks cautious approach as they address inflation concerns and growth requirements highlighted in the March 2024 . The recent rise in the Risk Off volatility index might indicate that investors are starting to protect themselves against potential market declines due to these uncertainties.

The analysis of market volatility from late 2023 to early 2024 reveals a dynamic interaction between investor confidence fueled by market recovery and technological advancements and prudence stemming from inflation concerns and geopolitical risks. The Z scores on the chart depict these changing sentiments. Periods of lower Risk Off volatility correspond with stronger market performance and higher investor trust, whereas increases in Risk Off volatility signal growing caution and aversion to risk. The way the market reacts to economic signals and government announcements will probably keep influencing the ‘Risk On’ and ‘Risk Off’ feelings as we head into 2024.

Conclusion

The outlook for April 2024 carries a mix of cautious optimism, influenced by how policymakers are responding to inflation, economic growth signals and global tensions. The strategies adopted by central banks, particularly in managing interest rates and inflation, will be pivotal in navigating the intricate dynamics of the market. The strength of sectors like manufacturing and services, as indicated by PMI data, along with the performance of the labor market and consumer spending, will greatly impact the global economic recovery and stability. Moreover, the reaction of currency markets to central bank communications, coupled with ongoing fluctuations in cryptocurrency and commodity markets, showcases the complex web of factors shaping investor sentiment and market trends.

Investors are treading carefully through this landscape with a blend of strategic optimism and risk awareness. They are focusing on adaptability in their investment strategies to seize emerging opportunities while safeguarding against potential downturns. The initial months of 2024 have witnessed a gradual shift towards a more positive outlook driven by encouraging signs in labor markets and technology sector performance. Despite concerns about inflation and geopolitical risks looming large on the horizon, this cautious optimism is complemented by a defensive approach towards safe haven assets – underscoring a nuanced balance between confidence in sectoral growth (especially in technology) and broader market vigilance. As fresh economic information emerges and geopolitical events develop, market trends are expected to mirror this intricate interplay of sentiments, where the decisions of central banks and global stability will remain pivotal in influencing market sentiments and perspectives.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.