Current Factors Influencing Current Gold Prices:

- Gold prices reached a new record high for the fifth consecutive time on Thursday as Federal Reserve officials reiterated expectations of interest rate cuts in 2024, although the timing remains uncertain, while traders anticipate crucial U.S. jobs data.

- Michael Langford, chief investment officer at Scorpion Minerals, noted that the depreciation of global currencies against the U.S. dollar is a primary driver for the surge in gold prices, as investors seek gold as a hedge against currency devaluation. Langford emphasized the potential for a 10% correction in gold prices if the Federal Reserve maintains the current interest rate throughout the year instead of implementing rate cuts.

- Federal Reserve officials, including Chair Jerome Powell, continued to stress the need for further discussion and data before deciding on interest rate cuts, a move expected by financial markets in June.

- The U.S. jobs report for March is scheduled for release on Friday, with new inflation data expected next week.

- Langford added that if the non-farm payrolls report meets or falls below expectations, indicating weakness in the job market, it could bolster the case for an interest rate cut, which would be positive for gold.

- Lower interest rates diminish the opportunity cost of holding gold, contributing to its attractiveness as an investment.

- Singaporean bank OCBC expressed optimism about gold prices, citing expectations of global easing measures, ongoing central bank gold purchases, and gold’s role as a geopolitical hedge.

- The gold rally is seen as extended beyond the peak of Bollinger bands, with many traders holding long positions at the end of March, likely even more now.

- The possibility of intervention by the Bank of Japan could trigger a significant increase in gold prices.

- Powell stated that if the economy progresses as expected, he and his Fed colleagues largely agree that lowering the policy interest rate will be appropriate “at some point this year.”

- According to the CME Group’s FedWatch Tool, traders are pricing in a 60% probability of the Fed beginning rate cuts in June, further diminishing the opportunity cost of holding gold.

- The U.S. dollar will remain strong in the coming months, as markets push back against expectations for the timing and scale of Fed interest rate cuts.

- Russia’s finance ministry announced plans to more than double its purchases of foreign currency and gold in the month ahead.

- Hedge funds closed the first quarter with gains across various strategies, benefitting from a rally in stocks, commodities, and the dollar, which helped offset a less favorable period for bonds.

Fundamental and Technical Analysis

Technical Outlook:

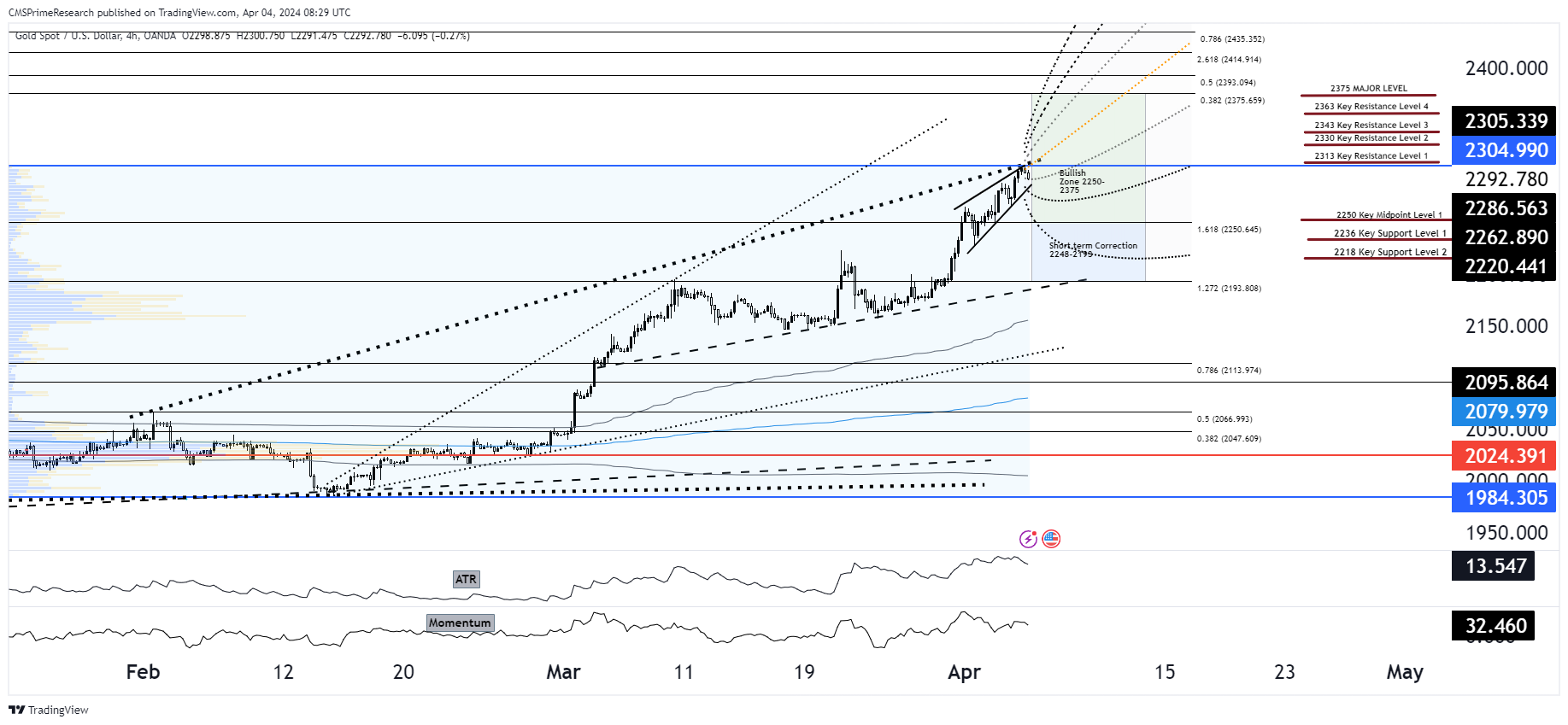

The chart presents a gold market that has been on a remarkable rally, with recent price action suggesting a consolidation phase may be approaching:

Resistance and Support Levels:

- Gold has hit a new peak, with resistance now likely to form around the $2300 – $2400 levels due to psychological barriers and the upper Bollinger band.

- Support is found near $2220, which aligns with recent breakout points and Fibonacci levels.

Fibonacci Levels and Trend Lines:

- The market is respecting the Fibonacci extension levels, with the 1.272 extension near $2199 acting as potential support.

- The steep uptrend is also noticeable, with the trendline support that may provide bounce-back strength in case of a pullback.

Indicators:

- The ATR suggests high volatility remains, which is typical in markets experiencing rapid price ascents.

- The Momentum indicator, while still on the higher side, shows signs of plateauing, indicating a potential slowing in the bullish momentum.

Fundamental Context:

Fundamental factors are significantly influencing the current bullish sentiment:

Federal Reserve’s Rate Decision:

- The expectation of interest rate cuts is fueling gold’s rally as it decreases the opportunity cost of holding the non-yielding asset.

Currency Devaluation Concerns:

- Depreciation of global currencies against the U.S. dollar is leading investors to seek refuge in gold as a hedge.

U.S. Jobs Data and Inflation Reports:

- Upcoming U.S. jobs data and inflation reports are crucial for shaping expectations about the Fed’s policy moves.

Sentiment Forecast:

Continued Rally (40% Probability):

- A weaker dollar, dovish Fed statements, or poor job data could drive gold towards $2375.

- Price Target: $2330- $2375

- Sentiment Analysis: The market remains predominantly bullish, factoring in rate cuts and geopolitical tensions.

Correction Phase (35% Probability):

- A stronger-than-expected jobs report or hawkish Fed rhetoric may lead to a correction, with gold prices retreating to retest support levels.

- Price Target: $2220 – $2200

- Sentiment Analysis: A correction would bring about a more cautious sentiment, with potential rate cuts being priced in more conservatively.

Sideways Movement (25% Probability):

- Absence of new catalysts could result in gold entering a consolidation phase, oscillating between recent highs and established support levels.

- Price Target: Trading range within $2220 – $2280

- Sentiment Analysis: A neutral sentiment may emerge as the market awaits clearer directional cues from economic data.

Target Levels and Analysis--- 2313-2335 or 2248-2200

Strategy Components

1. Positioning for Continued Rally (Bullish Scenario)

- Entry Point: A cautious entry would be advised given the current price level. Consider entering a long position if gold retraces slightly to $2280 or shows strong momentum breaking through the current level, indicating a continuation of the rally.

- Stop-Loss: To mitigate risk, set a stop-loss at $2248, just below the lower range of the bullish scenario’s starting point, to protect against sudden downturns.

- Take-Profit Targets: Set the first take-profit level at $2330, aligning with the lower end of the first bullish target. Given the strength of the rally, placing a second take-profit at $2375 (the stretch target) could capture additional upside from continued bullish momentum.

2. Preparing for a Correction (Bearish Scenario)

- Entry Point: If signs of a correction emerge, such as stronger-than-expected jobs data or hawkish Fed rhetoric, consider shorting gold at a break below $2248, which could indicate the beginning of a downward trend.

- Stop-Loss: Place a stop-loss around $2292, just above the current price, to limit losses if the market quickly rebounds.

- Take-Profit Targets: The primary target for a bearish move would be at $2200, with a stretch goal to capture further downside at $2191, near the 1.272 Fibonacci extension level, suggesting a significant retracement.

3. Neutral Strategy (Sideways Movement)

- Range Trading: In the event of a consolidation phase, engage in range trading between $2248 and $2313. Buy near the lower end of the range and sell near the upper end, capitalizing on the volatility within the established boundaries.

- Stop-Loss: For trades within this range, set a tight stop-loss just outside the expected trading zone to minimize exposure to unexpected breakouts or breakdowns.

Strategy Adjustments and Considerations

- Monitoring Economic Indicators: Pay close attention to the release of U.S. jobs data and inflation reports, as these will be pivotal in shaping Fed policy expectations and, by extension, gold prices.

- Federal Reserve Announcements: Stay alert to any statements from Federal Reserve officials regarding interest rate adjustments. Any indication of a delay or advancement in rate cuts could significantly sway market sentiment and necessitate strategy revisions.

- Global Currency Fluctuations: Given gold’s status as a hedge against currency devaluation, monitor major currency movements, especially the USD, as these can influence gold’s appeal to investors.

- Risk Management: Adjust position sizes based on the volatility and risk profile of the gold market. Given the current elevated levels, conservative positioning may mitigate potential losses from unexpected market turns.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.