Trend Perspective and Justifications:

The combination of the Envelope Channel and the Chaikin Oscillator provides a systematic approach to trading, leveraging mean reversion and momentum. While it offers clear benefits in terms of defined criteria and the incorporation of volume as a confirmation, traders must be aware of its limitations, including the potential for false signals and the need for active trade management.

Positives:

- Mean Reversion Principle: The use of the Envelope Channel, set with a specified length and percentage, capitalizes on the mean reversion principle. This suggests that prices tend to revert back to an average over time. Trading on deviations from this envelope allows for potentially high-probability entries when prices are extended.

- Volume Confirmation: The Chaikin Oscillator, a volume-based indicator, provides a secondary confirmation, ensuring that moves outside the envelope are backed by momentum. This can filter out false signals, as volume often precedes price movements.

- Defined Entry and Exit Points: The strategy provides clear, objective criteria for entry and exit points, reducing the emotional and psychological biases that can affect trading decisions.

- Adaptability: It can be adapted to various time frames and markets, making it versatile for different trading styles and objectives.

Negatives:

- False Breakouts/Breakdowns: Markets can occasionally move outside the envelope channels on news or events without mean-reverting in the expected timeframe. This can lead to false signals and potential losses.

- Lagging Indicators: Both the Envelope Channel and the Chaikin Oscillator are lagging indicators. They rely on past price and volume data, which may not always accurately predict future movements.

- Over-Optimization Risk: There is a risk of over-optimizing the parameters (length and percentage of the envelope, settings of the Chaikin Oscillator) to past data, which might not perform well in future market conditions.

- Requires Active Management: This strategy may require constant monitoring and adjustment, especially in fast-moving or volatile markets. It may not be suitable for those unable to dedicate the time to actively manage their trades.

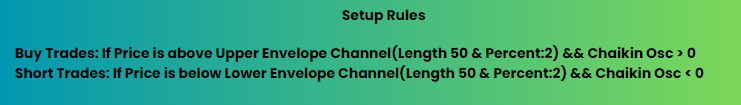

Signal Conditions for Trading Strategy:Effectiveness and Robustness

For the strategy, which involves price movements relative to an upper and lower envelope channel, and momentum as indicated by the Chaikin Oscillator, performance can be influenced by several factors, including market volatility, trend strength, and the asset’s characteristic behaviors.

The Strategy:

Trend Reversals and Momentum: The chart shows when the stock price touches or crosses the boundaries of the Envelope Channel. Each crossing could indicate overbought or oversold conditions especially when paired with the Chaikin Oscillator crossing zero. This might signal momentum shifts towards either an bearish trend reversal.

Volatility: The width of the envelope channels appears to respond to volatility levels. Wider bands may suggest volatility while narrower bands could indicate less volatile periods. The chart illustrates varying volatility periods where prices move between the lower bands reflecting changes in investor sentiment and market dynamics.

Bullish and Bearish Sentiments: Upward green arrows could signal buying opportunities when prices rise above the upper envelope band alongside a positive Chaikin Oscillator reading. Conversely downward red arrows might indicate selling signals as prices dip below the lower band with a negative Oscillator reading below zero. These signals align with shifts in sentiment showcasing traders’ reactions, to price extremes.

Price Corrections: After receiving bearish signals we often witness price corrections as stock prices realign within the envelope channels. These corrections may signify a neutralizing sentiment as the market adjusts to movements and seeks balance.

Different Phases in the Market: You can see changes between times, when the market is following a trend and when its moving within a range. In trending periods the price regularly touches the bands while in range bound times it moves back and forth inside the bands. This reflects how the market goes through cycles shifting between movements and consolidation phases.

Positives: This is when there are periods where prices stay above the moving average and frequently touch the upper band of the envelope.

Negatives: On the side this happens during extended periods when prices remain below the moving average and often interact with the lower band of the envelope.

Neutral: This occurs when prices move within the envelope bands without showing any direction bias. It implies uncertainty or balance in market sentiments.

Strength of Signals and Their Reliability: The number of signals where prices cross over envelope lines can affect how these signals are interpreted by traders. A single signal may be viewed with caution. Multiple signals confirming each other could reinforce assumptions, about market sentiments.

In depth Signal Analysis:

Signal Frequency: A occurrence of valid signals, where the price movement aligns well with the strategys conditions could indicate a ‘Positive Signal Sentiment’. This suggests that the strategy is spotting opportunities as intended.

Signal Clarity: Defined signals that are not mixed with erratic or overlapping price movements can contribute to a ‘Confident Signal Sentiment’. Having clear signals generally leads to execution and reduces the chances of misreading market actions.

Signal Conformity: When signals match the expected pattern – such as price breaking through the range alongside a Chaikin Oscillator direction – it would support a ‘Strong Signal Sentiment’. This indicates that the signals are not just frequent and clear but also consistent.

Signal Quality over Quantity: If the strategy generates signals but with greater accuracy and effectiveness it could be described as having a ‘High Quality Signal Sentiment’. This emphasizes valuing each signals impact over quantity.

Backtesting Results: The assessment of quality can be significantly influenced by how well the strategy performs in historical backtesting. A high success rate, in tests would enhance trust in the signals creating a ‘Trusted Signal Sentiment’.

Signal Adaptability: The ability of a strategys signals to adjust to varying market conditions like trending or range bound phases without needing parameter changes contributes to what we call an ‘Adaptable Signal Sentiment.’ Being able to perform across different market scenarios without manual adjustments indicates strong signal quality.

Handling Volatility: How well a strategy performs in levels of market volatility can impact its ‘Volatility Adjusted Signal Sentiment.’ If the signals of a strategy remain reliable in both high and low volatility environments it suggests that the signal quality is not affected by market volatility.

Consistent performance, clear indications and effectiveness, in market conditions would lead to a positive evaluation while inconsistencies lack of clarity and poor adaptability would result in a negative assessment.

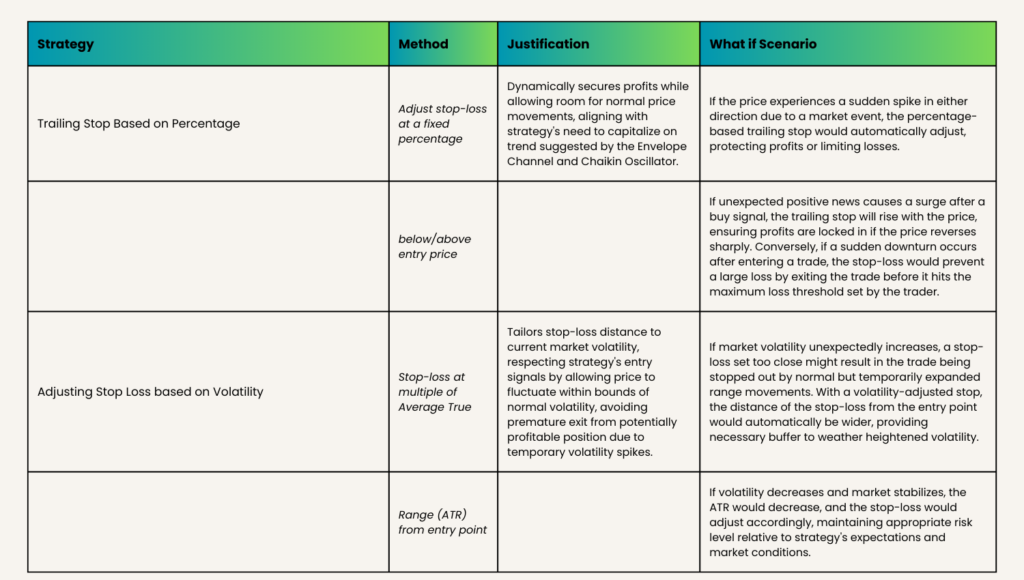

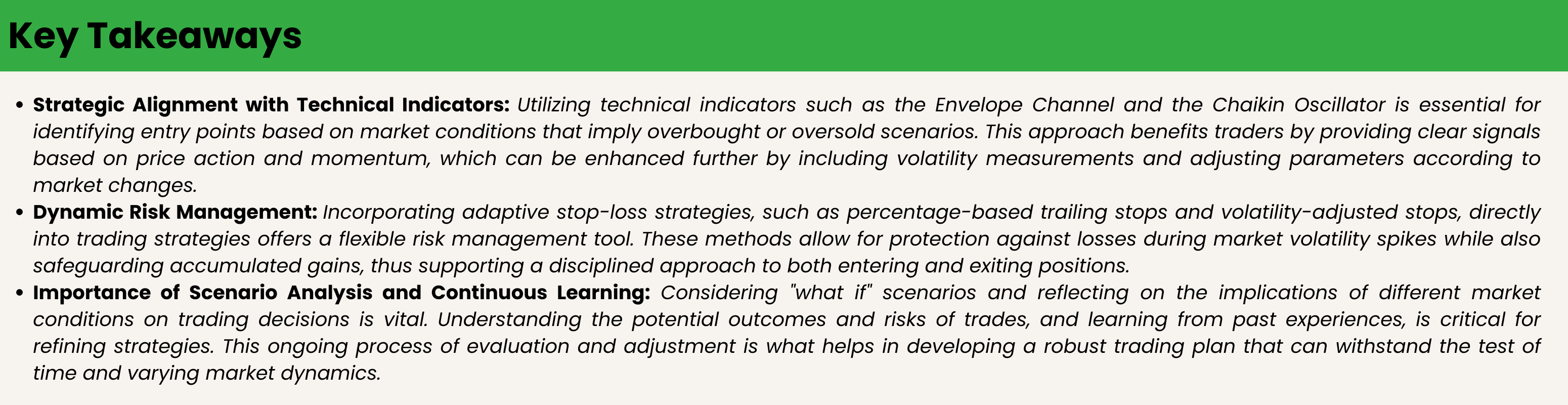

Two Stop Loss Strategies

Trailing Stop Based on Percentage Adjustments:

The trailing stop loss is a dynamic method where the stop-loss price is adjusted as the price fluctuates. This can incorporate the conditions of your strategy by setting the stop-loss at a fixed percentage below the price level at which the trade is initiated during a buy signal, according to the Upper Envelope Channel. For a short trade initiated at a sell signal below the Lower Envelope Channel, the stop could be set at a percentage above the entry price. This method ensures that the stop-loss level benefits from favorable price moves and protects capital during unfavorable movements, without being stopped out prematurely from normal price volatility.

Justification:This method is justifiable because it dynamically secures profits while allowing room for normal price movements, addressing the strategy’s need to capitalize on the trend suggested by the Envelope Channel and Chaikin Oscillator.

What if Scenario:What if the price experiences a sudden spike in either direction due to a market event? In such a case, a percentage-based trailing stop would automatically adjust, protecting a portion of the unrealized profits or limiting the loss. For example, if a buy signal is executed and the stock surges due to unexpected positive news, the trailing stop will rise with the price, ensuring profits are locked in if the price reversely sharply. Conversely, if there is a sudden downturn after entering a trade, the stop-loss would prevent a large loss by exiting the trade before it hits the maximum loss threshold set by the trader.

Adjusting Stop Loss based on Volatility:

This strategy involves adapting the stop loss level in line with the markets volatility. By using the Average True Range (ATR) of the asset you can place the stop loss at a multiple of the ATR from the entry point. For example in a buy trade you could set the stop loss at ‘entry price. ( × ATR)’ while in a short trade it might be ‘entry price + (multiplier × ATR)’. The stop loss levels change as per fluctuations in ATR. This approach considers both risk tolerance and current market conditions providing safety margins during high volatility and tighter stops, during periods of low volatility.

Justification: This method makes sense as it tailors the stop-loss distance to current market volatility, which can change rapidly. A volatility-adjusted stop-loss respects the strategy’s entry signals by allowing the price to fluctuate within the bounds of normal volatility, avoiding an exit from a potentially profitable position due to temporary volatility spikes.

What if Scenario: Consider a situation where market volatility unexpectedly increases, perhaps due to a geopolitical event or economic report. If a trade is already in place, a stop-loss set too close might result in the trade being stopped out by normal but temporarily expanded range movements. With a volatility-adjusted stop, the distance of the stop-loss from the entry point would automatically be wider in such conditions, providing the necessary buffer to weather the storm of heightened volatility. If the volatility then decreases and the market stabilizes, the ATR would decrease, and the stop-loss would adjust accordingly, maintaining an appropriate risk level relative to the strategy’s expectations and market conditions.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.