Current Factors Influencing Current Gold Prices:

- Gold prices remained steady on Thursday as traders refrained from entering new positions ahead of the release of key U.S. inflation data later in the day, which could offer insights into the Federal Reserve’s interest rate plans.

- Month-on-month, spot gold showed little change so far, following a 1.1% decline in January through Feb.

- The significance of the upcoming U.S. Personal Consumption Expenditures (PCE) data, suggesting that an upside surprise could pose downside risks for gold. Despite this, bullion has been holding up relatively well in range-trading conditions.

- The U.S. PCE inflation data, considered the Fed’s preferred measure of inflation, is scheduled for release on Thursday

- Fed officials have indicated that while there is still progress needed to reach the 2% inflation target, the possibility of interest rate cuts later this year is on the table.

- Lower interest rates typically enhance the attractiveness of holding non-yielding assets like gold.

- Seven more Fed officials are expected to speak on Thursday and Friday.

- Traders have adjusted their expectations for U.S. interest rate cuts in 2024, reducing the anticipated number of quarter-point cuts from five to three. Additionally, hopes for a rate cut in May have diminished, with a cut now expected in June.

- The U.S. dollar index climbed by 0.55%, and benchmark 10-year Treasury yields increased by over 30 basis points in February, impacting gold’s appeal.

- Spot silver rose by 0.27% to $22.50 per ounce, platinum climbed by 0.45% to $882.50 and palladium jumped by 0.75% to $935.90 per ounce

Fundamental and Technical Analysis

Technical Overview:

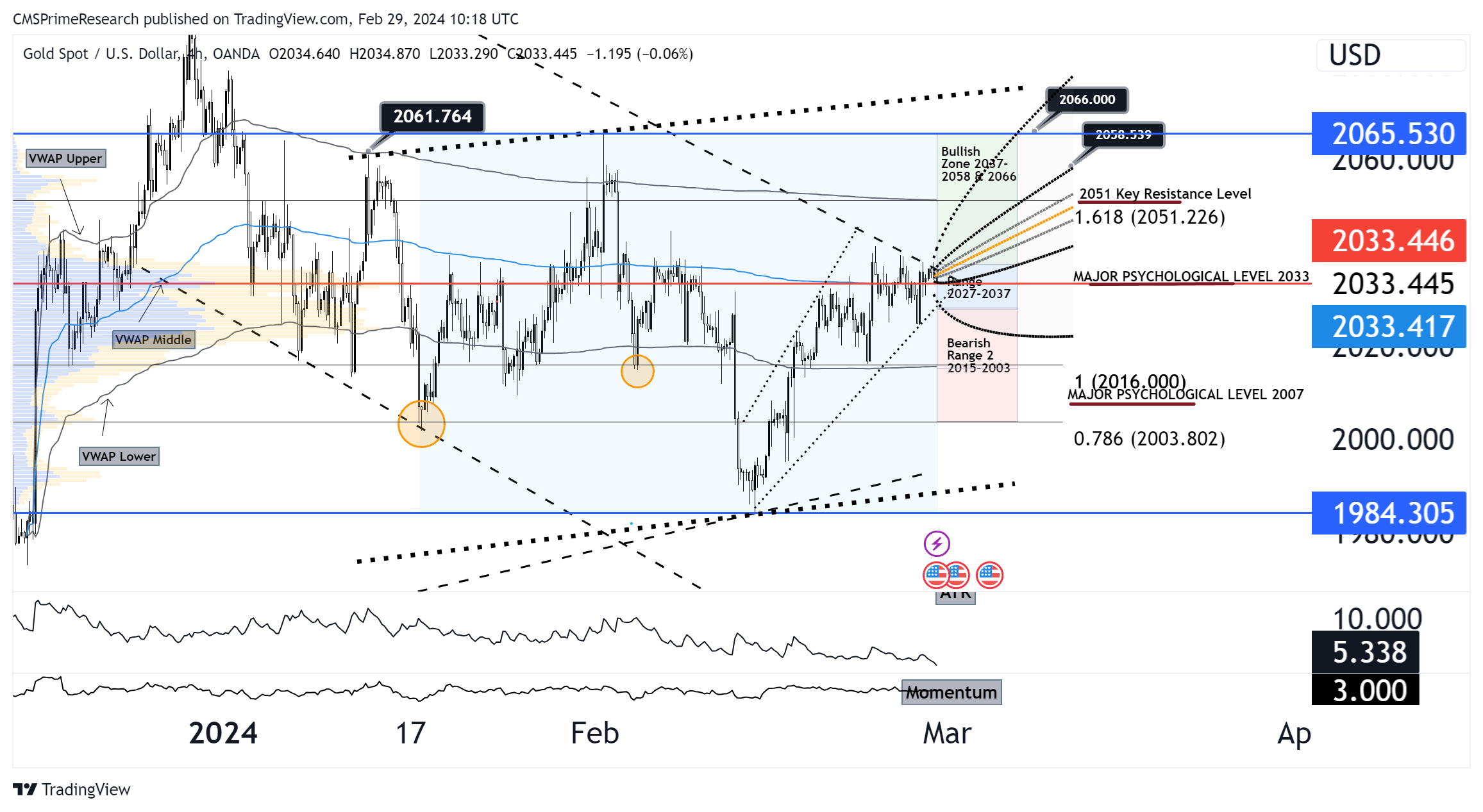

The provided gold chart displays a market in a state of flux, bounded by key technical levels:

Support and Resistance:

- Resistance is observed at the $ 2051 and $2061.764 level, with a more significant psychological barrier at $2066.000.

- The support is currently firm at $2033.445, a break above of which could see gold target the Fibonacci level at $2044 or the major psychological support at $2051.00.

VWAP Bands:

- Gold is trading just above the VWAP middle band, which could act as a pivot point for the price, suggesting a balance in the short-term between buyers and sellers.

Technical Indicators:

- The ATR shows moderate volatility, suggesting that significant price moves could still occur.

- Momentum is currently neutral, indicating a market waiting for a catalyst to determine direction.

Fundamental Analysis:

Anticipation of U.S. inflation data and Fed official statements set the stage for potential volatility:

U.S. Inflation Data:

- The upcoming PCE data is pivotal and could either reinforce the current range-bound trading conditions or be a catalyst for a breakout.

Federal Reserve Sentiment:

- The market is digesting the Fed’s mixed signals on interest rates, with any hawkish indications likely to pressure gold prices.

Interest Rate Expectations:

- Adjustments in interest rate cut expectations for 2024 and the scaling back of immediate rate cut hopes could dampen the allure of gold in the short term.

Scenario Analysis:

Bullish Scenario (40% Probability):

- A lower-than-expected PCE figure or dovish rhetoric from Fed officials could spur buying, pushing gold towards the $2051 to $2061.764 and potentially higher to $2080.

- Price Target: $2051.000 – $2066.000

- Sentiment Analysis: Positive sentiment could see a modest uptick with a dovish surprise, as lower rates bolster gold’s appeal.

Bearish Scenario (40% Probability):

- If PCE data exceeds expectations, reinforcing the Fed’s cautious stance on rate cuts, gold could break below the VWAP middle band, targeting $2016 then $2007 to $2003.802 or even $2000.00.

- Price Target: $2033.445 – $2007.00

- Sentiment Analysis: Negative sentiment is likely to intensify, driven by the prospect of sustained higher interest rates and a stronger dollar.

Neutral Scenario (20% Probability):

- In the event of PCE data in line with expectations and balanced commentary from Fed officials, gold could continue to trade within the current range, with $2033.445 serving as a floor and $2061.764 as a ceiling.

- Price Target: Range-bound between $2033 and $2016

- Sentiment Analysis: Neutral sentiment persists, reflecting the market’s cautious stance amid mixed economic cues.

Overall Market Sentiment Forecast:

- Positive Sentiment: Cautiously adjusted to 40%, given the potential for dovish surprises.

- Negative Sentiment: Elevated to 40%, as the market leans towards expectations of robust inflation figures.

- Neutral Sentiment: Steady at 20%, indicating ongoing uncertainty and the influence of upcoming economic data releases.

Overall Market Sentiment: 25% Positive, 50% Negative, 25% Neutral.

- Defensive Posture: Prioritize capital preservation with the potential for gold to test lower support levels, employing stop-losses to manage downside risk.

- Strategic Entries: Identify potential entry points for long positions should dovish signals emerge, with a keen eye on $2033.445 as a pivot.

- Diversification: Balance gold positions with assets that could benefit from a rate hike environment, such as short-duration fixed-income securities.

- Data Vigilance: Monitor the PCE release and Fed communications closely, as these will be key drivers for gold’s short-term price movements.

Target Levels and Analysis--- 2044 to 2051 or 2003-2016

Given the nuanced landscape of gold prices, influenced by upcoming U.S. inflation data, Federal Reserve sentiment, and technical chart patterns, a strategy targeting the specified price points of $2044-$2061 for bullish outlooks and $2003-$2016 for bearish scenarios requires careful consideration of both fundamental and technical factors. Here’s how such a strategy could be structured:

Strategy Overview

Market Context and Sentiment Analysis:

- The anticipation around the U.S. PCE inflation data and subsequent Federal Reserve officials’ speeches creates a volatile environment for gold, with the potential to drive significant price movements in either direction based on the outcomes.

- The market sentiment is split, with an equal probability (40%) for both bullish and bearish scenarios, indicating a high level of uncertainty and the critical importance of upcoming economic indicators.

Strategic Application for Target Price Points:

- Bullish Strategy for $2044-$2061 Target: Leverages the potential for dovish surprises from the PCE data or Fed commentary, which could decrease interest rate hike expectations and enhance gold’s appeal.

- Bearish Strategy for $2003-$2016 Target: Prepares for the possibility of higher-than-expected PCE figures or hawkish Fed statements, which could bolster the dollar and push gold prices down.

Execution Plan

Bullish Target ($2044-$2061):

- Entry Point: Consider entering long positions if gold prices show signs of breaking above the $2033.445 support level, particularly in response to dovish economic data or Fed commentary.

- Stop-Loss: Set a stop-loss order slightly below the $2033.445 level to minimize losses in case the market reaction does not favor gold.

- Profit Targets: Aim for initial profits at $2044, with the potential to extend towards $2061 if the bullish momentum continues. Adjust targets based on market volatility and resistance levels encountered.

Bearish Target ($2003-$2016):

- Entry Point: Initiate short positions on a confirmed break below the VWAP middle band or if PCE data exceeds expectations, suggesting a potential move towards $2016.

- Stop-Loss: Place stop-loss orders just above the $2033.445 pivot point to protect against an unexpected reversal in sentiment.

- Profit Targets: Set the primary profit target at $2016, with a stretch goal of $2003 if bearish drivers persist. Be prepared to adjust based on evolving market conditions and support levels.

Risk Management and Adaptation

- Position Sizing: Adjust the size of trades based on the assessed probability of scenario realization and individual risk tolerance. Given the market’s current indecision, a balanced approach is advisable.

- Continuous Monitoring: Stay vigilant for the release of the PCE data and subsequent Fed officials’ commentary. Be prepared to quickly adjust or exit positions based on new information.

- Sentiment and Technical Reassessment: Regularly reassess market sentiment, technical indicators, and economic developments. Flexibility in strategy is crucial as new data becomes available.

Conclusion

This strategy is designed to navigate the complexities and uncertainties in the gold market, leveraging technical levels and adjusting to fundamental economic indicators. By applying disciplined entry, stop-loss, and profit target mechanisms, and remaining adaptable to evolving market conditions, traders can aim to capitalize on the opportunities presented within the specified bullish and bearish price target zones. Continuous engagement with market developments and sentiment analysis will be key to refining the approach as conditions evolve.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.