Current Factors Influencing Current Gold Prices:

- Gold prices surged to reach a record high on Thursday, marking their seventh consecutive daily increase. This rally was propelled by sluggish U.S. economic data and indications from Federal Reserve Chair Jerome Powell suggesting potential rate cuts in the coming months if inflation eases.

- Spot gold climbed 0.28% to $2,154 per ounce, while U.S. gold futures added 0.2% to $2,163.

- Bullion continued its record-breaking rally, hitting an all-time high of $2,161 earlier in the session. It appeared poised for its longest intra-day winning streak since at least November 2021.

- The marginal weakness observed in U.S. data provided a catalyst for gold’s rally. However, the extent of the movement seemed disproportionately large, potentially influenced by significant futures buying that began on Friday.

- Gold received a boost following Powell’s remarks on Wednesday, where he hinted at likely interest rate cuts in the coming months alongside further evidence of declining inflation. Powell is scheduled to speak again later in the day.

- Lower interest rates enhance the attractiveness of non-yielding bullion.

- Powell’s comments, coupled with data indicating a softening labor market, led to declines in U.S. Treasury yields and the dollar, thereby increasing gold’s appeal.

- Should Friday’s labor market data or next week’s inflation figures reveal any weakness, $2,300 is seen as the short-term target based on technical levels. However, this surge may be short-lived, with prices expected to correct and consolidate thereafter.

- Jigar Pandit, head of commodity and currency business at BNP Paribas’ Sharekhan, anticipates continued central bank buying due to geopolitical uncertainty. He believes that the slowdown in China will constrain global growth, making gold a safe investment in an uncertain financial environment.

Fundamental and Technical Analysis

Technical Overview:

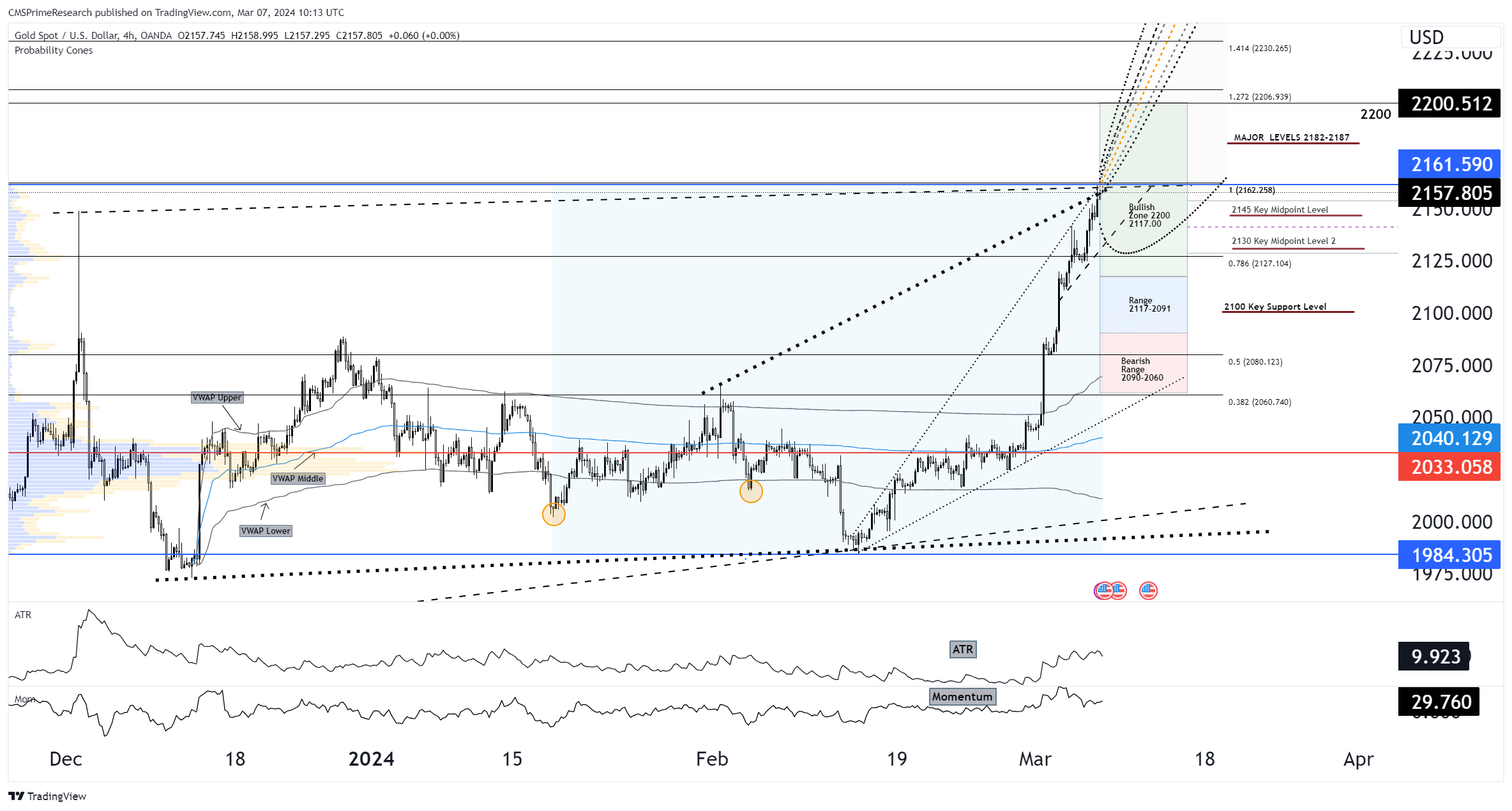

The gold market is exhibiting exceptional strength, breaking to record highs as indicated on the chart:

Support and Resistance:

- After reaching an all-time high, immediate support now sits at the $2154 level, formed by the recent breakout point.

- The next psychological resistance is projected at around $2200, inferred from the extrapolation of the current momentum and the Fibonacci extension level at 1.272 ($2206).

VWAP Bands:

- The price is substantially above the VWAP upper band, indicating overextension and a bullish bias in the market sentiment.

Technical Indicators:

- ATR is elevated, showcasing increased volatility consistent with strong price movements.

- Momentum is significantly positive, correlating with the steep ascent in prices.

Fundamental Analysis:

The backdrop for the rally is provided by a confluence of dovish signals from the U.S. Fed and weaker economic data:

Federal Reserve Signals:

- Chair Jerome Powell’s comments about potential rate cuts have set a dovish tone, which greatly favors gold.

Economic Data:

- The recent sluggish U.S. data underpin the rally as they suggest a cooling economy, which could justify lower rates.

Market Sentiment:

- The significant futures buying suggests a strong bullish consensus among institutional traders on the prospects of gold.

Scenario Analysis:

Bullish Scenario (60% Probability):

- If upcoming labor and inflation data reveal weaknesses, expect the rally to continue toward the $2300 short-term technical target.

- Price Target: $2200 – $2300

- Sentiment Analysis: Positive sentiment would likely remain elevated, driven by the anticipation of lower rates and a weaker dollar.

Bearish Scenario (20% Probability):

- A retracement could occur if profit-taking sets in after the rally or if forthcoming economic data outperforms expectations, showing economic resilience.

- Price Target: Retrace to $2100 or the $2071.700 breakout level for consolidation.

- Sentiment Analysis: Negative sentiment would be mild, as the market’s bullish sentiment is firmly rooted in recent dovish Fed signals.

Neutral Scenario (20% Probability):

- In the case of mixed data or a less dovish tone from Powell in subsequent talks, gold may consolidate at high levels, oscillating between $2150 and the recent all-time high.

- Price Target: Range between $2150 and all-time high

- Sentiment Analysis: Neutral sentiment is expected to hold as traders may seek to digest recent gains and reassess the direction.

Overall Market Sentiment Forecast:

- Positive Sentiment: Dominant at 60%, reflecting strong bullish momentum and dovish central bank expectations.

- Negative Sentiment: Limited to 20%, considering the possibility of a natural pullback after a significant rally.

- Neutral Sentiment: Also at 20%, accounting for potential consolidation after the rapid ascent.

Overall Market Sentiment: 60% Positive, 20% Negative, 20% Neutral.

Target Levels and Analysis--- 2200-2300 or 2150-2080

The current surge in gold prices, influenced by dovish Federal Reserve signals and weaker U.S. economic data, presents a unique opportunity for crafting a targeted trading strategy. The strategy focuses on the bullish and consolidation scenarios provided, aiming for the specified price targets of $2200-$2300 for an optimistic outlook and $2150-$2080 for potential retracement or consolidation phases. Here’s how such a strategy could be approached:

Strategy Framework

Market Context and Sentiment Analysis:

- The gold market’s momentum, fueled by expectations of rate cuts and economic softening, sets a bullish backdrop. However, the potential for short-term retracement or consolidation calls for a nuanced strategy that balances aggressive bullish positions with cautious hedging against possible pullbacks.

Strategic Application for Target Price Points:

- Bullish Strategy for $2200-$2300 Target: Leverages the strong bullish sentiment and the technical breakout pattern, anticipating further gains towards $2300 based on dovish Fed outcomes or weaker labor and inflation data next Week(US CPI).

- Consolidation Strategy for $2150-$2080 Target: Prepares for potential profit-taking or stronger-than-expected economic data that could trigger a consolidation phase within the specified range.

Execution Plan

Bullish Target ($2200-$2300):

- Entry Point: Consider entering long positions if gold prices show a strong rebound from the $2154 support level or break above a short-term resistance, particularly after dovish comments from Powell or weaker economic data.

- Stop-Loss: Place stop-loss orders below the $2150 level to protect against sudden market reversals or unexpected strong economic indicators.

- Profit Targets: Set a series of profit targets starting at $2200, extending to $2300, adjusting positions as each target is approached or met, based on market momentum and volume.

Consolidation Target ($2150-$2080):

- Entry Point: Initiate short positions or take profits on existing long positions if gold prices approach the recent all-time high without new dovish catalysts, signaling potential overextension.

- Stop-Loss: Implement stop-loss orders above the recent all-time high to mitigate risks if the bullish trend continues unabated.

Profit Targets: Aim for profit-taking within the $2150-$2080 range, closely monitoring market response to Federal Reserve communications and U.S. economic data releases for re-entry signals or reversal patterns.

Risk Management and Market Monitoring

- Position Sizing: Balance the size of bullish and consolidation-targeted positions according to current market sentiment and personal risk tolerance, erring on the side of caution given the market’s recent rapid ascent.

- Continuous Analysis: Stay updated on Fed communications, U.S. economic data, and global geopolitical developments that could impact gold prices, ready to adjust the strategy as new information emerges.

- Sentiment Adjustment: Regularly reassess market sentiment, particularly in response to economic indicators and central bank commentary, adapting the strategy to align with the evolving market landscape.

Conclusion

This strategy aims to capitalize on the bullish momentum in the gold market while remaining vigilant for signs of potential consolidation or retracement. By applying disciplined entry, stop-loss, and profit target mechanisms, and staying adaptable to changes in economic indicators and central bank policy, traders can navigate the complexities of the current gold market environment. Continuous engagement with market developments and sentiment analysis will be key to refining the approach as conditions evolve.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.