Different Ways Bollinger Bands can be Used

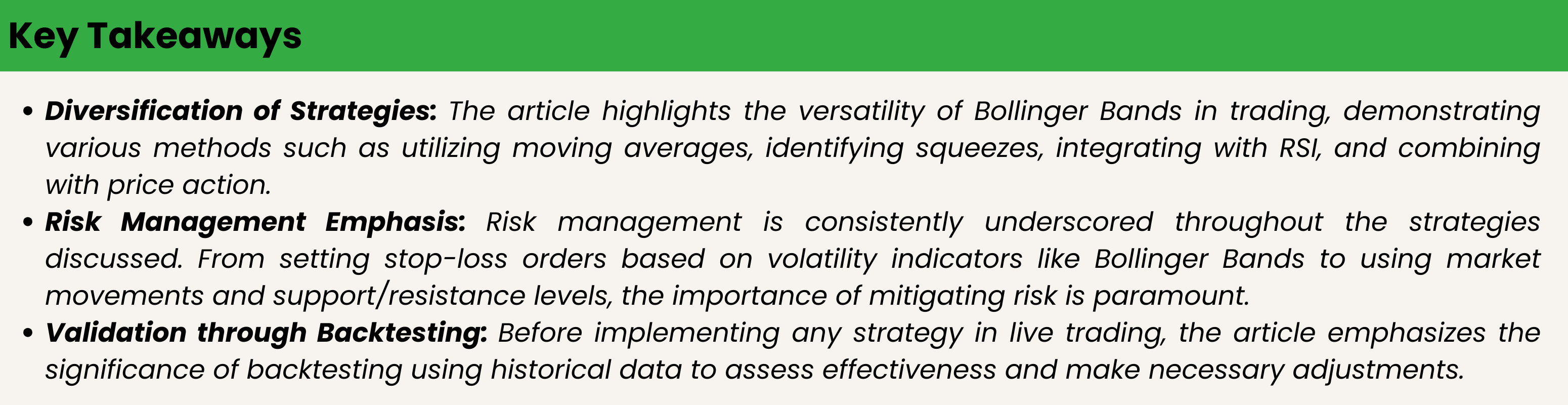

Developing a successful trading plan utilizing Bollinger Bands for stock trading involves various methods tailored to different trading preferences and market situations. Here is a summary of some effective strategies discovered through the investigation;

Utilizing Moving Average and Bollinger Bands Strategy: This method integrates Bollinger Bands with a 200 period Simple Moving Average (SMA). When the price surpasses the SMA, it signifies an upward trend, prompting traders to seek buying opportunities. Conversely, if the price falls below the SMA, it indicates a downtrend, favoring sell indications.

Bollinger Band Squeeze Tactic: This approach concentrates on the contraction of the bands, which typically indicates reduced volatility and foreshadows an imminent breakout. Once the bands expand again, it suggests the beginning of a new movement, presenting a chance to enter into a trade aligned with the breakout.

Following the Bands Approach: In contrast to the common misconception of selling when prices touch the upper band or buying at the lower band, this strategy proposes remaining in position as prices “walk” along the band during robust trends. This can be notably lucrative if sufficient leeway is provided for trades to evolve.

Price Action Strategy:This approach involves searching for a price to touch one of the Bollinger Band boundaries and then waiting for a Price Action signal such as a bullish reversal candlestick pattern if the price is near the lower band, signaling a possible upward movement.

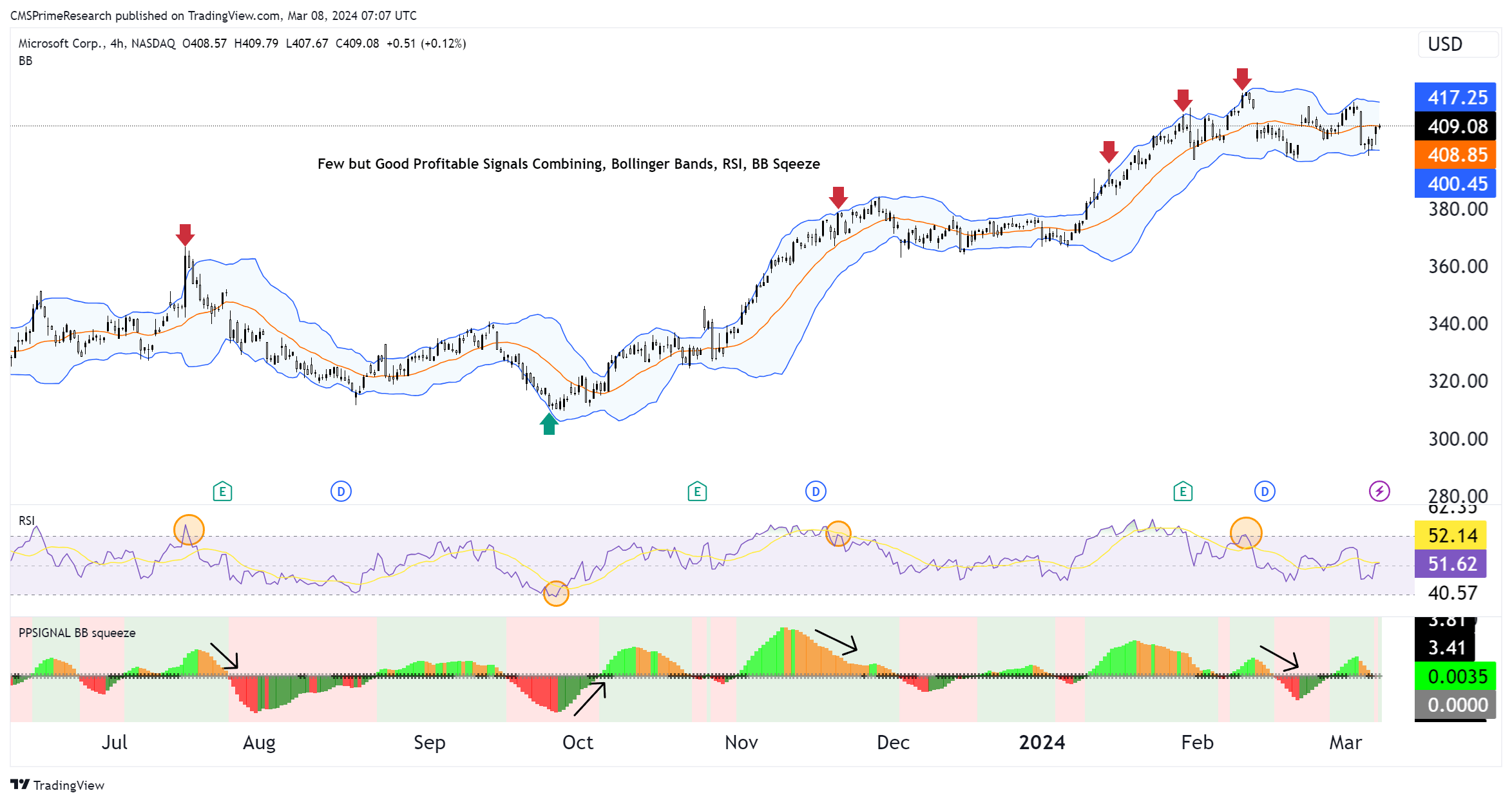

Utilizing Bollinger Bands with the Relative Strength Index (RSI) can aid in identifying reversals more effectively. This strategy entails waiting for the RSI to indicate overbought or oversold conditions while ensuring that the price is beyond the Bollinger Bands before considering an entry.

The Snap Back to the Middle of the Bands Strategy takes a cautious stance by waiting for the market to rebound off the bands towards the middle line. It operates on the premise that prices usually return to average levels, aiming for trades with higher probabilities and lower risks.

For traders seeking minimal risk, trading within the bands range is ideal. This strategy involves buying when stocks test the lower band and selling as they approach the upper band. By combining Bollinger Bands with support and resistance levels, traders can improve their ability to identify potential market reversals. One approach is to wait for the price to move away from the middle band towards a support or resistance level while observing reversal candlestick patterns.

These methods showcase how Bollinger Bands can be used in various trading situations and styles. It’s crucial to note that no strategy can guarantee success, so traders should combine these techniques with proper risk management and additional technical analysis to improve their trading outcomes.

A trading Strategy Method using BB, RSI and the BB Squeeze

Utilizing Bollinger Bands and Moving Averages:

Buy Signal: Keep an eye out for the price positioning itself above a long term Moving Average (like the 20 SMA) to indicate a general uptrend. At the same time, look for instances where the price touches or breaks below the lower Bollinger Band, suggesting potential oversold conditions and a potential upward price movement.

Sell Signal: Note when the price falls below the long term Moving Average, signaling a downtrend. Watch for occasions when the price reaches or surpasses the upper Bollinger Band, indicating possible overbought conditions and an anticipated reversal or pullback.

Bollinger Band Squeeze Approach: This method centers on observing when the Bollinger Bands begin to narrow, indicating decreased volatility that often precedes a significant price shift. A squeeze occurs when the bands move closer together.

Entry Signal: Following a squeeze, breaking out above the upper Bollinger Band can signify a potential buy signal, while breaching below the lower band may indicate a sell signal. It’s essential to wait for a clear breakout to avoid false signals.

Enhanced Confirmation with RSI Integration;

For improved accuracy in entry and exit points and minimizing false indications, incorporate the Relative Strength Index (RSI).

An RSI reading above 70 indicates that the market may be overbought, potentially signaling a sell opportunity when combined with a Bollinger Band breakout. Conversely, an RSI below 30 suggests oversold conditions, which could align with a buying opportunity during a Bollinger Band breakout.

Risk Management:

It is important to manage risk by strategically placing stop loss orders below or above your entry point (depending on whether you are going long or short) to limit potential losses. Additionally, consider using trailing stops to safeguard profits as a trade moves in your favor.

Backtesting and Adjustment:

Before applying this strategy in live trading, backtest it using historical data to evaluate its effectiveness and make any necessary tweaks.

2 Stop Loss Strategies to Consider

Strategy 1: Stop Loss Using Volatility Indicators (Bollinger Bands)

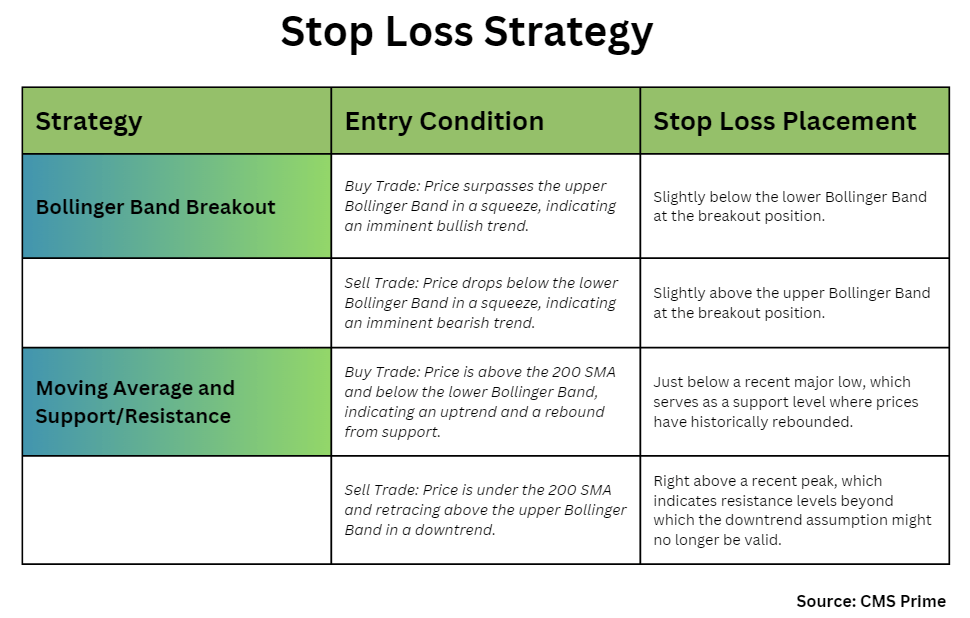

When initiating a trade based on a Bollinger Band breakout, like purchasing when the price surpasses the upper Bollinger Band in a squeeze, indicating an imminent bullish trend, set the stop loss slightly below the lower Bollinger Band at the breakout position. This is because the lower band serves as a volatility threshold, below which the initial breakout assumption loses validity.

Validation Approach:

Buy Trade; If entering a buy trade during an upward Bollinger Band squeeze breakout, position the stop loss just under the lower band at the breakout point. This considers market volatility and shields against false breakouts.

Sell Trade: Conversely, if engaging in a sell trade upon price dropping below the lower Bollinger Band, position the stop loss just above the upper band at the breakout point to ensure there’s a buffer against volatility.

Strategy 2: Stop Loss Based on Market Movements (Moving Averages and Support/Resistance)

When entering a trade using the Moving Average and price action strategy, such as when a buy signal is triggered by the price being higher than the 200 SMA with bullish price movements, it’s advisable to position the stop loss slightly below a recent significant low for buying or above a recent significant high for selling. This approach utilizes the Moving Average and support/resistance levels to clearly identify exit points.

Validation Logic:

For Buying: If you’re buying because the price is above the 200 SMA and below the lower Bollinger band, indicating an uptrend and a rebound from support, set your stop loss just below a recent major low. This low serves as a support level where prices have historically rebounded.

For Selling: In case of initiating a sell trade due to the price being under the 200 SMA and retracing above the upper Bollinger band in a downtrend, place your stop loss right above a recent peak. This peak indicates resistance levels beyond which the downtrend assumption might no longer be valid.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.