USD/JPY consolidates within the 151 range

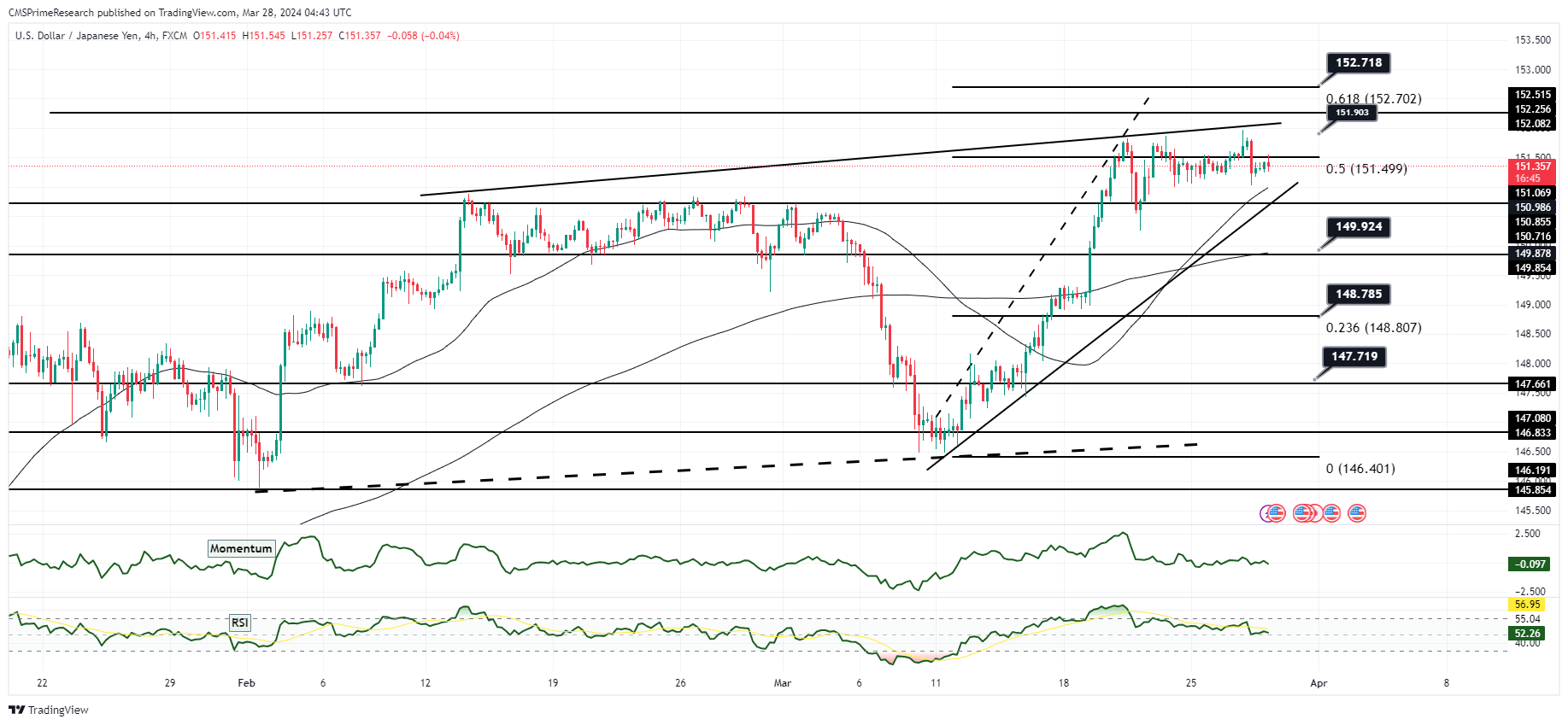

Technical Analysis: The USD/JPY pair achieved a modest new 34-year high at 151.971, eclipsing the peak set in 2022. This milestone was met with rhetoric from Japanese officials indicating a willingness to support the yen, expressing unease about the pair surpassing the 152 threshold. The technical outlook shows the pair retracting slightly, sustaining above the recent low of 151.00. Technical indicators are approaching overbought conditions, yet no significant divergence is noted, suggesting the momentum may still have the upper hand over immediate consolidation patterns.

The charts demonstrate a battle between the pair’s upward trajectory and potential resistance at the 152 level. With upcoming U.S. economic data and Federal Reserve officials’ speeches on the horizon, including PCE inflation and labor market reports, hawkish signals could provide impetus for the pair to test the resolve of the Ministry of Finance (MoF) against further yen weakening. Should U.S. data prove supportive of the Fed’s rate-cut trajectory, this could temper bullish momentum and align with MoF’s stance, potentially reinforcing resistance near current levels.

Fundamental Analysis: From a fundamental perspective, the market is weighing the possibility of continued Fed rate cuts against the recent assertive moves in the currency pair. While the MoF has signaled discomfort with rapid yen depreciation, market participants are cognizant of the limited effectiveness of verbal interventions compared to actual market operations. The dynamic interplay between U.S. economic indicators and Japanese policy responses will be critical in determining the near-term direction of USD/JPY.

Overall Market Sentiment: The market sentiment is cautiously optimistic for the USD/JPY pair, balancing the recent bullish run with the potential impact of upcoming economic data and MoF interventions.

Sentiment Percentage Breakdown:

- 50% Positive: Based on the pair’s ability to achieve new highs and the potential for U.S. data to endorse a stronger dollar narrative.

- 30% Neutral: Reflecting the current pause as traders await clear cues from upcoming data and policy comments.

- 20% Negative: Considering the possibility of actual intervention by the MoF and the implications of a dovish shift in Fed policy projections.

The positive sentiment is anchored on the momentum carried by recent highs and expectations of hawkish U.S. economic data. Neutral sentiment accounts for the uncertainty leading up to the data releases and potential policy statements. The negative sentiment is underpinned by the prospect of Japanese intervention and a U.S. data set that could reaffirm the path of rate cuts, thus pressuring the pair downward.

Key Levels to Watch: : 150.868,151.944,150.256,152.500

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 151.239 | 151.739 |

| Level 2 | 150.868 | 151.944 |

| Level 3 | 150.256 | 152.585 |