Reasons for Testing Indicator Efficiency:

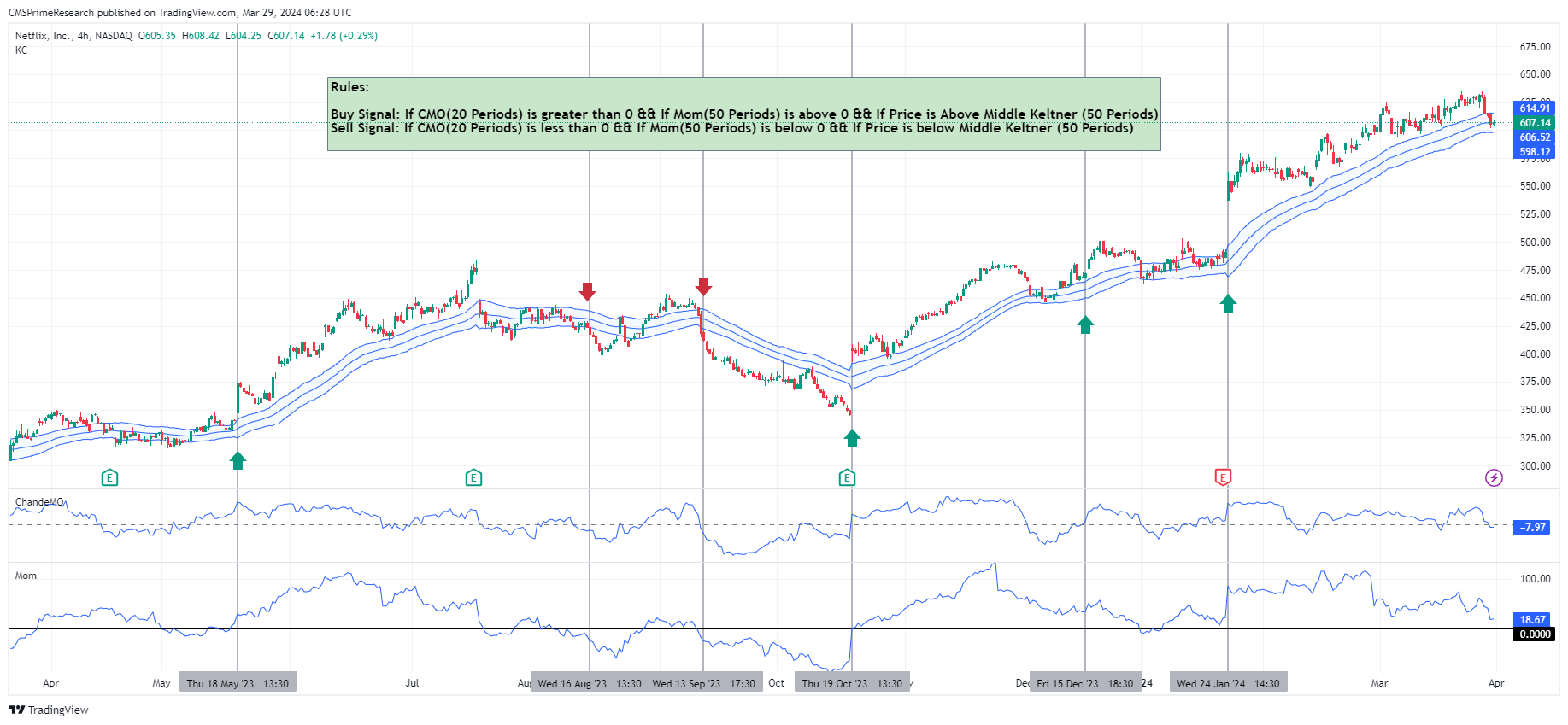

The trading strategy relies on using both momentum and trend following indicators to signal buying and selling decisions. It incorporates the Chande Momentum Oscillator (CMO) to measure momentum, the Momentum Indicator (Mom) to assess how quickly prices are changing and the Keltner Channels to determine the direction and volatility of the trend. Here are two reasons why this approach could work well, along with some possible drawbacks:

Reasons for Effectiveness

In depth Market Analysis Reason: By combining the CMO and Momentum Indicator, this system considers both how fast prices are changing and the strength of those movements. This combined analysis can help spot strong trends early on. Including the Keltner Channels provides a perspective on trend adjusted for volatility, which helps filter out signals during stagnant or range bound market conditions. This multifaceted approach ensures that buy or sell signals stem from a thorough analysis of market dynamics.

Drawback: This strategy’s effectiveness may be limited in highly volatile markets where sudden price swings can trigger false signals. The inherent delay in these indicators could also lead to late entry and exit points, potentially impacting profitability.

Managing Risk by Confirming Trends

Reason: The rule for the price to be above the middle Keltner Channel to signal a buy (and below for a sell) serves as a way to confirm the trend, helping reduce the risk of trading against the current market direction. This guideline ensures that trades are made in line with the overall market trend, improving the likelihood of successful trades.

Drawback: While confirming trends can minimize false signals, it could also result in missed opportunities. In fast paced markets, prices may have already moved significantly by the time all criteria are met, potentially reducing potential profits or increasing the chances of entering trades too late.

Factors to Consider in Recognizing Trends Adaptability: The system relies on fixed period indicators, which may not always be ideal in every market scenario. Financial markets are constantly changing and certain periods (like 20 for CMO, 50 for Mom and Keltner Channels) may be more effective at different times and across various assets. Incorporating an adaptive feature that adjusts these periods based on recent market conditions could enhance the system’s efficiency.

Market Phase: The strategy is primarily tailored for trending markets and may not perform as well during sideways or highly volatile market conditions. Traders should understand the current market conditions and adapt their strategy accordingly. This could involve adjusting stop loss levels or considering earlier profit taking during periods when the market is not trending.

Signal Conditions for Trading Strategy:Effectiveness and Dynamics

Incorporating a combination of the Chande Momentum Oscillator (CMO), Momentum Indicator (Mom), and Keltner Channels into a trading system offers a sophisticated approach for identifying trends, capturing breakouts, and managing risks, which can be crucial in navigating market biases and enhancing systematic trading processes. This multidimensional strategy leverages market volatility, momentum, and price trends in a holistic manner. Here’s a deeper dive into how this amalgamation can address market biases and differentiate the process, drawing from insights on Keltner Channels and their application in trading strategies.

System Development and Trend Pattern Recognition

Combining Volatility and Momentum

Keltner Channels provide a dynamic representation of market volatility and trend direction by adjusting their width based on the Average True Range (ATR), offering a smoother depiction of price movements compared to other volatility-based indicators. When combined with momentum indicators like the CMO and Mom, the system gains the ability to filter signals through a volatility-adjusted lens, ensuring that entries and exits are not just based on price momentum but are also contextualized within the current market volatility. This can be particularly effective in differentiating between false breakouts and genuine trend shifts.

Breakout Identification and Confirmation

The structure of Keltner Channels facilitates the recognition of breakout opportunities. A breakout above the upper band signals potential bullish momentum, while a breakout below the lower band indicates bearish momentum. Integrating this with momentum indicators (CMO and Mom) can help confirm the strength and direction of the trend, providing a systematic approach to capturing shifts in market sentiment and dynamics. This combination effectively addresses the market bias toward trending or range-bound conditions, allowing for more nuanced decision-making

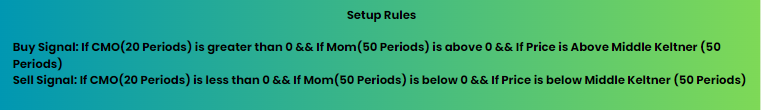

The Conditions:

Market Biases and Efficiency

Addressing Market Biases

Market participants often exhibit biases such as overreaction to news or underestimation of long-term trends. By systematically incorporating indicators that span volatility (Keltner Channels), momentum (CMO and Mom), and trend analysis, the strategy aims to mitigate these biases. It ensures that decisions are based on a balanced assessment of market conditions rather than on emotional reactions or singular viewpoints. The reliance on a structured rule-based system helps in disciplining the trading process and reducing cognitive biases.

Enhancing Market Efficiency

The strategic combination of these indicators aids in recognizing patterns and inefficiencies in the market. By backtesting and adjusting parameters such as the ATR multiplier for Keltner Channels or the periods for CMO and Mom, traders can refine their approach to better capture profitable opportunities across different market phases. This ongoing optimization process, grounded in historical data and performance metrics, contributes to a more efficient market engagement by continuously adapting to changing market conditions and recognizing shifts in market sentiment and volatility.

Through a comprehensive analysis, it’s clear that the integration of Keltner Channels with momentum indicators like CMO and Mom provides a robust framework for trend recognition, breakout confirmation, and risk management. This approach not only addresses market biases by offering a systematic method for trading decision-making but also enhances the ability to recognize and act on market inefficiencies. By incorporating a blend of volatility, momentum, and trend analysis, the strategy is well-equipped to navigate the complexities of financial markets, offering a differentiated process for achieving trading objectives.

Behavioral Biases and Patterns:

Trading behaviors can be greatly influenced by psychological biases and emotions, impacting decision making in assessing risks and returns. By utilizing tools like the Chande Momentum Oscillator (CMO), Momentum Indicator (Mom) and Keltner Channels, traders can adopt a more disciplined approach to navigate these biases for making well informed decisions.

For example, the CMO is crafted to gauge a security’s momentum by capturing the difference between its up and down days, presenting a momentum strength scale from 100 to +100. This assists traders in overcoming the tendency to follow the herd or act emotionally by providing clear signals on when a security is either overbought or oversold, prompting a more rational response.

Similarly, the Momentum Indicator (Mom) calculates the speed of price changes and acts as a valuable tool to counterbalance anchoring bias – where traders may excessively rely on past reference points when making trading choices.By focusing on the current market trends, traders can make informed decisions based on present conditions rather than being swayed by past prices.

Keltner Channels, which factor in volatility using the Average True Range, visually display potential overbought or oversold situations in the market. This can aid in addressing the inclination to hold onto losing trades while quickly selling winning ones. By pinpointing when prices are nearing extreme levels compared to the channel, traders have a clearer and unbiased reference point to determine whether to retain or sell a position.

To sum up, although behavioral biases like overconfidence, following the crowd, anchoring to past prices and holding onto losing trades can impact trading strategies significantly, utilizing indicators such as CMO, Mom and Keltner Channels systematically can help mitigate these biases. These tools provide factual data and signals that can steer traders towards more logical decisions, aligning their strategies better with market conditions and enhancing their risk management capabilities while maximizing returns.

Two Stop Loss Strategies

1. Stop Loss Strategies Based on Indicators

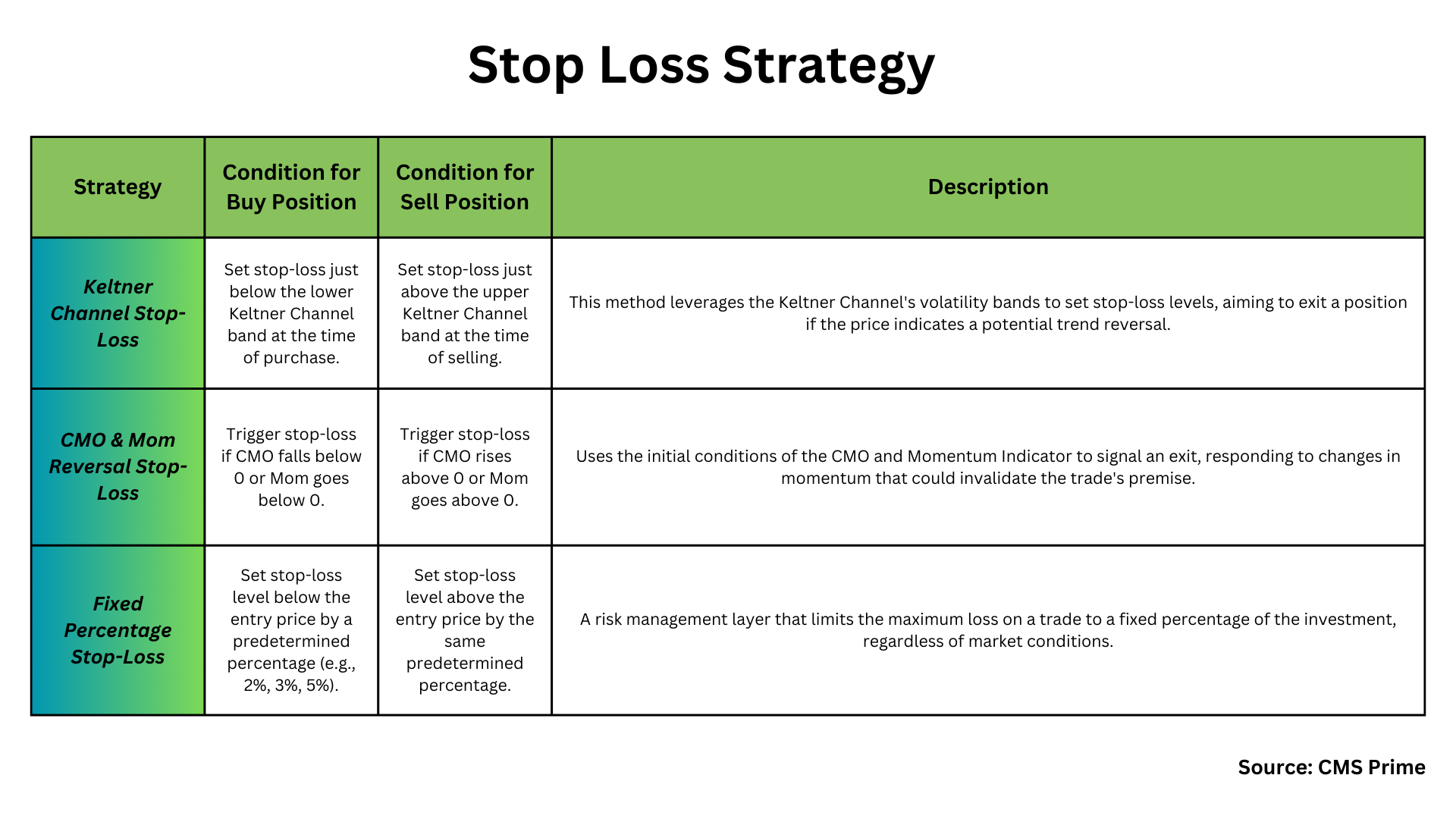

Approach 1: Using Keltner Channel for Stop Loss

For Buying: Place the stop loss slightly under the lower band of the Keltner Channel when making a purchase. This method assumes that as long as the price stays above the middle band (and meets the criteria for a buying signal), the trend is positive. If the price drops below the lower band, it could indicate a shift in trend or significant market volatility, justifying an exit.

For Selling: Reverse the buying strategy by setting the stop loss slightly above the upper band of the Keltner Channel when initiating a selling position. A move beyond the upper band might suggest a bullish turnaround, leading to potential losses in a short position.

Approach 2: Utilizing CMO & Momentum Indicator for Reversal Stop Loss

When Buying: The stop loss activates if either CMO falls below 0 or Momentum Indicator dips below 0, indicating a decline in bullish momentum. This approach aligns stop loss tactics with initial trade entry conditions, ensuring exits are executed if those conditions no longer hold true.

When selling: the stop loss will trigger if the CMO exceeds 0 or the Momentum Indicator goes beyond 0, indicating a potential return to positive momentum and possibly challenging the basis of the short position.

Apart from using indicators, setting a fixed percentage stop loss offers a simple risk management approach. This method involves determining the stop loss level as a fixed percentage away from the entry price.

Fixed Percentage Approach: Select a percentage (e.g., 2%, 3% or 5%) that matches your risk tolerance. For buying, place the stop loss level below the entry price by that chosen percentage. For selling, position the stop loss level above the entry price by that same percentage. This ensures that any trade’s maximum loss stays within a set portion of your investment, creating an uncomplicated yet efficient risk management layer.

It’s crucial to keep in mind that stop loss tactics don’t assure protection from losses but serve as aids in risk control. Factors like market fluctuations, such as gaps or slippage, could hinder the stop loss order from triggering at the anticipated price point.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.