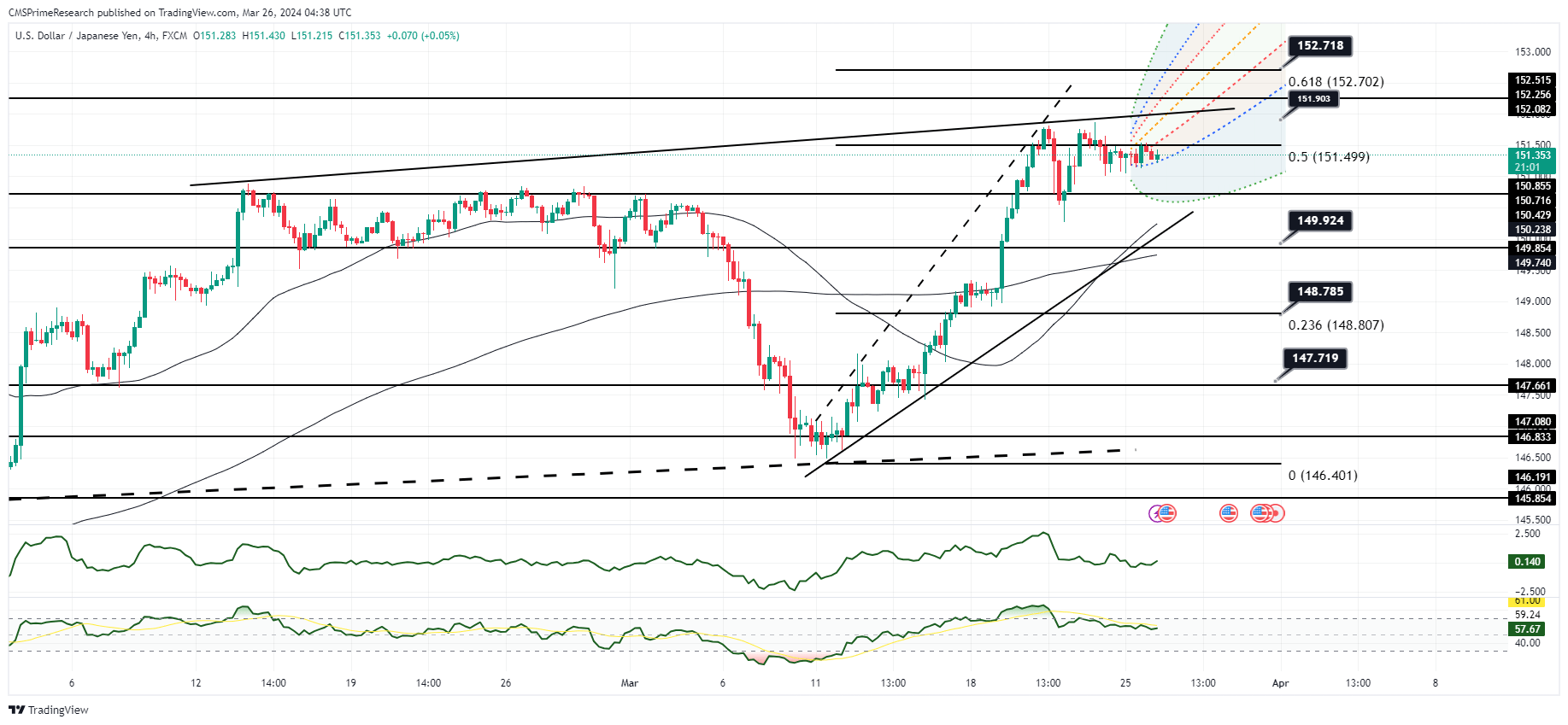

USD/JPY consolidates within the 151 range

USD/JPY displayed resilience after a dip toward Friday’s low of 151, which corresponded to the 50% Fibonacci retracement level of the rise from 150.250 to 151.80, coinciding with the hourly Ichimoku cloud base. The swift recovery indicates underlying buying interest. Spread differentials between U.S. Treasury and Japanese Government Bond yields, having recoiled from recent lows, offer additional support to the pair.

Technically, continued yen bearishness is palpable post-BoJ, as the termination of Yield Curve Control (YCC) was in name rather than in practice. The current focus is on key U.S. economic indicators, notably Friday’s core Personal Consumption Expenditures (PCE), as well as upcoming ISM data and payroll figures. These data points will provide further guidance on whether the Fed’s projected three interest rate cuts in 2024 will materialize and if a June cut is plausible.

The daily chart showcases a doji formation, indicative of market indecision. A close above the 151.92/94 peaks from previous years would be necessary to confirm bullish continuation, while a close below the recent pivot low of 151 could portend a test of the 150 psychological level.

Fundamental Analysis: The fundamental outlook hinges on the anticipation of U.S. economic releases. Robust data could reinforce the U.S. dollar by suggesting the Fed may not need to cut rates as soon as anticipated. Conversely, softer indicators could lend credence to the prospect of rate cuts, potentially weakening the dollar against the yen.

Overall Market Sentiment: Market sentiment is currently mixed, with technicals suggesting bullish undertones, while the fundamental landscape awaits clarification from impending economic data.

Sentiment Percentage Breakdown:

- 60% Positive: Predicated on the pair’s rebound from key support levels and favorable yield spreads.

- 20% Neutral: Reflecting the market’s current wait-and-see stance ahead of significant economic data releases.

- 20% Negative: Incorporating the potential for a dovish shift in Fed policy following critical economic indicators.

The optimistic sentiment is driven by the pair’s technical bounce from the Fibonacci level and support from yield differentials. The neutral sentiment acknowledges the forthcoming economic data’s potential to sway market direction. Lastly, the cautious sentiment accounts for the potential impact of the Fed’s rate path reassessment on the currency pair.

Key Levels to Watch: : 150.868,151.944,150.256,152.500

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 151.239 | 151.739 |

| Level 2 | 150.868 | 151.944 |

| Level 3 | 150.256 | 152.585 |