Intro-What is Risk On and Risk Off?

“In the world of finance, ‘Risk on’ and ‘Risk off’ are commonly used phrases to describe how investors feel about taking risks for potential high rewards or sticking to safer investments in uncertain times.

When we say ‘Risk on,’ it means investors are feeling positive about the global economy and are ready to invest in riskier assets like stocks, emerging market currencies and commodities. This optimism is usually fueled by good economic news, supportive monetary policies or political stability, encouraging investors to go for investments with higher returns even if they come with higher risks.

On the flip side, ‘Risk off’ refers to a time when investors become more careful and move their money into safer options such as government bonds, gold or stable currencies like the U.S. Dollar and Japanese yen. This cautious approach is often triggered by economic slumps, stricter monetary policies or geopolitical conflicts that make investors prioritize protecting their capital over chasing returns in an uncertain environment.

Our Methodology and Tickers

We categorize financial instruments into two groups known as “Risk On” and “Risk Off” based on the attitudes towards market volatility and risk tolerance. In the “Risk On” category, you’ll find assets like Bitcoin, the Nasdaq 100, sector ETFs such as ARK Innovation ETF and commodities ETFs like the United States Oil Fund LP. These investments are favored when markets are positive due to their potential for higher returns despite increased risk. On the other hand, in the “Risk Off” category, you have more defensive and lower risk assets like Vanguard Total Bond Market ETF, Treasury Bond ETFs such as iShares 20+ Year Treasury Bond ETF and Gold ETF. These assets are preferred during uncertain or negative market conditions for their stability and ability to serve as a hedge against volatility. Investors turn to them when aiming to protect their capital in times of potential downturns.

The Two methods Used for the Calculation:

Calculating the relative strength: To compute the relative strength using the first method, divide the prices of each risk and safe asset by the benchmark asset’s price. This normalization process ensures that the performance of each asset is measured relative to the benchmark, accounting for overall market movement. The benchmark asset, typically SPY, acts as a reference point for the broader market.

Using the second method, relative strength can be calculated by incorporating volume. Here, in addition to price, volume data is utilized. This method provides a more comprehensive assessment of relative strength, considering not only price movements but also the trading activity associated with each asset.

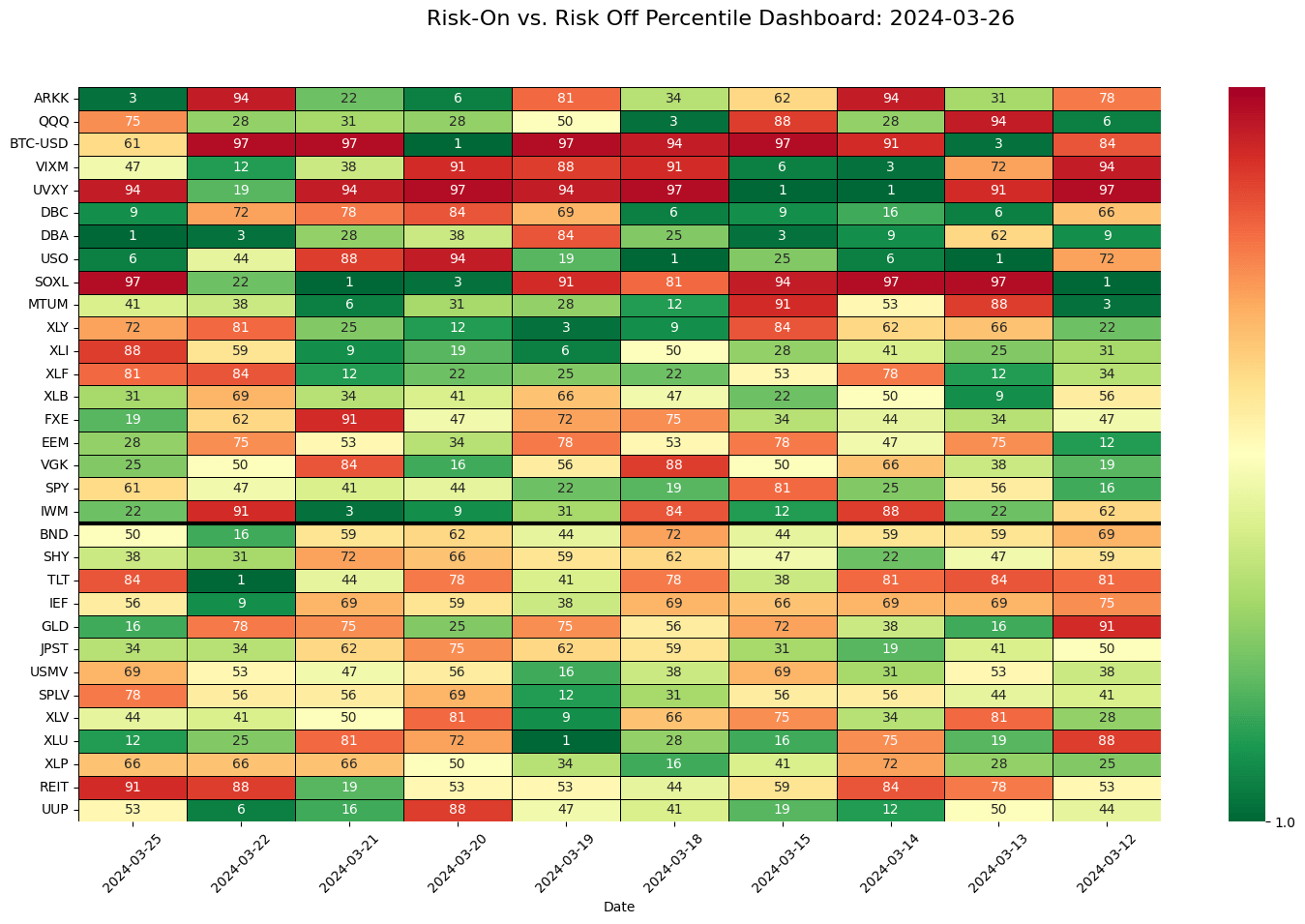

Risk On and Risk Off Sentiments-Current Market Scenarios-Based on Relative Strength

During the period from March 25, 2024, to March 22, 2024, there was a clear change in market sentiment from being more inclined towards risky investments (Risk On) to favoring safer options (Risk Off). Initially, on March 25, assets like ARKK, QQQ and BTC USD were performing well (green zone), while assets like BND, SHY and TLT were not doing as well (red zone). However, by March 22, the situation had reversed, safe assets were doing better with high percentile ranks while riskier assets saw lower percentile ranks. This shift indicates that investors were moving their investments from risky ventures to more secure ones due to a growing aversion to risk in the market.

In contrast, between March 21 and March 18 of the same year, there was a noticeable shift back from favoring safer options (Risk Off) to embracing riskier investments (Risk On). Assets like BND, TLT and GLD that were considered safe on March 21 experienced a decline in their performance by March 18.On the flip side, assets like ARKK, QQQ and SOXL saw an uptick in their rankings during that time frame. This shift suggests that investors felt more confident in the market and were open to taking on more risks.

The sentiment was mixed between March 15, 2024 and March 12, 2024, with no clear trend favoring either Risk On or Risk Off. Some risky assets such as BTC USD and EEM maintained relatively high rankings, while others like ARKK and QQQ had lower rankings. Safe assets also varied in their rankings, with some like TLT and IEF ranking higher than others like USMV and SPLV. This mixed sentiment indicates that investors were being selective in their asset choices amid market uncertainty.

What Does it Tell About the Current Market Scenario:

Investors seem to be playing it safe and selective when it comes to their investment options, showing no clear favoritism towards risky or safe assets. Here are some important points to note about the current market situation and where investors are placing their focus;

Cautious outlook: While certain risk assets like BTC USD and EEM continue to hold strong positions in terms of percentile ranks, others such as ARKK and QQQ lag behind. This indicates that investors are cautiously optimistic about specific sectors or asset types while exercising caution with others.

Seeking safety: Safe assets like TLT and IEF maintain higher percentile ranks, signaling that some investors still prefer the security of government bonds and other low risk investments. This reflects a lingering apprehension about market unpredictability and risks.

Specific sector attention: Investors seem to be concentrating on particular sectors or asset classes rather than making broad decisions. For instance, the technology sector (represented by QQQ) holds a lower percentile rank, whereas the healthcare sector (represented by XLV) enjoys a higher rank. This suggests that investors are assessing each sector individually based on its distinct attributes and potential for growth or stability.

Geopolitical and economic influences: The fluctuating market sentiment could be due to a range of geopolitical and economic factors, like shifts in interest rates, concerns about inflation or global events affecting investor trust.

In summary, the current market outlook as of March 12, 2024 shows a blend of sentiments among investors, who are cautiously optimistic and taking a selective approach to allocating assets. They seem focused on specific sectors and asset types while aiming for a balance between risk and security in their investment portfolios. It’s crucial for investors to stay vigilant about market conditions and adjust their strategies as necessary amidst this uncertain terrain.This illustrates multiple shifts between Risk On and Risk Off sentiments from March 25, 2024 to March 12, 2024. These changes can be attributed to evolving market conditions, economic factors and how investors perceive risk.

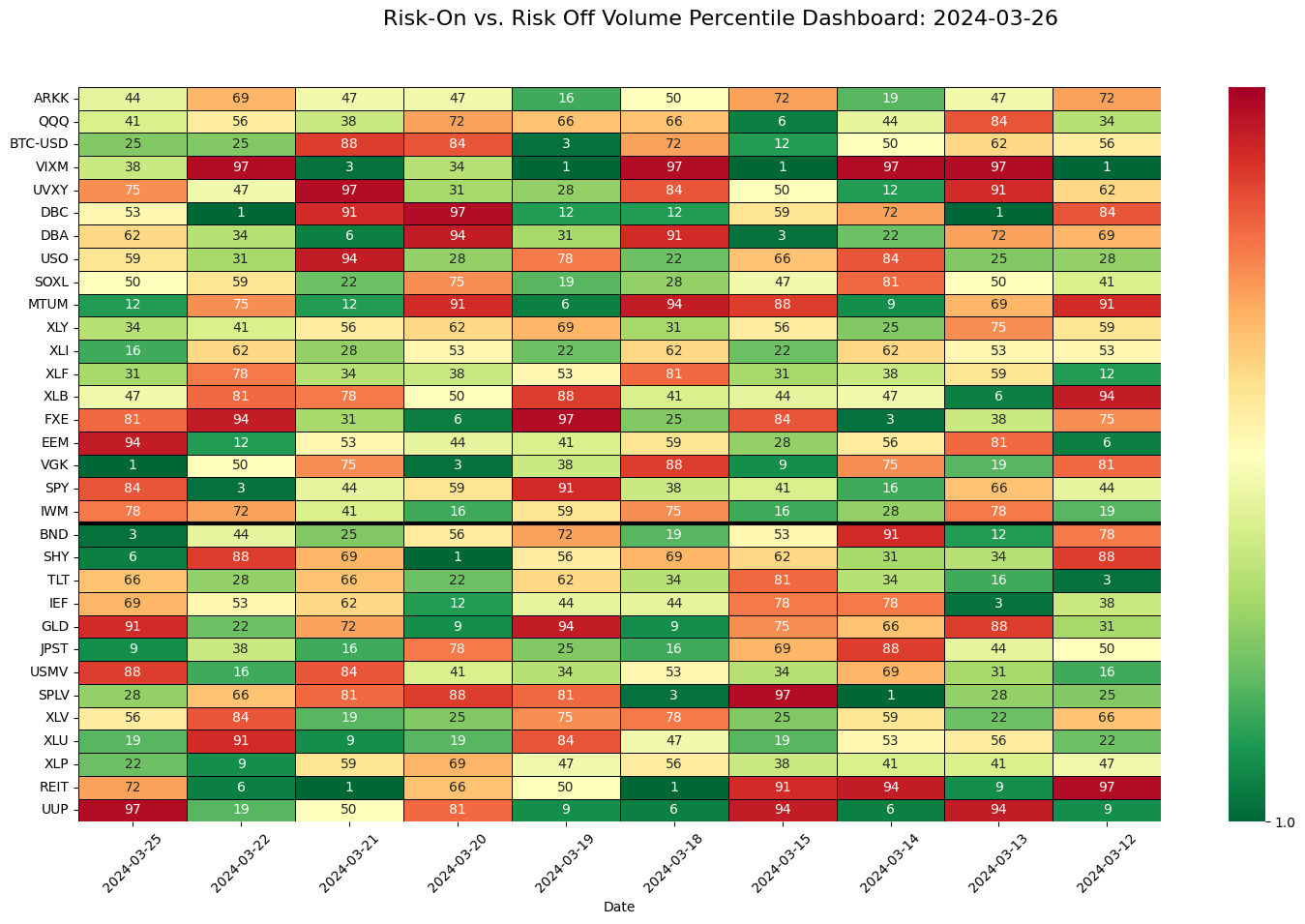

Risk On and Risk Off Sentiments-Current Market Scenarios-Based on Volume Changes

We can see changes in the trading volume of different assets, giving us insights into how investors feel and their risk preferences.

Transition from Risk On to Risk Off (March 25, 2024, to March 22, 2024): During this timeframe, there was a noticeable switch in trading volume from risky assets to safe assets. On March 25, 2024, high volume percentiles were seen for risk assets like ARKK, QQQ and BTC USD while safe assets like BND, SHY and TLT had lower ranks. However, by March 22, 2024, the volume percentiles for safe assets increased significantly while those for risky assets decreased. This shift suggests that investors were moving their investments from riskier options to safer ones as a sign of increasing aversion to risks in the market.

Transition from Risk Off to Risk On (March 21, 2024, to March 18, 2024): Between March 21 and March 18 of the same year saw a change in trading volume where money moved from safe assets back to risky ones. Safe options like BND, TLT and GLD had high volume ranks on March 21 but by March18 experienced a decline in their rankings.On the flip side, assets like ARKK, QQQ and SOXL saw an uptick in their volume percentile rankings during that time frame. This hints at investors feeling more confident in the market and being open to taking risks.

Sentiment Mix (15th March 2024 to 12th March 2024): The period between 15th March 2024 and 12th March 2024 reflects a blend of sentiments regarding trading volumes. Some risky assets such as BTC USD and EEM maintained relatively high volume percentile rankings, while others like ARKK and QQQ had lower ranks. Likewise, safe assets displayed varied volume percentile rankings with certain ones (e.g., TLT, IEF) ranking higher and others (e.g., USMV, SPLV) ranking lower. This mixed sentiment implies that investors were discerning in their asset selections and that the market was facing uncertainty.

As of 12th March 2024, the volume percentile rankings slightly favored risk assets, with ARKK, QQQ and BTC USD holding higher ranks compared to most safe assets. Nevertheless, the overall sentiment seems mixed as some safe assets like GLD and TLT continue to maintain relatively high volume percentile ranks.

In summary, the Risk On versus Risk Off Volume Percentile Method highlights different shifts in how investors feel about risk and preference from March 25, 2024, to March 12, 2024. These changes in trading activity across various assets offer valuable insights into market trends and can assist investors in making well informed choices based on current market conditions. As of March 12, 2024, the market appears to have a mix of sentiments, leaning slightly towards riskier assets. However, it’s advisable for investors to stay vigilant and keep a close eye on the market for any new developments.

Overall Sentiment Conclusions:

We can observe several commonalities, trends and comparative insights that may provide a perspective on the potential market movements.

Commonalities:

- Both methods indicate a shift from Risk On to Risk Off sentiment between March 25, 2024 and March 22, 2024, followed by a return to Risk On sentiment between March 21, 2024 and March 18, 2024.

- The mixed sentiment observed from March 15, 2024 to March 12, 2024 is apparent in both methods with varying percentile ranks and volume percentiles for risk and safe assets.

The shifts between Risk On and Risk Off sentiments seem to occur relatively quickly within a few days as reflected in both methods.During periods of Risk On sentiment, assets like ARKK, QQQ and BTC USD tend to have higher percentile ranks and volume percentiles while safe assets such as BND, TLT and GLD tend to have higher ranks during Risk Off periods.

Comparative Analysis: The Volume Percentile Method appears to offer a slightly clearer insight into investor sentiment compared to the Percentile Method. The changes in trading volume among assets seem more noticeable and definitive. On the other hand, the Percentile Method provides a broader perspective on how assets are performing relative to each other, considering actual price movements rather than just trading volume.

Key Narratives and Biases: The market is experiencing mixed sentiment, leaning slightly towards a Risk Off environment as of March 25, 2024. The rapid shifts between Risk On and Risk Off sentiments in the past indicate that investors are closely monitoring market conditions and reacting swiftly to changes.

Looking ahead, the market’s trajectory will likely be influenced by various factors like economic indicators, geopolitical events and investor confidence. If positive news and favorable market conditions persist, there may be a continued tilt towards Risk On sentiment, benefiting risk assets such as ARKK, QQQ and BTC USD due to heightened investor interest. However, if uncertainty or negative developments dominate the market scene, a shift back to Risk Off sentiment could occur favoring safe havens like BND, TLT and GLD.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.