Dollar Index:

The U.S. dollar is experiencing a significant rally, with the Bloomberg Dollar Spot Index registering its biggest weekly gain since September 2022. The dollar index hit a 5-month high against a basket of major currencies, driven by expectations that U.S. interest rates will remain elevated for longer due to stubborn inflation.

On April 26, US core PCE Price Index, personal income, personal spending, and consumer sentiment are scheduled for Release, pottentially impactacting the USD.

Robust U.S. economic data, including stronger-than-expected March retail sales and consumer price index figures, have bolstered the case for the Federal Reserve to keep rates higher. Investors have dramatically reduced bets on Fed rate cuts in 2024, now expecting only 50 basis points of easing compared to 150 basis points priced in at the start of the year.

Federal Reserve Chair Jerome Powell stated that recent data has not given the central bank greater confidence on inflation, suggesting rates may need to stay high for an extended period. This hawkish stance has further supported the dollar’s ascent.

The dollar’s strength is putting pressure on other major currencies. The euro fell to a 5-month low against the greenback, while the Japanese yen hit its weakest level since 1990, raising concerns about potential intervention by Japanese authorities.

Escalating geopolitical tensions are adding to the dollar’s safe-haven appeal. However, gold prices have also surged despite the stronger dollar, as investors seek haven assets amid the Middle East conflict.

In summary, the U.S. dollar is rallying on the back of strong economic data, expectations of a hawkish Federal Reserve, and its safe-haven status amidst geopolitical risks. This is putting pressure on other currencies and impacting global markets.

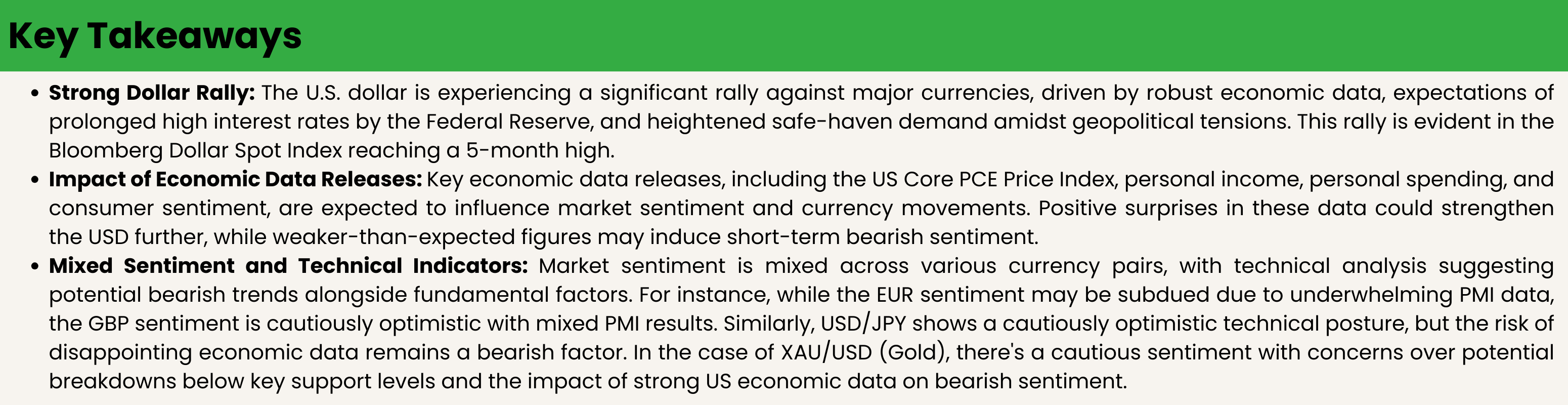

Upcoming Events for the week:

The week ahead holds key economic data releases that will be closely watched by currency market participants. The preliminary PMI figures from both the Eurozone and the UK have come in, with the Eurozone data slightly underperforming against expectations for both manufacturing and services. This could apply downward pressure on the EUR as it may signal slower economic growth than anticipated. In contrast, the UK’s figures are somewhat mixed, with the manufacturing PMI marginally outperforming and services PMI falling slightly behind expectations, potentially leading to mixed sentiment for the GBP.

In the United States, the S&P Global Services PMI has underperformed relative to the consensus, potentially signaling a slowdown in the service sector’s growth. This data, combined with a lower-than-expected new home sales figure, may induce bearish

sentiment for the USD in the short term. However, the focus will soon shift to the GDP growth rate figures. If the actual GDP growth outpaces the consensus significantly, it could counter any initial negative sentiment by suggesting robust economic activity, which might bolster the USD.

Towards the end of the week, the ECB’s Guindos will deliver a speech that could provide further cues on the monetary policy outlook, influencing the EUR. Furthermore, the U.S. Core PCE Price Index, the Fed’s preferred inflation measure, along with personal income and spending figures, will be scrutinized for indications of inflation trends and consumer behavior. Positive surprises in these data could strengthen the USD, particularly if inflation pressures are shown to be contained without dampening consumer spending.

Overall Market Sentiment:

- EUR sentiment might be subdued due to underwhelming PMI data, with an anticipated breakdown of 40% Positive, 40% Negative, and 20% Neutral.

- For the GBP, mixed PMI results could lead to a sentiment breakdown of 50% Positive, 30% Negative, and 20% Neutral, reflecting cautious optimism.

- The USD sentiment, heading into the GDP and PCE data releases, could be balanced at 50% Positive, 30% Negative, and 20% Neutral, contingent on the economic indicators supporting sustained growth with controlled inflation.

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios with Specific Levels

Bullish Scenario:

- A break above the current resistance level at the Fibonacci retracement of around 1.0629 could lead to a test of the next resistance near 1.07138.

- Sustained trading above the falling wedge pattern could target the 1.07515.

Bearish Scenario:

- If prices break below the recent low around 1.0525, we could see a move towards the 1.05742 (2.618 Fibonacci extension level).

- A further decline may target the 1.06445 (2.272 Fibonacci extension level), reinforcing the bearish trend.

Neutral Scenario:

- In the event of consolidation, the price could oscillate between the recent low of 1.0525 and the near-term resistance at 1.0855.

- The Momentum indicator hovers around the centerline, suggesting a lack of directional bias, supporting a sideways movement within these levels.

Fundamental Scenarios

Positive Data Impact:

- If the Manufacturing and Services PMI data outperform consensus, this could bolster the Euro as it indicates economic expansion.

- Strong GDP and Personal Spending data may boost the USD, applying bearish pressure on EUR/USD.

Negative Data Impact:

- If PMI data falls short of expectations, the Euro may weaken due to concerns over economic slowdown.

- Weaker than expected US GDP, Personal Income, and Spending data may weaken the USD, which could be bullish for EUR/USD.

Mixed Data Outcome:

- Mixed data, with some indicators above and some below consensus, could lead to increased market volatility and indecisive price action.

Overall Market Sentiment

Sentiment Analysis:

- The technical analysis shows a confluence of bearish indicators which suggests a sentiment leaning towards the negative side.

- Upcoming high-impact fundamental events are likely to significantly sway market sentiment.

Sentiment Percentages:

- 55% Negative: Technical indicators and potential bearish reactions to upcoming economic events dominate.

- 30% Positive: Potential for positive surprises in economic data and the technical possibility of a bullish reversal.

- 15% Neutral: Uncertainty due to mixed technical signals and the anticipation of high-impact news releases.

Impact of PCE Data on EUR/USD:

- PCE data, being a key indicator of inflation, will likely have a significant impact on the USD.

- Higher-than-expected PCE data could strengthen the USD as it may signal higher inflation and a potential for more aggressive Fed rate hikes, leading to bearish EUR/USD action.

- Conversely, a lower PCE print may suggest subdued inflation pressures, potentially weakening the USD and providing a bullish case for EUR/USD.

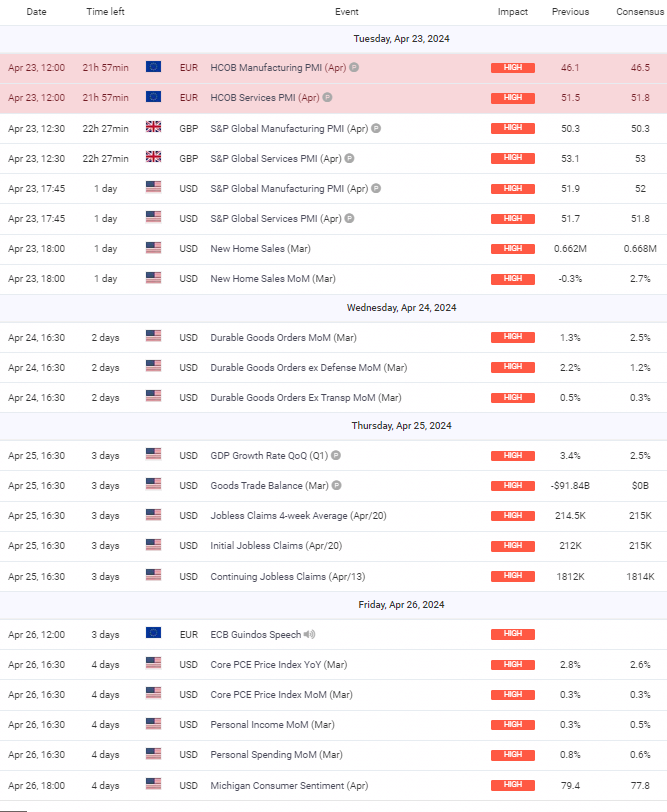

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Scenarios:

Technical Scenarios for GBP/USD

Bullish Scenario:

- If the price breaks above the short-term resistance at 1.2452, the next target could be the 0.5 Fibonacci level at 1.25146.

- A further extension above this level may lead to a retest of the 0.618 Fibonacci level at 1.24663, potentially signaling a shift to a bullish trend.

Bearish Scenario:

- A breakdown below the current support at the recent low of 1.22208 could see a continuation of the bearish trend towards the 1.618 Fibonacci extension level at 1.21360.

- Persistence of the downtrend might then target the psychological level of 1.2100, marking a strong bearish sentiment.

Neutral Scenario:

- In a range-bound scenario, the pair could oscillate between the immediate resistance at 1.2452 and the recent support at 1.22208.

- A flattening momentum indicator could suggest a lack of directional conviction, supporting this neutral outlook.

Fundamental Scenarios for GBP/USD

Positive Data Impact:

- If UK PMI figures surpass the consensus, it could boost GBP strength due to improved economic outlook perceptions.

- Strong US economic data, however, could counteract this, applying downward pressure on GBP/USD.

Negative Data Impact:

- Disappointing PMI figures from the UK may weigh down on GBP, intensifying the bearish trend.

- Weak US data, especially lower-than-expected PCE figures, could weaken the USD, potentially offsetting GBP losses.

Mixed Data Outcome:

- Contrasting data with UK PMI outperforming and US data underperforming (or vice versa) may lead to erratic price movements and increased volatility.

Overall Market Sentiment

Based on the technical chart and the high-impact economic events:

Sentiment Percentages:

- 60% Negative: The chart displays a descending channel with price below several key Fibonacci levels, indicating a stronger bearish technical sentiment.

- 25% Positive: There’s a potential for bullish reversal if resistance levels are breached, especially if backed by strong UK economic data.

- 15% Neutral: The possibility of consolidation within the current price range if upcoming data results are mixed and fail to provide a clear direction for the currency pair.

Impact of PCE Data on GBP/USD:

- Higher-than-anticipated PCE data could strengthen the USD on expectations of continued monetary tightening by the Fed, potentially dragging GBP/USD lower.

- Lower-than-expected PCE data could lead to USD weakness, providing an upward push for GBP/USD as it might signal a slower pace of rate hikes.

- The impact of the PCE data on GBP/USD will also depend on the market’s interpretation of the data in the context of the Fed’s policy path and other concurrent economic indicators.

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Bullish Scenario:

- A sustained move above the current price level may push towards the upper boundary of the ascending channel, aiming for the level at 155.217.

- If momentum remains strong and the pair breaks out of the channel, the psychological resistance at 155.604 could be tested.

Bearish Scenario:

- A reversal from the current level could see USD/JPY test the lower boundary of the ascending channel, with potential support at the level of 154.

- Should the pair breach the channel to the downside, the next target could be the 0.5 Fibonacci level at 153.578, marking a significant bearish development.

Neutral Scenario:

- The pair might continue to trade within the boundaries of the ascending channel, oscillating between the current price and of 153.

- The Momentum indicator and RSI hovering in the middle of the range suggest a potential for continued range-bound activity within the channel.

Fundamental Scenarios for USD/JPY

Positive Data Impact:

- Stronger-than-expected US economic data, especially the PCE, could propel the USD higher due to increased expectations of Federal Reserve tightening.

Negative Data Impact:

- If the US PCE data disappoints, this could suggest a slower trajectory for interest rate increases, potentially weakening the USD against the JPY.

- Simultaneously, stronger economic indicators from Japan could bolster the JPY, contributing to a bearish USD/JPY scenario.

Mixed Data Outcome:

- Mixed signals from economic data releases could result in heightened volatility with no clear directional trend, supporting the neutral scenario.

Overall Market Sentiment

Sentiment Percentages:

- 55% Positive: The ascending channel and proximity to the upper boundary suggest a cautiously optimistic technical posture for the pair.

- 30% Negative: The potential for a channel breakdown and the risk of disappointing economic data provide a substantial bearish counterweight.

- 15% Neutral: The possibility of range-bound trading within the established channel reflects a measure of market indecision.

Impact of PCE Data on USD/JPY:

- Higher PCE figures could lead to a stronger USD as they may reinforce expectations for more aggressive rate hikes by the Federal Reserve, potentially boosting USD/JPY.

- Conversely, lower PCE numbers could prompt a decline in USD strength, pressuring USD/JPY to the downside if the market interprets this as a sign of less aggressive monetary tightening.

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD

Bullish Scenario:

- A breakout above the consolidation pattern near the $2370 mark could target the level around $2431.

- The ascending trendline from previous lows indicates support, which if holds, might suggest continued bullish sentiment.

Bearish Scenario:

- A breakdown below the current consolidation pattern and the ascending trendline could see a move towards the 0.786 Fibonacci retracement level at around $2345.

- Further bearish momentum might test the 0.618 Fibonacci level near $2316, where a significant level of support might be found.

Neutral Scenario:

- If XAU/USD remains within the current consolidation pattern, it could fluctuate between the recent high around $2370 and the support trendline.

- The RSI hovering around the mid-level and a lack of significant momentum could be indicative of a continued range-bound market.

Fundamental Scenarios for XAU/USD

Positive Economic Data Impact:

- Strong US data, especially higher-than-expected PCE figures, may strengthen the USD, potentially leading to a decline in Gold prices due to their inverse relationship.

Negative Economic Data Impact:

- Weaker-than-anticipated US data, particularly lower PCE figures, could lead to a weaker USD, and as a result, an increase in Gold prices as it is often seen as a hedge against currency weakness.

Mixed Economic Data Outcome:

- A combination of positive and negative data releases might create uncertainty, leading to heightened volatility and a lack of clear direction for Gold prices.

Overall Market Sentiment

Sentiment Percentages:

- 40% Positive: Given the uptrend and recent consolidation, there is a cautiously optimistic sentiment for continued bullish behavior, provided support levels hold.

- 35% Negative: Concerns over a potential breakdown below key support levels and strong US economic data could fuel bearish sentiment.

- 25% Neutral: Uncertainty ahead of high-impact economic releases and technical indicators showing consolidation suggest a sizeable neutral sentiment in the market.

Impact of PCE Data on XAU/USD:

- A higher PCE reading could indicate inflationary pressures, potentially resulting in a stronger USD and lower Gold prices as the opportunity cost of holding non-yielding assets rises.

- Conversely, a lower PCE reading may weaken the USD and bolster Gold prices as it might reduce the likelihood of aggressive interest rate hikes by the Federal Reserve.

Risk based Sentiments-What to Look out for?

EUR/USD:

- Focus on: U.S. Core PCE Price Index and Eurozone CPI data. Strong U.S. inflation may reinforce the USD’s strength, while significant Eurozone CPI figures could impact ECB monetary policy decisions, influencing the EUR.

GBP/USD:

- Focus on: UK’s employment change and retail sales data. Weakness in these indicators could drive bearish sentiment towards the GBP, while unexpected strength could provide support.

USD/JPY:

- Focus on: U.S. GDP growth rate and Core PCE Price Index. Robust U.S. economic performance and sustained inflation pressures may further bolster the USD, impacting the USD/JPY exchange rate.

XAU/USD (Gold):

- Focus on: U.S. Core PCE Price Index and geopolitical developments. Inflation trends will influence gold prices due to its role as an inflation hedge, while escalating tensions could enhance its safe-haven appeal.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.