Factors to Consider:

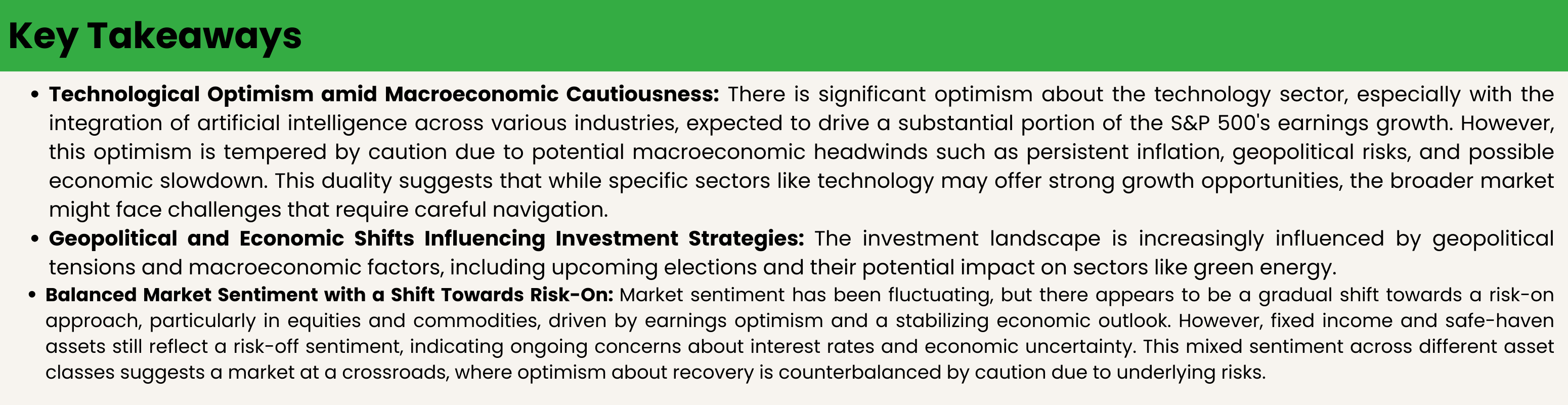

The outlook for the Q2 earnings season of 2024 is shaped by a mix of optimistic and cautious perspectives across different sectors and global markets.

U.S. Market and Economic Environment:

The U.S. stock market has shown resilience, with S&P 500 earnings growth expectations for 2024 revised upwards. The technology sector is anticipated to play a significant role, accounting for about half of this year’s S&P 500 earnings. This reflects an upbeat risk appetite, particularly around the integration and impact of artificial intelligence across various sectors.

However, the overall performance of risky assets and the macro outlook for the next year are viewed with caution due to ongoing monetary headwinds and geopolitical risks.

Global Economic Trends:

The global economic growth is expected to be slow, with challenges such as moderate growth and persistent inflation affecting market dynamics.

Japan presents a brighter scenario with solid corporate earnings and supportive monetary policies, making it a favorable market for investors.

Labor Market and GDP Growth:

U.S. GDP growth is expected to normalize by the fourth quarter, but a slowdown is anticipated for 2024. The labor market is expected to experience a modest uptick in unemployment, though severe impacts like a recession are not anticipated.

Inflation and Interest Rates:

Inflation is expected to ease, and with it, interest rates might see adjustments. The U.S. has experienced what some analysts call “immaculate disinflation,” where inflation rates have fallen without significant harm to the economic cycle, largely due to improvements in supply chains and labor market recoveries. The inflation rate in the US stands at 3.48%, a slight increase from 3.15% in February. The annual increase is lower compared to 4.98% a year ago, marking a significant easing of inflation over the year.

Overall, while there are positive indicators like technological advancements and supportive policies in certain regions, the broader picture remains mixed with potential risks from inflation, interest rates, and geopolitical tensions. This sets a stage for cautious optimism with a focus on strategic, nimble investment approaches as the economic and market conditions evolve.

Comparing Q1 to Expected Q2: Expectations

Q1 2024 Overview:

Q1 saw a focus on strategic positioning within portfolios, with a particular emphasis on sectors poised to benefit from technological advancements such as AI. Market sentiments were cautiously optimistic, buoyed by solid corporate earnings and the persistent influence of AI across various sectors, which contributed to an upbeat risk appetite. This period also reflected a strong emphasis on managing macroeconomic risks, with inflation expectations being a critical focal point. Investors were advised to remain nimble in their investment strategies due to potential volatility and dispersion in market returns.

Q2 2024 Expectations:

Moving into Q2, the expectations for S&P 500 earnings growth are revised upwards, particularly with the tech sector anticipated to drive significant performance. However, the broader economic indicators suggest a more mixed outlook. For instance, geopolitical risks and a potential slowdown in economic demand are expected to cloud the equity market outlook. Market valuations are under scrutiny, with a more challenging macro backdrop anticipated to impact investor sentiment and asset pricing. J.P. Morgan highlights concerns over stubborn inflation and geopolitical tensions as major factors that could weigh on markets, suggesting a cautious approach to equity investments.

Valuations and Justifications:

Valuations heading into Q2 are being justified on the basis of sector-specific growth potentials and macroeconomic adjustments. The tech sector, driven by AI, is seen as a key area for growth, influencing higher valuations and investment interest. Conversely, sectors sensitive to macroeconomic pressures, such as those heavily impacted by geopolitical risks or inflation, may face valuation pressures. Firms are emphasizing the need for a granular approach to investment, targeting sectors and geographies with specific growth prospects or resilience to macro pressures.

Going Forward:

The advice from leading research firms underscores a strategic approach to investment, advocating for flexibility in asset allocations and readiness to adjust to shifts in the economic landscape. The potential for inflation to moderate and the impact of Fed policies will be critical in shaping market trajectories. Investors are encouraged to focus on long-term value creation, leveraging sectors with strong fundamentals and growth prospects, despite short-term uncertainties.

In conclusion, as we move from Q1 to Q2 2024, the investment landscape is characterized by a blend of optimism in technology and caution due to macroeconomic and geopolitical challenges. This nuanced narrative reflects a complex interplay of factors that investors need to navigate to optimize their market positions.

SWOT Analysis:

Conducting a SWOT analysis through the lens of narrative and biases provides a structured way to evaluate the contrasting perspectives provided by research firms regarding the economic and market outlook for Q1 and Q2 of 2024. Here’s how the analysis might look:

Strengths

- Technological Adoption and AI Integration: Firms like BlackRock highlight the persistent influence and integration of artificial intelligence (AI) across various sectors as a major strength, driving optimism and growth, particularly in the tech sector.

- Solid Corporate Earnings: Q1 shows strong corporate earnings, especially from Japan, as a result of supportive monetary policies and improved market conditions.

Weaknesses

- Geopolitical Risks and Stubborn Inflation: These factors are repeatedly mentioned as potential drags on market performance and economic stability, reflecting a significant vulnerability.

- High Valuation Concerns: With the tech sector expected to drive significant portions of S&P 500 earnings, there’s a risk of overvaluation, especially if the broader economic indicators do not support such optimism.

Opportunities

- Sector-Specific Growth: There’s a clear opportunity in sectors that are effectively leveraging AI and other technological innovations. Additionally, geographic granularity suggests targeting specific markets like Japan and sectors poised for reform or regulatory benefits could yield strong returns.

- Inflation Moderation: If inflation expectations are managed and begin to align more closely with central bank targets, this could stabilize market conditions and support further economic growth, creating opportunities for investors to capitalize on lower-valued assets.

Threats

- Narrative Bias: The optimism shown by some analysts, especially regarding tech and AI, could lead to a narrative bias where the risks are underplayed. This bias might affect investment decisions, leading to potential overexposure in hyped sectors.

- Economic Slowdown Risks: Despite strong corporate earnings, the broader economic indicators such as GDP growth rates and labor market trends point towards a potential slowdown. This dissonance between corporate performance and macroeconomic indicators could mislead investors about the actual health of the economy.

Analysis of Narrative and Biases:

The prevailing narratives from major research firms reflect an underlying bias towards technological optimism, particularly with AI’s role in driving market growth. This could skew investor sentiment positively in the short term but may also lead to potential oversight of fundamental economic challenges such as inflation and geopolitical instability. On the other hand, the cautious tone regarding macroeconomic challenges reflects a conservative bias that aims to temper the tech-driven enthusiasm. This could either prevent overinvestment in volatile markets or potentially lead to missed opportunities if the caution is overemphasized.

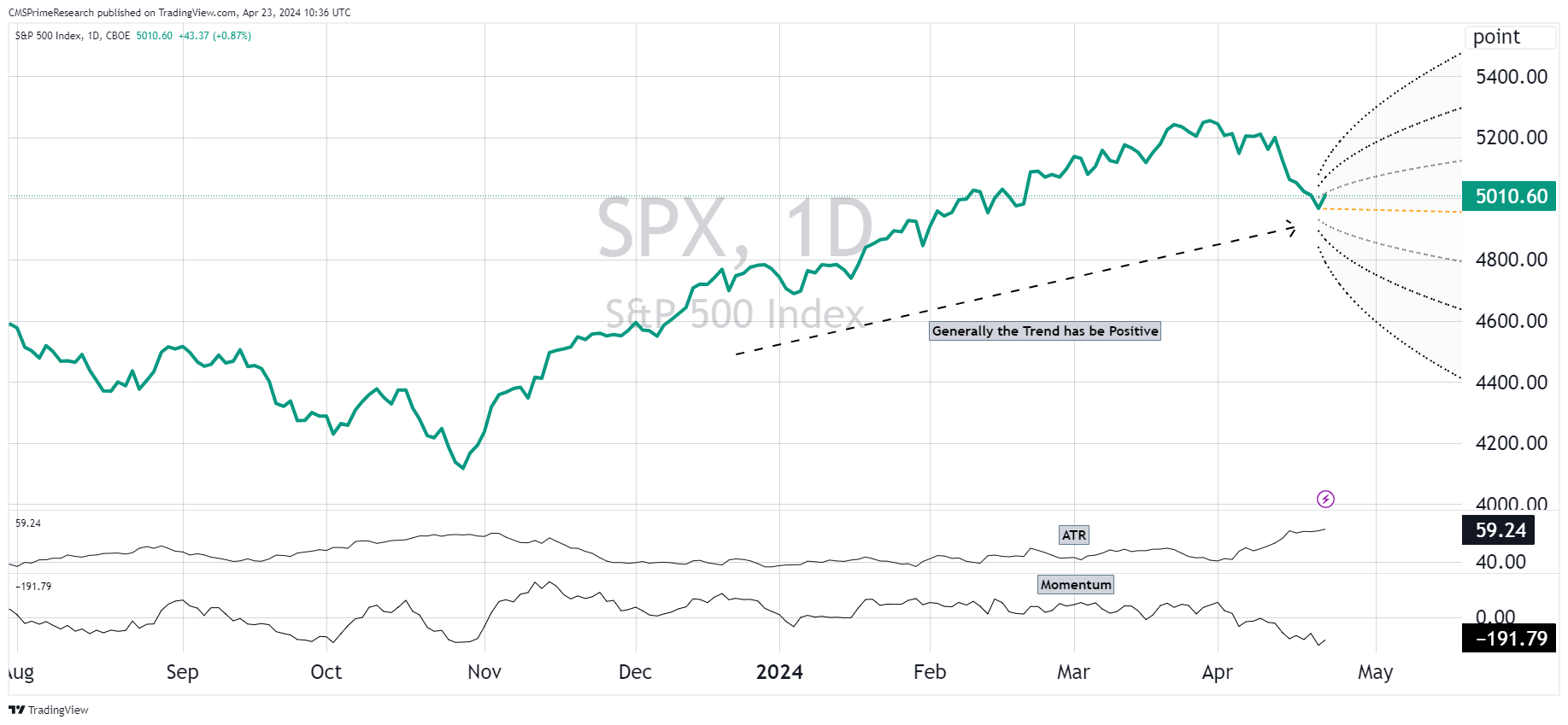

Risk on and Risk of Sentiments:

Equity-Linked ETFs and Assets

- ARKK & QQQ: Initially, these ETFs showed a strong risk-off sentiment (reds and oranges), indicating skepticism towards growth stocks. Over the months, there seems to be an intermittent shift towards risk-on (greens), possibly due to earnings optimism or a shift in tech sector outlook.

- MTUM: This momentum-based ETF has fluctuated but shows a trend towards risk-on, indicating a return to favoring high-momentum stocks.

Volatility Indexes

- VIXM & UVXY: Both started with high risk-off sentiment but moved towards a more neutral stance. The initial fear indicated by deep reds could have been due to geopolitical tensions or market volatility, which appears to have subsided, leading to less reliance on volatility hedges.

Commodities

- USO & DBC: Strong risk-on sentiment, especially in USO, may reflect expectations for economic growth or inflationary pressures, making commodities an attractive bet. Over three months, this sentiment remained largely consistent.

Fixed Income and Safe-Haven Assets

- TLT & IEF: These assets, which often signal risk-off moves, showed a consistent preference for risk-off, potentially due to interest rate hike expectations or economic uncertainty.

- GLD: The preference for gold, a classic safe-haven asset, fluctuated but ended on a stronger risk-off note, possibly due to increased market uncertainties or inflation fears.

Over the past three months, the market sentiment oscillated but appears to have reached a more balanced state with both risk-on and risk-off signals across different asset classes.

Current Market Position: Risk-On or Risk-Off?

- The overall market sentiment currently leans towards risk-on, particularly in equities and commodities, despite some persisting caution as indicated by fixed income and safe-haven assets.

- The presence of both risk-on and risk-off sentiments suggests a market at a crossroads, reflecting a mix of optimism about economic recovery and concerns over inflation, interest rates, and geopolitical issues

Other Factors to Consider:

Valuations and Justifications Across Sectors:

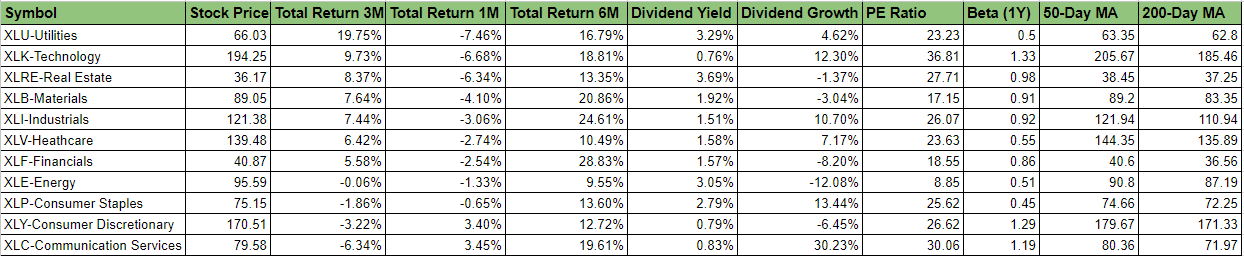

General Trends

- Returns: The past 3-month, 1-month, and 6-month returns show varying performance across sectors with technology and communication services leading in 3-month returns and Financials in 6-month returns.

- Dividends: Dividend yields vary, with energy providing the highest yield. Dividend growth is robust in sectors like technology and communication services but negative for financials and energy.

- Volatility: Betas show that utilities, healthcare, and consumer staples are less volatile sectors, while technology, consumer discretionary, and communication services exhibit more volatility.

- Valuation: PE ratios indicate that energy is the most undervalued or least growth-expected sector, while communication services are the most highly valued in terms of growth expectations.

Geopolitical Factors and Election Cycles: The political landscape, particularly in the U.S., with an upcoming election, is influencing sector-specific behaviors, notably within green energy sectors, which are highly sensitive to policy changes. Such sectors show heightened activity in discussions around potential regulatory changes that could arise from election results.

Sectoral Opportunities: Specific sectors such as healthcare and technology appear poised for growth, driven by innovation and the ongoing digital transformation. However, the performance is closely tied to broader economic indicators and investor sentiment, which are currently mixed due to the ongoing macroeconomic adjustments.

Emerging Market Divergence: Emerging markets are showing a divergent growth pattern, with some regions potentially offering lucrative opportunities due to less stringent monetary policies and different stages of economic recovery post-pandemic.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies, CFD’s involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.