Dollar Index:

As of March 18th, 2024, the latest news impacting the USD revolves around various global economic events and market trends.

Federal Reserve’s Interest Rate Decision: The Federal Reserve is anticipated to maintain interest rates at 5.25% to 5.50% until its June meeting. Market attention will be on the Fed’s “dot-plot,” with the possibility of the Fed adjusting projections to just two 25 basis point cuts this year, following hotter than expected U.S. CPI and PPI data last week.

Bank of Japan’s Policy Shift: The Bank of Japan is on the verge of ending eight years of negative interest rates, driven by historical wage hikes that increase prospects for inflation to sustainably reach its 2% target. This significant policy shift could have broader implications for global markets and currency valuations, including the USD.

US Economic Activity and Federal Reserve’s Position: According to a recent Fed survey, US economic activity showed little to no change from December through early January. Despite mixed pricing pressures and signs of a cooling labor market, retail sales in December suggested consumers were still spending robustly as they entered 2024. This information is crucial for investors and analysts watching the USD, as the Federal Reserve’s future rate decisions hinge on these economic indicators. The Fed has indicated a potential for rate cuts within the year, aiming to manage inflation while supporting growth.

Global Economic Growth Predictions for 2024: Projections indicate that global economic growth may slow in 2024. High interest rates, increased energy prices, and a slowdown in the world’s top two economies could contribute to this deceleration. Geopolitical risks and ongoing conflicts could further exacerbate the situation, potentially impacting the USD as investors navigate these uncertainties

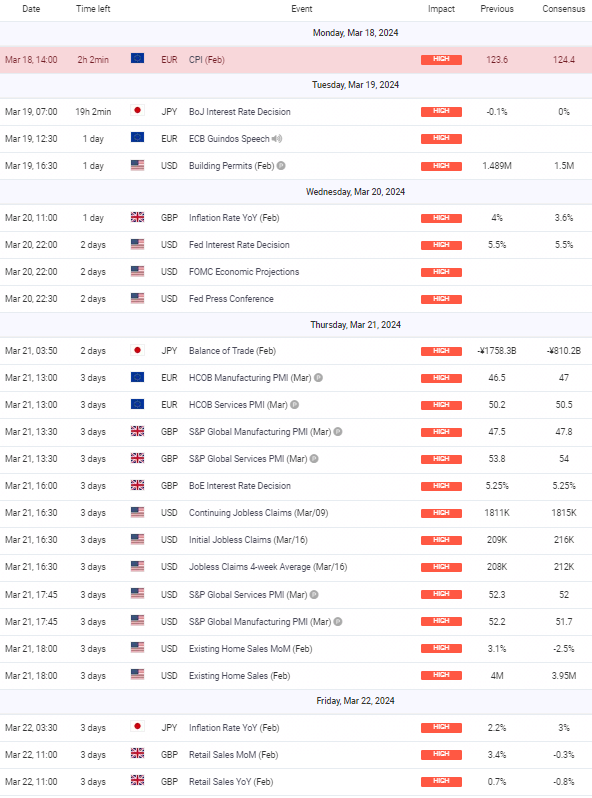

Upcoming Events for the week:

The upcoming week in the currency markets is particularly crucial with several high-impact events scheduled. Notably, the CPI data from the Eurozone has come in lower than the forecast, which may signal subdued inflation pressures that could potentially soften the EUR if the market interprets this as a cue for less aggressive monetary tightening by the European Central Bank (ECB).

The main event of the week is the U.S. Federal Reserve’s interest rate decision. With rates expected to hold at 5.5%, the market has likely already priced in this scenario. However, the associated FOMC economic projections and subsequent press conference will be parsed meticulously for forward guidance. Any hawkish surprises or indications that the Fed may not be as close to ending its rate-hiking cycle as anticipated could lead to a surge in the USD as market participants recalibrate their expectations for U.S. monetary policy.

Additionally, PMI data across Europe and the UK will provide insights into the manufacturing and services sectors. Robust figures here could bolster the respective currencies by indicating economic resilience. On the other hand, the GBP will be impacted by the BoE interest rate decision, where rates are expected to remain unchanged.

Overall Market Sentiment:

- The sentiment towards the EUR might be cautious, with a sentiment breakdown of 40% Positive, 40% Negative, and 20% Neutral, reflecting the lower-than-expected inflation figures.

- The USD sentiment is poised to be highly sensitive to the Fed’s communications, with a potential breakdown of 60% Positive, 20% Negative, and 20% Neutral, skewing towards the positive if the Fed maintains a hawkish tone.

- For the GBP, pending the outcome of the BoE decision and PMI data, the sentiment could be cautiously optimistic at 50% Positive, 30% Negative, and 20% Neutral, especially if economic data remains resilient despite ongoing challenges.

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD:

Bullish Scenario:

- The EUR/USD could target the Fibonacci level of 0.618 at 1.10516 if it gains upward momentum, potentially challenging the 0.786 level at 1.10219.

- If the RSI continues to trend upwards and crosses above the 50 mark, it may confirm bullish strength.

Neutral Scenario:

- The currency pair may fluctuate around the current level near 1.08869, between the Fibonacci levels of 1.08549 (support) and 1.09841 (resistance).

- A stable RSI around the mid-level indicates a balanced market sentiment, leading to a sideways trend.

Bearish Scenario:

- A breakdown below the immediate support level of 1.08549 could send EUR/USD towards the next Fibonacci level at 1.08172, with a further downside targeting the 1 level at 1.07810.

- A downward trend in the RSI below 50 would support this bearish outlook.

Fundamental Scenarios for EUR/USD:

Positive Data Outcomes:

- Strong U.S. economic data, particularly from the Fed interest rate decision and FOMC projections, could strengthen the USD, aligning with the bearish scenario.

- Better-than-expected retail sales or PPI figures may also contribute to USD strength against the EUR.

Neutral Data Outcomes:

- If upcoming U.S. and European data releases meet the market consensus, EUR/USD might experience limited fundamental-driven movements, correlating with the neutral technical scenario.

- Traders might then rely more on technical levels and global economic sentiment rather than individual data points.

Negative Data Outcomes:

- Disappointing U.S. inflation or employment data could weaken the USD, which might encourage a bullish scenario for EUR/USD.

- Any dovish indications from the Fed or worse-than-expected U.S. economic figures could prompt a flight to the relative safety of the EUR.

Overall Market Sentiment:

The sentiment for EUR/USD in the upcoming week, given the technical posture and forthcoming economic data, could be approximated as:

- Positive: 40% – Reflecting the possibility of EUR/USD advancing in case of weaker USD data or negative surprises in U.S. economic reports.

- Negative: 40% – Indicating the chance of EUR/USD declining if U.S. economic data strengthens the USD.

- Neutral: 20% – Accounting for the potential of a ranging market if data releases are in line with expectations and absent new market-moving events.

GBP USD Outlook:

GBPUSD: Week Ahead Technical and

Technical Scenarios for GBP/USD:

Bullish Scenario:

- Break above the current consolidation pattern, targeting the 0.5 Fibonacci retracement level at 1.29113.

- Sustained upward movement could test further resistance near the 0.382 Fibonacci level at 1.28851.

- A rising RSI above 50 would reinforce the bullish momentum.

Neutral Scenario:

- Price may oscillate within the range defined by the 0.618 Fibonacci level at 1.27302 and the 0.5 level at 1.29113, indicating indecision.

- The RSI hovering around the midpoint would align with a sideways trend in price.

Bearish Scenario:

- A break below the 0.618 Fibonacci level at 1.27302 could see the price heading down towards the lower boundary of the channel near 1.27139.

- A declining RSI, especially if it moves below the 50 threshold, would suggest increasing bearish momentum.

Fundamental Scenarios for GBP/USD:

Positive Data Outcomes:

- Strong UK inflation data could signal a bullish scenario for the GBP, causing a rise in GBP/USD.

- If US data underperforms (e.g., lower-than-expected CPI or Fed interest rate decision), it could weaken the USD and strengthen GBP/USD.

Neutral Data Outcomes:

- In-line economic data releases from both the UK and US might result in limited GBP/USD volatility, fitting the neutral technical scenario.

Negative Data Outcomes:

- If UK data disappoints, particularly if the inflation rate falls below expectations, the GBP could weaken.

- Conversely, stronger than expected US data (e.g., higher CPI or a more hawkish Fed) could drive GBP/USD lower.

Overall Market Sentiment:

Based on the technical and fundamental potential scenarios, the overall sentiment for GBP/USD might be estimated as follows:

- Positive Sentiment: 30% – Given the potential for GBP strength on good inflation numbers or USD weakness on poor economic performance.

- Negative Sentiment: 40% – Considering possible USD strength from an aggressive Fed stance or weak UK economic figures.

- Neutral Sentiment: 30% – Acknowledging the possibility of balanced forces if economic data meets market expectations, leading to range-bound movement.

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Scenario 1: Bullish Reversal

- The USD/JPY pair finds support at the current level of 149.119, buoyed by the positive momentum indicator.

- A rebound from the trend line suggests a potential return to test the 149.321 resistance.

- A break above this level could see a move towards the 150.000 psychological level, with the RSI remaining above the 50 mid-line, indicating bullish sentiment.

Scenario 2: Continued Consolidation

- The pair may continue to trade within the current range between support at 149.119 and resistance at 149.321.

- The RSI hovering around the midpoint suggests indecision, which may result in a sideways movement within the defined levels.

- Traders might await further economic clues from upcoming high-impact events before committing to a clear direction.

Scenario 3: Bearish Breakdown

- A sustained break below the 149.119 level could lead to further bearish momentum.

- The next level of support is at the 148.471 zone, where any break could extend losses towards the 148.000 area.

- The RSI dipping below 50 would provide additional confirmation of a bearish scenario.

Fundamental Scenarios for USD/JPY

Scenario 1: Hawkish Federal Reserve

- The Fed Interest Rate Decision and FOMC Economic Projections indicate a hawkish stance, increasing rates beyond 5.5%.

- A hawkish outcome would likely strengthen the USD as it reflects confidence in the economic outlook and a commitment to controlling inflation.

- USD/JPY could rise as investors seek yield in a higher interest rate environment.

Scenario 2: Dovish Central Banks’ Narrative

- If the Bank of Japan (BoJ) Interest Rate Decision reveals a more dovish stance than expected, maintaining or deepening negative rates.

- The contrast between the Fed’s hawkishness and BoJ’s dovishness could lead to USD strength against JPY.

- This could result in the USD/JPY pair trending higher as the interest rate differential widens.

Scenario 3: Economic Data Driven Movement

- If the US Building Permits and Jobless Claims come in stronger than expected, it could signal a robust US economy, supporting the USD.

- Conversely, weaker than expected data could raise concerns about economic health, leading to USD selling pressure.

- JPY could either weaken or strengthen in response, depending on its own domestic data, such as the Inflation Rate YoY and Retail Sales MoM.

Overall Market Sentiment

Based on the provided economic events and technical analysis:

- Bullish Sentiment: 40% Positive

- Neutral Sentiment: 40% Neutral

- Bearish Sentiment: 20% Negative

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Scenario 1: Bullish Recovery

- Gold shows a potential for recovery from the support level around $2,147.

- A bullish scenario could see the price rebound towards the Fibonacci retracement level at 0.5 ($2,179) as a short-term target.

- Sustained bullish momentum could test the 0.618 level ($2,199), with the RSI moving above the 50 level indicating increasing buying pressure.

Scenario 2: Sideways Movement

- The consolidation pattern within the Fibonacci retracement levels of 0.382 ($2,158) and 0.5 ($2,179) could persist.

- This scenario suggests a neutral stance with the RSI oscillating near the 50 level, implying indecision among traders.

- Gold prices may oscillate without a clear direction until a catalyst prompts a breakout.

Scenario 3: Bearish Continuation

- A break below the current support level could lead to a test of the $2,110 support zone.

- The RSI trending towards the oversold territory would corroborate the bearish momentum.

- A clear break below $2,110 could extend losses towards the psychological level of $2,000, with momentum indicators confirming the downtrend.

Fundamental Scenarios for XAU/USD (Gold)

Scenario 1: Hawkish Federal Reserve

- If the Fed Interest Rate Decision is more hawkish than expected, the USD may strengthen, potentially pressuring gold prices.

- Rising interest rates could lead to lower gold prices as opportunity cost for holding non-yielding assets increases.

- A scenario that favors a stronger USD typically weighs negatively on XAU/USD.

Scenario 2: Inflationary Concerns

- If CPI data or other indicators suggest increasing inflation, gold may find support as a traditional hedge against inflation.

- Rising inflation without a corresponding increase in interest rates could bolster the appeal of gold.

- Inflationary pressures tend to be bullish for gold, possibly leading to an increase in its price.

Scenario 3: Risk Sentiment and Economic Data

- If global economic data indicates a slowdown, risk-off sentiment may lead investors to seek safety in gold.

- Conversely, strong economic data may reduce demand for safe-haven assets like gold, causing prices to fall.

- Gold prices are often influenced by overall risk sentiment in the markets, which is in turn affected by economic indicators.

Overall Market Sentiment

Based on the provided economic events and technical analysis for XAU/USD:

- Bullish Sentiment: 35% Positive

- Neutral Sentiment: 50% Neutral

- Bearish Sentiment: 15% Negative

Risk based Sentiments-What to Look out for?

EUR/USD: Keep an eye on the Federal Reserve’s interest rate decision and FOMC economic projections. Any unexpected hawkish tones could strengthen the USD, pressuring EUR/USD lower.

GBP/USD: The Bank of England’s interest rate decision and PMI data will be crucial. Positive surprises could bolster the GBP, while negative outcomes may weaken it against the USD.

USD/JPY: Monitor the Federal Reserve’s interest rate decision closely, along with the Bank of Japan’s policy announcements. A divergence in their monetary policy stances could significantly impact USD/JPY movements.

XAU/USD (Gold): Federal Reserve’s interest rate decision and inflation data are key. Hawkish Fed actions or higher inflation could drive gold prices, as gold is often viewed as an inflation hedge and reacts to USD strength.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.