Introduction:

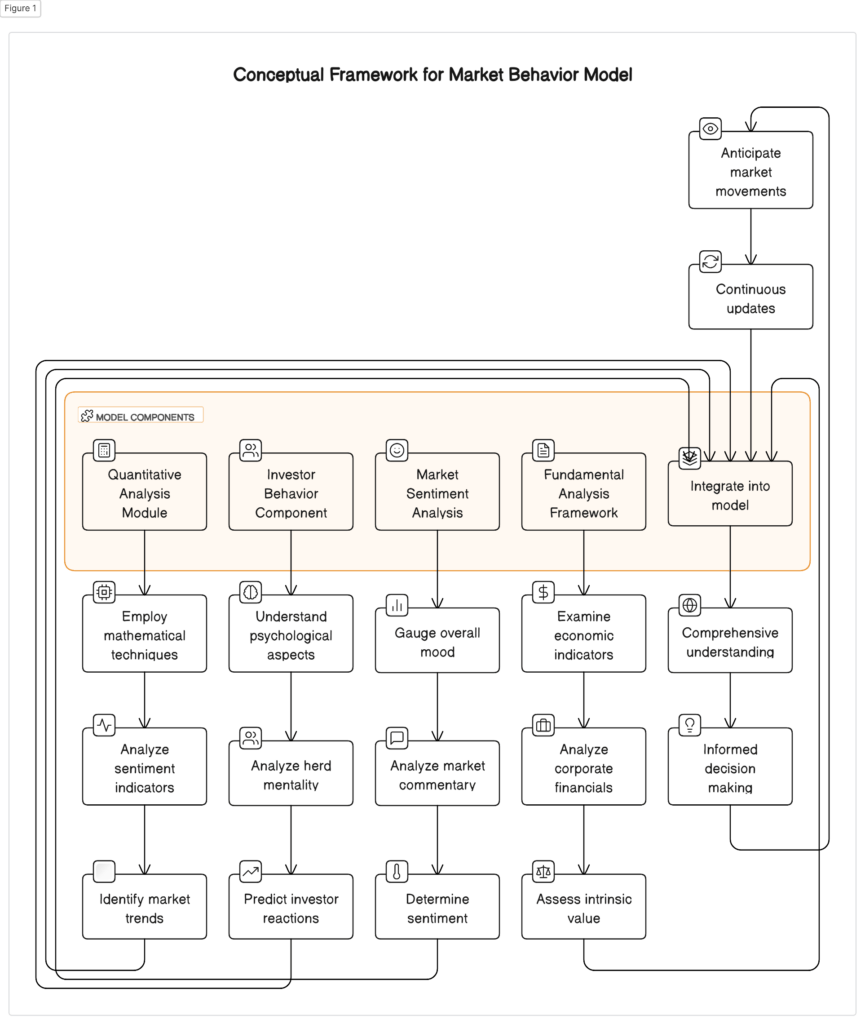

Creating a model to understand market behavior can be achieved by integrating Investor Behavior, Quantitative Analysis, Market Sentiment Analysis, and Fundamental Analysis. Here’s a conceptual framework for such a model:

Investor Behavior Component: This part of the model focuses on understanding the psychological and behavioral aspects of market participants. It includes the analysis of herd mentality, emotional biases like fear and greed, and other behavioral finance principles. This component helps in predicting how investors might react to different market conditions.

Quantitative Analysis Module: This module employs mathematical and statistical techniques to analyze market data. It includes sentiment indicators (like the CBOE Volatility Index), social media sentiment analysis, and algorithmic analysis of news articles. The quantitative analysis helps in identifying market trends and sentiment shifts, providing a data-driven perspective.

Market Sentiment Analysis: This aspect of the model gauges the overall mood and attitude of investors towards the market or specific assets. It involves analyzing market commentary, investor surveys, and expert opinions to determine whether the sentiment is bullish, bearish, or neutral. This analysis is crucial for understanding the current market dynamics and potential future directions.

Fundamental Analysis Framework: This part of the model involves the examination of economic indicators (like GDP, unemployment rates, inflation, and interest rates) and corporate financials (like P/E ratios, dividend yields, and EPS). Fundamental analysis provides insights into the intrinsic value of assets and the overall health of the economy. It is essential for long-term market predictions and assessing the underlying strengths or weaknesses in the market.

The integration of these components in a single model provides a comprehensive understanding of market behavior, combining insights from human psychology, statistical analysis, market mood, and economic fundamentals. Such a model can be immensely valuable for investors and traders in making informed decisions and anticipating market movements. The model would require continuous data inputs and regular updates to remain accurate and relevant in a rapidly changing market environment.

Building the Framework

To construct a comprehensive framework for the proposed model, integrating Investor Behavior, Quantitative Analysis, Market Sentiment Analysis, and Fundamental Analysis, it is essential to follow a systematic approach. This approach should focus on data collection, analysis methods, integration of different components, and continuous model validation. Here’s a step-by-step guide:

Data Collection:

- Investor Behavior Data: Gather data on trading volumes, buying and selling patterns, survey results on investor confidence, and other behavioral metrics.

- Quantitative Analysis Data: Collect historical market data, sentiment indicators, social media sentiment, and news articles for algorithmic analysis.

- Market Sentiment Data: Aggregate market commentary, expert opinions, and investor surveys to assess the overall market mood.

- Fundamental Analysis Data: Acquire economic indicators and corporate financials.

Analysis Methods:

- Investor Behavior Analysis: Employ behavioral finance theories to interpret data, focusing on herd mentality and emotional biases.

- Quantitative Analysis: Use statistical and mathematical models to identify trends and sentiment shifts. Techniques might include time-series analysis, machine learning, and sentiment scoring algorithms.

- Market Sentiment Analysis: Apply natural language processing (NLP) to analyze textual data and gauge market sentiment.

- Fundamental Analysis: Conduct ratio analysis, trend analysis, and comparative studies of financials and economic indicators.

Integration of Components:

- Develop a multi-faceted analysis framework where each component feeds into an overarching model.

- Ensure that the outputs of individual analyses can be integrated, possibly using a weighted scoring system or a decision matrix.

- Utilize machine learning to find correlations and causal relationships between different data sets and components.

Model Implementation and Interface:

- Create a user-friendly interface for analysts and investors to interact with the model.

- Implement real-time data feeds to keep the model updated.

- Ensure the model can generate actionable insights, such as market predictions, risk assessments, and investment opportunities.

Continuous Validation and Improvement:

- Regularly back-test the model against historical data to assess its predictive accuracy.

- Update the model algorithms and data sources as needed to adapt to market changes.

- Solicit feedback from users to improve the model’s usability and relevance.

Documentation and Training:

- Create comprehensive documentation for the model, including methodologies, data sources, and interpretation guides.

- Provide training for users to effectively utilize the model.

This framework aims to create a dynamic and holistic model that not only analyzes current market conditions but also anticipates future market behavior. It should be noted that the effectiveness of such a model heavily relies on the quality and timeliness of data, as well as the sophistication of the analytical methods employed.

Model Expectations- Market Movements vs Biases

The expectations from the model integrating Investor Behavior, Quantitative Analysis, Market Sentiment Analysis, and Fundamental Analysis, in terms of understanding market movements and biases:

Enhanced Predictive Power: The model is expected to provide superior insights into future market movements by combining diverse analytical perspectives. It should be capable of identifying potential turning points, trends, and market cycles more accurately than models relying on a single analytical approach.

Understanding of Investor Behavior: The model will shed light on how investor psychology and behavior impact market dynamics. It should reveal patterns in herd mentality, panic selling, overconfidence, and other behavioral biases, helping to anticipate market reactions to various stimuli.

Identification of Market Sentiment Trends: By analyzing news, social media, and expert opinions, the model should be able to gauge the prevailing sentiment in the market, whether bullish, bearish, or neutral. This component is crucial for understanding short-term market movements and investor attitudes.

Data-Driven Insights from Quantitative Analysis: The model will employ statistical techniques to decipher complex market data, leading to data-driven insights. Expectations include identifying hidden correlations, market anomalies, and sentiment indicators that might not be apparent through traditional analysis.

Comprehensive Fundamental Analysis: It will offer a deep understanding of the intrinsic value of assets and the overall economic environment. This includes insights into how macroeconomic factors and corporate financial health influence market movements.

Integration of Short-Term and Long-Term Perspectives: The model is expected to balance short-term market sentiment and investor behavior with long-term economic fundamentals. This integration is crucial for investors and traders with different investment horizons.

Bias Identification and Mitigation: The framework should help in identifying and mitigating common analytical biases. By combining various methodologies, the model aims to provide a more balanced and objective view of the markets.

Risk Assessment and Management: The model should assist in better risk assessment by understanding market volatilities and investor behavior under stress. This includes identifying potential risk factors that might not be evident through traditional risk management approaches.

Actionable Intelligence for Decision Making: Users of the model should be able to derive actionable intelligence for investment decision-making. The model should offer recommendations or scenarios based on current market data and historical trends.

Adaptive Learning and Improvement: The model is expected to adapt and improve over time, learning from new data, market conditions, and user feedback.

Continuous refinement should lead to increasingly accurate predictions and insights.

It is important to note that while such a model can significantly enhance understanding of market dynamics, no model is infallible. Market behavior can be influenced by unpredictable factors, and models must be used in conjunction with sound judgment and risk management practices.

Potential Short-term and Long-term Market Movements-A Scenario Framework

To provide insights into potential short-term and long-term market movements based on the integrated model encompassing Investor Behavior, Quantitative Analysis, Market Sentiment Analysis, and Fundamental Analysis, we can hypothetically analyze each component:

Investor Behavior:

- Short-term: If the model detects strong herd mentality or panic selling, it may suggest a short-term market downturn. Conversely, overenthusiastic buying might indicate a short-lived market rally.

- Long-term: Persistent trends in investor behavior, like increasing risk aversion or growing confidence, could signal more sustained market movements. For example, a gradual shift towards riskier assets might suggest a bullish market trend in the long term.

Quantitative Analysis:

- Short-term: Fluctuations in sentiment indicators like the CBOE Volatility Index could imply increased market volatility in the near term. Rapid changes in social media sentiment or news sentiment might also indicate short-term market reactions.

- Long-term: Stable, long-term trends identified through statistical analysis, such as consistent growth in certain sectors or technologies, might suggest sustainable market movements in those areas over the long term.

Market Sentiment Analysis:

- Short-term: A sudden shift to bullish or bearish sentiment in market commentaries and investor surveys might precede short-term market movements in the corresponding direction.

- Long-term: If market sentiment is steadily positive or negative over a longer period, it could indicate a longer-term trend in line with the sentiment, influenced by broader economic or geopolitical factors.

Fundamental Analysis:

- Short-term: Short-term market movements are less likely to be influenced by fundamentals unless there are significant, unexpected news or events impacting economic indicators or corporate financials.

- Long-term: Fundamental analysis provides a strong basis for long-term market predictions. For instance, strong economic fundamentals like stable GDP growth and healthy corporate earnings are likely to support a long-term bullish market, while weak fundamentals could suggest a bearish trend.

By integrating insights from all these components, the model can offer a nuanced view of potential market movements:

- In the short term, market movements are likely to be more influenced by investor behavior, quantitative sentiment indicators, and sudden shifts in market sentiment.

- In the long term, fundamental economic indicators and deeper trends in investor behavior and quantitative analyses will play a more significant role.

It’s crucial to remember that market predictions, especially in the short term, are inherently uncertain and influenced by a wide range of unpredictable factors. The model’s insights should be one of several tools used in decision-making, complemented by continuous monitoring of market developments and a robust risk management strategy.

Conclusion

In conclusion, the integration of Investor Behavior, Quantitative Analysis, Market Sentiment Analysis, and Fundamental Analysis into a comprehensive model offers a multifaceted understanding of market behavior. This holistic approach equips investors and traders with enhanced predictive capabilities, a nuanced view of biases, and valuable insights into both short-term and long-term market movements. While the model provides a powerful tool for decision-making, it’s essential to acknowledge the inherent complexity and unpredictability of financial markets. Effective use of the model requires a balanced approach, combining data-driven insights with sound judgment and proactive risk management, recognizing that markets are influenced by a multitude of dynamic and sometimes unforeseeable factors.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.