GBPUSD exhibiting signs of weakness, 1.2540 a key level to test.

Technical Analysis:

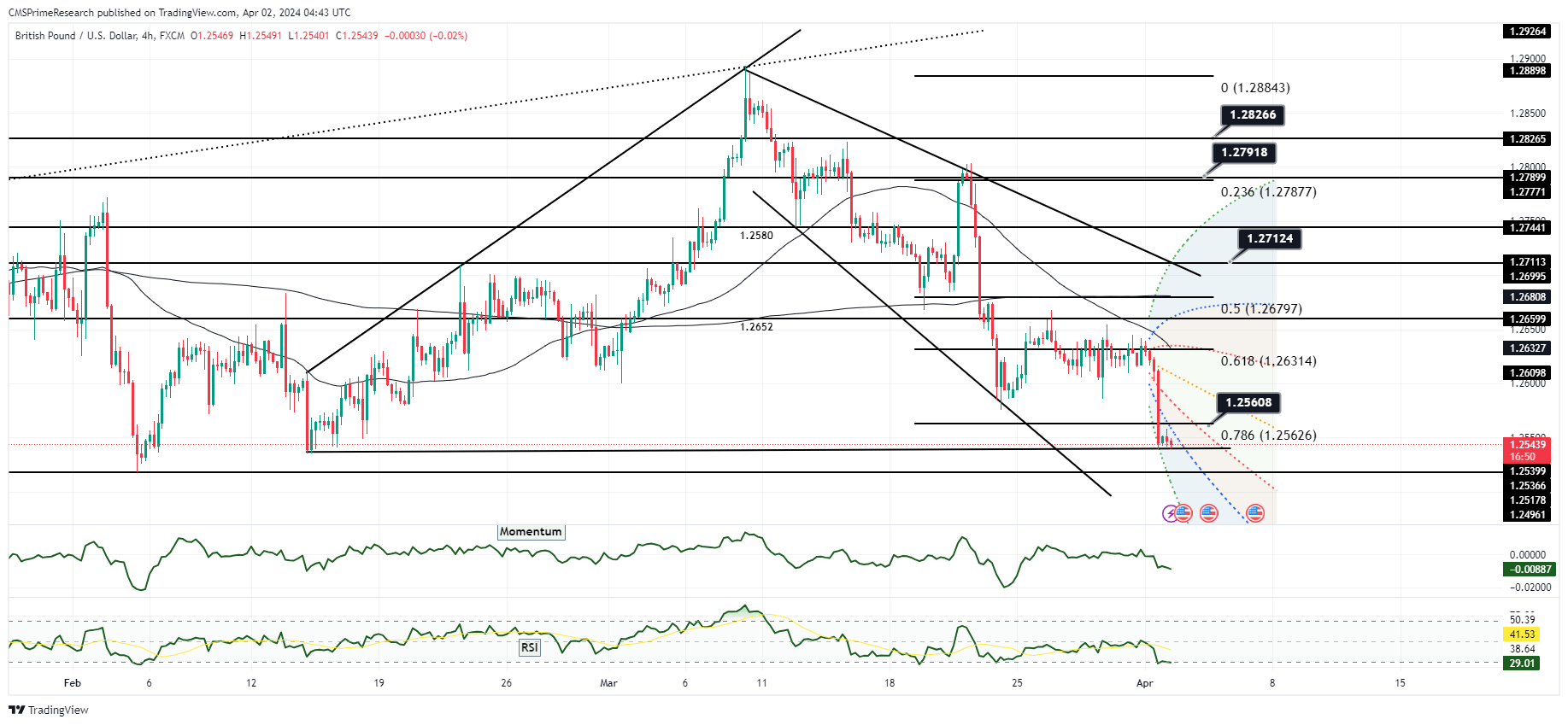

The GBP/USD pair is exhibiting signs of weakness, hovering close to its 2024 low of 1.2515. The currency has traded within a narrow band between 1.2640 and 1.2545 amid subdued liquidity due to the Easter holiday in Europe. The pair’s softening comes against the backdrop of positive U.S. data and a rise in U.S. Treasury yields, factors that traditionally support the dollar.

From a technical perspective, the pair has breached the lower Bollinger Band at 1.2540, which suggests oversold conditions that may typically precede a retracement. However, continued pressure could see the pair retesting the 2024 low at 1.2515. Resistance is now formed by the previous support of the 200-Day Moving Average (DMA) around 1.2595, the falling 200-DMA at 1.2622, and the daily Ichimoku cloud base at 1.2650.

Fundamental Analysis: Fundamentally, the outlook for the GBP is clouded by expectations of forthcoming Fed commentary that could adopt a less dovish tone than anticipated, potentially reinforcing the dollar. As the U.S. economic outlook appears relatively upbeat, contrasted with mixed sentiment regarding the UK’s economic resilience, the pound is underperforming.

Overall Market Sentiment: The prevailing market sentiment for GBP/USD is bearish, influenced by strong U.S. economic performance and expectations of hawkish Fed rhetoric.

Sentiment Percentage Breakdown:

- 20% Positive: There’s limited bullish sentiment, with potential for a corrective bounce from oversold conditions.

- 30% Neutral: Some market participants adopt a neutral stance awaiting more clarity from upcoming Fed discussions and economic data.

- 50% Negative: The predominant sentiment is bearish, factoring in the technical breakdown below key levels and the macroeconomic backdrop that favors the dollar.

The negative sentiment is anchored on the technical violations of support levels and the fundamental challenges facing the GBP, including divergent central bank policies and the relative economic outlooks of the UK and U.S. The positive sentiment is cautious, recognizing that the pair is nearing significant lows which could attract buyers, while the neutral sentiment reflects the uncertainty surrounding central bank communications in the coming week.

Key Levels to Watch: : 1.2727,1.2736,1.2745

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2530 | 1.2565 |

| Level 2 | 1.2508 | 1.2600 |

| Level 3 | 1.2490 | 1.2627 |