Current Factors Influencing Current Crude Oil Prices:

- Brent crude futures experienced a slight increase of 0.28%, reaching $82.56 a barrel, while U.S. West Texas Intermediate (WTI) crude futures also saw a 0.28% rise to $77.20.

- Both Brent and WTI contracts had previously dropped from near three-week highs, with the immediate U.S. crude futures premium over the following month’s contract widening significantly, which incentivizes immediate sales over storage.

- Crude futures prices are currently stable within a certain range, with a risk premium of $4-6 per barrel factored into the current prices

- The situation in the Gaza crisis is pivotal for future price movements, with potential impacts from either a ceasefire or an escalation of conflict.

- The United States vetoed a UN Security Council resolution calling for an immediate ceasefire between Israel and Hamas, preferring a resolution that includes the release of Israeli hostages.

- Russia has committed to its OPEC+ output reduction quota for February, despite a decrease in oil refining due to damage from Ukrainian drone attacks.

- Anticipations of U.S. interest rate cuts have been delayed due to recent inflation data, with economists now predicting a rate cut by the Federal Reserve in June.

Technical Analysis

Chart Overview and Price Action

Technical Analysis

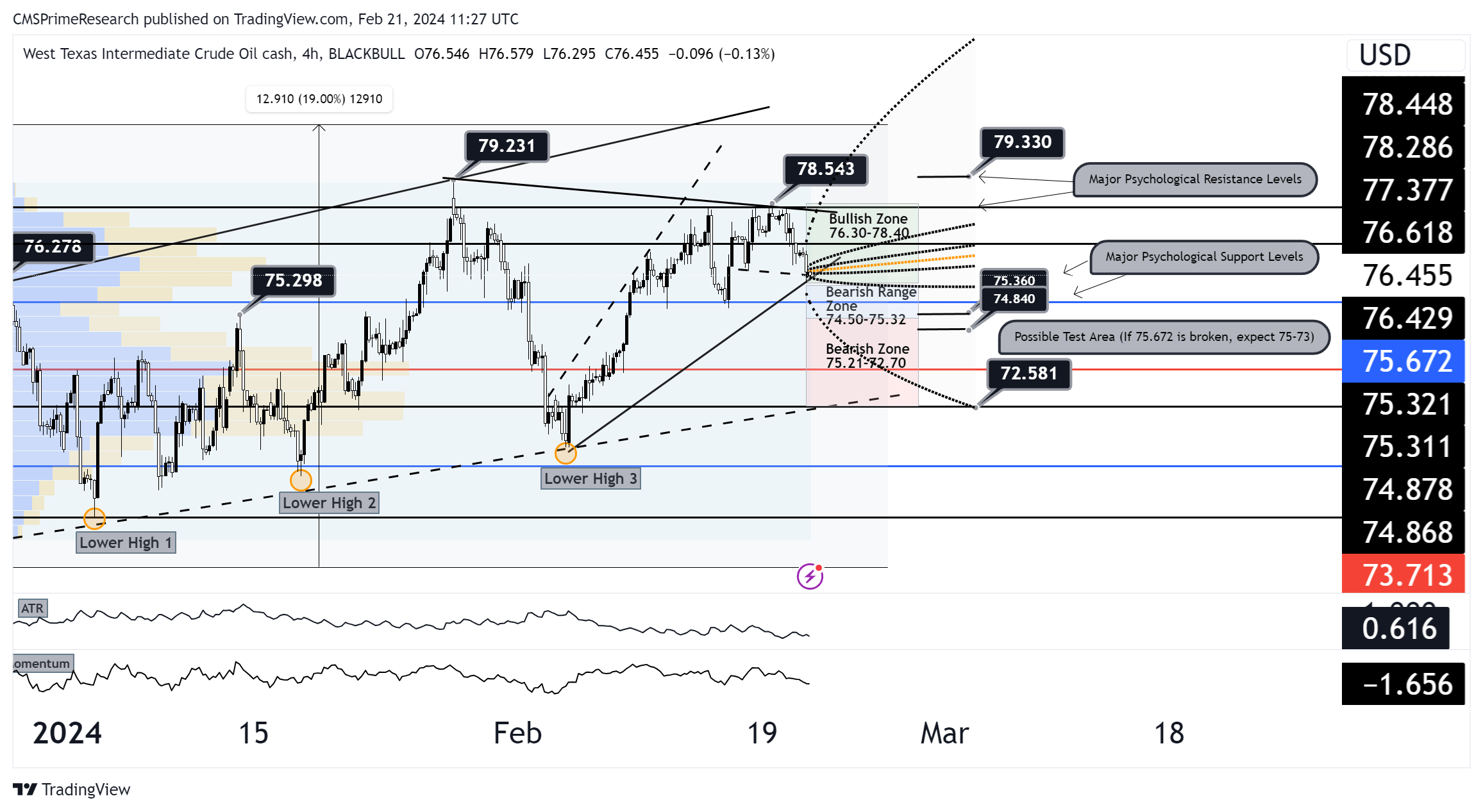

Technical Analysis: WTI Crude Oil as of February 21, 2024

Current Price Action:

- The price has recently failed to sustain above the $76.543 level, suggesting that this level is acting as a strong resistance.

- The chart indicates a sequence of lower highs, which is typically a bearish signal.

- The price is trading within a descending channel pattern, with the upper boundary serving as resistance and the lower boundary providing support.

Key Levels:

- Immediate support is seen near $75.672, a break below which could lead to a test of the $72.581 level.

- Resistance is seen at $76.543, followed by $79.330, a major psychological resistance level.

Indicators:

- The Average True Range (ATR) indicates reduced volatility, which could suggest a lack of strong directional momentum.

- Momentum indicators show declining bullish momentum, aligning with the recent downtrend.

Fundamental Analysis:

- Market Dynamics:

- The Gaza crisis holds significant geopolitical risk that could impact oil prices. An escalation could lead to higher prices due to risk premiums, while a ceasefire could stabilize or lower prices.

- Russia’s commitment to OPEC+ output reduction supports oil prices, but refinery damage could impact actual supply levels.

- Delayed expectations for U.S. interest rate cuts could stabilize the dollar, potentially capping gains in oil prices due to the oil-dollar inverse relationship.

Scenario Forecasts:

Bullish Scenario (20% Probability):

- Catalysts: A ceasefire in the Gaza crisis or a significant reduction in crude inventories.

- Technical Target: A breakout above $76.543 could see a move towards $79.330.

- Fundamental Target: Positive geopolitical developments could push prices towards $80-82.

Bearish Scenario (60% Probability):

- Catalysts: Escalation in the Gaza crisis, increasing U.S. crude inventories, or unexpectedly high U.S. interest rates.

- Technical Target: A break below $75.672 could see a move towards $72.581.

- Fundamental Target: Negative developments could depress prices towards $70-72.

Neutral Scenario (20% Probability):

- Catalysts: A balanced market reaction to geopolitical events and economic data.

- Technical Target: Continued range-bound trading between $75.672 and $76.543.

- Fundamental Target: Prices stabilize around the current level, with potential fluctuations within a $3-5 range.

Overall Market Sentiment:

- Positive: 20%

- Negative: 60%

- Neutral: 20%

Bullish Scenario:

- Price Target: Expect a test of the previous high around $79.330. If this level is convincingly breached, the next psychological barrier is at $80.00, followed by a stretch target at $82.00, in alignment with Brent crude’s current levels.

Bearish Scenario:

- Price Target: Prices may retreat toward the nearest support at $75.360. A breakdown below this could see a further slide to the next major support zone around $74.840 – $74.00, and potentially down to $72.581 if bearish momentum intensifies.

Neutral Scenario:

- Price Target: The neutral path would likely see WTI continue to trade within the recent range, bounded by resistance at $76.543 and support at $75.360. The median line around $75.672 could serve as a pivot point in this scenario.

Please Note that the Above Sentiments and Probabilities are just an estimation with a bias. Remember that markets are extremely dynamic, volatile with Prices and Markets Sentiments changing rapidily over time.

Price analysis and Targets:($74.50-$78)

Strategy Framework

Analyzing Method:

- The bearish sentiment, with a 50% probability, primarily stems from the significant increase in US crude inventories and concerns over high-interest rates impacting demand.

- Bullish potential, with a 20% probability, hinges on OPEC’s demand growth forecast and potential geopolitical tensions or supply disruptions.

- The technical structure shows a tightening consolidation pattern, hinting at a potential breakout or breakdown.

2 Scenarios:

- Targeting $74.50 (Neutral to Bearish Outlook): This price point lies within the lower bound of the current consolidation pattern. Positioning for this target involves preparing for either continuation within the range or a bearish breakout.

- Targeting $78.50 (Neutral to Bullish Outlook): This target is closer to the upper resistance zone. Achieving this would likely require a bullish catalyst or a shift in sentiment favoring demand growth or supply concerns.

Entry Points and Trade Management

For Targeting $74.50:

- Entry Point: Consider short positions if prices show signs of failing to break above the median consolidation point or if bearish fundamentals strengthen (e.g., further inventory builds or hawkish Fed signals).

- Stop-Loss: Place stop-loss orders above the $75.50 level to mitigate risk, acknowledging the consolidation pattern’s upper range.

- Profit Target: Set the initial profit target at $74.50, with flexibility to extend towards the $73.50 support zone if bearish momentum increases.

For Targeting $78.50:

- Entry Point: Initiate long positions on signs of a bullish breakout from the consolidation pattern, especially if triggered by positive demand forecasts or geopolitical tensions easing.

- Stop-Loss: Set stop-loss orders below the $77.00 level to protect against false breakouts or a return to bearish sentiment.

- Profit Target: Aim for the $78.50 level, remaining vigilant to adjust based on resistance encounters or shifts in market sentiment.

Risk Management and Adjustments

- Position Sizing: Allocate capital to each trade based on the assessed probability of the scenario and personal risk tolerance. Given the bearish dominance, a cautious approach to sizing bullish positions is prudent.

- Sentiment and Technical Reassessment: Regularly review market sentiment, fundamental news, and technical indicators for signs that could warrant strategy adjustments.

- Diversification: Consider balancing this strategy with positions in other commodities or asset classes to spread risk, especially in a market environment characterized by significant uncertainties.

Conclusion

This strategy aims to navigate the current complexities of the crude oil market by leveraging technical signals and aligning with the prevailing sentiment, whether bearish or bullish. By implementing disciplined entry, stop-loss, and profit target mechanisms, and continuously monitoring for fundamental shifts or technical breakout/breakdown patterns, traders can position themselves to capitalize on movements towards the identified price targets. Flexibility and a keen eye on global economic indicators and oil-specific supply-demand dynamics will be crucial for success.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.