Current Factors Influencing Current Gold Prices:

- Gold prices climbed on Thursday due to a softer U.S. dollar and increased demand for safe-haven assets amidst concerns of a potential escalation in the Middle East conflict, offsetting the impact of reduced expectations for U.S. interest rate cuts this year.

- Spot gold surged by 0.8% to $2,380.5 per ounce, following a record high of $2,431.29 reached last Friday. Concurrently, U.S. gold futures increased by 0.2% to $2,393

- Bank of China International (BOCI) analyst Xiao Fu attributed the rise in precious metals to the declining U.S. dollar, along with other factors such as geopolitical tensions and central bank diversification.

- The U.S. dollar experienced a second consecutive day of decline following a rare joint warning from the finance chiefs of the United States, Japan, and Korea regarding the sharp depreciation of other currencies. A weaker dollar typically enhances the attractiveness of gold for holders of other currencies.

- However, despite the postponement and downsizing of rate cut expectations by the Federal Reserve, coupled with the natural profit-taking that accompanies rapid price surges, Fu suggested that any downward pressure on gold prices would likely be moderate rather than sharp as they consolidate within the current range.

- Federal Reserve officials, led by Chair Jerome Powell, are exercising caution in discussing the timing of rate cuts, indicating that rates may remain elevated for a longer period.

- Traders have adjusted their expectations, now anticipating less than a 50-basis point reduction in rates this year and postponing the projection for the first quarter-point cut to September from the previously anticipated June or July.

- The allure of holding non-yielding gold is diminished by higher interest rates.

Fundamental and Technical Analysis

Technical Overview:

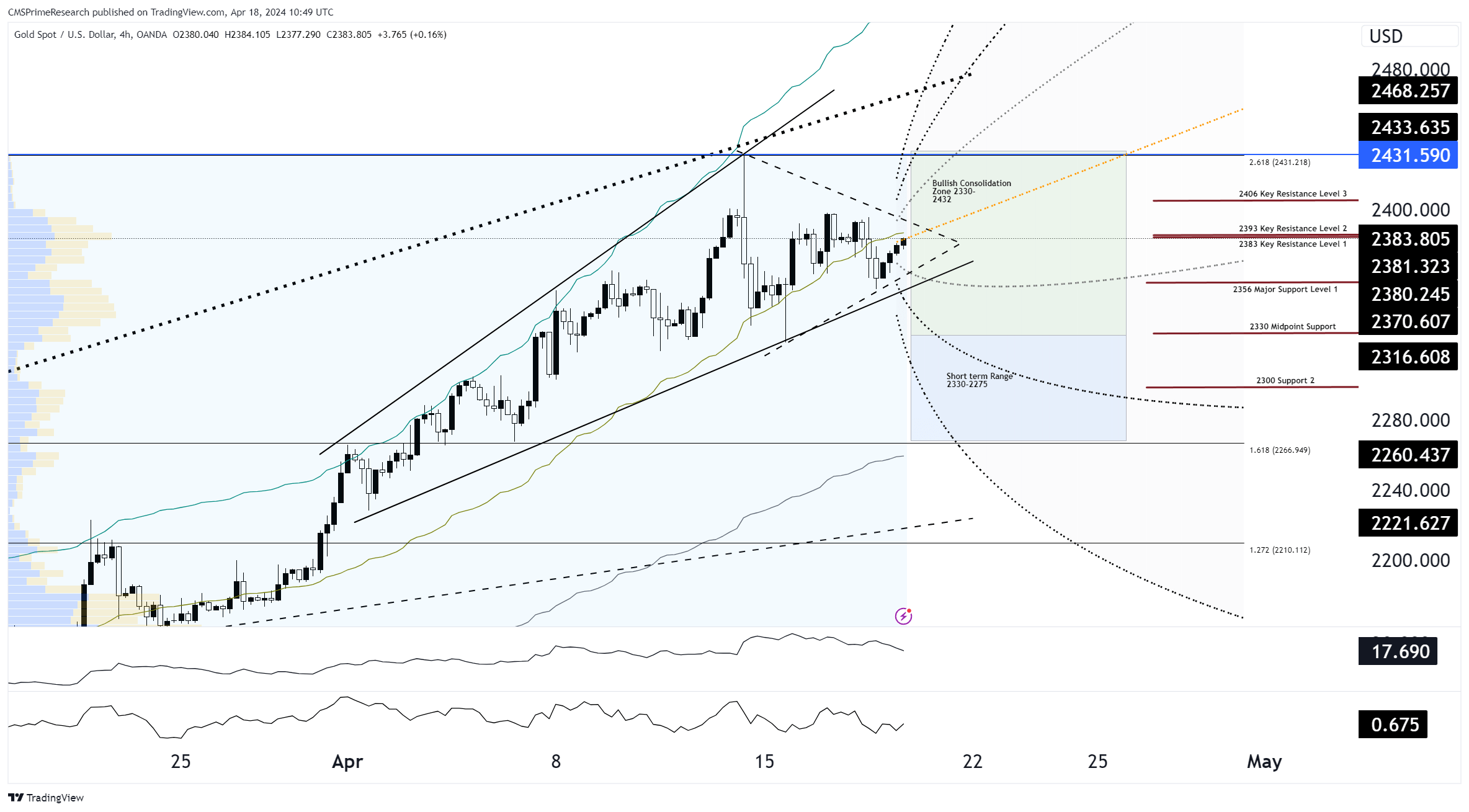

The gold chart indicates a market that is currently in a consolidation phase after a substantial rally:

Current Price Movements:

- Gold prices have been experiencing a bullish consolidation phase, which is evident from the price movements within the ascending channel.

Key Support and Resistance Levels:

- Immediate resistance is noted near the recent highs around $2431.

- Strong support levels are established around the lower bound of the ascending channel and Fibonacci levels, particularly near $2330 and $2300.

Indicator Analysis:

- The ATR indicates high volatility, characteristic of markets where significant price moves are occurring.

- Momentum indicators suggest the momentum is still positive, although it shows signs of leveling off, indicating a potential pullback or consolidation.

Fundamental Context:

Fundamental aspects provide a backdrop for the current technical setup:

Geopolitical Risks:

- Rising tensions in the Middle East have historically increased demand for gold as a safe-haven asset.

Currency Market Movements:

- A softer U.S. dollar, partly due to coordinated warnings against currency depreciation by U.S., Japanese, and Korean finance chiefs, has been supportive of higher gold prices.

Fed’s Rate Path:

- There’s a recalibration of expectations for U.S. interest rate cuts, with traders now pricing in less aggressive cuts and pushing the timeline for rate reductions.

Scenario Forecasts:

Uptrend Continuation (40% Probability):

- Gold could retest and potentially break its recent high if geopolitical tensions escalate or the dollar weakens further.

- Price Targets: $2400 – $2431

- Sentiment Analysis: Positive sentiment would likely dominate due to gold’s appeal as a safe-haven and the potential for reduced opportunity cost of holding gold amid a weaker dollar.

Range-bound Trading (35% Probability):

- Gold may consolidate within the current range if geopolitical tensions do not escalate further and the U.S. dollar stabilizes.

- Price Targets: Trade within $2330 – $2430

- Sentiment Analysis: A neutral sentiment could prevail as traders await new catalysts to provide clear directional cues.

Profit-taking Retracement (25% Probability):

- After a rapid price surge, natural profit-taking could cause a moderate retracement, potentially towards the lower bound of the current channel.

- Price Targets: Down to $2356- $2330

- Sentiment Analysis: A mild negative sentiment could take hold temporarily if traders lock in profits from the recent rally.

Overall Market Sentiment Synthesis:

- Positive Sentiment: Remains robust at 40%, supported by ongoing geopolitical concerns and currency devaluation.

- Negative Sentiment: A conservative 25%, factoring in potential profit-taking after recent highs.

- Neutral Sentiment: 35%, reflecting a cautious market awaiting further developments.

Target Levels and Analysis--- 2406-2431 or 2356-2330

Considering the current gold market scenario, with a spot price of $2382 and a high Average True Range (ATR) of 17.7 indicating significant volatility, we can devise a trading strategy that optimizes potential gains while mitigating risks. The strategy will focus on the provided price targets of $2406 to $2431 for a bullish scenario and $2356 to $2330 for a bearish retracement, based on the ongoing market dynamics including geopolitical tensions and currency fluctuations.

Strategy Components

1. Bullish Scenario Planning

- Entry Point: Given the bullish outlook and current price consolidation, an optimal entry might be to wait for a small pullback to increase the risk-to-reward ratio. Consider initiating a long position if the price slightly retraces to $2370, closer to the lower end of the intraday volatility range.

- Stop-Loss: Set the stop-loss at $2356, just above the higher end of the bearish target range. This placement limits downside risk while allowing room for normal price fluctuations within the current volatility.

- Take-Profit Targets: The first take-profit can be set at $2406, which is the lower bound of the bullish target. If the upward momentum continues, adjust or set a second take-profit at the upper end of the bullish range at $2431.

2. Bearish Retracement Strategy

- Entry Point: If signs emerge that the market is entering a profit-taking phase, consider a short position if the price breaks below $2356. This break would confirm a shift towards the bearish scenario.

- Stop-Loss: Place the stop-loss just above the recent consolidation at $2385 to cap potential losses should the price unexpectedly move back into the bullish channel.

- Take-Profit Targets: Aim for a take-profit at $2330, aligning with the lower end of the bearish price target. Be ready to adjust this target if market sentiment shifts swiftly back to bullish due to external catalysts like geopolitical developments.

3. Monitoring and Adjustments

- Economic and Geopolitical News: Keep a close watch on developments in the Middle East and any further announcements from central banks or financial authorities that could influence the dollar and, consequently, gold prices.

- Technical Reassessment: Regularly reassess the momentum and volatility indicators. If the ATR trends higher than the current 17.7, consider widening stop-loss and take-profit margins to accommodate increased volatility.

- Position Sizing: Given the high ATR, manage risk by adjusting the size of the trading positions, ensuring that they do not exceed a prudent percentage of the trading capital.

Additional Considerations

- Volatility Management: With an ATR of 17.7, expect intraday swings that could test both support and resistance levels. This high volatility should inform tighter monitoring and readiness to execute stop-loss and take-profit orders dynamically.

- Market Sentiment: Regular updates on market sentiment from financial news and analysts will be crucial, especially concerning the U.S. dollar’s performance and geopolitical risks, which are pivotal to gold’s price movements.

This strategy aims to exploit the current market sentiment and technical setup by capitalizing on significant gold price movements, leveraging the defined support and resistance levels to make strategic entries and exits. Adaptability and close monitoring will be essential to navigate the expected volatility and potential market shifts over the next five trading days.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.