Current Factors Influencing Current Gold Prices:

Gold prices remained relatively unchanged during early Asian trading hours on Thursday, hovering near record-high levels, supported by a broadly weaker dollar as traders awaited further economic data that could influence expectations for a mid-year rate cut by the U.S. Federal Reserve.

Spot gold traded flat at $2,172 per ounce, while U.S. gold futures dipped 0.1% to $2,176

The Federal Reserve is anticipated to maintain steady rates at its upcoming policy meeting next week, with focus turning to the ‘dot plot’ projections. In its December meeting, the U.S. central bank projected three quarter-point rate cuts for 2024.

Investors are closely monitoring U.S. retail sales data, the producer prices index (PPI) report, and jobless claims scheduled for release later in the day to assess the health of the U.S. economy and determine if it will influence the Fed’s decision regarding rate cuts in June.

Traders perceive a 67% likelihood of a rate cut in June, down from 72% prior to data revealing a slight increase in U.S. consumer prices in February, indicating some resilience in inflation. The probability of a rate cut in July stands at 83%.

The U.S. dollar index (DXY) stabilized after relinquishing all gains made following robust inflation data on Wednesday.

The SPDR Gold Trust (GLD), the world’s largest gold-backed exchange-traded fund, reported a 0.21% increase in holdings to 816.86 tonnes on Wednesday from 815.13 tonnes on Tuesday.

Fundamental and Technical Analysis

Technical Overview:

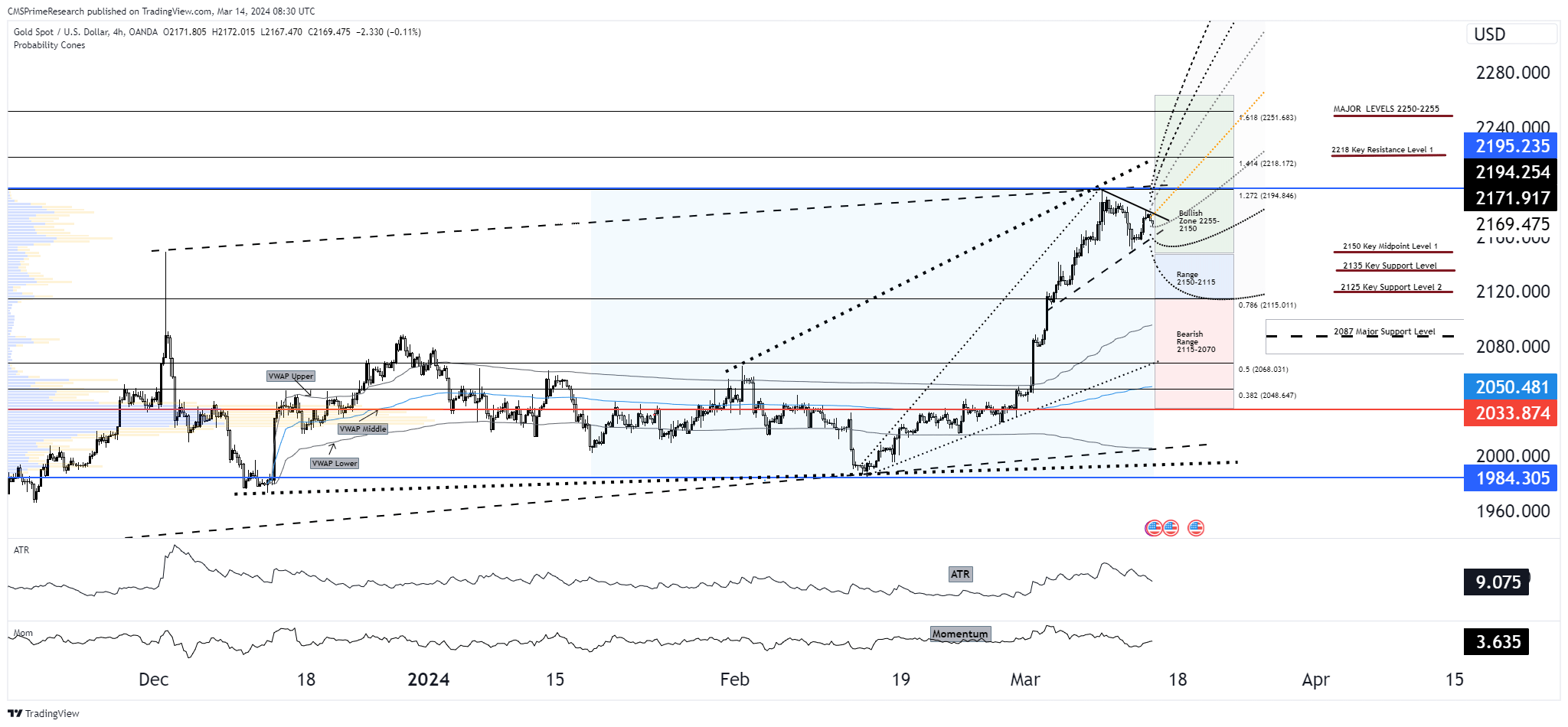

Support and Resistance:

- There’s evident resistance near $2180, with psychological levels at $2200 and Fibonacci extensions indicating potential resistance up to $2250.

- The support structure begins at $2125, with significant midpoints at $2135 and $2150.

Technical Indicators:

- ATR suggests volatility is high, supporting the potential for significant price movements.

- Momentum is upward but showing signs of deceleration as indicated by the leveling off in the chart, which may precede a consolidation or pullback.

Fundamental Forces:

Fundamental factors are shaping the bullish sentiment in the gold market:

Federal Reserve’s Rate Outlook:

- Expectations are set for a hold on rates with a keen eye on the dot plot projections, which could affirm or change the trajectory of gold prices.

U.S. Economic Health Indicators:

- Retail sales data, PPI report, and jobless claims may offer clues to the economic health and influence the Fed’s rate decision.

Rate Cut Probabilities:

- A perceived likelihood of a rate cut in June and high probability for July are keeping the bullish sentiment intact for gold.

Scenario Forecasting:

Bullish Continuation (50% Probability):

- Positive data aligning with rate cut expectations could propel gold toward $2200, with a technical stretch goal of $2250.

- Price Targets: $2200, Stretch to $2250

- Sentiment Analysis: Gold’s allure would intensify, with rate cut expectations and dollar weakness providing a solid foundation for continuation.

Corrective Retracement (30% Probability):

- A consolidation phase or stronger-than-anticipated economic indicators could trigger a pullback to retest $2125 or $2100 support levels.

- Price Targets: $2125, Retest $2100

- Sentiment Analysis: Temporary negative sentiment on profit-taking and reassessment of rate cut timelines could emerge.

Neutral Congestion (20% Probability):

- Absence of significant data surprises may result in gold trading within a narrow range, between $2125 and $2180.

- Price Targets: Range-bound trading between $2125 and $2180

- Sentiment Analysis: Neutral sentiment could persist, reflecting market indecision and balanced risk sentiment.

Overall Market Sentiment Projection:

- Positive Sentiment: Remains high at 50%, buoyed by dovish Fed expectations and a weaker dollar.

- Negative Sentiment: A cautious 30%, due to the possibility of economic data-driven corrections.

- Neutral Sentiment: At 20%, indicating a possibility of sideways movement in anticipation of clearer signals.

Strategic Recommendations

- Portfolio Positioning: Maintain a bullish stance but be vigilant for signs of reversal. Implement trailing stops to protect gains.

- Liquidity Management: Prepare for potential increased trading volumes around key data releases and Fed announcements.

- Data-Driven Reevaluation: Be prepared to reassess positions post-economic data releases, which could materially affect market expectations for interest rates.

- Diversification Tactics: Hedge with interest rate-sensitive instruments to balance the portfolio against unexpected shifts in Fed policy.

Target Levels and Analysis--- 2200-2300 or 2150-2080

Strategy Overview

Market Context and Sentiment Analysis:

- With a 50% positive sentiment driven by dovish Fed expectations and a 30% cautious stance due to potential economic data corrections, the market is ripe for strategic positioning across identified price targets.

Strategic Application for Target Price Points:

- Bullish Strategy for $2218-$2250 Target: Capitalizes on continued bullish sentiment propelled by dovish Fed rate outlook and weakening dollar.

- Retracement Strategy for $2135-$2125 Target: Prepares for a mild pullback triggered by stronger-than-expected economic indicators.

- Deeper Correction Strategy for $2115-$2087 Target: Anticipates a more substantial retracement amid a reassessment of rate cut timelines or surprising economic strength.

Execution Plan

Bullish Target ($2218-$2250):

- Entry Point: Initiate long positions on signs of gold breaking above $2180, especially if economic data align with Fed rate cut expectations.

- Stop-Loss: Set stop-loss orders just below $2180 to mitigate risks in case of an unexpected downturn.

- Profit Targets: Aim for profits starting at $2218, extending to $2250, adjusting based on momentum and resistance levels encountered.

Retracement Target ($2135-$2125):

- Entry Point: Consider short-term short positions or profit-taking from long positions if gold prices start to decline towards $2135, signaling a potential pullback.

- Stop-Loss: Place stop-loss orders above $2150 to protect against a reversal back to the bullish trend.

- Profit Targets: Set the primary profit target within the $2135-$2125 range, closely monitoring market response for signs of further descent or stabilization.

Deeper Correction Target ($2115-$2087):

- Entry Point: Engage in more aggressive short positions or continue profit-taking if prices breach below $2125, indicating stronger bearish momentum.

- Stop-Loss: Implement stop-loss orders slightly above $2135 to minimize exposure to a swift bullish recovery.

- Profit Targets: Target profits within the $2115-$2087 zone, adjusting positions based on evolving market dynamics and support levels.

Risk Management and Market Monitoring

- Position Sizing: Balance trade sizes based on current sentiment, risk tolerance, and the evolving geopolitical and economic landscape, favoring caution given the market’s near-record levels.

- Continuous Analysis: Stay updated on Fed communications, U.S. economic data, and global macroeconomic developments, ready to adjust or exit positions based on new information.

- Sentiment Adjustment: Regularly reassess market sentiment, especially in response to real-time economic indicators and central bank commentary, adapting the strategy to align with market shifts.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.