USD/JPY Gains Momentum as U.S. Yields Climb; Key Resistance at 159 Ahead of US PCE Data

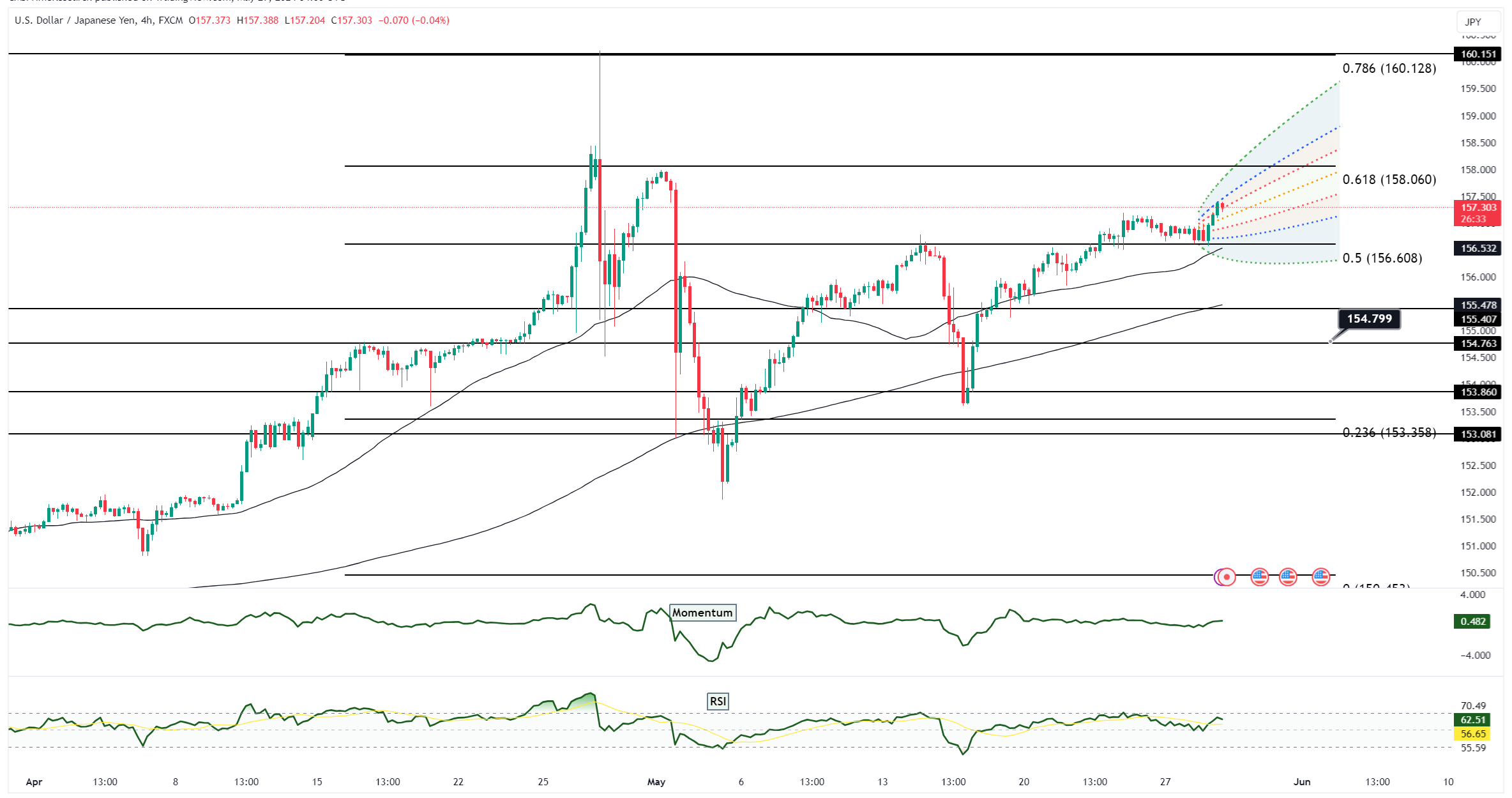

The USD/JPY pair has demonstrated a resurgence as a surprising boost in U.S. consumer confidence and a notable increase in Treasury yields, following substantial Treasury offerings this Tuesday, prompted buying activity. The currency pair is rallying from recent downturns, supported by traders capitalizing on the considerable yet narrowing yield differential between U.S. Treasuries and Japanese Government Bonds (JGBs). This gap, while reduced from its April highs, still offers compelling opportunities for investment. From a technical perspective, if USD/JPY can sustain a move above the crucial 107.04 level—the 61.8% Fibonacci retracement of the major decline from 160.245 to 51.86—it could pave the way toward the 158 level and potentially reach as high as 158.26. These figures correspond to the highs of the May 1 intervention and the 76.4% Fibonacci level. However, the potential for Bank of Japan (BoJ) intervention remains a concern for investors, particularly with significant U.S. economic reports on the horizon this week and next.

As we look forward, the persistence of long positions in USD/JPY may largely depend on the upcoming U.S. economic indicators. Friday’s core PCE data is expected to mirror the previous month’s figures of 0.3% monthly and 2.8% annually. The forthcoming week’s ISM surveys, JOLTS data, and employment statistics will be pivotal in determining whether the pair can maintain positions above the 158 mark or challenge the 160 threshold, in spite of potential BoJ actions. Market sentiment has been bolstered in the futures domain, with IMM speculators significantly increasing their net long positions, anticipating a surge past the 157.04 mark to revisit the 157.99 peak at the 76.4% Fibonacci level of 158.27. Market responses to these technical thresholds will be shaped by the strength of U.S. economic data and the changing landscape of Federal Reserve rate cut expectations, which have notably decreased to just 34 basis points this year. Meanwhile, the disinflationary trend in Japan suggests a diminished urgency for BoJ rate increases, thus supporting the attractiveness of USD/JPY carry trades in the context of global central bank policy adjustments.

Key Levels to Watch: : 155,156,160,158