The stock market’s most critical driver, S&P 500 (^GSPC) earnings, continues to show impressive growth, fueling optimism among investors and analysts. According to FactSet data, S&P 500 earnings grew by 6% in the first quarter compared to the previous year. Excluding the underwhelming performance of Bristol Myers-Squibb (BMY), earnings growth stood at an even more impressive 10%, as per Bank of America.

The outlook for future quarters is also promising, with consensus estimates for earnings growth on the rise. Projections for 2024 earnings have increased to 11.4%, up from 10.9% in early April. For 2025, earnings growth estimates have climbed to 14.2%, a significant jump from the 11.6% previously anticipated.

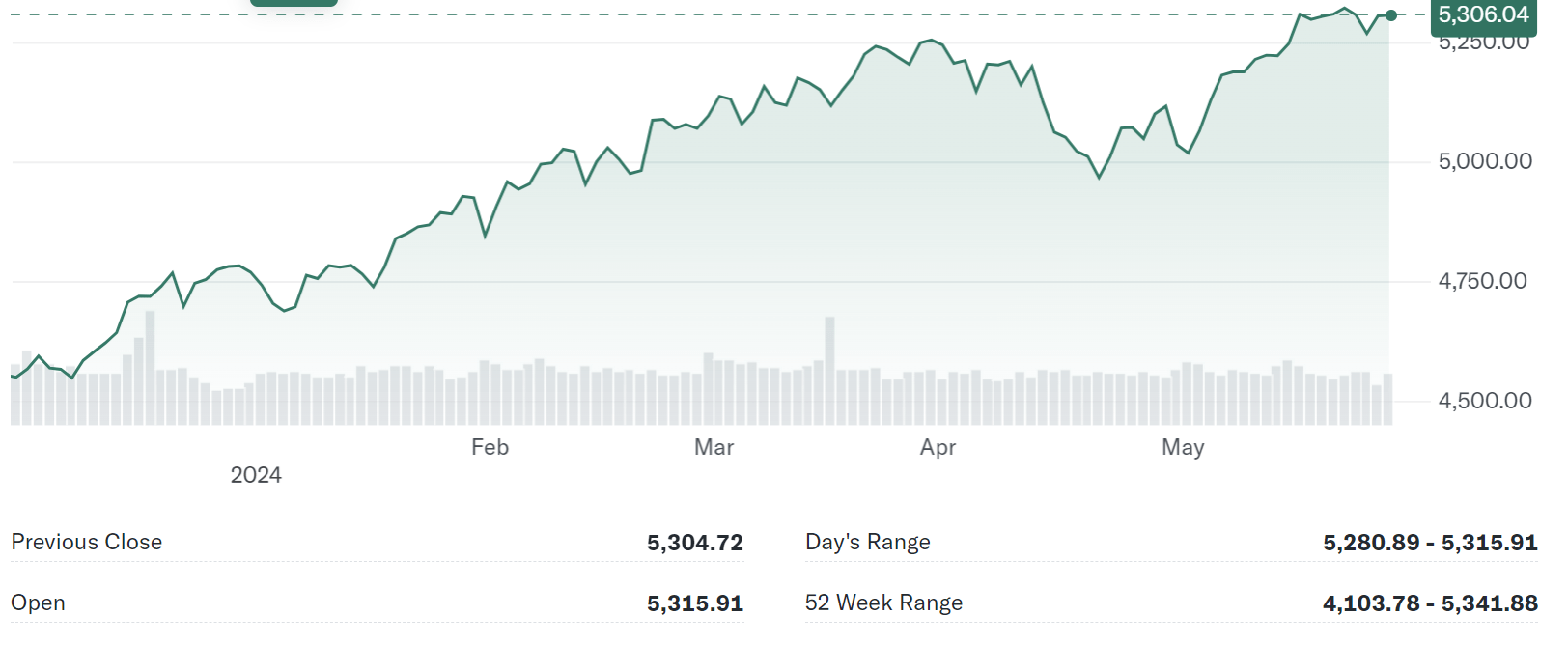

UBS Investment Bank’s US equity strategist Jonathan Golub recently raised his year-end S&P 500 target to 5,600 from 5,400, citing stronger-than-expected earnings. Golub observed that second-quarter earnings estimates have remained robust, a trend that also extends to full-year 2024 estimates, supporting the potential for further market upside.

Earnings Growth Factor

Earnings growth is one of several factors prompting Wall Street strategists to boost their year-end targets for the S&P 500. A decline in economic “tail risks” and improved economic growth projections have also contributed to this optimism. Deutsche Bank’s chief global strategist Binky Chadha suggested that stronger-than-expected economic growth could push the S&P 500 to 6,000 by the end of the year. However, his current target of 5,500 is largely based on accelerating earnings growth.

Chadha emphasized that the earnings cycle has significant momentum, with market confidence in a continued recovery likely to rise by year-end, thus supporting higher equity multiples. Although he had anticipated a rotation in earnings growth from Big Tech to other sectors, the first quarter did not fully realize this shift. The “Mega-Cap Growth and Tech” basket, which includes major players like Netflix (NFLX), Visa (V), and Adobe (ADBE), maintained robust growth at around 39%, similar to the previous quarter’s 40%.

Despite this, Chadha expects earnings growth in these tech giants to slow eventually, allowing other market segments to catch up. Earnings for Cyclicals and Defensives grew at a healthy 7.5% in the first quarter, and other strategists foresee a similar catch-up scenario unfolding throughout the rest of the year.

Bank of America’s US and Canada equity strategist Ohsung Kwon noted that Nvidia has driven a substantial portion of the S&P 500’s earnings growth over the past year. However, its contribution is expected to decrease significantly in the next 12 months, suggesting a broadening of growth to other sectors such as power, commodities, and utilities.

Kwon highlighted that the primary driver of earnings growth has been cost-cutting rather than increased demand and booming revenues. He believes this will change later in the year, as companies in the industrial sector anticipate a recovery in demand. With this recovery, operating leverage and better margins are expected to follow.

Charles Schwab’s senior investment strategist Kevin Gordon pointed out that companies beating revenue estimates outperformed those merely surpassing earnings estimates, indicating that the market values genuine demand growth over cost-cutting measures. Gordon emphasized that real demand recovery will be a key trend for investors to watch in the coming months.

Strategy Perspective on Companies from a Business Cycle Performance Perspective

From a strategic perspective, companies are expected to leverage the positive market outlook by focusing on sustainable revenue growth rather than merely cost-cutting measures. This approach is crucial as market performance shows a preference for companies that outperform on revenue estimates, indicating genuine demand recovery, over those that achieve earnings growth through cost-cutting alone. Analysts are anticipating a rotation in earnings growth from Big Tech to other sectors, although this shift has not fully materialized yet. Big Tech continues to show robust earnings growth, while sectors such as Cyclicals and Defensives also demonstrate healthy growth rates, with further catch-up expected in industries like power, commodities, and utilities. Businesses should position themselves to capitalize on the anticipated demand recovery, which is projected to enhance operating leverage and improve margins in the second half of the year. This strategic positioning will be crucial in sustaining earnings growth and supporting elevated market valuations.

In summary, the S&P 500’s earnings growth and positive future outlook are driving bullish sentiment in the stock market. With economic conditions improving and a broadening of growth across various sectors, investors have reasons to remain optimistic about the market’s trajectory in 2024 and beyond.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.