USD/JPY Nudges Higher as Fed Minutes Support 'Steady Rate' Outlook; Eyes on Key Resistance Levels

USD/JPY saw a modest uptick, closing the North American trading session with a 0.27% gain at 156.60, fluctuating within the day’s range of 156.63 to 156.12. The dollar maintained its strength as U.S. Treasury yields climbed, a reaction to the latest Federal Reserve meeting minutes. These minutes revealed the Fed’s cautious approach, hinting that the pace of disinflation might be slower than initially thought, which lends support to the idea that interest rates could remain elevated longer than expected. This scenario, along with comments from Goldman Sachs’ CEO suggesting unlikely rate cuts this year, bolstered the attractiveness of the dollar. The ongoing advantage in U.S. interest rates continues to favor a bullish outlook for USD/JPY, with market participants likely to keep favoring the dollar given the Fed’s stance on keeping rates steady.

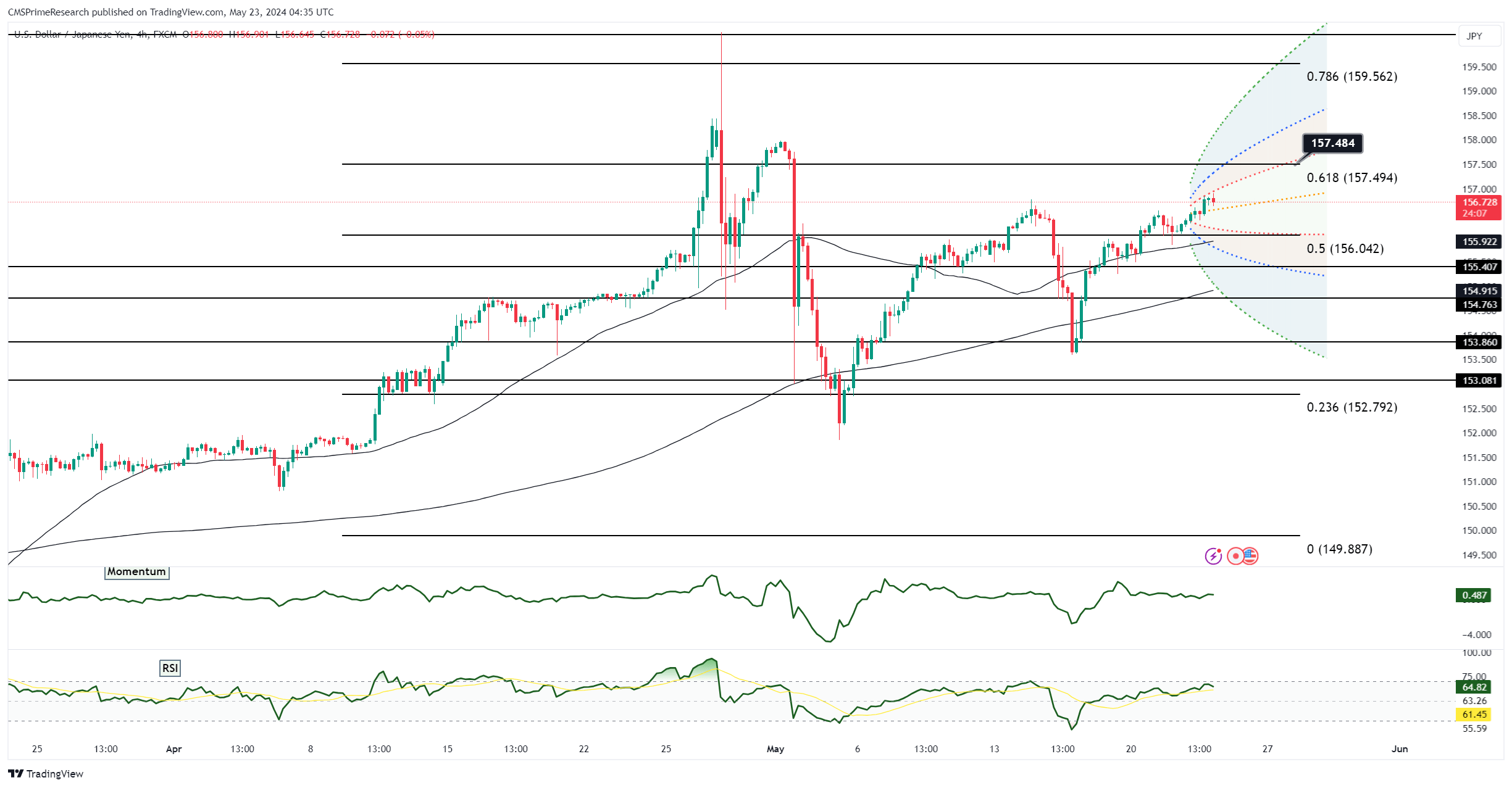

Technically speaking, the USD/JPY is in a strong position, focusing on the May 14 high of 156.80. Surpassing this level could lead to a test of 157.50, a point where previous market interventions are believed to have occurred, and potentially reaching the upper Bollinger Band at 158.00. On the flip side, the pair finds initial support at Wednesday’s low of 156.12, with subsequent support at the rising 10-day moving average of 155.90, and more substantial support at the May 17 low of 155.25. These technical indicators are pivotal for traders, serving as benchmarks for setting trading strategies and risk management parameters. As USD/JPY nears these critical levels, the market’s response will provide valuable clues about the momentum and investor sentiment, potentially triggering swift movements in either direction, influenced by U.S. monetary policy outlook and the latest economic indicators.

Key Levels to Watch: : 155,156,160,158