USD/JPY rises after BOJ Decisions to Raise rates for the First time in 17 Years

Technical Analysis: The USD/JPY pair demonstrated strength into the Bank of Japan’s (BOJ) policy announcement, and extended gains thereafter. The BOJ’s policy adjustments, while still on the dovish spectrum, indicated an acceptance of slightly higher interest rates, more reflective of the current economic realities. Importantly, the BOJ has signaled no further need to persist with aggressive ETFs and J-REITs buying, owing to the equity market’s rally.

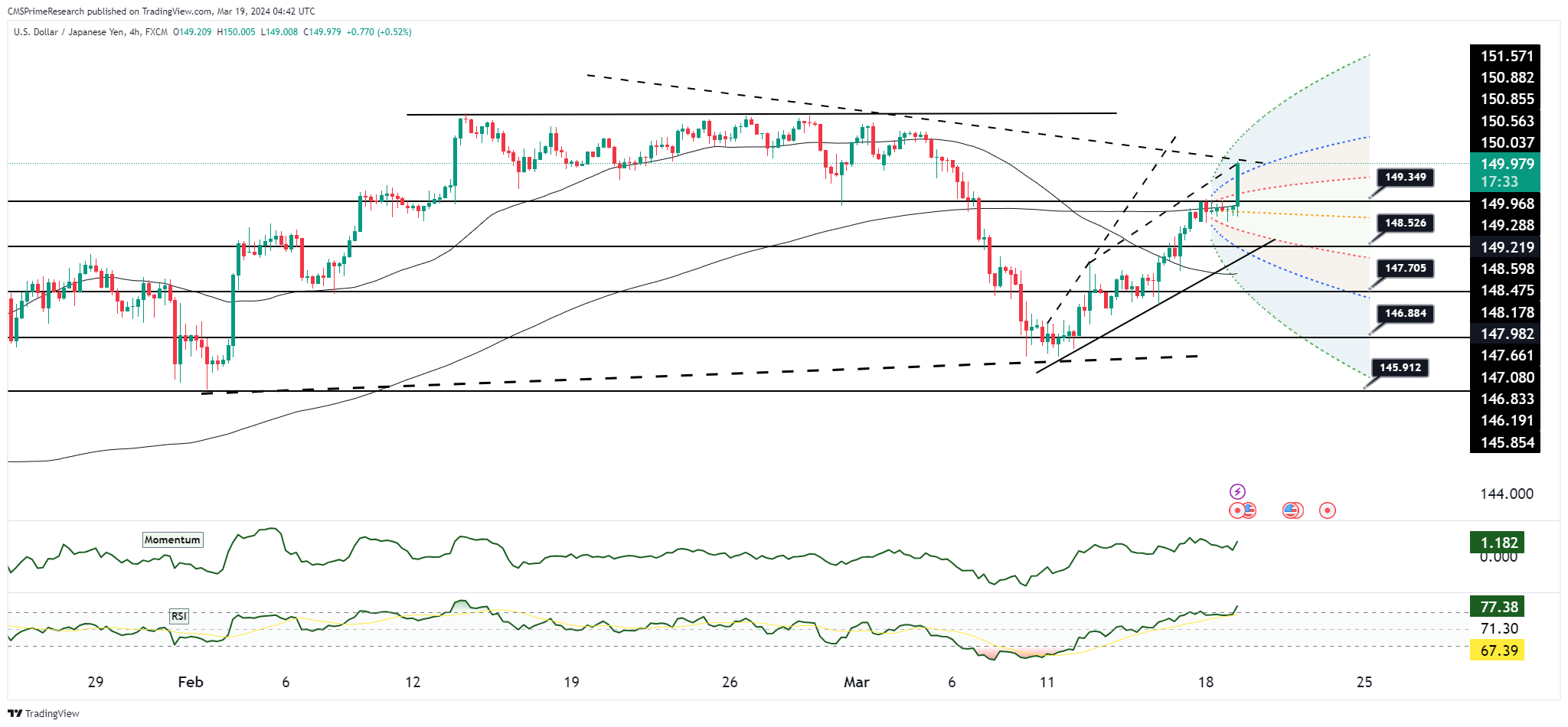

Technically, USD/JPY found initial support at 149.00 post-BOJ before surging to a high of 149.92. The pair is trading upwards within the ascending daily Ichimoku cloud with a span of 145.54-147.72, which provides dynamic support. The price is distancing itself from the flat daily Ichimoku Kijun at 148.68 and potentially aiming for the February 13 high of 150.88.

The options market suggests a range between 147 and 150 into the upcoming Federal Open Market Committee (FOMC) meeting, with significant gamma peaks at these levels. Additionally, there’s chatter about option knock-outs adjusting higher at each big figure above 151.00, which could serve as technical waypoints for price action.

Fundamental Analysis: The BOJ’s dovish stance alteration is a nuanced acknowledgment of economic conditions warranting marginally higher rates but does not signify a major policy pivot. The Japanese economy’s moderate recovery pace, coupled with prevailing uncertainties, caps any runaway optimism. Meanwhile, firm U.S. Treasury yields provide a tailwind to the USD/JPY, as yield differentials play a critical role in currency valuation. The market is also adjusting to the expectation that the Fed may not lower interest rates until September rather than June, which could underpin the dollar’s strength.

Overall Market Sentiment: The market sentiment is positive for USD/JPY, buoyed by a supportive yield environment and the BOJ’s policy nuances that stop short of signaling a significant hawkish turn.

Sentiment Percentage Breakdown:

- 70% Positive: Backed by the bullish price action post-BOJ announcement and the supportive U.S. yield environment.

- 20% Neutral: Reflecting the market’s watchful stance ahead of the FOMC meeting and considering the remaining economic uncertainties.

- 10% Negative: Accounting for the limited dovish policy changes from the BOJ and potential resistance at higher technical levels.

The strong positive sentiment is anchored on the price momentum and the favorable yield spread between the U.S. and Japan. The neutral sentiment considers the potential market recalibration pending the FOMC outcome, while the slight negative sentiment remains vigilant about Japan’s economic outlook and the technical resistance that could cap the pair’s advance.

Key Levels to Watch: : 150.256,149.980,149.256,148.681

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 149.256 | 149.980 |

| Level 2 | 148.808 | 150.120 |

| Level 3 | 148.861 | 150.256 |