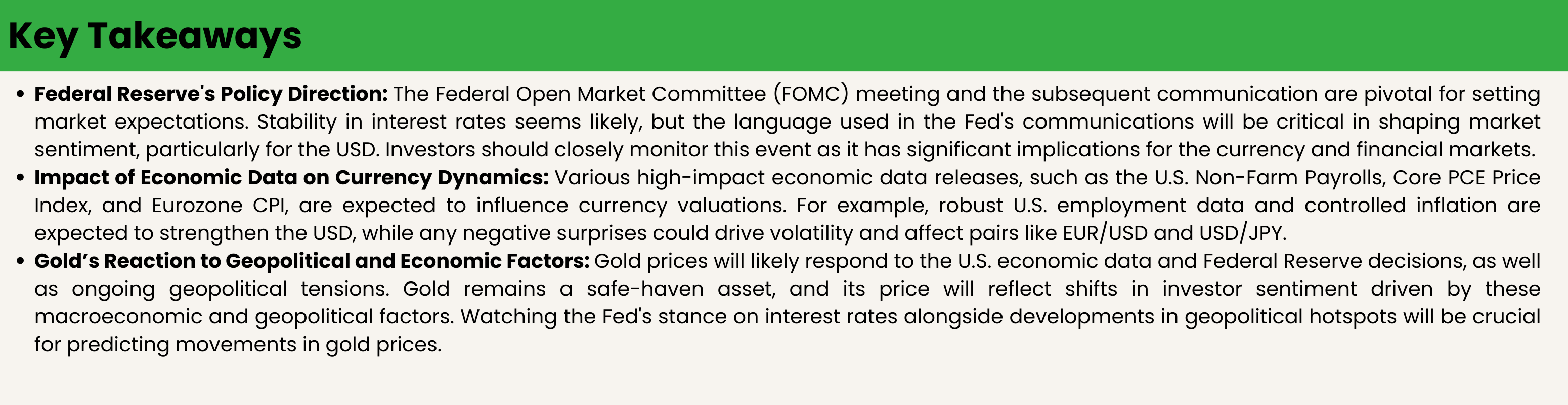

Dollar Index:

The focus is largely on the upcoming Federal Open Market Committee (FOMC) meeting and the Non-Farm Payroll (NFP) data, which are significant for market expectations around the U.S. Federal Reserve’s monetary policy decisions. This anticipation influences USD volatility and investor sentiment.

Inflation saw a moderate increase, with the Core Personal Consumption Expenditure (PCE) Price Index rising by 0.3% month-on-month and 2.8% year-on-year. These figures were in line with forecasts, indicating a controlled inflation environment, consistent with the Federal Reserve’s targets .

- GDP growth for the first quarter was reported at 1.6%, which was below the anticipated 2.4%. This underperformance highlighted the ongoing challenges in the economy, including the impact of high imports restraining growth. However, strong labor market data provided a counterbalance, suggesting underlying economic strength despite the GDP figures .

- The US dollar has experienced relative stability against major currencies such as the Japanese yen and the euro. However, the yen saw a notable surge against the dollar, attributed to suspected intervention by Japanese authorities. This movement in the yen comes amid reduced liquidity due to a national holiday in Japan and precedes the upcoming FOMC meeting, which has heightened sensitivity in currency markets

- Oil prices have slightly decreased as the US intensifies diplomatic efforts, aiming to reduce geopolitical tensions in the Middle East. This development could potentially impact global oil supply dynamics and has implications for the energy sector, which in turn can affect currency valuations including the USD

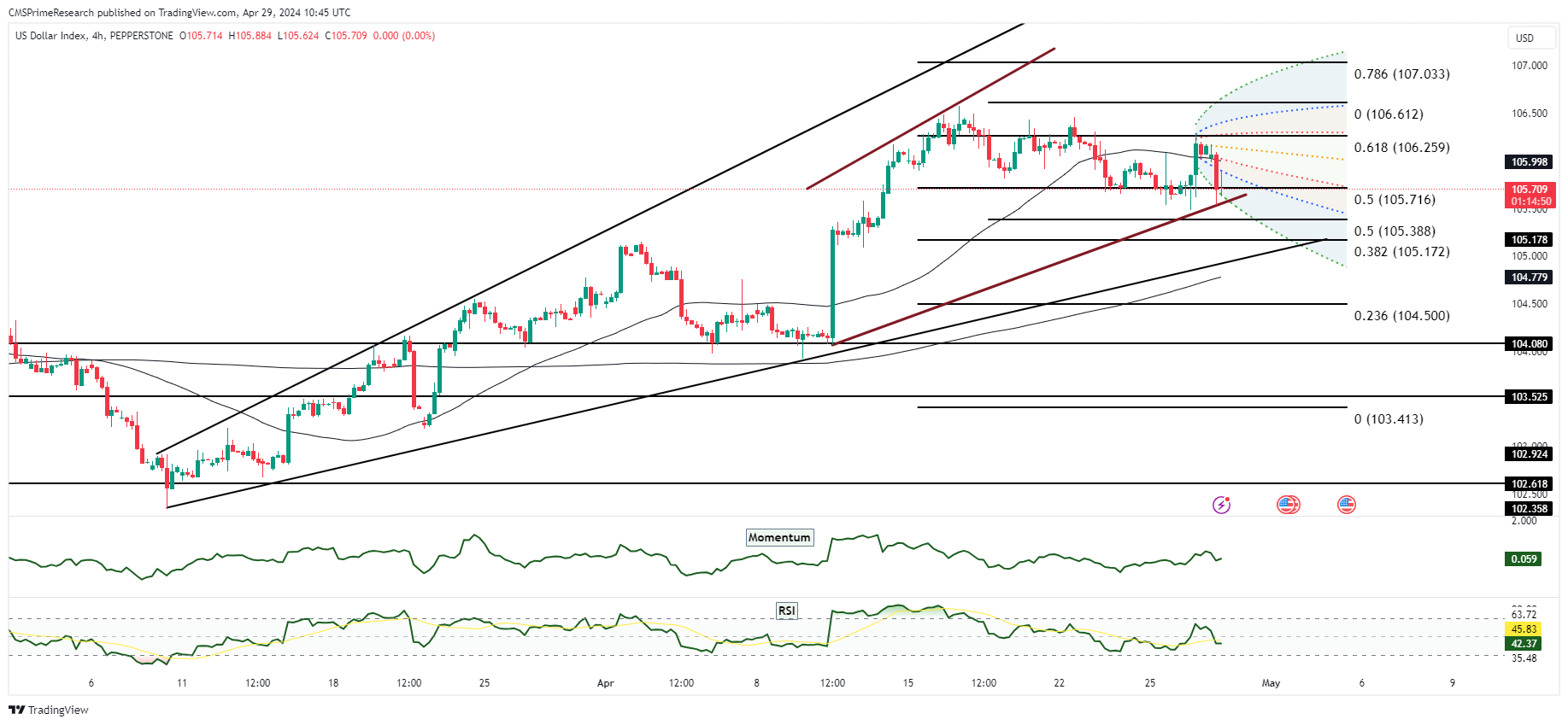

Upcoming Events for the week:

The upcoming week’s economic events are loaded with significant data that will likely influence the forex markets. The Eurozone starts the week with ECB Guindos’ speech, which traders will scrutinize for any hints about future ECB policy, especially considering that the CPI has come in right at the consensus, suggesting stable inflation. This could maintain current sentiment towards the EUR if no new policy directions are revealed.

Midweek, attention shifts to the U.S. with the Federal Reserve’s interest rate decision, which is widely expected to hold steady. However, the subsequent press conference will be critical. Markets will be eager for insights into the Fed’s economic outlook and policy intentions, especially with ADP employment change and manufacturing PMI indicating a slightly healthier economy than anticipated. Positive language from the Fed could reinforce the USD’s strength.

Towards the end of the week, the focus will be on the U.S. employment situation with the release of Nonfarm Payrolls and the unemployment rate. Given that the unemployment rate is expected to hold steady and Nonfarm Payrolls are forecasted to show substantial growth, robust figures could solidify a bullish sentiment for the USD, reflecting a resilient labor market.

Overall Market Sentiment:

- EUR sentiment could be neutral to slightly positive, with an estimated breakdown of 45% Positive, 35% Negative, and 20% Neutral, depending on the outcomes of the ECB speech and Eurozone data.

- For the USD, expectations of continued economic strength could lead to a sentiment breakdown of 60% Positive, 20% Negative, and 20% Neutral, especially if the Fed’s communication supports a positive economic narrative.

- The GBP’s sentiment will depend on the services PMI, but given a potential strong showing, the sentiment might be cautiously optimistic, with an estimated breakdown of 50% Positive, 30% Negative, and 20% Neutral.

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Bullish Scenario:

- A clear break above the immediate resistance at the 1.08967 Fibonacci level could lead to testing the 1.09401 (0.786 Fibonacci level).

- Continued bullish momentum might push the pair towards the 1.09880 (0.618 Fibonacci extension level).

Bearish Scenario:

- Rejection at the current level and a breach below the ascending trendline could see the pair test the 1.08162 support area.

- Further downside may bring the 1.07485 level into play, corresponding with the lower boundary of the recent price channel.

Neutral Scenario:

- The pair might consolidate around the current levels, fluctuating between the resistance at 1.08967 and the support at 1.08162.

- The Momentum indicator near the centerline suggests potential for indecision in the market.

Fundamental Scenarios for EUR/USD

Impact of Positive Economic Data:

- Better than expected CPI and GDP data from the Eurozone could strengthen the Euro.

- Positive US data, particularly a strong ADP Employment Change, could bolster the USD, potentially limiting gains in EUR/USD.

Impact of Negative Economic Data:

- Disappointing CPI and GDP figures from the Eurozone could exert bearish pressure on the Euro.

- If US data disappoints, especially the Non-Farm Payrolls or the Unemployment Rate, it could weaken the USD, offering support to EUR/USD.

Impact of Mixed Economic Data:

- Mixed economic data may lead to volatile but range-bound trading, with the pair swinging between key technical levels.

Impact of Fed Interest Rate Decision

- An interest rate increase by the Fed could strengthen the USD due to the higher yield attractiveness, possibly leading to a bearish scenario for EUR/USD.

- If the Fed keeps rates steady or the language is less hawkish than expected, it could weaken the USD, supporting a bullish scenario for EUR/USD.

Overall Market Sentiment

Sentiment Percentages:

- 40% Positive: The uptrend and price action above significant support levels provide a moderately positive outlook.

- 40% Negative: The potential for a reaction to the Fed’s decision and technical resistance could contribute to a bearish view.

- 20% Neutral: Uncertainty ahead of key economic releases and technical indicators reflecting a balance of forces suggest a neutral market sentiment.

These scenarios incorporate the forthcoming high-impact economic data and the current technical posture of the EUR/USD pair. Market sentiment may evolve with the actual data and investor interpretation of the Fed’s interest rate decision. It is important for market participants to follow the developments closely and manage risk accordingly.

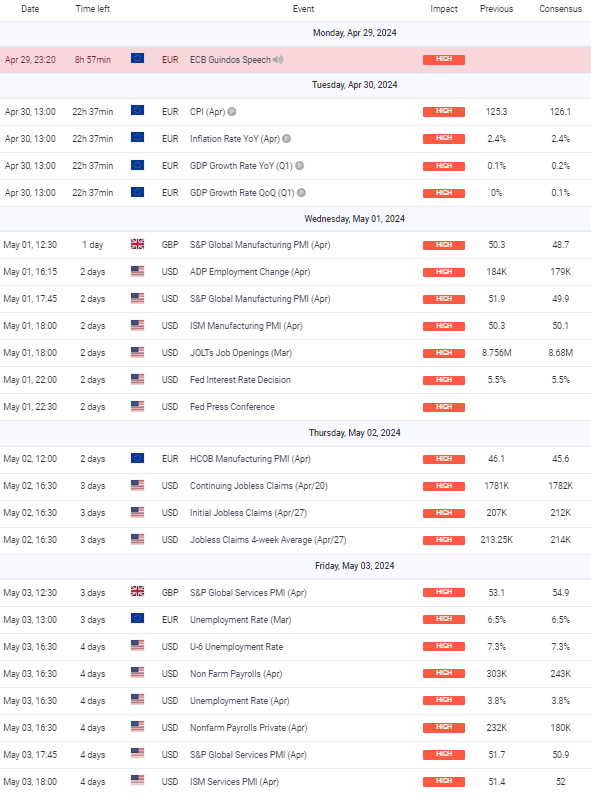

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Scenarios:

Technical Scenarios for GBP/USD

Bullish Scenario:

- Break above the immediate resistance at 1.25857 (0.786 Fibonacci retracement level) may lead to testing the 1.27304 (0.5 Fibonacci level).

- Breaching this level might open a path towards the 1.27711 resistance zone.

Bearish Scenario:

- Failure to maintain the momentum above the 1.24738 level could result in retesting the support around 1.2464.

- A sustained move below this support may further bring the 1.2652 level into focus, indicating a stronger bearish sentiment.

Neutral Scenario:

- The pair might experience consolidation within the range of 1.24738 and 1.25857, particularly if the economic data does not provide clear direction.

- The RSI hovering around the midpoint also supports the possibility of a range-bound scenario.

Fundamental Scenarios for GBP/USD

Positive Economic Data Impact:

- Strong GDP or Manufacturing PMI data from the UK could support a bullish scenario for GBP.

- On the flip side, robust US economic data may limit the upside for GBP/USD.

Negative Economic Data Impact:

- Weaker-than-expected UK data may weigh on the GBP, leading to a bearish outlook.

- Conversely, disappointing US employment figures or a dovish Fed may weaken the USD, offering support to GBP/USD.

Mixed Economic Data Outcome:

- A mix of positive and negative data from both the UK and US may lead to volatile trading sessions, with no clear trend emerging.

Impact of Fed Interest Rate Decision

- If the Fed raises rates, this may result in a stronger USD, pushing GBP/USD lower.

- Alternatively, if the Fed holds rates steady or the tone is less hawkish than anticipated, GBP/USD could rise as the USD weakens.

Overall Market Sentiment

Sentiment Percentages:

- 45% Positive: Based on the potential for positive UK economic data and the current technical setup above key support levels.

- 35% Negative: The chance of a bearish reversal given the proximity to significant resistance levels and the impact of the Fed’s decision.

- 20% Neutral: Given the uncertainty around the Fed’s decision and potential mixed economic data outcomes.

USD/JPY Outlook:

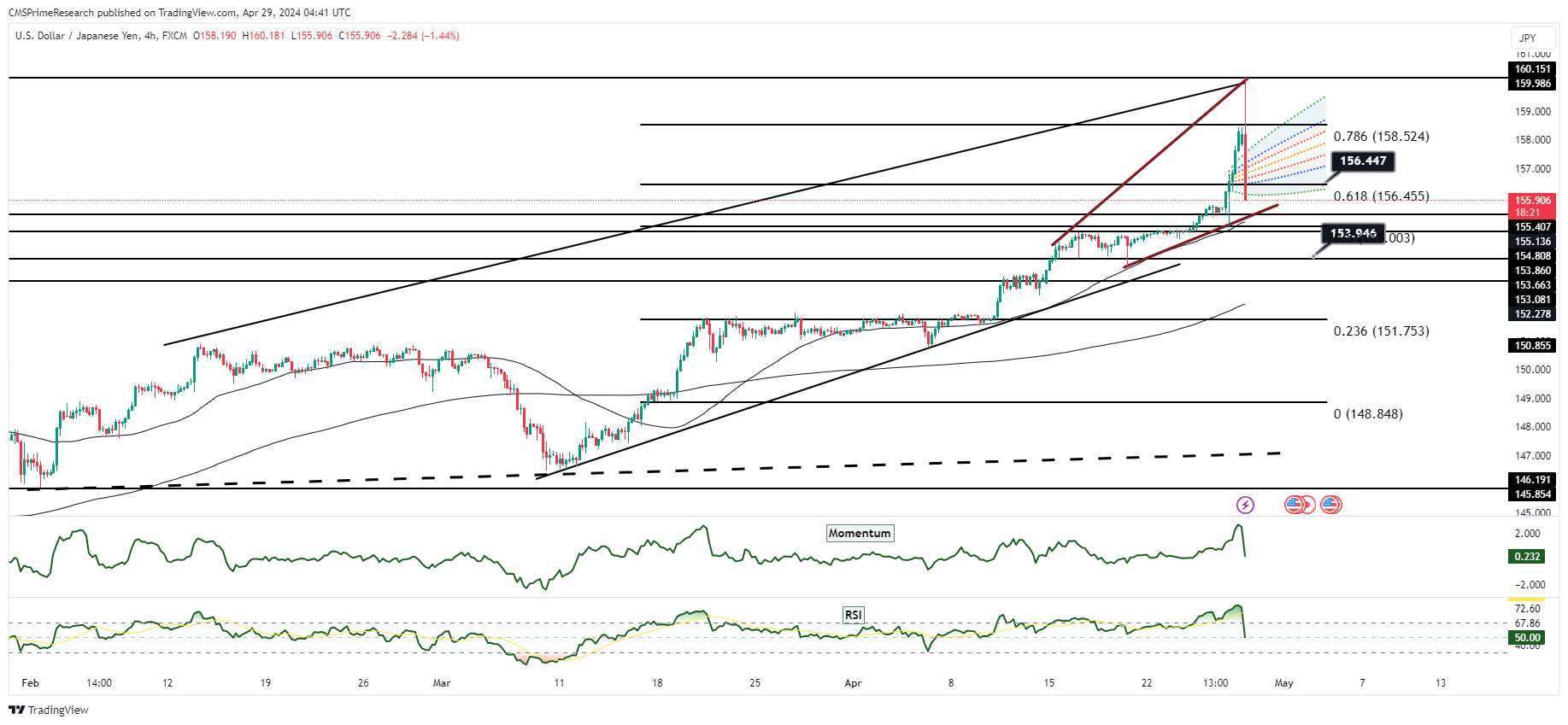

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Bullish Scenario:

- If the price maintains above the recent low at 155.906, a push towards the 0.618 Fibonacci retracement level at 156.455 may occur.

- Breaking above this level could lead to further bullish momentum, potentially testing the 0.786 level at 158.524.

Bearish Scenario:

- A break below the 155.906 support level might signal a move towards the lower end of the upward channel near 153.663.

- Continuing downward pressure could see USD/JPY targeting the 0.236 Fibonacci retracement level at 151.753.

Neutral Scenario:

- The pair may oscillate between the 155.906 support and 156.447 resistance levels if there is indecision in the market.

- With the RSI near the 50 mark, a lack of momentum might result in range-bound trading conditions.

Fundamental Scenarios for USD/JPY

Positive Economic Data Impact:

- Better than expected U.S. employment data or hawkish Fed interest rate decision could strengthen the USD and support the bullish scenario.

- Surprisingly strong manufacturing PMI data could also contribute to USD strength.

Negative Economic Data Impact:

- Disappointing U.S. economic data, especially from the labor market or a dovish stance from the Fed, could weaken the USD and lead to the bearish scenario.

- Unexpectedly weak PMI data might further pressure USD/JPY to the downside.

Mixed Economic Data Outcome:

- Mixed signals from the economic data releases could lead to a neutral stance with traders and investors taking a wait-and-see approach.

Impact of Fed Interest Rate Decision

- An increase in the Fed’s interest rate would likely support the USD as it increases the yield on U.S. dollar-denominated assets, potentially leading to bullish sentiment for USD/JPY.

- Conversely, if the Fed’s decision or forward guidance is more dovish than expected, it could result in USD weakness and a bearish outcome for the pair.

Overall Market Sentiment

Sentiment Percentages:

- 50% Positive: The ongoing upward trend and support above significant technical levels may encourage bullish sentiment.

- 30% Negative: Potential bearish shifts due to technical support break or dovish Fed decision.

- 20% Neutral: The possibility of mixed economic data and market indecision could contribute to a neutral sentiment.

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD

Bullish Scenario:

- A hold above the $2332 level could see the price aiming for the 0.618 Fibonacci retracement level at around $2386.

- Further bullish momentum could target the $2360 resistance zone, before potentially challenging the upper boundary of the descending channel.

Bearish Scenario:

- If the price breaks below the $2332 support, a move towards the $2317 level could follow.

- A significant bearish turn might see gold prices heading towards the next key support level at $2271, near the lower end of the channel.

Neutral Scenario:

- Gold may consolidate within the descending channel, particularly between the $2332 support and $2360 resistance.

- A flatlining momentum indicator suggests potential indecision and sideways movement.

Fundamental Scenarios for XAU/USD

Positive Economic Data Impact:

- Strong U.S. data, particularly an aggressive rate hike decision by the Fed, could bolster the USD, pressuring gold prices downward.

- Solid manufacturing and employment figures could also lead to a stronger USD and weaker gold prices.

Negative Economic Data Impact:

- Weaker than expected U.S. data, especially if the Fed is less hawkish than anticipated, could lead to USD weakness, supporting higher gold prices.

- Gold could also benefit from its safe-haven status if data points to economic uncertainty.

Mixed Economic Data Outcome:

- Divergent data points, with some indicators beating and others missing expectations, could lead to choppy trading within the established technical range.

Impact of Fed Interest Rate Decision

- A rate increase by the Fed would likely enhance the value of the USD, potentially leading to a drop in gold prices as the opportunity cost of holding a non-yielding asset increases.

- Conversely, a hold on rates or a dovish message could weaken the USD, increasing the attractiveness of gold.

Overall Market Sentiment

Sentiment Percentages:

- 40% Positive: Potential for gold to rally on economic uncertainty or a dovish Fed stance.

- 45% Negative: A stronger USD on positive economic data or aggressive Fed action could depress gold prices.

- 15% Neutral: Indecision ahead of significant economic announcements could lead to range-bound price action.

Risk based Sentiments-What to Look out for?

EUR/USD:

- Focus on: U.S. Core PCE Price Index, FOMC meeting outcomes, and ECB Guindos’ speech. These indicators and events are critical for assessing the policy divergence between the Fed and ECB, which could drive EUR/USD movement.

GBP/USD:

- Focus on: UK services PMI and Non-Farm Payroll data from the U.S. The contrast between UK economic health and U.S. labor market strength will play a key role in determining GBP/USD direction.

USD/JPY:

- Focus on: Non-Farm Payrolls and the FOMC decision. Strong U.S. job growth combined with a hawkish Fed could push USD/JPY higher, especially if the market sees sustained U.S. economic strength.

XAU/USD (Gold):

- Focus on: U.S. Core PCE Price Index and geopolitical tensions. Gold’s position as a safe haven will be pivotal, with its price influenced by both U.S. inflation trends and global geopolitical risks.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.