Dollar Index:

Inflation Data:US inflation data came in higher than expected in March, reinforcing expectations that the Federal Reserve will maintain higher interest rates for longer. The Consumer Price Index (CPI) rose 3.5% year-over-year, up from 3.2% in February, while core CPI remained at 3.8%. This caused US stock futures and Asian markets to decline.

- The hotter-than-anticipated inflation report sent stocks and bonds sliding, as it signaled the Fed will be in no rush to cut interest rates. Treasury yields jumped, with the 10-year yield reaching over 4.5%, the highest level year-to-date. yields. The USD/JPY pair reached a 34-year high of 153.18.

- Gold prices hit record highs despite the rally in US real yields, as some investors sought safe-haven assets amid fears of a potential “hard landing” scenario. However, analysts believe gold’s meteoric rise could be more momentum-driven than fundamentally supported.

- Economic data showed the US economy remained resilient, with a strong jobs report in March. However, persistently high inflation has led investors to doubt the Fed’s ability to lower interest rates this year as previously anticipated.

- The escalating tensions over the weekend, caused some volatility in global markets.

- The US dollar strengthened broadly against major currencies like the euro and Japanese yen amid the geopolitical concerns and rising US Treasury yields.

- The global maritime industry is concerned about tougher times ahead due to the escalating tensions.

Upcoming Events for the week:

The week’s economic calendar is dense with significant reports that are expected to create ripples across currency markets. In the United States, retail sales have outperformed expectations, which may be a bullish signal for the USD as it indicates healthy consumer spending—a cornerstone of the U.S. economy. This is compounded by the building permits data, which exceeded consensus, suggesting optimism in the housing market and potentially reinforcing USD strength.

On the other side of the Atlantic, the GBP is facing headwinds with a negative employment change, clashing with expectations for growth. This could lead

to bearish sentiment towards the GBP as it may raise concerns about the UK’s economic health. Conversely, a better-than-expected unemployment rate could offer some support. For the EUR, CPI data will be closely watched; higher inflation could pressure the ECB to maintain or intensify its current monetary policy stance, potentially impacting the EUR.

Later in the week, market attention will turn to additional jobless claims data from the U.S., which, if consistent with previous trends, could reinforce the narrative of a tight labor market. Meanwhile, the UK’s retail sales data will be pivotal for the GBP. If retail sales figures mirror the employment change’s negative surprise, it could compound worries about domestic consumption and further dampen the GBP’s appeal.

Overall Market Sentiment:

- The USD sentiment is likely to be optimistic, buoyed by strong retail and housing data, with a sentiment breakdown of approximately 60% Positive, 20% Negative, and 20% Neutral.

- For the GBP, mixed labor and pending retail sales data could result in a sentiment breakdown of 40% Positive, 40% Negative, and 20% Neutral.

- The EUR’s sentiment will be contingent on the inflation figures and ECB commentary, potentially leading to a sentiment of 50% Positive, 30% Negative, and 20% Neutral if inflation is in line with or exceeds expectations, indicating a possible continued hawkish policy stance.

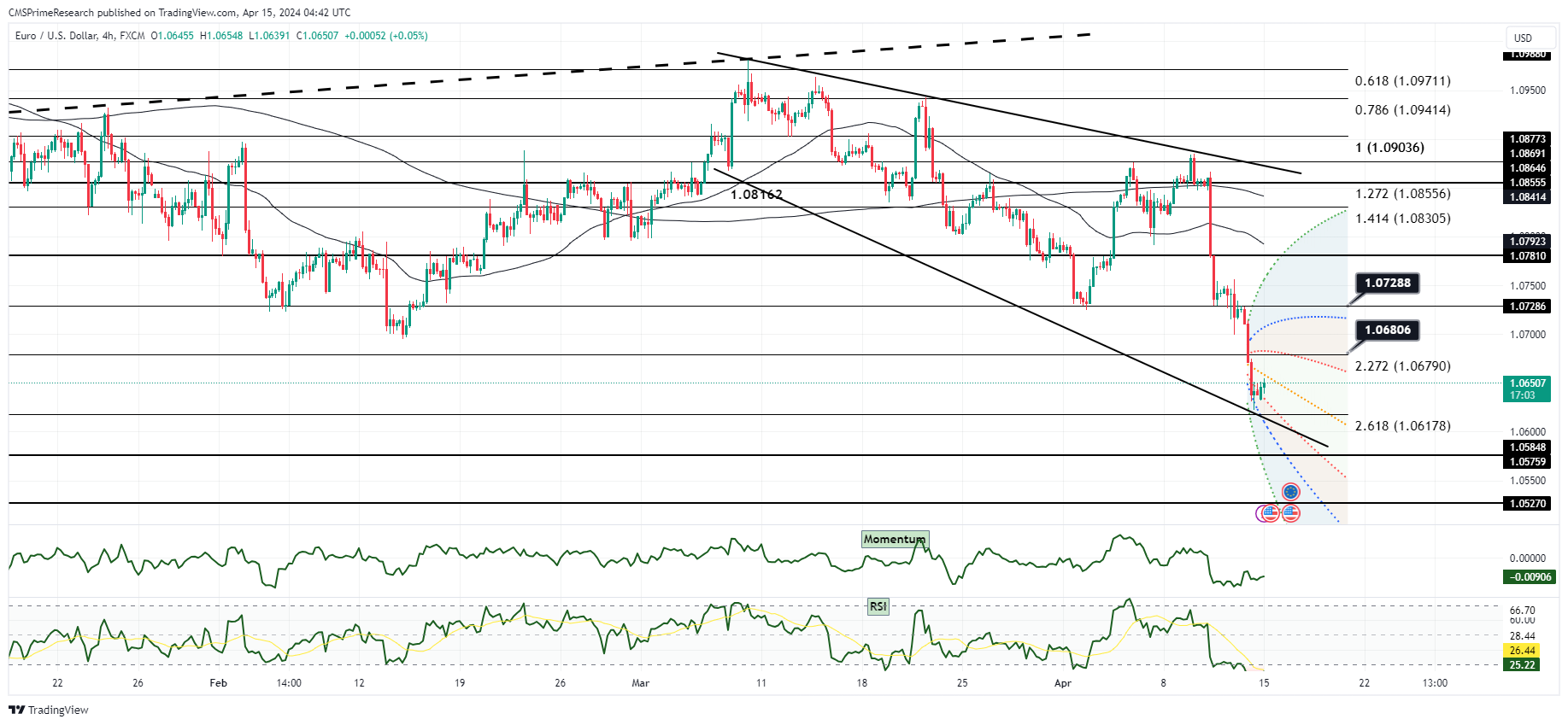

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Scenario 1: Recovery Rally

- Technical Observation: EUR/USD is hovering above the 1.06806 support level, with potential for a short-term rebound.

- Potential Trigger: A positive divergence in RSI may signal a pullback from oversold conditions.

- Upside Targets: A bounce could test resistance at 1.07288, and if momentum builds, it could reach towards 1.07810.

Scenario 2: Further Downtrend

- Technical Observation: A continued hold below the downward trendline may suggest bearish momentum.

- Potential Trigger: A sustained break below the 1.06806 level could intensify selling pressure.

- Downside Targets: If the downward trend persists, the next levels to watch might be 1.06790 and potentially 1.06507.

Scenario 3: Consolidation

- Technical Observation: The RSI near oversold territory may lead to a period of consolidation around current levels.

- Potential Trigger: Absence of significant market catalysts could keep trading within a tight range.

- Consolidation Range: The pair may stabilize between the 1.06806 support and the 1.07288 resistance.

Fundamental Scenarios for EUR/USD

Scenario 1: EUR Strengthening on Economic Optimism

- Economic Data: Strong retail sales or employment data from the Eurozone may lift the EUR.

- Market Sentiment: An improving economic outlook for the Eurozone, combined with ECB official’s optimistic comments, could bolster EUR strength.

Scenario 2: EUR Weakening on Economic Pessimism

- Economic Data: Weak Eurozone inflation or higher unemployment could weigh on the EUR.

- Market Sentiment: Dismal Eurozone figures, contrasting with solid US economic data, may favor USD over EUR.

Scenario 3: Mixed Market Reactions

- Economic Data: A mixed set of data releases from both the Eurozone and the US could lead to indecisive market moves.

- Market Sentiment: Investors may remain cautious, resulting in choppy trading conditions if the data does not provide clear direction.

Overall Market Sentiment

Positive Sentiment: 35%

- The likelihood of EUR recovery if technical indicators show a reversal and if Eurozone data outperform.

Negative Sentiment: 45%

- The chance of continued EUR weakness given the current technical trend and if US data remain robust.

Neutral Sentiment: 20%

- The possibility of a sideways market in the absence of definitive economic signals or if data from both economies is mixed.

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Scenarios:

Technical Scenarios for GBP/USD

Scenario 1: Bullish Recovery

- Technical Observation: GBP/USD is near the 1.23556 Fibonacci retracement level.

- Potential Trigger: A bullish divergence on the RSI could indicate a possible reversal from this point.

- Upside Targets: If a recovery ensues, the pair might aim for 1.24736, and possibly higher towards 1.25837.

Scenario 2: Continued Downtrend

- Technical Observation: The current downtrend momentum is strong, with the pair recently breaking past several support levels.

- Potential Trigger: Further bearish momentum could be sustained by poor UK economic data or strong US retail figures.

- Downside Targets: The next key support level lies at 1.23460, followed by the lower Fibonacci extension at 1.2267.

Scenario 3: Sideways Movement

- Technical Observation: RSI approaching the oversold territory could lead to consolidation.

- Potential Trigger: Lack of new fundamental drivers or mixed economic data.

- Trading Range: The pair might oscillate between the support at 1.23556 and resistance near 1.24736.

Fundamental Scenarios for GBP/USD

Scenario 1: GBP Strengthening on Positive UK Data

- Economic Data: An improvement in the UK Unemployment Rate or a positive surprise in Retail Sales could lift the GBP.

- Market Sentiment: Better-than-expected economic reports may lead to bullish sentiment for the GBP.

Scenario 2: GBP Weakening on Negative UK Data

- Economic Data: Weakness in UK Inflation or Retail Sales figures could put downward pressure on the GBP.

- Market Sentiment: Dismal UK economic data may increase bearish bets against the GBP.

Scenario 3: Mixed Data Reactions

- Economic Data: A combination of positive US data and negative UK data could lead to a continuation of the downtrend.

- Market Sentiment: Traders might react to the contrasting economic outlooks, favoring the USD over the GBP.

Overall Market Sentiment

Positive Sentiment: 30%

- The potential for GBP recovery if technical signals indicate an upturn and if UK data are favorable.

Negative Sentiment: 50%

- The possibility of further decline given the current strong downtrend and potential for negative UK economic news.

Neutral Sentiment: 20%

- The chance of market indecision and range-bound trading if upcoming economic releases provide mixed signals.

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Scenario 1: Sustained Bullish Trend

- Technical Observation: USD/JPY is currently testing the 0.618 Fibonacci retracement level at 153.069, within an ascending channel.

- Potential Trigger: Holding above this level with an increasing RSI could indicate a continuation of the bullish trend.

- Upside Targets: Resistance at 153.105 may be tested, with potential moves towards 154.844 if the trend remains intact.

Scenario 2: Bearish Reversal

- Technical Observation: If the pair fails to hold the Fibonacci support level, it could signify a change in sentiment.

- Potential Trigger: A clear break below 153.069 with a declining RSI might suggest a reversal.

- Downside Targets: Subsequent support levels at 151.773 and 150.287 could be exposed.

Scenario 3: Consolidation Phase

- Technical Observation: RSI approaching the mid-level suggests a possible consolidation.

- Potential Trigger: Without significant economic news to drive momentum, the pair could enter a consolidation phase.

- Trading Range: Possible consolidation between the 0.618 level at 153.069 and the next resistance at 153.105.

Fundamental Scenarios for USD/JPY

Scenario 1: USD Strengthens on Positive US Data

- Economic Data: If upcoming US retail and employment figures exceed expectations, the USD could gain.

- Market Sentiment: Strong economic indicators may lead to increased buying pressure for the USD.

Scenario 2: USD Weakens on Economic Downturn

- Economic Data: A downturn in US economic data, particularly retail sales or jobless claims, could weaken the USD.

- Market Sentiment: Negative news could prompt traders to seek safety in JPY, pushing USD/JPY lower.

Scenario 3: Mixed Market Reactions

- Economic Data: Conflicting data from the US, such as strong retail sales but increasing jobless claims, could lead to mixed reactions.

- Market Sentiment: Uncertainty due to mixed economic signals may result in erratic trading and unclear direction.

Overall Market Sentiment

Positive Sentiment: 35%

- Likelihood of further USD gains if economic data is robust, reinforcing the uptrend.

Negative Sentiment: 45%

- Possibility of a trend reversal if economic data disappoints, favoring JPY strength.

Neutral Sentiment: 20%

- Potential for a lack of clear direction and range-bound conditions amid mixed economic outcomes.

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Scenario 1: Bullish Continuation

- Technical Observation: Gold is exhibiting a pullback with potential support at the Fibonacci level (2346).

- Potential Trigger: Rising geopolitical tensions typically increase the appeal of safe-haven assets like gold.

- Upside Targets: A rebound off the support could lead to retesting the high around 2434 and potentially establish new highs if the uptrend resumes.

Scenario 2: Bearish Correction

- Technical Observation: If gold breaks below the current Fibonacci support, a deeper correction could be underway.

- Potential Trigger: An easing of geopolitical tensions or strong USD economic data could dampen gold’s appeal.

- Downside Targets: The next levels of notable support may be around the 0.618 level (2317.529) followed by the 0.5 level (2296.391).

Scenario 3: Consolidation Within Range

- Technical Observation: The momentum indicator is leveling, which might suggest a phase of consolidation.

- Potential Trigger: Mixed economic data and uncertain geopolitical outcomes could lead to range-bound trading.

- Trading Range: The consolidation could occur between the 0.786 Fibonacci level (2346.856) and the recent peak around 2434.

Fundamental Scenarios for XAU/USD (Gold)

Scenario 1: Gold Strengthens on Geopolitical Risks

- Geopolitical Impact: Escalation in geopolitical tensions can drive investors towards gold.

- Market Sentiment: Fear-induced demand could increase gold’s price, especially if stock markets weaken.

Scenario 2: Gold Weakens on Resolution of Tensions

- Geopolitical Impact: De-escalation or resolution of geopolitical conflicts could reduce the demand for safe havens.

- Market Sentiment: A shift towards riskier assets could occur, leading to a decline in gold prices.

Scenario 3: Mixed Impact from Economic Data and Geopolitics

- Geopolitical Impact: Ongoing conflicts can maintain some demand for gold.

- Economic Data: Strong US retail or employment data could counteract some of the geopolitical-driven demand for gold, leading to mixed market sentiment.

Overall Market Sentiment

Positive Sentiment: 40%

- This reflects the potential for gold to rise on the back of continued geopolitical tensions and its status as a safe-haven asset.

Negative Sentiment: 30%

- There is a chance of gold’s decline if geopolitical tensions ease quickly or if US economic data comes out strong, boosting the USD.

Neutral Sentiment: 30%

- Given the uncertain impact of mixed economic data and the unpredictable nature of geopolitical developments, there could be significant indecision in the market.

Risk based Sentiments-What to Look out for?

EUR/USD:

- Focus on: U.S. PCE Price Index and Eurozone CPI data. Strong U.S. inflation may strengthen the USD, while significant Eurozone CPI figures could influence the ECB’s policy decisions and impact the EUR.

GBP/USD:

- Focus on: UK employment change and retail sales data. Negative job data and weak retail sales can drive bearish sentiment towards the GBP, while any positive surprises could support a recovery.

USD/JPY:

- Focus on: U.S. nonfarm payrolls and overall employment data. Strong job growth can reaffirm a strong USD stance, potentially pushing USD/JPY higher if the data signals sustained economic strength.

XAU/USD (Gold):

- Focus on: Geopolitical tensions and U.S. PCE Price Index. Increased geopolitical risks often boost gold as a safe-haven asset, while strong U.S. economic data could enhance USD strength and pressure gold prices.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.