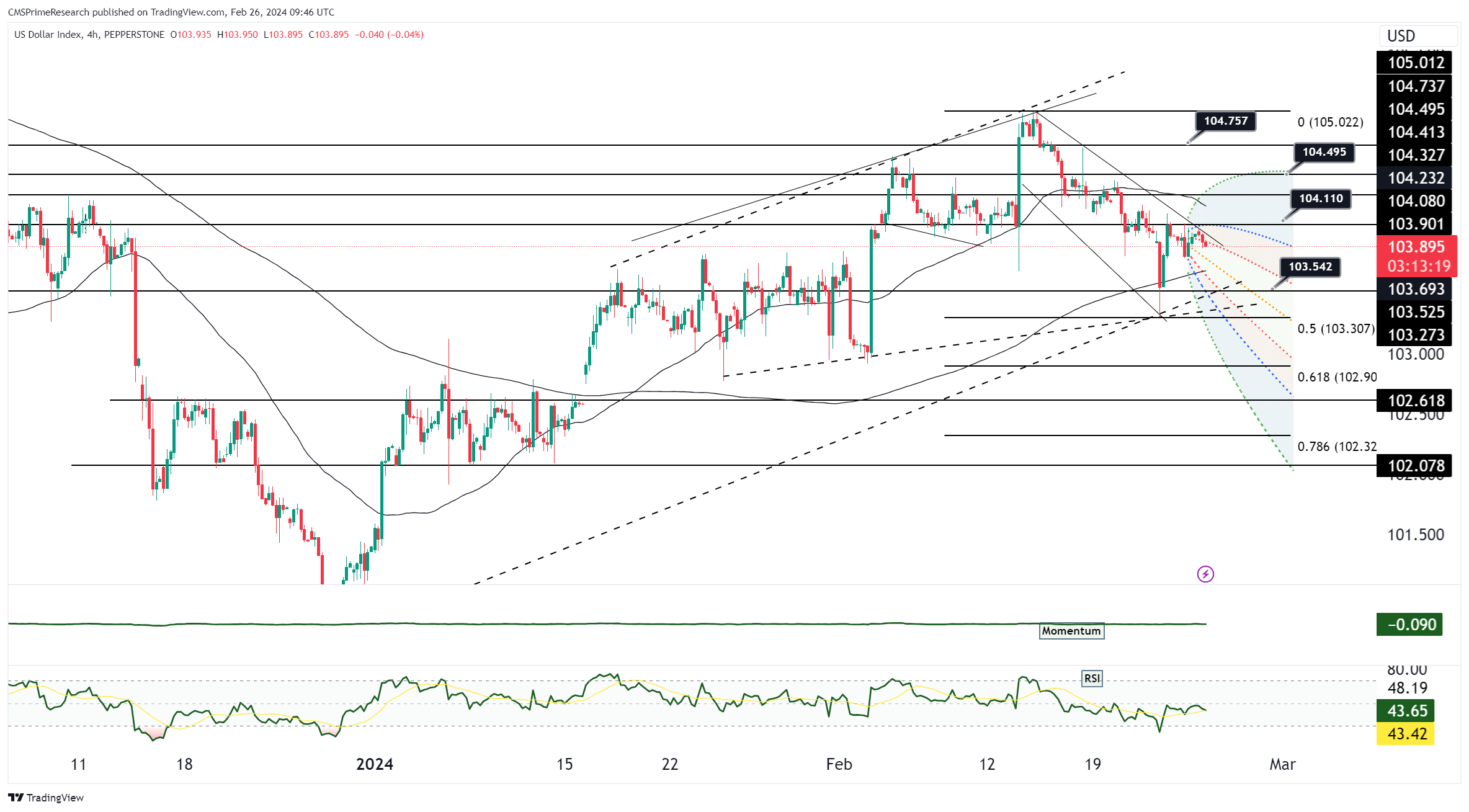

Dollar Index:

As of February 26th, the latest factors impacting the USD include surging US inflation and investor responses to economic indicators. A report highlighted the Euro weakening against the Dollar due to hot US inflation data, suggesting persistent inflationary pressures in the US. This has boosted the Dollar’s value and affected currency pairs such as EUR/USD and GBP/USD. The USD Index’s rise above 104.50 reflects increased investor confidence in the US economy, with upcoming Federal Reserve speeches and consumer sentiment data poised to further influence the Dollar’s trajectory.

The market is awaiting key economic releases from the United States, including Q4 GDP, February PCE, and unemployment claims reports. These data points are likely to provide fresh directional cues, as they will offer insights into the U.S. economic health and inflation trends, which are pivotal in shaping the Federal Reserve’s monetary policy.

Additionally, the annual inflation rate in the United States was reported at 3.1% for the 12 months ending January 2024, a slight decrease from the previous rate of 3.4%. This slight moderation in inflation rates indicates ongoing economic factors that the Federal Reserve and investors closely monitor, as they have significant implications for monetary policy and the USD’s value.

These insights suggest that the USD’s strength is closely tied to domestic inflation dynamics and broader economic indicators, with investor sentiment being swayed by economic releases and central bank communications.

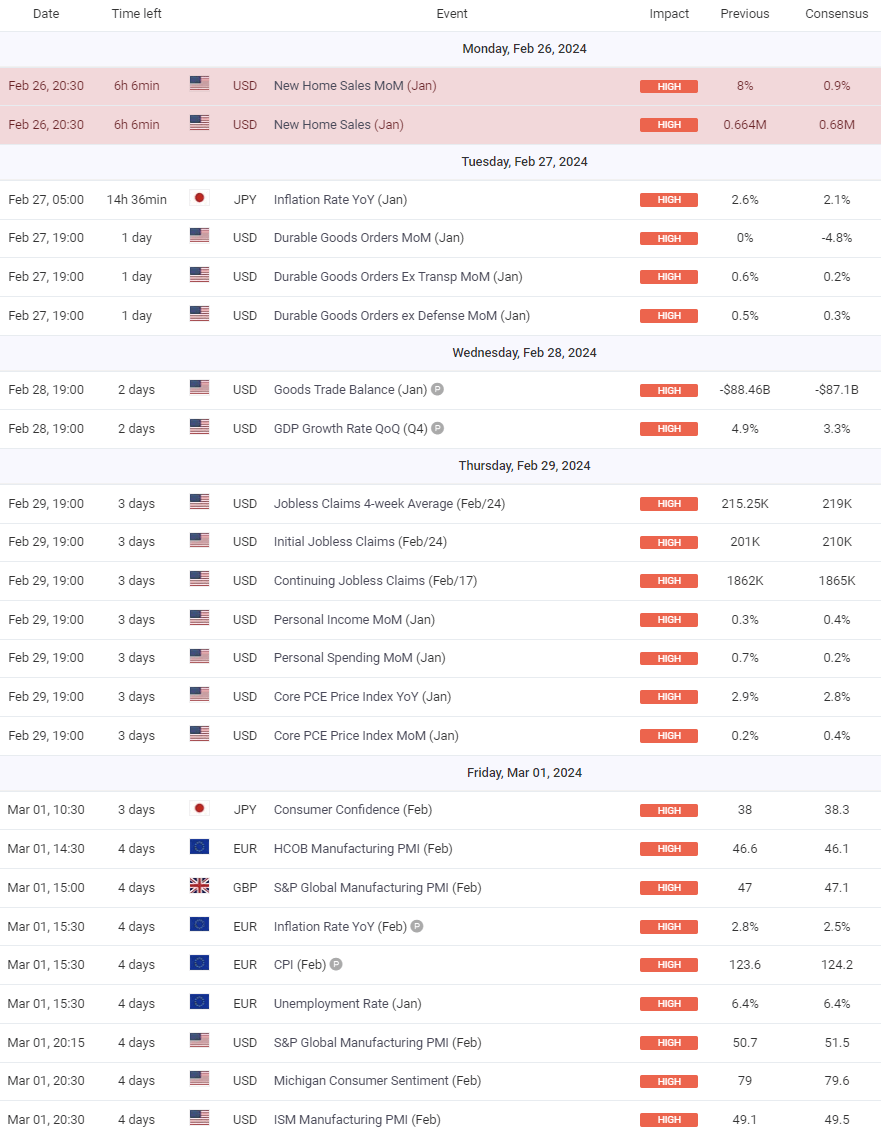

Upcoming Events for the week:

The week ahead in the currency markets is laden with significant data releases, with a particular spotlight on the U.S. Core PCE Price Index, a favored gauge of inflation by the Federal Reserve. With the Core PCE figures coming in lower than expected, this could suggest that inflationary pressures are moderating, which might lead to a softer stance by the Fed on interest rate hikes, potentially weakening the USD in the near term as traders adjust their expectations for future monetary policy.

Earlier in the week, the U.S. new home sales for January have exceeded expectations, signaling strength in the housing market which is a key economic indicator. This could provide some initial support for the USD, reflecting consumer confidence and a willingness to make significant purchases. However, this sentiment could be short-lived if market participants weigh the implications of the Core PCE data more heavily.

In contrast, the Eurozone will present its own CPI data, which if it follows the trend of a subdued Core PCE, could ease concerns about rampant inflation in the Eurozone, potentially softening the ground for the EUR. Similarly, the U.K. and Japan will also be releasing pivotal data, with any unexpected figures likely to cause volatility in the GBP and JPY, respectively.

- The USD sentiment could be mixed, with a lean towards caution due to the lower Core PCE figures, estimated at 45% Positive, 35% Negative, and 20% Neutral, as investors consider the implications for Fed policy.

- The EUR’s sentiment will be influenced by the upcoming CPI data, but the initial outlook could be moderately positive, with a sentiment breakdown of 50% Positive, 30% Negative, and 20% Neutral, assuming no significant deviation from expectations.

- The JPY’s and GBP’s sentiments will hinge on their respective inflation and consumer confidence releases, with potential sentiment breakdowns being contingent on whether these releases mirror the U.S.’s softer inflation trajectory.

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD:

Bullish Scenario:

- The pair maintains support above the Fibonacci level of 0.786 (1.08064) and the upward momentum continues, targeting the resistance at 1.0861, followed by the 0.618 Fibonacci retracement level at 1.08361.

- A break above the recent high of 1.08766 could lead to a test of the upper trend line around 1.088-1.089 levels.

- The RSI stays above the 50 mid-level, supporting the continuation of the current uptrend.

Neutral Scenario:

- EUR/USD oscillates around the 1.08157 pivot point as market participants assess incoming economic data.

- The currency pair remains within the ascending channel, with the potential for sideways movement between the 1.07704 support and the 1.08350 resistance.

- The RSI hovers around the midpoint without indicating a clear direction, suggesting consolidation.

Bearish Scenario:

- A break below the key psychological support at 1.08000, coinciding with the 0.786 Fibonacci level, could trigger a bearish move towards 1.07704.

- If the bearish momentum intensifies, the next support at 1.07686 (Fibonacci level of 1) may be tested.

- The RSI dips below the 50 level, confirming a potential shift in momentum to the downside.

Fundamental Scenarios for EUR/USD:

Positive Data Outcomes:

- Higher than expected readings on the New Home Sales, Durable Goods Orders, GDP Growth Rate, and Personal Income could strengthen the USD, pressuring EUR/USD downwards.

- If U.S. inflation indicators (Core PCE Price Index) come in hotter than anticipated, it may fuel expectations of a more aggressive Fed, bolstering USD.

Neutral Data Outcomes:

- If the data releases match consensus expectations, the market’s focus may remain on technical levels, with a muted fundamental impact on EUR/USD.

- Concurrent positive and negative data could offset each other, leading to limited fundamental-driven volatility.

Negative Data Outcomes:

- Weaker than forecasted data on the U.S. economic front could undermine the USD, potentially leading to a rally in EUR/USD.

- Any surprise reduction in key economic indicators such as the GDP Growth Rate or a rise in Jobless Claims may weaken investor confidence in the USD.

Overall Market Sentiment:

Given the data, the sentiment for EUR/USD in the upcoming week could likely be as follows:

- Positive: 40% – Potential for USD strength if economic data exceeds expectations, particularly in housing, durable goods, and consumer sentiment.

- Negative: 30% – Risks of USD weakness on softer economic readings, especially if jobless claims rise or inflation indicators suggest less Fed tightening.

- Neutral: 30% – Possibility of mixed data leading to a neutral impact, with technical levels guiding the pair’s direction.

This sentiment analysis is hypothetical and based solely on the provided economic events and technical chart, without any additional market factors taken into account.

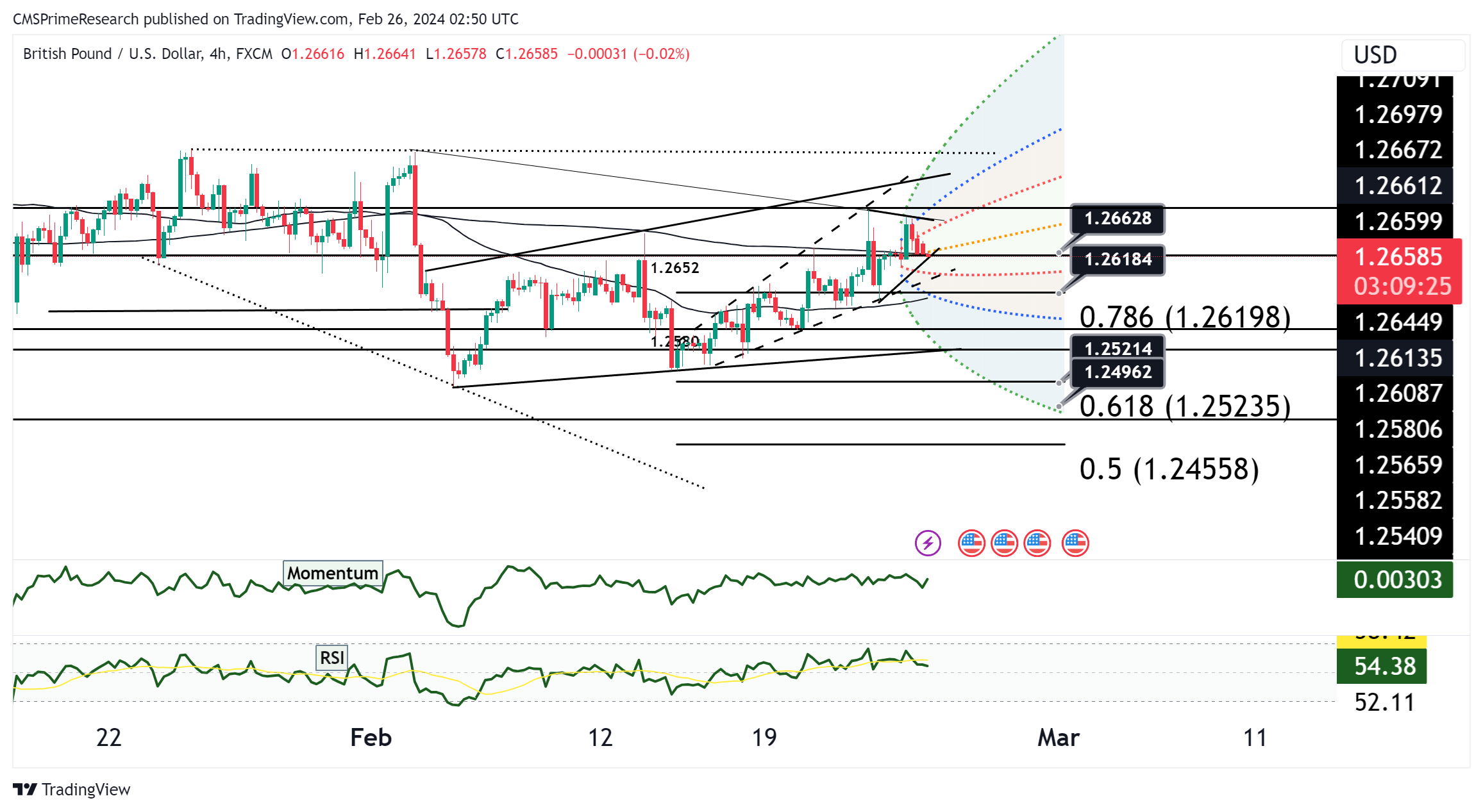

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for GBP/USD:

Bullish Scenario:

- The pair continues to respect the upward trendline, pushing past the resistance at 1.26628 towards the 0.786 Fibonacci level at 1.26198.

- A sustained move above the current level could target the next resistance zone near 1.2700.

- RSI remains above the 50 level, indicating potential for further upside momentum.

Neutral Scenario:

- GBP/USD consolidates within the current range, with immediate support at the 0.618 Fibonacci level at 1.25325.

- The pair trades sideways, caught between the support at 1.25214 and the resistance at 1.26628.

- RSI fluctuates around the mid-line, suggesting a lack of clear directional bias.

Bearish Scenario:

- A break below the 0.618 Fibonacci level at 1.25325 could lead to a test of lower support levels, particularly around the 0.5 level at 1.24558.

- Failure to maintain the trendline support could trigger a downside move towards the next key support area.

- The RSI dips below 50, confirming a shift in momentum to the downside.

Fundamental Scenarios for GBP/USD:

Positive Data Outcomes:

- Stronger than expected UK manufacturing PMI and inflation data could provide a lift to GBP, challenging the upper resistance levels.

- If UK data significantly outperforms relative to the US data, there could be a bullish push for GBP/USD.

Neutral Data Outcomes:

- If the data releases meet consensus expectations, technical levels are likely to play a larger role in determining price action for the week.

- Matching data points from both the UK and the US could lead to a balanced market view, resulting in range-bound movement.

Negative Data Outcomes:

- Weaker than anticipated UK manufacturing PMI or a higher unemployment rate could weigh on GBP, leading to a potential bearish move.

- Disappointing UK data, especially if coupled with strong US economic figures, may lead to a sell-off in GBP/USD.

Overall Market Sentiment:

The sentiment for GBP/USD in the upcoming week could likely be as follows:

- Positive: 35% – Potential for GBP strength if UK economic data surpass expectations, supporting a bullish technical posture.

- Negative: 40% – Possibility of GBP weakness on disappointing UK data, which could exacerbate technical bearish signals.

- Neutral: 25% – Chance of indecision in the market if data from both economies come in as expected, leading to a neutral impact.

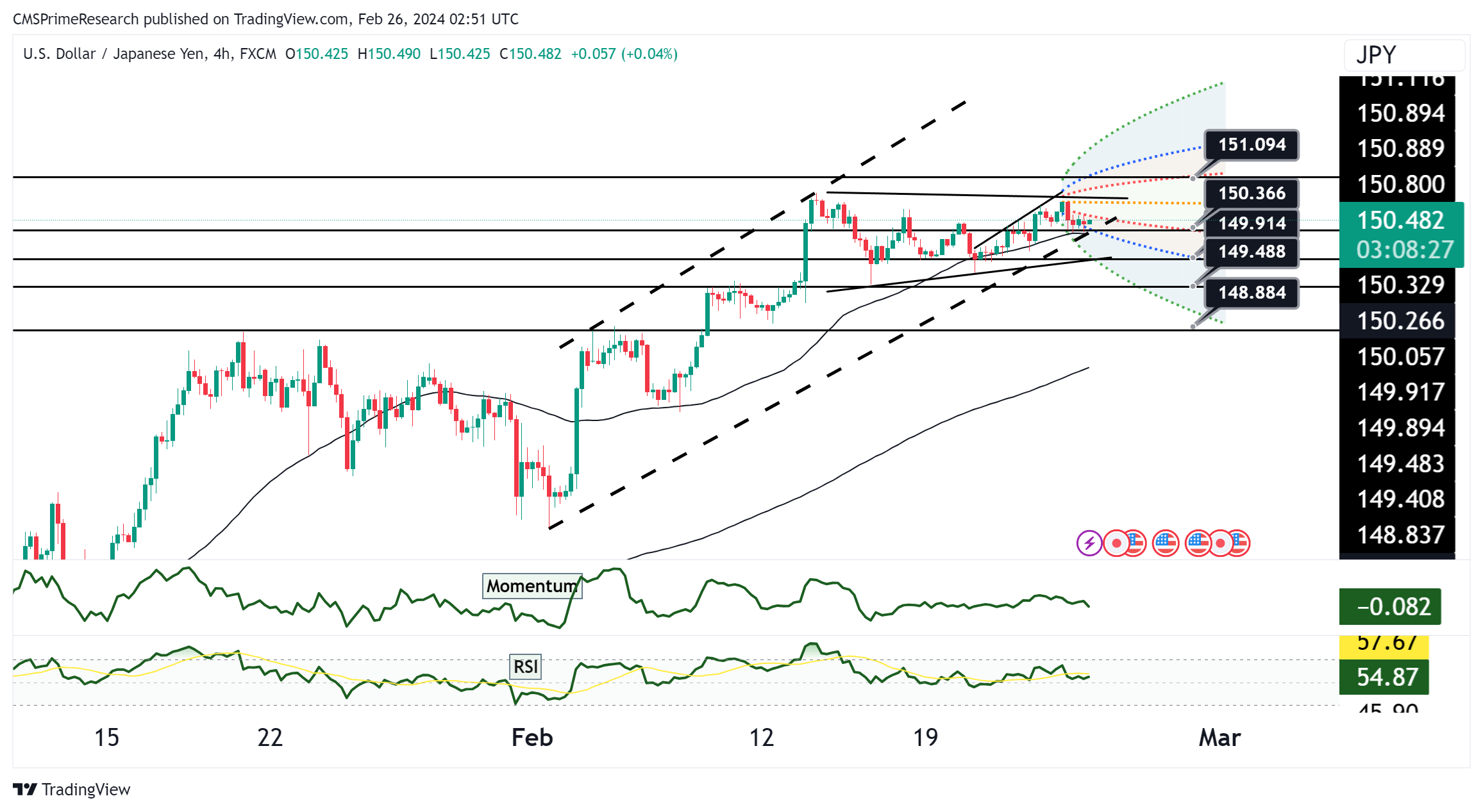

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY:

Bullish Scenario:

- If USD/JPY maintains its position above the ascending trendline, it could target the near-term resistance at 151.094.

- A breakout above the 151.094 level may lead to an approach of the next resistance at around 151.700.

- The RSI is above the mid-level of 50, suggesting that there is still bullish momentum that could support an upward move.

Neutral Scenario:

- The pair could enter a consolidation phase, trading within a tight range between the support level near 149.914 and the resistance at 151.094.

- The RSI hovering around the 50 mark may indicate a lack of conviction among traders, leading to a sideways movement.

Bearish Scenario:

- A breakdown below the support level of 149.914 could see the pair testing the next significant support at 149.488.

- If the price falls below the ascending trendline, it may indicate a reversal of the uptrend and could lead to further declines towards the 148.884 level.

- Should the RSI fall below 50, it would provide additional confirmation of bearish momentum.

Fundamental Scenarios for USD/JPY:

Positive Data Outcomes:

- Strong US economic data, particularly in GDP growth rate and core PCE price index, may reinforce the strength of the USD, contributing to the bullish scenario.

- If the actual figures for high-impact US data such as jobless claims and personal spending are better than expected, this could lead to upward pressure on USD/JPY.

Neutral Data Outcomes:

- If the US data matches consensus expectations, the impact on USD/JPY may be limited, possibly leading to the pair following the neutral technical scenario.

- Consistent economic figures may not provide new directional cues, resulting in range-bound price action.

Negative Data Outcomes:

- Weaker than anticipated US data releases, especially concerning GDP and inflation indicators, could weaken the USD, aligning with the bearish technical scenario.

- If the jobless claims increase unexpectedly, this could dampen investor sentiment towards the USD, potentially leading to a decline in USD/JPY.

Overall Market Sentiment:

The sentiment for USD/JPY in the upcoming week, based on the data, could be distributed as follows:

- Positive: 45% – Supported by the possibility of strong US economic figures and sustained technical uptrend signals.

- Negative: 25% – Risks of a bearish reversal if US data disappoints, coupled with potential technical breakdowns.

- Neutral: 30% – Probability of a lack of clear direction if data outcomes are mixed or meet expectations, leading to consolidation.

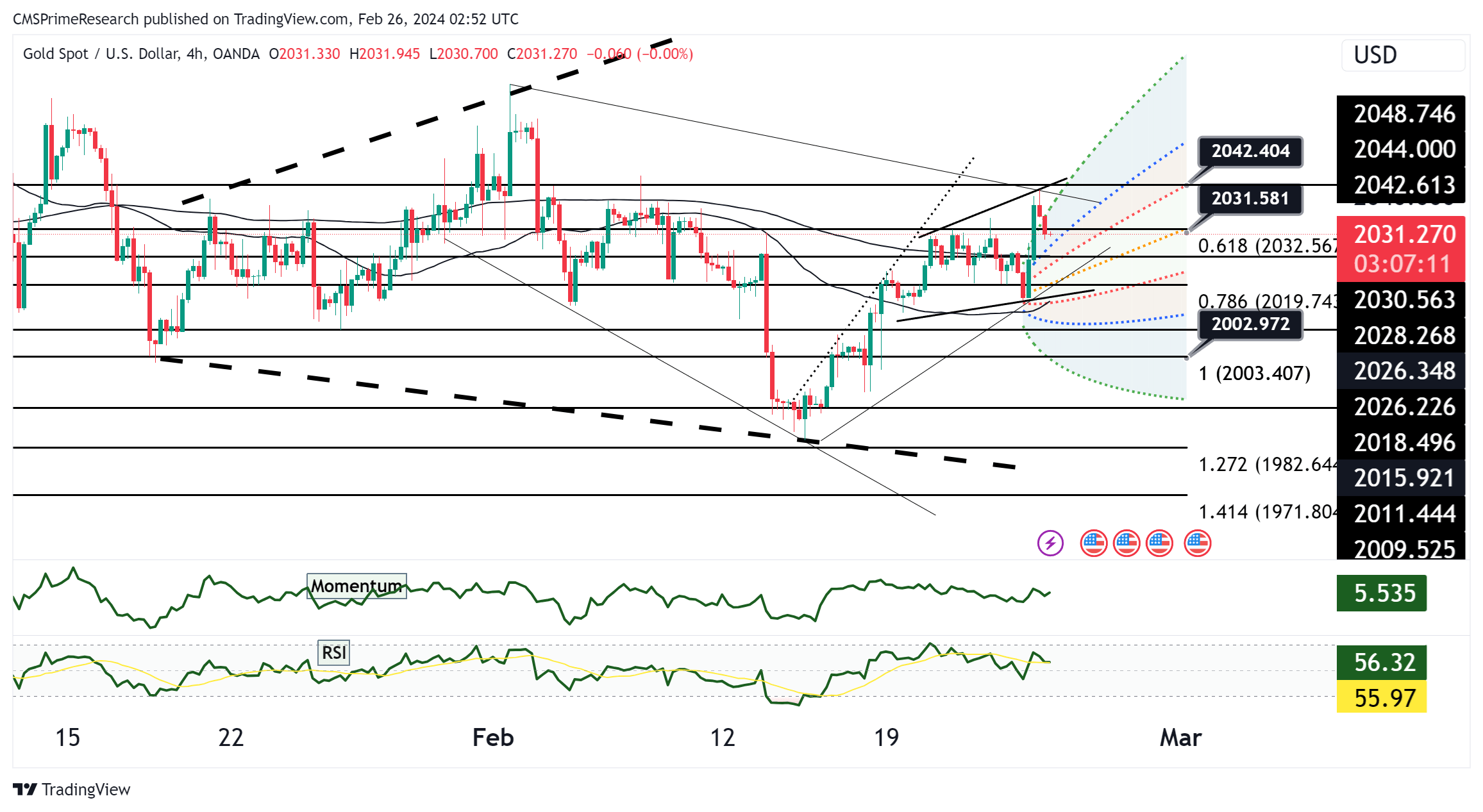

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD:

Bullish Scenario:

- Gold continues to find support at the Fibonacci retracement level of 0.618 (2032.56), leading to a potential retest of the recent high at 2042.404.

- A break above 2042.404 could signal further bullish momentum, targeting the resistance levels near 2048.746.

- The RSI maintains above the mid-level of 50, supporting the potential continuation of the upward trend.

Neutral Scenario:

- XAU/USD may consolidate around the current price level, bounded by the Fibonacci levels of 2032.56 and 2002.972.

- The pair could trade sideways, with the RSI hovering around the 50 mark, indicating a balance between buyers and sellers.

Bearish Scenario:

- A break below the 0.786 Fibonacci level at 2002.972 could lead to a test of the psychological support at 2000, with further downside towards the 1 (2003.407) level.

- If the RSI moves below 50, it could confirm a bearish momentum shift, increasing the likelihood of further declines.

Fundamental Scenarios for XAU/USD:

Positive Data Outcomes:

- Stronger than expected U.S. data, such as GDP Growth Rate and Personal Income, could boost the USD and weigh on gold prices.

- Higher inflation indicators like the Core PCE Price Index may lead to speculation of tighter monetary policy, potentially strengthening the USD and pressuring gold.

Neutral Data Outcomes:

- If the economic data releases align with consensus expectations, the impact on gold may be muted, leading to a continuation of the neutral technical scenario.

- Balanced data outcomes may not provide strong directional cues for gold, potentially leading to range-bound trading.

Negative Data Outcomes:

- Weaker than anticipated U.S. economic figures could diminish the USD’s appeal, making gold more attractive as a safe-haven asset, supporting the bullish scenario.

- An increase in jobless claims or weaker consumer sentiment could lead to risk-averse behavior, favoring gold.

Overall Market Sentiment:

The sentiment for XAU/USD in the upcoming week, based on the data, could be distributed as follows:

- Positive: 35% – Potential for gold prices to rise if U.S. data disappoints, or if risk aversion increases, driving demand for safe-haven assets.

- Negative: 40% – Risks of a decline in gold prices if U.S. economic data comes in strong, supporting the USD.

- Neutral: 25% – Chance of a neutral impact on gold prices if data releases meet expectations, with technical levels playing a more significant role.

Risk based Sentiments-What to Look out for?

EUR/USD: Keep an eye on the U.S. Core PCE Price Index and Eurozone CPI data. These inflation measures are critical for assessing monetary policy directions in both regions, which could sway the EUR/USD pair significantly.

GBP/USD: Attention should be directed towards the UK manufacturing PMI and inflation data, alongside U.S. economic health indicators. The comparative strength of these economies’ data releases can induce volatility in the GBP/USD exchange rate.

USD Index (DXY): The U.S. Q4 GDP, February PCE, and unemployment claims reports are pivotal. These indicators will offer insights into the U.S. economic landscape, influencing the Dollar’s strength against a basket of currencies.

USD/JPY: Focus on U.S. GDP growth rate and core PCE price index, alongside Japan’s own key economic releases. Strong U.S. data could bolster the USD, while weaker figures might strengthen the JPY.

XAU/USD (Gold): U.S. economic figures, particularly the GDP Growth Rate and Core PCE Price Index, are vital. Strong U.S. data could pressure gold prices, while weaker outcomes may enhance gold’s appeal as a safe-haven asset.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.