Dollar Index:

Inflation Data: Investors are awaiting further indications of future U.S. interest rate cuts, with a focus on U.S. core personal consumption expenditure (PCE) price index data due on Friday. The PCE price index is seen rising 0.3% in February, which would keep the annual pace at 2.8%. High inflation readings have not changed the overall story of slowly easing U.S. price pressures, according to Fed Chair Jerome Powell.

Monetary Policy and Interest Rates: The Federal Reserve’s monetary policy is a significant driver of the dollar’s direction. In 2024, central banks around the world, including the Federal Reserve, are poised to cut interest rates. This could lead to a moderate fall in the dollar as the yield differences between the U.S. and other countries shrink[1]. However, the dollar’s downside is likely to be limited, as other central banks are expected to begin easing by mid-year.

Trade Balance: The trade-weighted exchange value of the U.S. dollar has increased slightly since the middle of last year. The Federal Reserve tends to look at the broad trade-weighted index for an overall measure of the dollar’s direction, as it is weighted by the value of trade with other countries.

Employment Data: The labor market remains relatively tight, with the unemployment rate near historically low levels and job vacancies still elevated. The slowing in inflation has occurred without a significant increase in unemployment.

GDP Growth: Real gross domestic product (GDP) growth has been strong, supported by solid increases in consumer spending.

These factors, along with global economic conditions and geopolitical events, will likely influence the US dollar’s trajectory in the coming week.

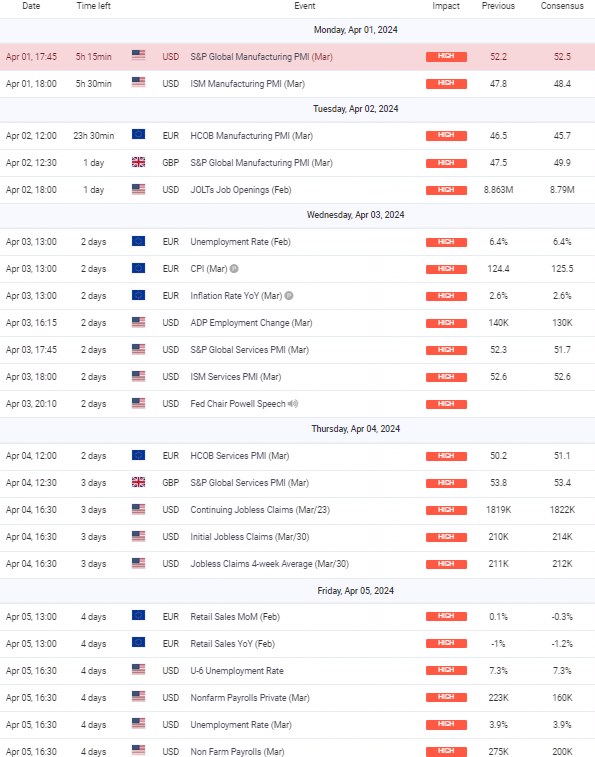

Upcoming Events for the week:

Moving through the week, the EUR zone will reveal its unemployment rate and CPI figures, which have met expectations, maintaining the status quo in the market’s view of the Eurozone economy. However, any deviations in the services PMI data could shift the EUR’s strength, depending on whether the services sector is expanding or contracting. In the UK, a higher than expected services PMI could lend support to the GBP, reflecting a robust sector that dominates the British economy.

The focal point for the USD will be the nonfarm payrolls and unemployment rate towards the week’s end, alongside the ADP employment change earlier. Employment data tends to be a critical indicator of economic health and may significantly influence Federal Reserve policy decisions. Strong job numbers could lead to a bullish sentiment for the USD, as they may validate the Fed’s current interest rate path to tame inflation without severely hampering employment.

Overall Market Sentiment:

- The USD sentiment could be cautious, given the mixed signals from the manufacturing sector, with an anticipated sentiment breakdown of 45% Positive, 35% Negative, and 20% Neutral, pending employment data.

- For the EUR, stable unemployment and inflation rates might lead to a neutral sentiment, at 40% Positive, 40% Negative, and 20% Neutral, unless PMI data delivers a surprise.

- The GBP sentiment appears more optimistic, bolstered by the strong services data, with a possible sentiment breakdown of 55% Positive, 25% Negative, and 20% Neutral.

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Scenario 1: Bullish Breakout

- Technical Observation: EUR/USD is currently testing the resistance around 1.07845, near a descending trendline.

- Potential Trigger: A strong bullish breakout could be signaled by a candlestick close above this level.

- Upside Targets: If a breakout occurs, the next resistance point could be around 1.08320, followed by 1.08907.

Scenario 2: Bearish Rejection

- Technical Observation: If EUR/USD faces rejection at the current resistance, it could signal bearish sentiment.

- Potential Trigger: A formation of a bearish reversal pattern at the resistance line.

- Downside Targets: Potential retest of the support around 1.07045, with further possible decline towards 1.06722.

Scenario 3: Consolidation

- Technical Observation: The RSI is near the midpoint, suggesting potential consolidation.

- Potential Trigger: Indecision in the market, possibly due to mixed technical signals.

- Consolidation Range: The currency pair might trade within a range bounded by 1.07845 resistance and 1.07045 support.

Fundamental Scenarios for EUR/USD

Scenario 1: EUR Strength on Positive Eurozone Data

- Economic Releases: A higher-than-expected Eurozone CPI or Inflation Rate could strengthen the EUR.

- Market Sentiment: Positive data may increase investor confidence in the Eurozone’s economy, leading to EUR buying.

Scenario 2: EUR Weakness on Negative Eurozone Data

- Economic Releases: If the CPI and Inflation Rate come in below expectations, it could indicate subdued inflation pressures and weaken the EUR.

- Market Sentiment: Poor economic performance could dampen investor sentiment towards the euro.

Scenario 3: Mixed Data Outcomes

- Economic Releases: A mix of expected and unexpected data figures may lead to market uncertainty.

- Market Sentiment: Conflicting data points could cause investors to take a wait-and-see approach, leading to limited price action.

Overall Market Sentiment

Positive Sentiment: 30%

- Based on the possibility of bullish technical breakout and potential positive Eurozone data.

Negative Sentiment: 45%

- Considering the chance of a technical rejection at key resistance and the risk of weaker-than-anticipated Eurozone economic figures.

Neutral Sentiment: 25%

- Reflecting the potential for market indecision due to mixed data outcomes and the current RSI indicating no clear trend.

Traders should prepare for volatility and be ready to adjust their strategies based on actual economic releases. Monitoring real-time market reactions to the economic events, especially Eurozone inflation data, is crucial for informed decision-making.

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Scenarios:

Technical Scenarios for GBP/USD

Scenario 1: Bullish Momentum

- Technical Observation: GBP/USD has bounced off the Fibonacci support level at 1.25616.

- Potential Trigger: A sustained move above the current RSI mid-level could indicate increasing bullish momentum.

- Upside Targets: The pair may target resistance levels at 1.27116 and possibly extend towards 1.27910 if the momentum continues.

Scenario 2: Bearish Reversal

- Technical Observation: A potential double-top formation around the 1.27116 resistance level.

- Potential Trigger: Failure to break above the resistance, followed by a bearish candlestick pattern.

- Downside Targets: A reversal could see the pair heading back down to retest the support at 1.25616 and, if broken, further down towards the 1.25178 level.

Scenario 3: Range-Bound Trading

- Technical Observation: The pair has been trading within the range defined by the Fibonacci levels of 1.25616 and 1.27116.

- Potential Trigger: No clear breakout or breakdown from the current levels, coupled with indecisive market sentiment.

- Consolidation Range: The pair may continue to trade within this range, particularly if technical signals remain mixed.

Fundamental Scenarios for GBP/USD

Scenario 1: GBP Strength on Positive UK Data

- Economic Data: Strong readings from UK Services PMI or Job Openings could boost the GBP.

- Market Sentiment: Better-than-expected UK economic performance could lead to GBP buying.

Scenario 2: GBP Weakness on Negative UK Data

- Economic Data: Weak UK Services PMI or employment data could lead to bearish sentiment for the GBP.

- Market Sentiment: If data disappoint, the GBP could be sold off in favor of the USD.

Scenario 3: Mixed Data Leading to Uncertainty

- Economic Data: Mixed outcomes from UK and US data releases may result in an unclear direction for the pair.

- Market Sentiment: If investors receive conflicting signals, it could lead to cautious trading and reduced volatility for the GBP/USD.

Overall Market Sentiment

Positive Sentiment: 35%

- Potential for GBP strength if UK economic data outperform expectations, leading to bullish price action.

Negative Sentiment: 40%

- Possibility of GBP weakness if fundamental indicators suggest a slowing UK economy, contributing to a bearish outlook.

Neutral Sentiment: 25%

- Chance of mixed market reactions and range-bound price movement if economic data are inconclusive or cancel each other out.

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Scenario 1: Bullish Continuation

- Technical Observation: USD/JPY is trading above the support level near 151.367.

- Potential Trigger: A bounce from this level with increasing momentum could signal a continuation of the uptrend.

- Upside Targets: Resistance at 151.548 may be tested, potentially moving towards the 152.687 level.

Scenario 2: Bearish Turnaround

- Technical Observation: If the support at 151.367 is broken, it might indicate a bearish shift.

- Potential Trigger: A consistent move below this level with a bearish candlestick formation.

- Downside Targets: The next levels of potential support could be at 149.909 and 148.816.

Scenario 3: Range-Bound Trading

- Technical Observation: The RSI is near the midpoint, suggesting no strong momentum in either direction.

- Potential Trigger: A lack of significant economic catalysts could lead to a period of consolidation.

- Trading Range: The currency pair may oscillate between the current support at 151.367 and resistance at 151.548.

Fundamental Scenarios for USD/JPY

Scenario 1: USD Strength on Positive Economic Data

- Economic Releases: Strong US economic data, such as low unemployment and high job openings, could boost the USD.

- Market Sentiment: Positive figures may lead to heightened expectations of Fed tightening, supporting the dollar.

Scenario 2: USD Weakness on Negative Economic Data

- Economic Releases: Poor performance in US job data or manufacturing PMI could undermine the USD.

- Market Sentiment: Disappointing data might lead to speculation about a less aggressive Fed policy, weighing on the USD.

Scenario 3: Mixed Data Impact

- Economic Releases: Mixed outcomes from the US and Japan could result in an unclear direction.

- Market Sentiment: If investors receive conflicting signals, they may adopt a wait-and-see approach, leading to reduced volatility.

Overall Market Sentiment

Positive Sentiment: 35%

- Anticipation of continued USD strength if upcoming US economic data outperform.

Negative Sentiment: 40%

- Potential for a bearish turn if US data disappoint, especially if job figures are weaker than expected.

Neutral Sentiment: 25%

- Possibility of indecision and range-bound movement if data releases are mixed or meet market expectations.

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Scenario 1: Bullish Extension

- Technical Observation: Gold is trading within an upward channel, currently near the 0.618 Fibonacci retracement level at 2234.560.

- Potential Trigger: A sustained upward momentum could see it test the recent high around 2259.060.

- Upside Targets: Potential targets include the recent peak and could extend to the 0.786 level at 2263.987.

Scenario 2: Bearish Correction

- Technical Observation: A bearish divergence on the RSI could indicate a potential pullback.

- Potential Trigger: A reversal pattern or a sustained move below the 2234.560 level.

- Downside Targets: Correction targets could be the 0.5 Fibonacci level at 2214.051, and further to the 0.382 level at 2193.463.

Scenario 3: Consolidation Phase

- Technical Observation: The RSI is hovering near overbought territory, suggesting a possible pause in the trend.

- Potential Trigger: Lack of new catalysts or profit-taking after the recent run-up.

- Trading Range: A consolidation between the 0.618 Fibonacci level at 2234.560 and the recent high at 2259.060.

Fundamental Scenarios for XAU/USD (Gold)

Scenario 1: Gold Strength on Market Uncertainty

- Economic Data: Weak manufacturing PMI or service PMI data from the US may increase the appeal of gold as a safe haven.

- Market Sentiment: A dovish stance from Fed Chair Powell could boost gold if markets anticipate a less aggressive rate hike policy.

Scenario 2: Gold Weakness on Positive Economic Outlook

- Economic Data: Strong US employment data could bolster confidence in the US economy, diminishing gold’s safe-haven demand.

- Market Sentiment: Hawkish comments from Fed Chair Powell regarding inflation and the economy could strengthen the USD and pressure gold prices.

Scenario 3: Mixed Data Leading to Fluctuation

- Economic Data: A combination of strong and weak data points may result in fluctuating gold prices.

- Market Sentiment: Mixed signals may lead to a cautious approach among investors, with gold prices reacting to short-term news flow.

Overall Market Sentiment

Positive Sentiment: 30%

- The possibility of continued bullish momentum if economic uncertainties surface, increasing gold’s appeal.

Negative Sentiment: 40%

- The potential for a correction if US economic data strengthen the case for higher interest rates, reducing the attractiveness of non-yielding gold.

Neutral Sentiment: 30%

- The chance for consolidation if the market receives mixed signals from economic data and central bank communications.

Risk based Sentiments-What to Look out for?

EUR/USD: Monitor the U.S. PCE Price Index closely and EUROZONE CPI indications, as it could signal future Federal Reserve and ECB actions regarding interest rates. This will be crucial for determining the direction of EUR/USD.

GBP/USD: Pay attention to both the U.S. employment data (nonfarm payrolls and unemployment rate) and the UK services PMI. These will be pivotal in shaping GBP/USD movements.

USD/JPY: U.S. economic releases, particularly the nonfarm payrolls and ADP employment change, will be key. Additionally, any policy shifts indicated by the Federal Reserve or the Bank of Japan will significantly impact USD/JPY.

XAU/USD (Gold): Gold traders should focus on the U.S. PCE Price Index and Fed Chair Powell’s speech for indications of future monetary policy. These factors will influence gold’s attractiveness as an investment.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.