EUR/USD Stages Rebound as Equity Gains and Weakening Dollar Offset Early Losses

EUR/USD Opens Near 1.0700, Slides on Firm Yields and USD Strength

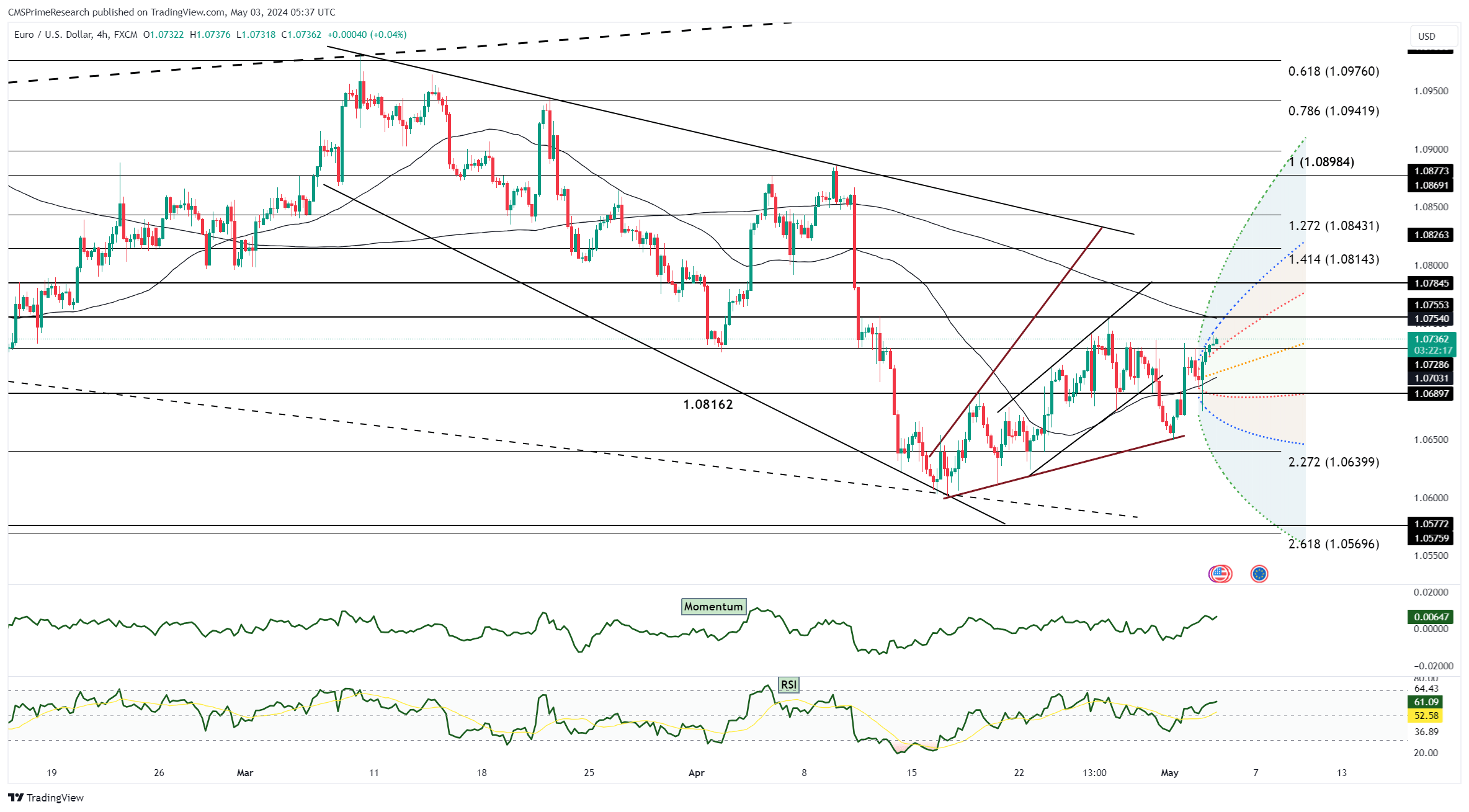

The EUR/USD currency pair kicked off the trading session in the vicinity of 1.0700, with the most recent transaction taking place at 1.0725. However, the pair quickly encountered downward pressure as yields and the US dollar displayed strength in early trading. This initial slide was further compounded by a surge in the USD/CNH pair, which broke above the 7.2360 level, and a concurrent decline in commodity prices. These factors worked in tandem to weigh on the EUR/USD pair, setting the stage for a bearish trend.

As the day progressed, the bearish sentiment intensified, with sellers pushing the EUR/USD pair down to the 1.0670 level. This marked a significant intraday low for the pair, as the downward momentum appeared to be gathering steam. However, just as the bears seemed to be in control, the downward pressure began to abate, and the pair found some respite.

The shift in sentiment was attributed to a rebound in equity markets, which provided a more positive backdrop for the EUR/USD pair. Additionally, yields and the US dollar began to weaken, further alleviating the pressure on the pair. This change in market dynamics attracted buyers back into the market, helping to stabilize the EUR/USD pair and preventing a more pronounced decline. As the trading session drew to a close, market participants were closely monitoring the pair’s ability to maintain its recovery and potentially stage a more meaningful rebound in the near term.

Key Levels to Watch: : 1.06645,1.07305,1.06926