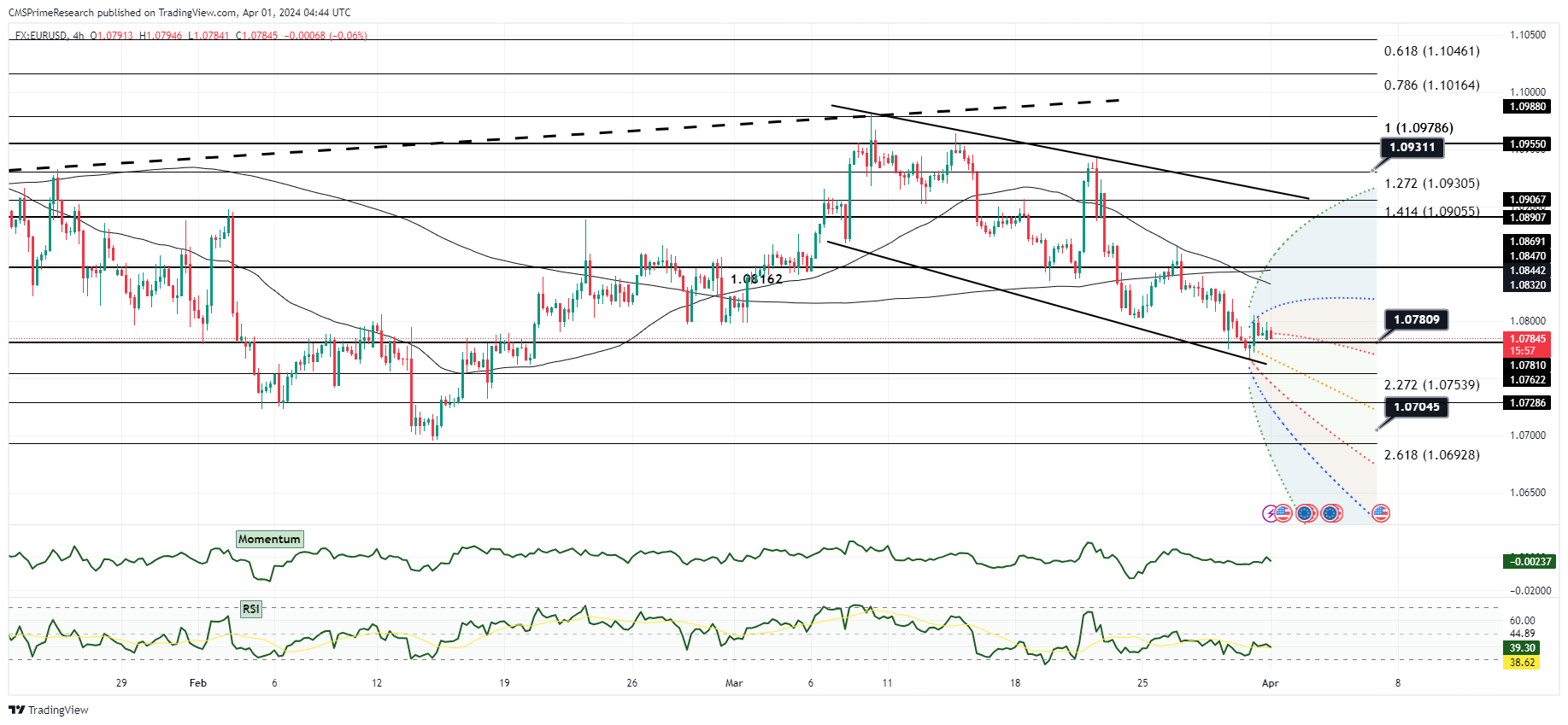

EUR/USD possible retest to Feb Lows at 1.07045

EUR/USD encountered significant bearish momentum, hitting a new low for March at 1.0760 before recovering to flat levels post-U.S. core Personal Consumption Expenditures (PCE) data release. The mixed nature of the data failed to provide a decisive market direction, as reflected by the subsequent failed attempt to breach the hourly and daily cloud bases, with the recovery stalling at 1.0820. The downward breach of the uptrend line from lows around 1.0750 indicated increasing bearish pressure, although the pair managed to stay above the 76.4% Fibonacci retracement of lows at 1.0755.

The recent comments from Federal Reserve Chair Jerome Powell lent some support to the dollar by tying rate cut prospects to further signs of disinflation, which kept rate cut expectations in check. With critical data such as ISMs, JOLTs, and payroll figures due next week, there is scope for these to influence both the Fed’s perspective and the dollar’s valuation.

Fundamental Analysis: The market is weighing the latest U.S. economic data against the backdrop of a dimming outlook for core Eurozone economies, exemplified by French and Italian CPI figures falling short of forecasts. Despite the mixed data from the U.S., the European Central Bank’s (ECB) policy trajectory may diverge as core inflation readings and economic indicators suggest a weakening economic situation, potentially weighing on the euro.

Overall Market Sentiment: Market sentiment appears cautiously bearish, taking into account the EUR/USD’s struggle to maintain upward traction and the potentially stronger dollar supported by Powell’s comments.

Sentiment Percentage Breakdown:

- 30% Positive: Mildly optimistic, given the pair’s rebound from the new March lows, suggesting some underlying support.

- 20% Neutral: With significant data releases on the horizon, a portion of sentiment remains undecided, reflecting market participants’ wait-and-see approach.

- 50% Negative: The dominant sentiment is bearish, factoring in the technical breaks below trendlines and the cloud, along with potentially stronger U.S. data and weaker core Eurozone indicators.

The negative sentiment is primarily due to technical weakness and fundamental headwinds from Europe, counterbalanced by a minor positive sentiment deriving from the pair’s capacity to pull back from its lows. Neutral sentiment indicates the market is bracing for future data to provide clearer direction.

Key Levels to Watch: : 1.08339,1.08160,1.08394,1.07897

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07840 | 1.07964 |

| Level 2 | 1.07675 | 1.08032 |

| Level 3 | 1.07600 | 1.08160 |