EUR/USD trading lower, waiting on EUROZONE CPI and FED's interest Rate Decisions.

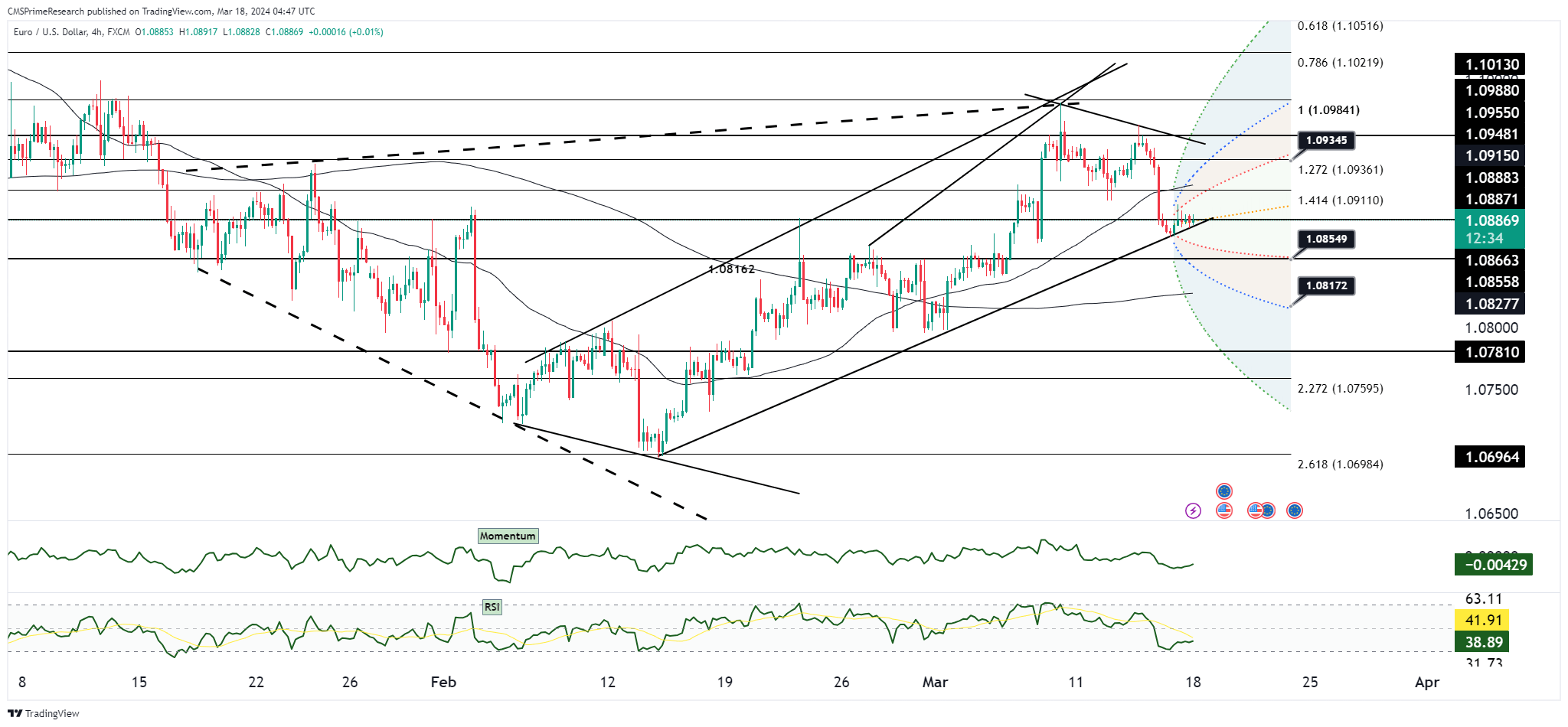

The EUR/USD has commenced the week with limited volatility, maintaining levels around the 1.0890 mark after a marginal climb on Friday. The currency pair confronts immediate resistance at the 10-day Moving Average (MA) located at 1.0915, where a congregation of sellers is anticipated. On the flip side, the 20-day MA offers support at 1.0866, with additional bids expected near the 1.0875 area. A more substantial support zone is situated at the 1.0830/40 region, which marks the 50% retracement of the February to March rise and coincides with the 200-day MA, indicating a critical technical confluence.

The market appears to be in a consolidation phase, potentially extending this holding pattern in anticipation of pivotal events, notably the Federal Reserve’s decision.

Fundamental Analysis: Fundamentally, the quiet trading in the EUR/USD pair suggests a market on pause, with traders likely bracing for the upcoming key events such as the Fed decision. These events may significantly influence market direction, with expectations of policy decisions affecting the relative strength of the U.S. dollar. The Fed’s tone and decision will be closely analyzed for insights into the future trajectory of interest rates, which are a primary driver for currency valuations.

Overall Market Sentiment: Given the technical setup and the impending fundamental catalysts, market sentiment appears to be one of caution as traders await clarity from central bank guidance.

Sentiment Percentage Breakdown:

- 30% Positive: There’s a cautiously optimistic sentiment in the market given the recent slight uptrend, with the euro showing resilience above the 21-day MA.

- 40% Neutral: A large portion of the market sentiment is neutral, reflective of the consolidation pattern and the anticipation of the Fed’s decision.

- 30% Negative: There is a guarded negative sentiment due to potential resistance ahead and the possibility that the Fed’s decision could reinforce dollar strength.

The positive sentiment is modest due to the euro’s slight ascent and support levels holding, while the neutral sentiment dominates as the market hesitates before key economic announcements. The negative sentiment factors in the resistance faced at the 10-day MA and the potential for a stronger dollar depending on the outcome of the Federal Reserve meeting.

Key Levels to Watch: : 1.09669,1.09828,1.09086

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.09240 | 1.09433 |

| Level 2 | 1.09086 | 1.09669 |

| Level 3 | 1.08980 | 1.09835 |