EUR/USD in consolidation, Wednesday's FOMC Minutes in Focus

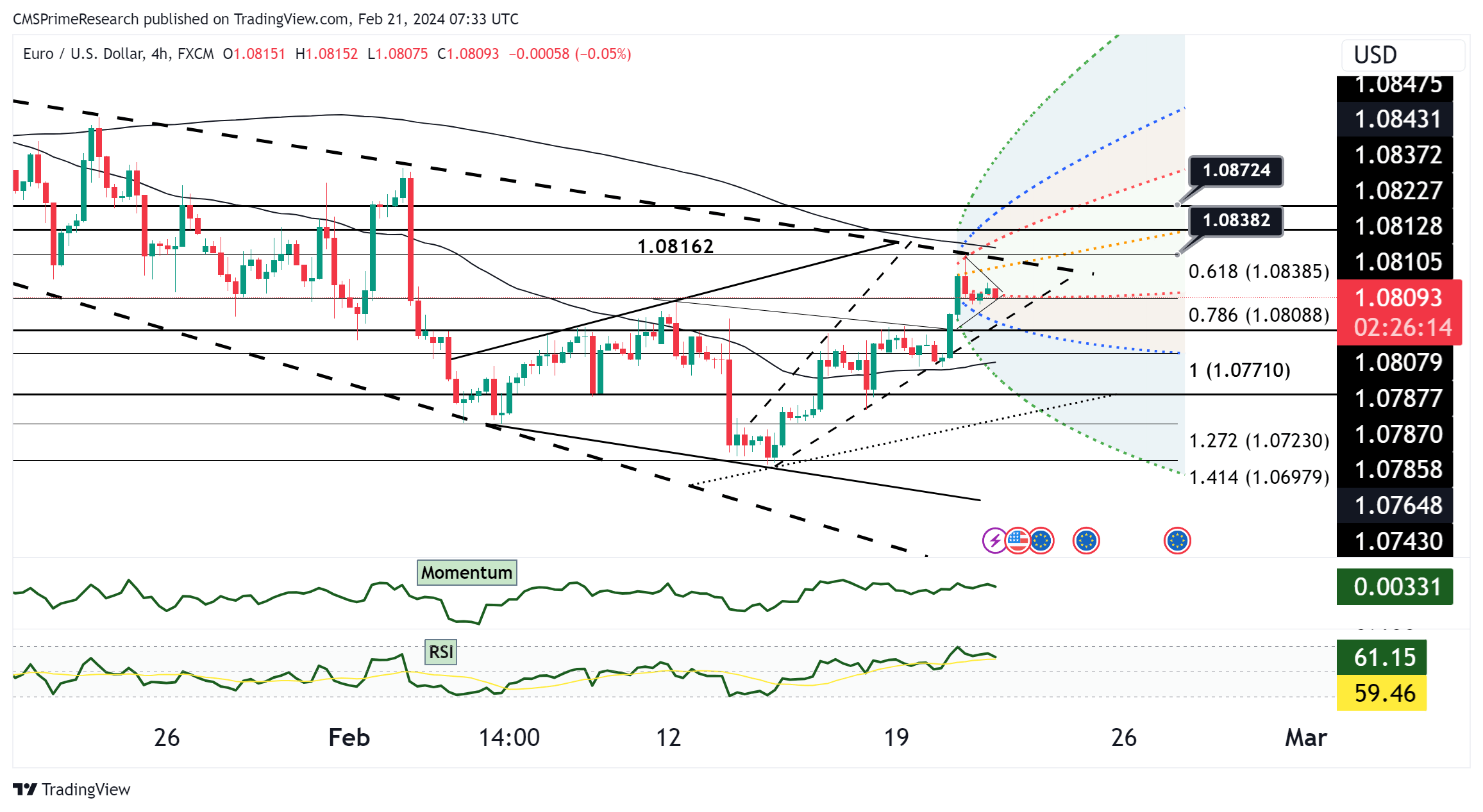

Technical Analysis: From a technical viewpoint, the EUR/USD’s break above the 200-day moving average (DMA) and the recent high of 1.0839 points to a bullish phase. This technical breakout is accompanied by a rising daily Relative Strength Index (RSI) and the pair’s position above both the 10- and 21-DMAs, which further support the bullish technical posture. The chart displays the currency pair retreating slightly after reaching the session high, which suggests a consolidation phase or a possible retest of the newly established support levels.

Fundamentally, the EUR/USD rally was supported by lower U.S. yields and a corresponding decrease in the USD value against a basket of currencies. The tightening of the spread between German and U.S. yields has also played a role in strengthening the Euro. Additionally, the decline in USD/CNH and the uptick in gold prices are indicative of a risk-on sentiment that traditionally benefits the Euro.

Overall Market Sentiment: The market sentiment for EUR/USD can be characterized as follows:

- 65% Positive: The bullish technical signals and the fundamental backdrop of softer U.S. yields and tighter DE-US yield spreads contribute to a positive outlook.

- 25% Neutral: A neutral sentiment persists due to the recent pullback from session highs, suggesting that traders are taking a cautious approach ahead of upcoming Federal Reserve communications.

- 10% Negative: There is a minor negative sentiment acknowledging that gains may be capped and a reversal is possible, particularly if the Federal Reserve’s minutes reveal a more hawkish stance than anticipated.

The positive sentiment reflects the current technical uptrend and supportive fundamental factors. The neutral sentiment accounts for the cautiousness ahead of potential volatility from the Fed’s Bostic, Bowman, and the release of the Fed’s January meeting minutes. The slight negative sentiment is due to the possibility of a hawkish surprise from the Fed, which could strengthen the USD and pressure the EUR/USD pair downwards.

Key Levels to Watch: : 1.07600,1.08256,1.07306

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07510 | 1.07792 |

| Level 2 | 1.07306 | 1.07897 |

| Level 3 | 1.07137 | 1.08032 |