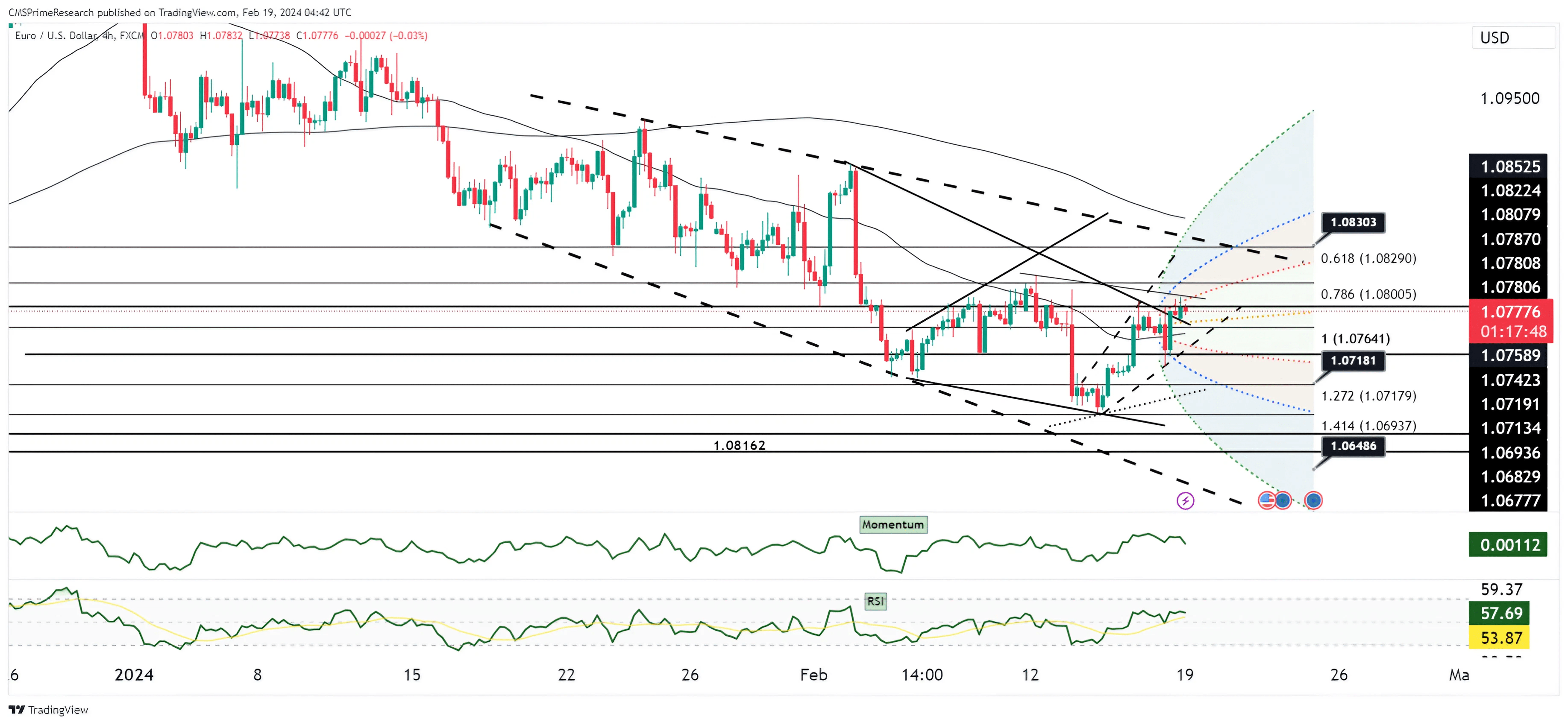

EUR/USD in consoldidation, key tests at the 1.08000 level

From a technical standpoint, EUR/USD experienced short-covering at the New York close, which continued into the Asian session with a limited range between 1.0775 and 1.0788. The currency pair is showing signs of easing after this short-covering rally. Resistance is noted near the ascending 100-day moving average (DMA) at 1.0752, which suggests a key technical level that bulls may need to breach to sustain an upward trend. Supportive features in the technical landscape include the 1.0758 level, which corresponds with the hourly Ichimoku Kijun line, and the broader 1.0735-1.0765 Ichimoku cloud. The presence of the 200, 50, and 100-hour moving averages within this cloud further underscores the significance of this support zone.

Fundamental Analysis: Fundamentally, the market is relatively quiet due to the US Presidents’ Day holiday, with traders seeking fresh directional cues. The recent movements in EUR/USD have been more technical in nature rather than driven by new fundamental developments. With the absence of major economic releases from the U.S. and a lack of significant news flow, the market is likely to be reactive to changes in sentiment or external economic indicators.

Overall Market Sentiment: The prevailing market sentiment for EUR/USD can be described as follows:

- 50% Neutral: The market is currently without a strong directional bias, reflecting the quiet trading environment and the wait for fresh stimuli.

- 30% Positive: A moderate positive sentiment is maintained, supported by recent short-covering and technical indicators suggesting potential for upward movement if resistance levels are breached.

- 20% Negative: There remains a cautious sentiment due to potential resistance ahead and the absence of fundamental drivers, which could limit upside potential.

Key Levels to Watch: : 1.07600,1.08256,1.07306

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07510 | 1.07792 |

| Level 2 | 1.07306 | 1.07897 |

| Level 3 | 1.07137 | 1.08032 |