EUR/USD in consoldidation as market awaits key PPI Data

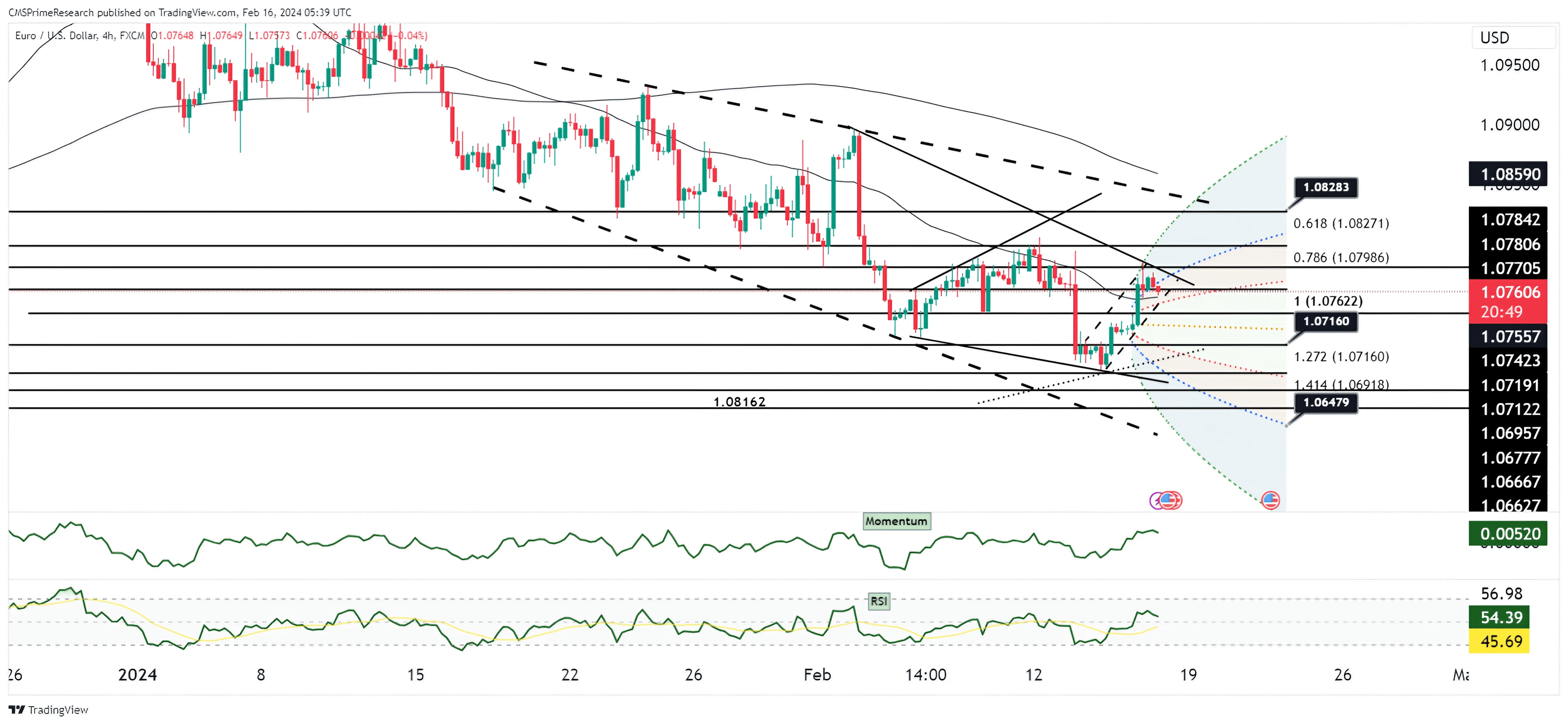

Technical Analysis: The technical chart for EUR/USD shows a resurgence in bullish momentum, as indicated by the pair’s rally above the 10-day moving average. This recent upswing, following a bullish hammer candlestick pattern on Wednesday, suggests that the market sentiment has shifted slightly in favor of the Euro. The daily Relative Strength Index (RSI) is ascending, which aligns with the increasing momentum and provides a cautionary signal for shorts. The pair has encountered resistance near the 1.07845 level, before receding slightly, indicating that bulls are testing the resolve of the recent bearish trend.

Fundamentally, the pair has been buoyed by disappointing U.S. retail sales data, which came in well below estimates, leading to a fall in U.S. yields and a weakening of the dollar. The spread between U.S. and German two-year yields has tightened, further supporting the Euro. Additionally, the drop in USD/CNH and gains in equities and gold have contributed to a risk-on environment that typically benefits the Euro.

Overall Market Sentiment: Market sentiment for EUR/USD is cautiously optimistic but remains vigilant of upcoming economic indicators:

- 55% Positive: This sentiment reflects the recent bullish technical signals and the fundamental factors that have pressured shorts and supported the Euro.

- 35% Neutral: A sizeable portion of the market remains neutral, awaiting further data such as the U.S. Producer Price Index (PPI) and University of Michigan inflation outlooks, which could sway sentiment.

- 10% Negative: Despite the recent rally, there is a minimal negative sentiment considering the potential for the upcoming U.S. data to reinforce a hawkish Federal Reserve stance, which could revive the dollar’s strength.

The positive sentiment captures the market’s reaction to the recent U.S. economic data and the technical recovery of the Euro. The neutral sentiment accounts for the cautious approach of traders ahead of further economic releases. The slight negative sentiment holds space for a reversal of the Euro’s gains if forthcoming data from the U.S. point to persistent inflationary pressures or a hawkish Federal Reserve policy trajectory.

Key Levels to Watch: : 1.07600,1.08256,1.07306

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.07510 | 1.07792 |

| Level 2 | 1.07306 | 1.07897 |

| Level 3 | 1.07137 | 1.08032 |