USD/JPY holds steady post-CPI release

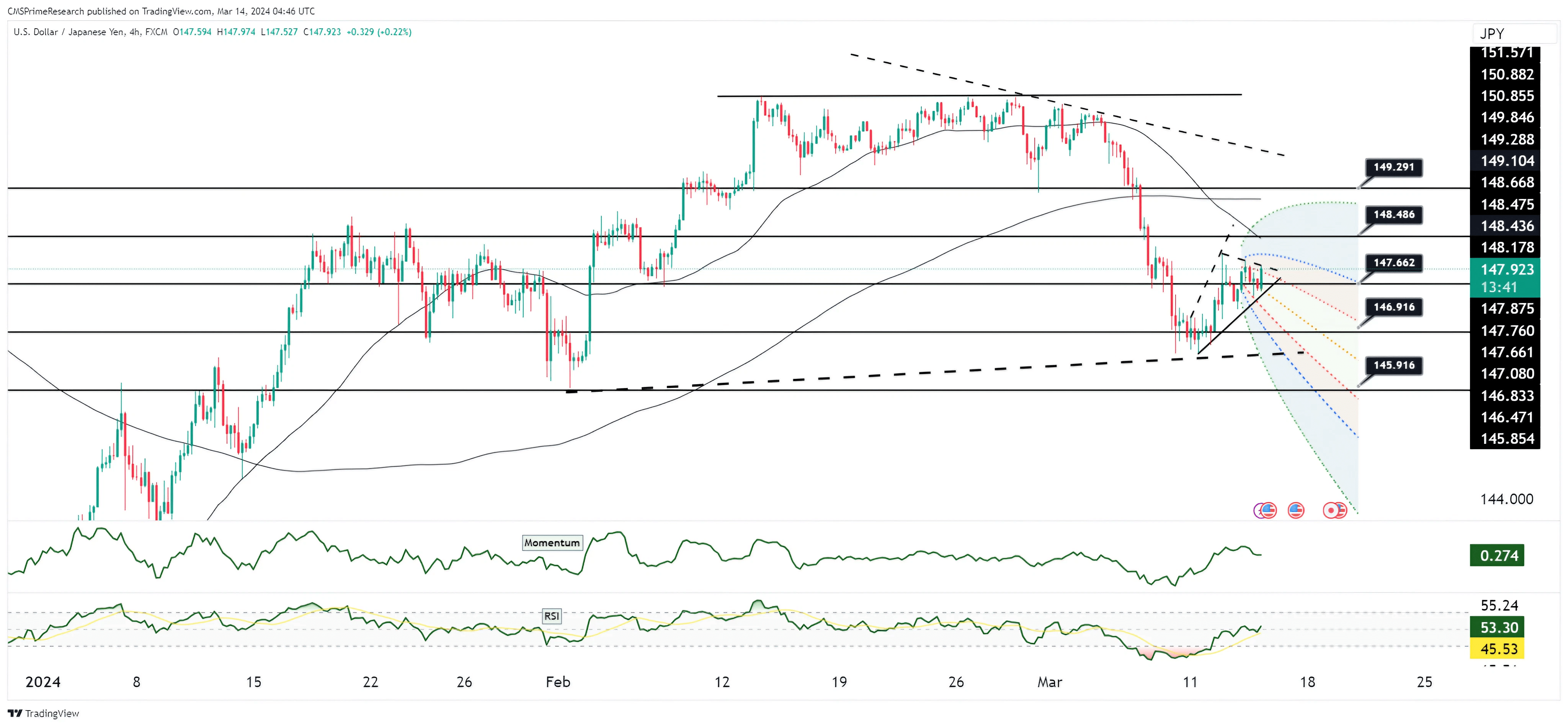

The USD/JPY currency pair has been holding steady below the rebound high witnessed on Tuesday post-CPI release. The chart illustrates that the pair is currently in a retracement phase, losing some of the gains made following the Non-Farm Payrolls (NFP) and CPI data points. The focus for traders now shifts to the upcoming U.S. economic data, including job claims, Producer Price Index (PPI), and retail sales, which are particularly significant as they precede the Federal Reserve meeting.

Resistance is found near the 148.200 level, which corresponds to the 38.2% Fibonacci retracement of the February to March decline. On the downside, there are multiple levels of support below the March lows of 146.40, offering a cushion against further declines.

Fundamental Analysis: Fundamentally, the speculation around a potential Bank of Japan (BoJ) rate hike next week is limiting the yen’s decline, despite the seasonal bullishness expected before the Japanese fiscal year-end. Record wage increases reported in Japan may tilt the balance in favor of the BoJ considering a tighter monetary policy, although market probabilities place a rate hike at a tentative 44%.

Overall Market Sentiment: The market sentiment for USD/JPY is mixed, with technical indicators suggesting a cautious stance below key resistance levels, and fundamentals indicating a balance of forces between U.S. data anticipation and BoJ policy expectations.

Sentiment Percentage Breakdown:

- 40% Positive: Supported by the seasonal bullishness ahead of Japan’s fiscal year-end and the recent rebound in prices.

- 40% Neutral: The market is in a holding pattern due to mixed signals from technical resistance levels and awaiting clarity from upcoming U.S. economic data and the BoJ policy meeting.

- 20% Negative: There is a risk-averse sentiment due to the potential unwinding of post-NFP and CPI gains and the possibility of a BoJ rate hike limiting further upside.

The positive sentiment is buoyed by the price support levels and seasonal trends, while the neutral sentiment reflects the market’s uncertainty ahead of significant economic data releases and policy decisions. The negative sentiment accounts for the correction from recent highs and the potential for policy tightening in Japan, which could support the yen.

Key Levels to Watch: : 146.620,148.327,147.089,147.732

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 147.436 | 148.327 |

| Level 2 | 147.090 | 148.681 |

| Level 3 | 146.616 | 148.943 |