USD/JPY near consolidation after Japan CPI Data

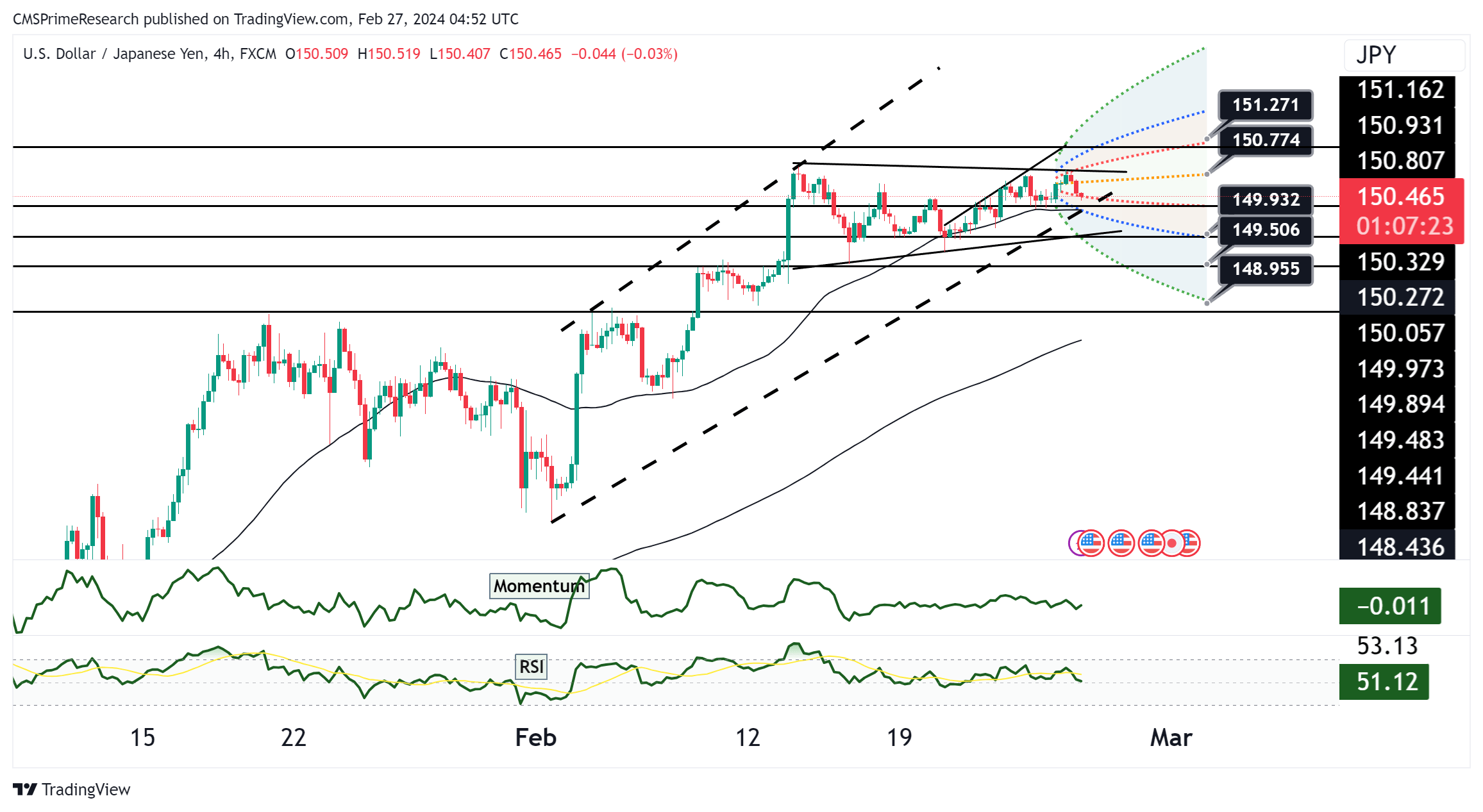

The USD/JPY is trading within a defined range of 149.50 to 150.88, indicating a period of consolidation after recent inflation figures, which showed a core inflation rate at 2% against a forecast of 1.8%. The technical structure suggests that the currency pair is finding a temporary equilibrium, with the flatlining of the Tenkan and Kijun lines from the Ichimoku Kinko Hyo indicating potential for continued range-bound trading. The 150.20 Tenkan line presents initial support, followed by the 148.39 Kijun line, which traders may look to if a downward movement ensues. Conversely, resistance is identified at the 150.88 high, which remains a significant level to overcome for further bullish momentum.

Fundamentally, the market is closely observing the outcome of the ‘Shunto’ (spring wage talks) in Japan, which could be crucial for the next move in the Bank of Japan’s policy and the yen’s valuation. The high from 2022 and 2023 at 151.92 is also a key level that market participants are watching for potential BOJ intervention, as sustained movements above this threshold might prompt action from the central bank.

Overall Market Sentiment: The market sentiment for USD/JPY can be quantified as follows:

- 50% Neutral: A balanced sentiment predominates, reflecting the pair’s tight trading range and the market’s wait-and-see approach to the outcome of Japanese wage talks and any potential BOJ policy shifts.

- 30% Positive: There is a cautiously optimistic sentiment based on the stability of U.S. yields and the possibility of further economic recovery supporting the dollar.

- 20% Negative: A reserved negative sentiment persists, taking into account the recent softness after the inflation report and the proximity to key technical resistance levels that could cap upside gains.

The neutral sentiment is a result of the currency pair’s recent range-bound behavior and the anticipation of pivotal economic discussions that could influence BOJ policy decisions. The positive sentiment is underpinned by the broader economic context that may support dollar strength. The negative sentiment allows for the potential impact of significant Japanese economic developments and technical resistance levels that could limit the pair’s upward movement.

Key Levels to Watch: : 149.505,150,151.237,151.739

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 150.256 | 150.868 |

| Level 2 | 149.830 | 151.237 |

| Level 3 | 149.505 | 151.740 |