Introduction:

Keltner Channels, a technical analysis tool developed by Chester W. Keltner, are versatile in their application across various financial instruments like stocks, currencies, and commodities. A Keltner Channel trading strategy can be effective, but its profitability greatly depends on setting accurate parameters and combining it with other technical indicators.

Keltner Channel Basics:

- Structure: Keltner Channels consist of three lines on a chart. The central line is the exponential moving average (EMA) of closing prices. The outer bands measure market volatility using the average true range (ATR).

- Indicator Combination: Combining Keltner Channels with other indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can enhance signal reliability.

Setting Up Keltner Channels:

- Parameters: Common settings include a 20-day EMA and ATR set at 1.5 to 2 times the ATR for the channel bands, although these can be adjusted according to trading style and asset volatility.

- 20-Period EMA: Some prefer a 20-period EMA for the middle band, with the upper and lower bands plotted two times the ATR away from it.

Trading Strategies:

- Trend Identification: Prices close to the upper band indicate an uptrend, and those close to the lower band suggest a downtrend.

- Breakouts: Look for breakouts outside the bands for short-term trading. If the price breaks above the upper band, consider a long trade; if below the lower band, a short trade.

- Reversals: Identify reversals by observing if the price touches a band and then reverses direction. This is particularly effective in ranging or consolidating markets.

- Bounce and Squeeze Strategies: The Keltner Bounce Strategy involves trading the price bouncing off a Keltner band and returning to the central EMA. The Keltner Squeeze Strategy focuses on moments when bands tighten, suggesting a potential breakout.

Effectiveness in Various Asset Classes

Stocks

Keltner Channels have been widely adopted in stock trading. Originally intended for commodities markets, their use has expanded due to their ability to visually identify potential breakouts and manage risk through indications of market consolidation or volatility.

Commodities

The Keltner Channel was initially developed for the commodities market by a grain trader. Its effectiveness in identifying overbought and oversold levels, trends, and potential reversals made it a popular choice among commodities traders.

Forex

Forex trading, with its dynamic nature, has seen the adoption of Keltner Channels as a key tool for assessing price volatility and identifying potential trading opportunities. In Forex, they help gauge volatility, detect overbought and oversold conditions, and identify trend reversals. The importance of volatility in Forex trading is well-captured by Keltner Channels, which use the Average True Range (ATR) to measure price volatility. This feature allows traders to adapt their strategies to varying market conditions, making Keltner Channels especially useful in Forex where market conditions can change rapidly.

In summary, Keltner Channels are effective in various markets, including stocks, commodities, and Forex. Their adaptability through parameter adjustments, suitability for different trading strategies, and utility in risk management make them a valuable tool across these diverse financial markets. However, it’s crucial for traders to understand and adjust the parameters of Keltner Channels according to the specific characteristics and conditions of the market they are trading in.

How does it Perform in Different Market Conditions?

Optimal settings for Keltner Channels can vary depending on the market’s volatility. Here are some guidelines:

In Volatile Markets:

Multiplier Adjustment: In a volatile market, the Keltner Channel ATR (Average True Range) multiplier should be increased. This adjustment widens the channel, which helps in reducing the number of false signals. A higher multiplier accommodates the larger price swings typical in volatile markets. The typical range for the Keltner Channel multiplier is between 2-3, but it may need to be adjusted higher in particularly volatile conditions.

EMA Period: The length of the exponential moving average (EMA) also impacts the channel’s sensitivity. While the default setting is often a 20-period EMA, you might experiment with shorter or longer lengths depending on the market’s characteristics. In volatile markets, a longer EMA period can help smooth out the rapid price changes and provide a more stable centerline for the channel.

In Stable Markets:

Narrower Channels: In a stable or less volatile market, Keltner Channels tend to be more effective with narrower bands. This means using a lower multiplier for the ATR. Narrower bands are more responsive to smaller price movements typical in stable markets, allowing for more precise entry and exit points.

EMA Period: For stable markets, a shorter EMA period may be more appropriate. This makes the channel more responsive to the market’s subtle movements, which is beneficial in a less volatile environment.

General Considerations:

- False Signals: It’s important to note that Keltner Channels, like many technical indicators, can produce false signals, especially when the channels are too wide or too narrow relative to the market’s volatility. This can lead to challenges in consistently using Keltner Channels for profitable trades.

- Market Conditions: Adjusting the Keltner Channel settings according to the prevailing market conditions is crucial. This includes not just volatility but also factors like market trends and the asset being traded.

- Backtesting: Experimenting with different settings and backtesting them against historical data can help determine the most effective parameters for a given market condition or trading style.

In conclusion, while there are standard settings for Keltner Channels, optimal use in different market conditions (volatile vs. stable) requires adjustments to the ATR multiplier and the EMA period. The key is to balance responsiveness with the ability to filter out noise and false signals, tailored to the specific characteristics of the market being traded.

Strategy Adaptation-Long Term vs Short Term

Adapting a Keltner Channel trading strategy for short-term versus long-term trading requires a nuanced approach that acknowledges the differences in market behavior and trader objectives across these time horizons. This adaptation involves a critical and connected perspective, recognizing that financial markets are complex, nonlinear, and interrelated systems. Let’s juxtapose the strategies for short-term and long-term trading using Keltner Channels:

Short-Term Trading

Focus on Breakouts: Short-term strategies often rely on identifying breakouts from the Keltner Channels. If the price breaks above the upper band, it signals a potential long trade, and a break below the lower band indicates a short-selling opportunity. This approach aligns with the volatile and fast-paced nature of short-term trading.

Channel Bounces: Traders also watch for price bounces off the Keltner Channel boundaries. A bounce from the upper channel can signify a short entry, while a bounce from the lower channel may indicate a long entry. This strategy assumes that the price will revert to the mean, which is a common occurrence in shorter time frames due to market noise and frequent oscillations.

Risk Management: Short-term trading with Keltner Channels requires rigorous risk management, such as prudent position sizing and effective stop-loss and take-profit strategies. Position sizing is crucial to manage potential loss, typically involving risking a fixed percentage of the total account balance on each trade.

Long-Term Trading

Entry Point Determination: For long-term investors, Keltner Channels serve as a tool for objectively determining entry points into the market. While long-term traders might pay less attention to the exact entry point, Keltner Channels can provide clarity in this regard.

Price Closure Above/Below Bands: A long-term strategy might involve acting when the price closes above the upper Keltner band, indicating a potential long-term bullish trend, or below the lower band for bearish trends.

Letting Winners Run: An essential aspect of long-term trading with Keltner Channels is allowing successful positions to run as long as possible. This approach acknowledges that while not all trades will be successful, the profits from successful trades can significantly outweigh the losses, provided the positions are held for an extended period.

Juxtaposing the Strategies

- Time Horizon and Market Sensitivity: Quick trading needs a more active way because it reacts a lot to quick changes in the market. Trading for a long time can use more planning and less reacting to changes in the market that happen in a short time.

- Risk and Reward Dynamics: Short-term plans need strict loss and profit limits to handle quick changes in the market. On the other hand, long-term plans focus on possible big wins in future times. They know not all trades will do well.

- Indicator Settings: The settings for Keltner Channels might be different between short-term and long-term trading. Quick plans might need tighter ranges and a shorter EMA time to be more responsive for market changes. On the other hand, long-term plans can gain from wider ranges and a longer EMA time for stability.

In conclusion, when adapting Keltner Channel strategies for different trading horizons, it is crucial to adopt a critical and connected perspective, understanding the inherent complexities and interconnections within the market. Short-term trading strategies focus on quick responses to market movements and rigorous risk management, while long-term strategies emphasize strategic entry points and the potential for larger, though less frequent, gains.

Backtesting Keltner Channels

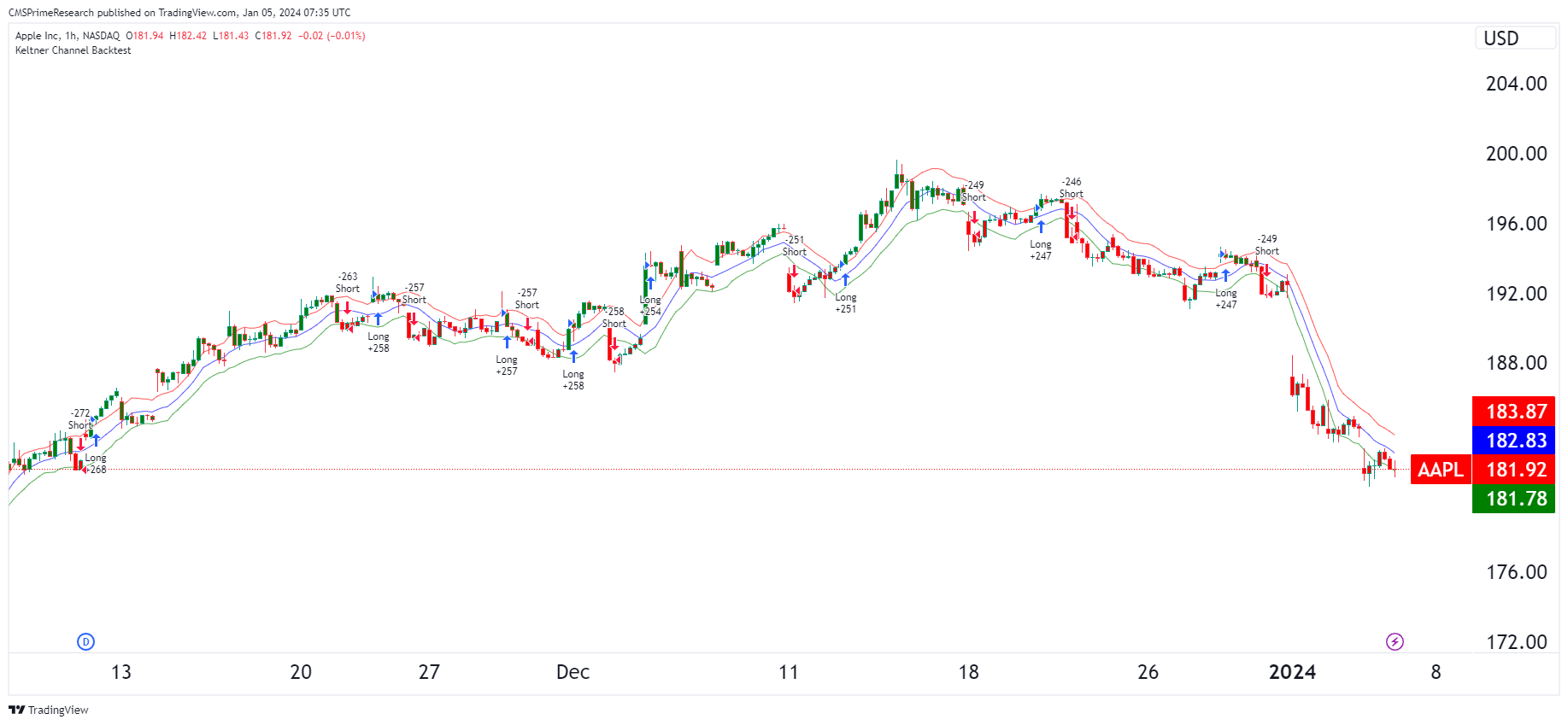

In this particular backtest, you can see instances where “Long” and “Short” positions are suggested:

- A Long signal is typically indicated when the price moves above the upper Keltner Channel, suggesting a strong upward momentum and a bullish sentiment, prompting traders to consider buying or holding a position.

- A Short signal is indicated when the price drops below the lower Keltner Channel, signaling a strong downward momentum and a bearish sentiment, where traders might consider selling or shorting a position.

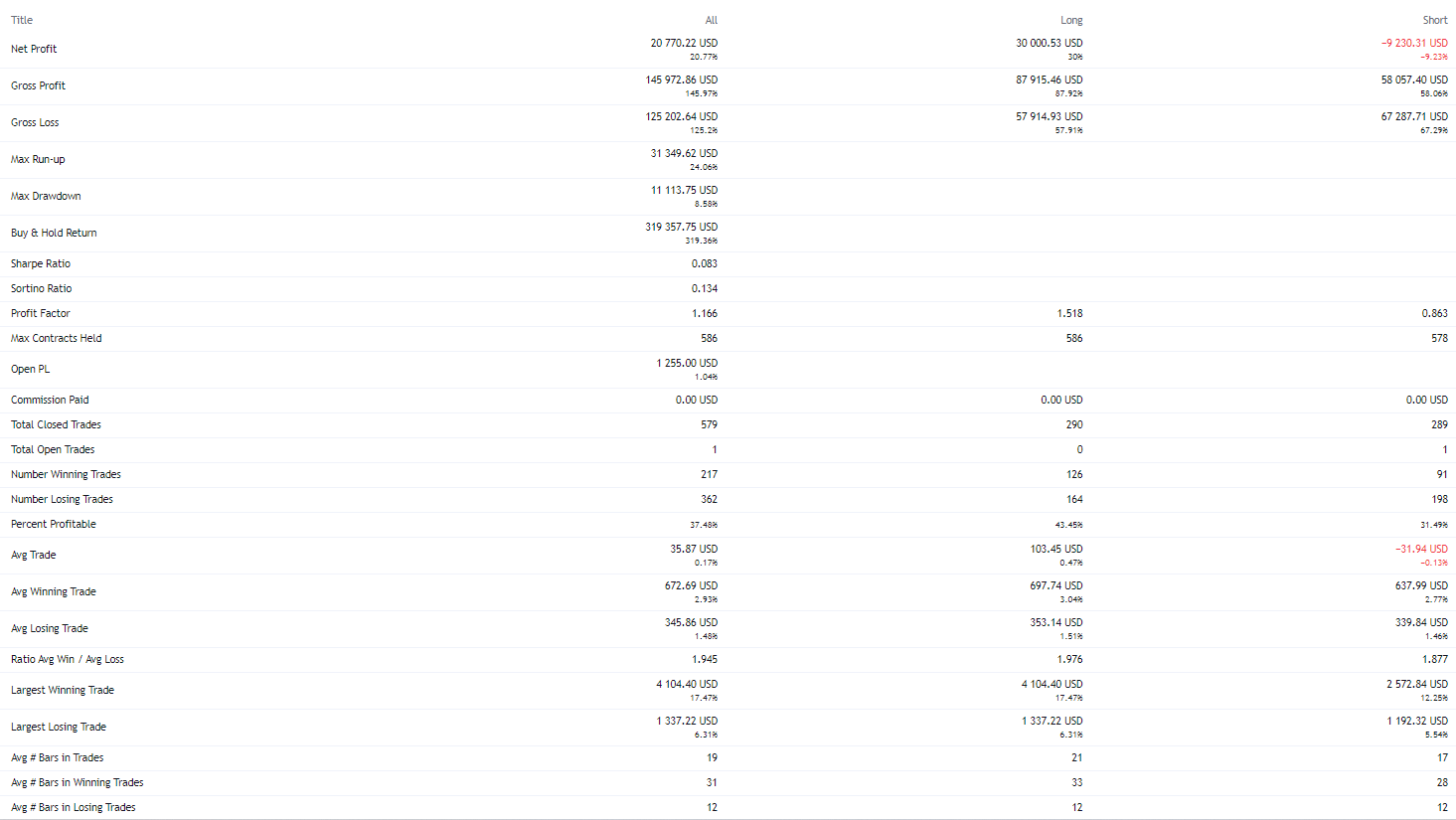

Dynamics of Comparisons

Profit Factor: The Long trades have a higher profit factor (1.518) compared to Short trades (0.863), suggesting that Long trades are more profitable overall.

Profitability: While the overall percent profitable is not high (37.48%), the Long trades seem to be doing better in terms of net profit, indicating a bullish bias in the strategy’s effectiveness.

Average Trade Results: The average winning trades are relatively similar for Long and Short, but the average losing trade is slightly higher for Long trades. This could suggest that while the strategy is profitable, the risks associated with Long positions might be higher.

Ratios: The higher ratio of average win to average loss in Long trades (1.978) compared to Short trades (1.877) indicates a better performance of the Long strategy.

Largest Trades: The largest winning trades are the same for All and Long, suggesting that the most significant gains come from Long positions. However, the largest losing trades are relatively close, indicating that losses can be significant in both directions.

Long-Term Viability and Bias Recognition

Given the positive net profit for Long trades and a negative one for Short trades, the strategy seems to exhibit a bullish bias. The Long trades not only yielded more gross profit but also managed to maintain a higher profit factor despite the losses. This suggests that in the long run, the strategy could be effective if the market conditions that favor Long positions persist. However, the relatively low Sharpe and Sortino ratios for the overall strategy indicate that the returns are not significantly high when adjusted for risk, which may question the strategy’s attractiveness for risk-averse investors.

Comparative Complexity

If one aspect, like the profit factor, is low (as it is for Short trades), it could mean that the strategy isn’t as effective or robust against market downturns. However, if the profit factor is high for Long trades, this demonstrates the strategy’s potential under favorable market conditions. The complexity arises in managing the risks and recognizing when to shift bias from bullish to bearish based on market dynamics.

The strategy appears to have a stronger performance in Long trades compared to Short trades, suggesting a bullish bias. While the strategy has demonstrated profitability, its long-term success will depend on consistent risk management and the ability to adapt to changing market conditions. The Sharpe and Sortino ratios point to a need for a careful assessment of risk versus return. This analysis indicates that the strategy has been more effective in Long positions but also carries inherent risks that must be carefully weighed.

Conclusion

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.