Gold Prices Hold Steady Above $1,950 Amid Fed Caution and China CPI

Gold prices are currently holding above the $1,950 level in the face of a subdued U.S. dollar. However, the precious metal is facing challenges as some Federal Reserve officials resist the idea of reducing interest rates. Additionally, China’s recent Consumer Price Index (CPI) data showed a decline of 0.2%, slightly worse than the expected 0.1% decrease, which can affect gold’s performance due to its relationship with inflation. Fed Governor Michelle Bowman has indicated the possibility of future interest rate hikes, but she is currently taking a cautious approach in assessing economic data. Neil Kashkari, President of the Minnesota Fed, has expressed skepticism about whether the central bank has raised rates enough, given the economy’s resilience. Despite a drop in Treasury yields, gold has not capitalized on it, and investors are awaiting fresh cues, particularly ahead of the upcoming Federal Reserve decision in December. The recent reduction in safe-haven demand for gold, partly due to a lack of escalation in the Israel-Hamas conflict, has also posed challenges for the precious metal.

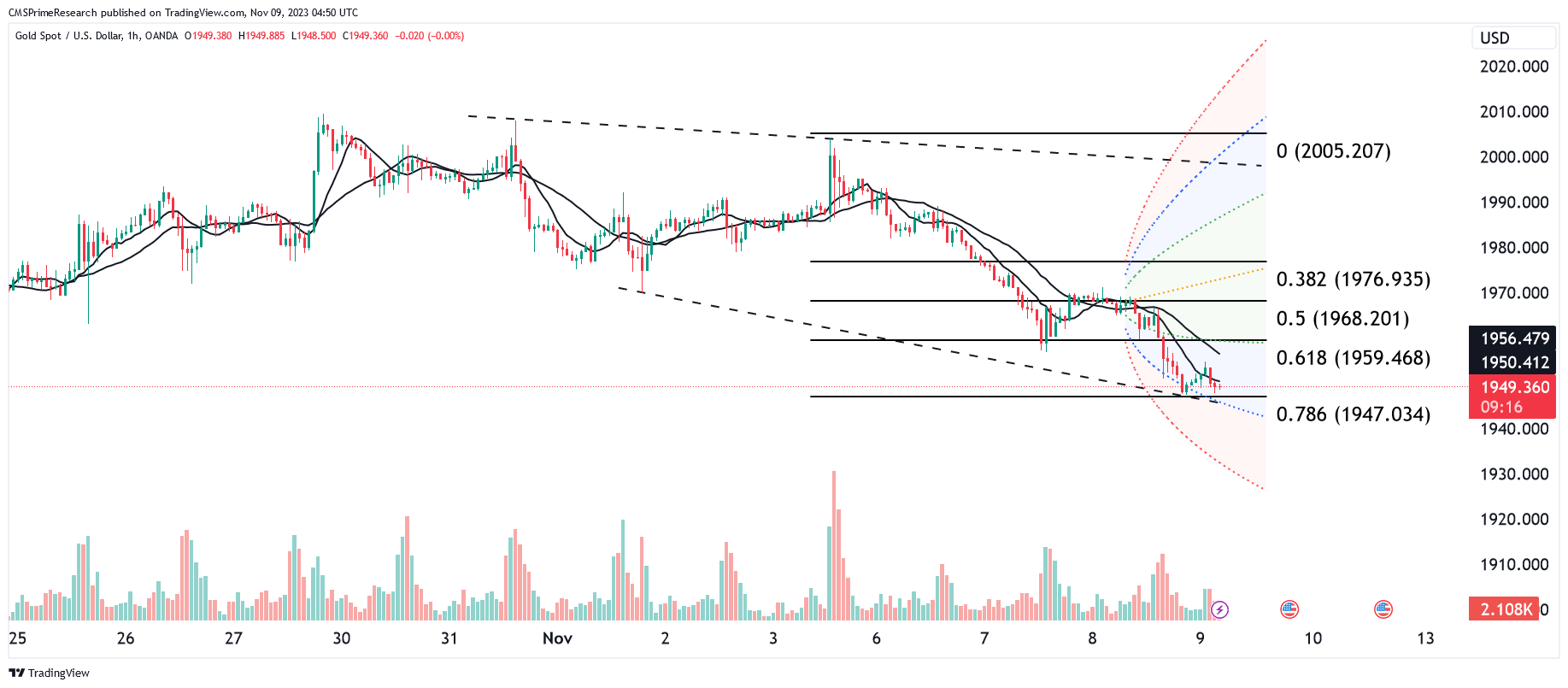

From a technical analysis perspective, gold is currently in a bearish range trend, with its price hovering around $1,950.00. It’s worth noting that the metal’s price is below both the 200-day and 50-day moving averages in the 1-hour timeframe, indicating a bearish range zone. Potential support levels for gold include $1,942, with further possible declines to $1,933, and a significant support level at $1,930. On the other hand, if the price were to rise, it could challenge resistance at $1,960, followed by a key resistance at $1,963, with a major resistance level at $1,970. The market is closely watching developments in inflation, central bank policies, and geopolitical factors to gauge the future direction of gold prices.

Key Levels to watch are 1952,1987,1963

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1941.00 | 1957.50 |

| Level 2 | 1933.50 | 1963.50 |

| Level 3 | 1922.50 | 1970.50 |