Gold Prices See Dip-Buying but Remain Below Key Level as Market Awaits Fed Signals

On Tuesday, Gold prices (XAU/USD) experienced some dip-buying during the Asian session, yet remained within the previous day’s broader trading range and below the $2,400 mark. The weaker tone in equity markets, along with geopolitical risks from conflicts in the Middle East, supported the safe-haven commodity. Additionally, growing expectations that the Federal Reserve (Fed) will begin cutting rates in September kept the US Dollar (USD) bulls defensive below the two-week high reached on Monday, further benefiting the non-yielding yellow metal.

However, the upside for Gold is likely to be limited as traders await more clarity on the Fed’s policy direction before committing to a firm near-term stance. The focus is on the outcome of the two-day Federal Open Market Committee (FOMC) meeting on Wednesday. Furthermore, significant US macroeconomic data, including the Nonfarm Payrolls (NFP) report on Friday, will influence USD price dynamics and, consequently, XAU/USD. It seems prudent to wait for follow-through buying before confirming that the recent pullback from the all-time peak has ended.

Daily Digest Market Movers: Gold Attracts Haven Flows Amid Softer Risk Tone

Despite the US Dollar reaching a two-and-a-half-week high on Monday, Gold failed to build on last week’s modest bounce from around the $2,350 level. Evidence of easing price pressures in the US has reinforced market bets for an imminent start of the Fed’s policy easing cycle in September, keeping US Treasury bond yields depressed. The yield on the rate-sensitive 2-year US government bond fell to its lowest since February 2, while the benchmark 10-year Treasury yield remained near a one-month low amid improving inflation outlook. This should cap further upside for the USD and provide support for Gold as traders look ahead to this week’s key central bank events for meaningful direction.

The Bank of Japan and the Fed are set to announce their policy decisions at the end of their two-day meetings on Wednesday, followed by the Bank of England’s update on Thursday. Investors will also contend with key macroeconomic releases, including official Chinese PMIs, Eurozone consumer inflation figures, and the US Nonfarm Payrolls report.

Technical Analysis: Gold Prices Might Struggle Above $2,400 Mark

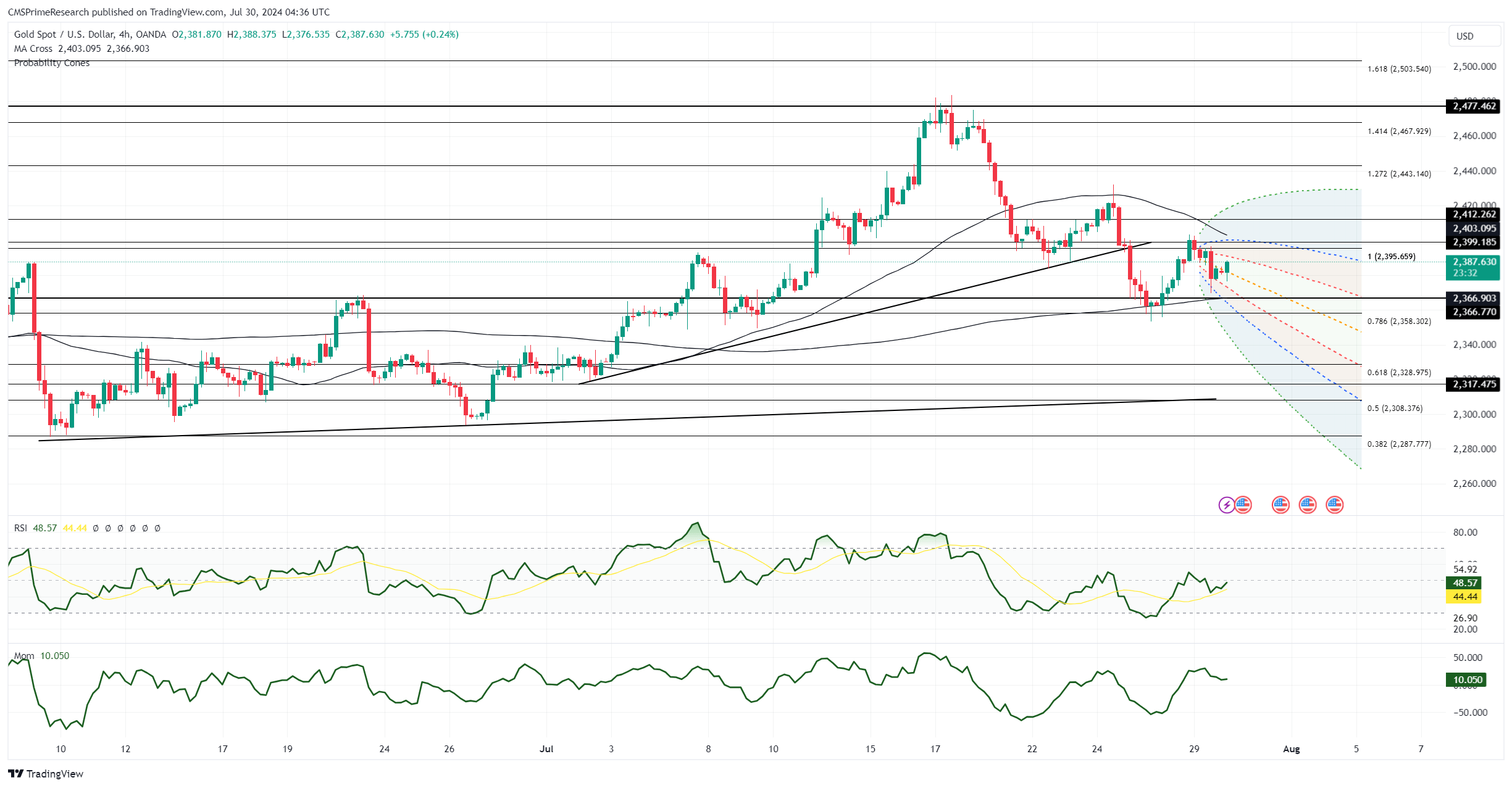

From a technical perspective, Gold’s failure to sustain above the $2,400 mark overnight and the subsequent downtick warrant caution before positioning for further upside. Oscillators on the daily chart have begun to gain negative traction, suggesting that the path of least resistance for Gold may be downward. Bearish traders should wait for a sustained break below the 50-day Simple Moving Average (SMA) support, currently near the $2,358 region, before placing new bets.

Further selling below last week’s swing low around $2,352 would reinforce the negative outlook, potentially dragging XAU/USD to the next support near the $2,324 area. The downward trajectory could extend further, testing the $2,290 round-figure mark for the first time since late June.

Conversely, momentum above the $2,400 mark could face resistance near the $2,415 area, ahead of last week’s swing high around $2,437. Sustained strength beyond this level would suggest that the corrective decline from the all-time peak earlier this month has ended, paving the way for additional gains. Gold prices might then climb to the $2,470-2,475 intermediate resistance and challenge the record peak around the $2,480-2,491 zone.