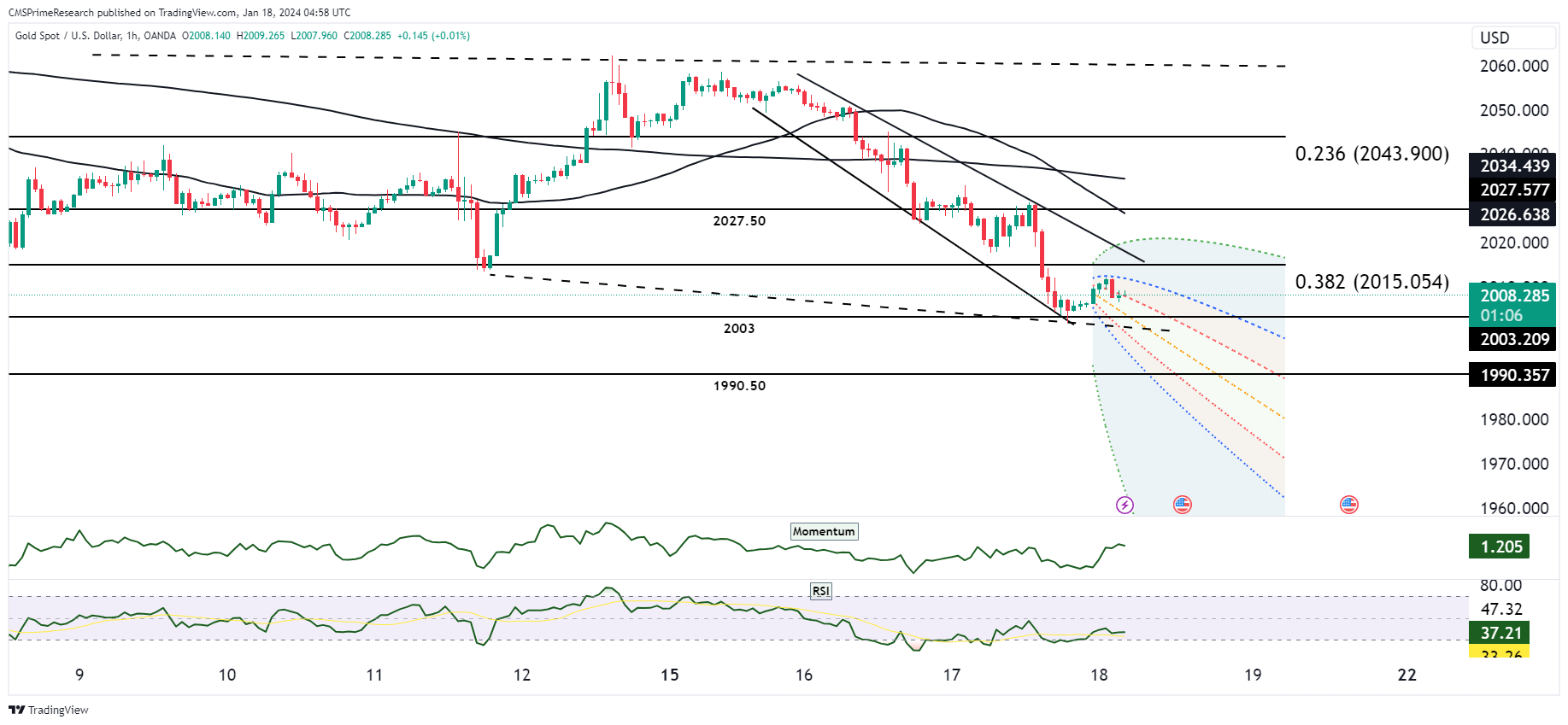

Gold in a short term bearish outlook looking to break below the 2000 level.

The technical indicators are signaling a “Buy,” which denotes a bullish sentiment in the market but however caution is advised as the Long term indicators are Bearish. This is supported by the recent RSI uptick, although still within the neutral range, and the Ultimate Oscillator and Rate of Change (ROC) indicators, which also advocate for buying pressure. The Moving Averages (MAs), however, present a neutral to slightly bullish picture, with the shorter-term MAs indicating a “Buy” while the longer-term MAs remain in the “Sell” zone, suggesting the need for caution as the market may not have full commitment to the uptrend yet.

The price of gold has been fluctuating within a downtrend channel, as illustrated by the recent descent towards the 0.382 Fibonacci retracement level at 2015.054. However, gold prices are finding some support above this level, indicating a potential consolidation or reversal point if the bullish technical indicators hold true.

The market has absorbed positive retail sales data from the United States, indicating a stronger-than-expected consumer spending pattern. The import prices remained unchanged, defying expectations for a decrease, while manufacturing output experienced a modest rise. These data points underscore the resilience of the American economy and suggest less impetus for immediate monetary easing by the Federal Reserve.

Despite this, trader sentiment anticipates potential rate cuts by the Fed in March, a factor that typically would be bullish for gold, as it is often seen as a hedge against currency devaluation and inflation.

Market Sentiment Ratings:

- Bullish Sentiment: Approximately 60% – The positive economic data and the anticipation of a Fed rate cut may foster an environment conducive to gold’s value appreciation.

- Neutral Sentiment: Approximately 30% – The divergence between the short-term and long-term MAs, along with the gold price’s proximity to a key Fibonacci level, injects a level of uncertainty into the market.

- Bearish Sentiment: Approximately 10% – The persisting downward price channel and the resistance faced at higher Fibonacci retracement levels suggest that bearish risks have not fully abated.

In summation, XAU/USD finds itself at an intersection of technical bullish signals and a fundamentally robust US economic backdrop, with a looming expectation of dovish shifts in Fed policy. The market sentiment is cautiously optimistic, with an inclination towards a bullish outlook for gold prices. However, traders should remain vigilant and responsive to shifting economic indicators and central bank policy announcements, which could rapidly alter the market dynamics.

Key Levels to Watch: : 2000,1995,1986,2019

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 2009.50 | 2015.00 |

| Level 2 | 2002.50 | 2019.50 |

| Level 3 | 1991.50 | 2023.00 |