Gold Still Bearish on Key market events this week. Waiting on Upcoming Non Farm Payrolls and Unemployment Figures

Despite having already escalated its principal interest rate to a zenith not witnessed since 2001, the Federal Reserve has signaled that U.S. interest rates might remain elevated into the next year, diverging from prior expectations. Contrarily, Treasury yields have ascended as traders acclimate to a new market normalcy, accepting protracted periods of elevated interest rates. A key focal point for the Fed is the U.S. labor market, as potent activity therein could propel wages higher, potentially sustaining inflation significantly above its 2% target. A recent report from ADP underscored that private-sector employers appended 89,000 jobs last month, a deceleration in hiring more pronounced than the anticipated 140,000 jobs forecasted by economists.

Simultaneously, an additional economic report indicated that growth in U.S. service industries decelerated in September, slightly exceeding economist predictions. The political arena is also impacting Wall Street, with Kevin McCarthy’s removal from the Speaker of the U.S. House of Representatives being absorbed by the markets. Although this move is unprecedented, short-term implications seem limited, especially as U.S. government funding is secured until November 17. A shutdown, while disruptive to the U.S. economy and increasing recession risk, has seen financial markets remain relatively robust during prior occurrences.

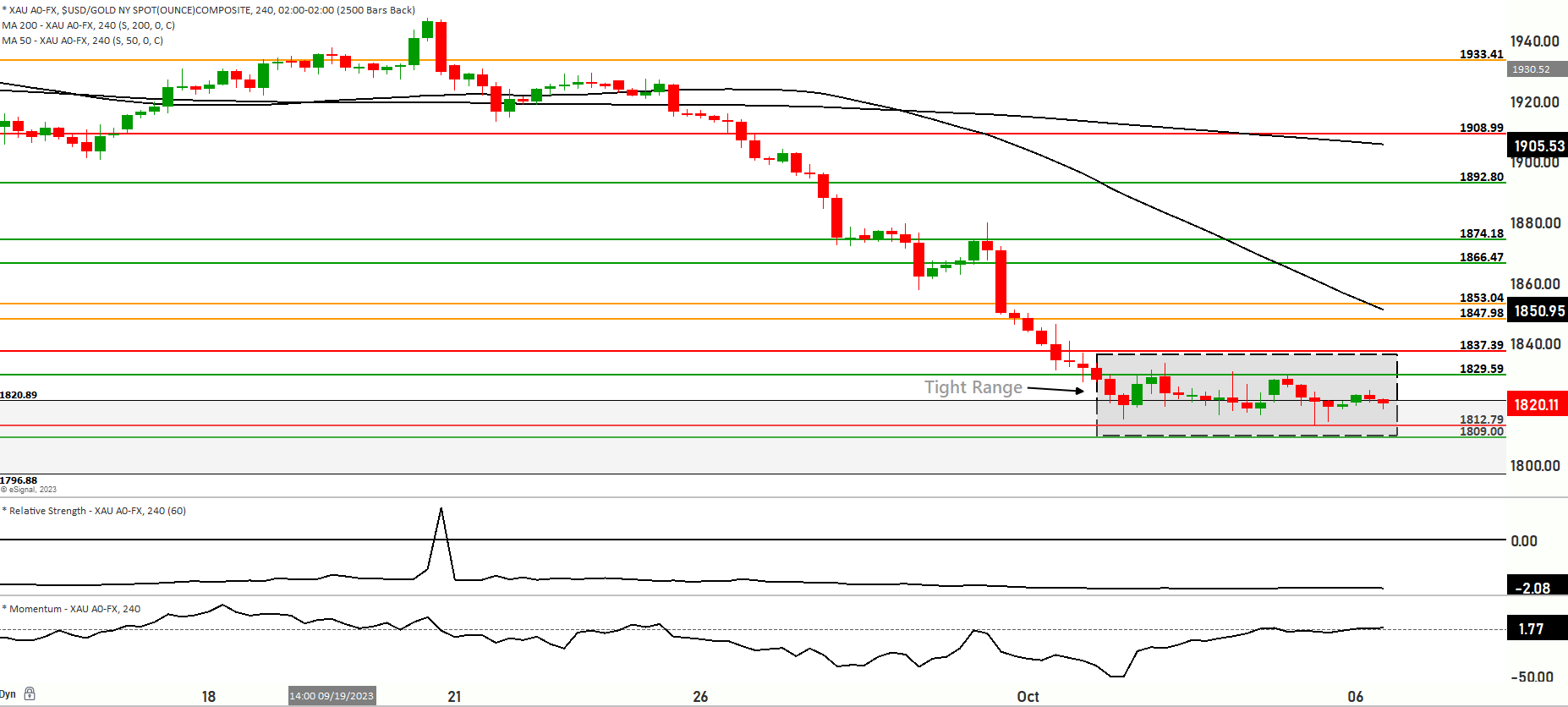

Concurrently, gold’s price trends present a captivating narrative. The psychological support for the general price trend of gold is targeting $1,800, which if breached lower, may present a lucrative re-entry point for purchasing. Global geopolitical tensions and recession apprehensions could bolster gold, particularly if coupled with a U.S. dollar decline. The daily chart suggests that bulls could reclaim control over the gold trend post-recent losses without ascending towards resistance levels at 1855 and 1880 dollars respectively. Despite a bearish trend, gold is currently range-trading at the 1821 level, positioned beneath both the 200-day and 50-day moving averages, indicative of a bearish range zone.

Envisaging potential scenarios, a decline from its current level could see the price of gold testing support levels at 1817 with possible further downward momentum at 1812. If the bearish trend persists, 1809 and 1805 levels could be explored, with 1805 acting as significant support. Conversely, should the price ascend from its current position, resistance at 1830 might be tested, with 1837 forming the main resistance level. Further potential resistance exists at 1847 and 1853, the latter serving as a major resistance level. Though the short-term momentum in the market is bearish within a range, there exists a high possibility of a bullish reversal, warranting caution as the market could potentially range from 1800 to 1853 in forthcoming days.

Key Levels to watch are 1809,1796,1782,1830,1847

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1817.00 | 1830.50 |

| Level 2 | 1809.50 | 1837.50 |

| Level 3 | 1805.00 | 1847.50 |