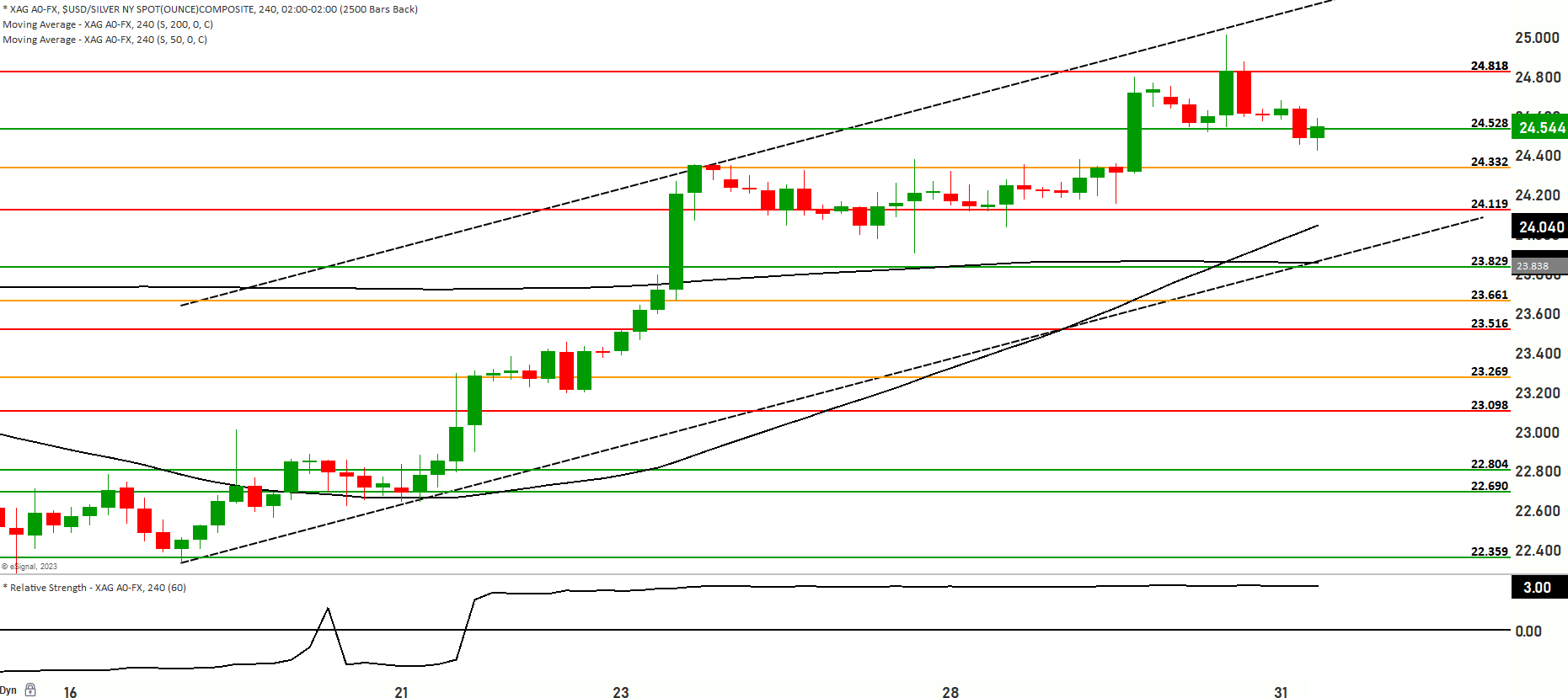

XAG/USD in a Short term Bullish Range, possible retest to 25 level

The current price of silver is exhibiting a bullish sentiment within a range, with prices positioned at the 24.580 level. The price of silver is currently trading above both the 50 and 200 Day Moving Averages, indicating a range-bound but bullish sentiment.

Scenario 1: Bearish Correction

If the price experiences a decline, it could test the 24.528 and 24.454 levels. Successful tests at these levels might lead to further downside movement towards the 24.332 level. A crucial support level to monitor is at 24.245, as a breach of this level could indicate a more significant downward correction.

Scenario 2: Bullish Continuation

Conversely, if the price moves higher from its current level, it could test the 24.690 level. Further upward momentum might encounter resistance around the 24.818 level. Continued bullishness could lead to a test of the 24.922 and 25.057 levels, with the latter acting as a major uppermost resistance level.

Given the market’s behavior, it’s important to exercise caution, as the price could continue to range between the 24.990 and 24.818 levels. The market’s reaction at these levels will provide insights into its future direction. The current momentum for the market falls within a range, and the Relative Strength Index (RSI) is positioned in an oversold range.

While the price reflects a bullish sentiment within a range, ongoing economic factors and global events can influence its trajectory. Traders should pay close attention to the support and resistance levels outlined in the scenarios.

Key Levels to watch are 24.119,23.829,23.661,24.528,24.818

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 24.433 | 24.674 |

| Level 2 | 24.332 | 24.818 |

| Level 3 | 24.119 | 25.011 |