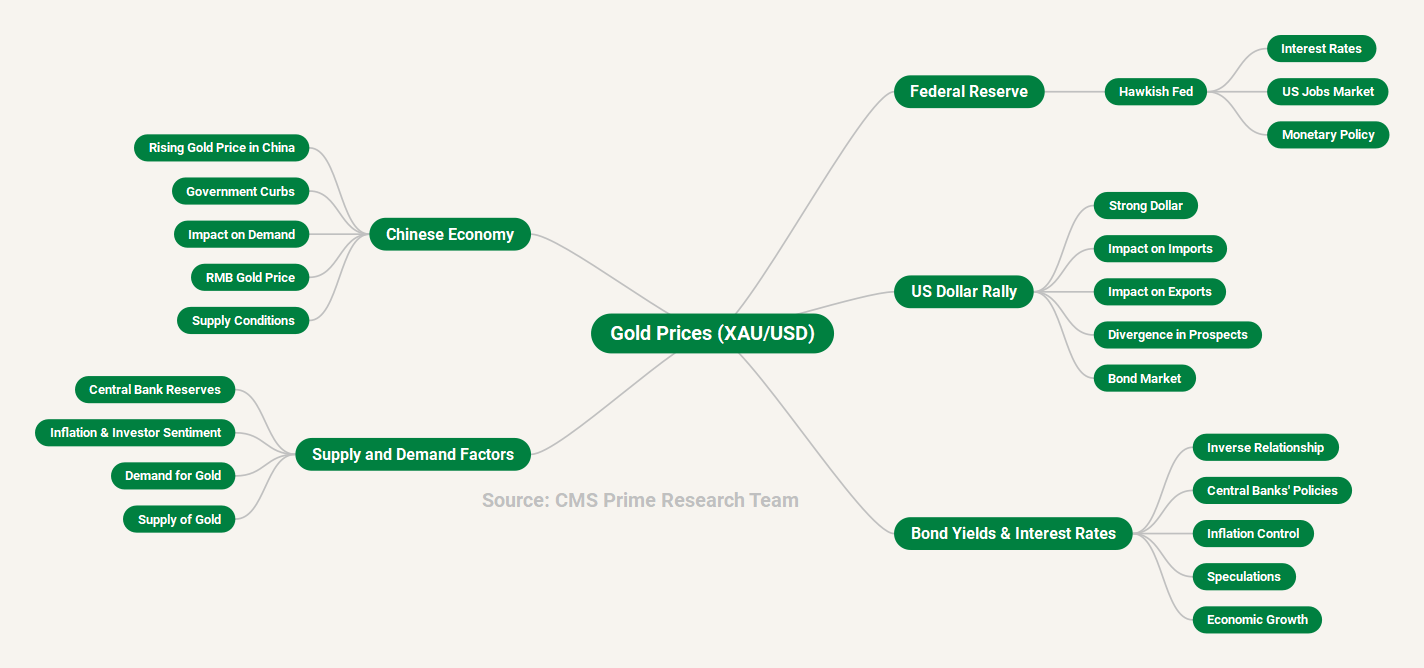

The latest economic news impact factors affecting the XAU/USD price move are:

- Hawkish Federal Reserve narrative and resilient US jobs market limiting gold upside.

- Money market pricing suggesting a pause by the central bank, with messaging from Federal Reserve Chair Jerome Powell being key for gold.

- Death cross formation in XAU/USD price action, indicating a bearish outlook for gold.

- The Federal Reserve’s monetary policy and the performance of the Chinese economy being major drivers for gold price in 2023.

- Softening consumer and wage inflation in the US, allowing markets to remain hopeful about a Fed policy pivot later in the year.

- Demand vs supply for gold and its influence on XAU/USD.

- Struggling markets or context of currency devaluation, as gold is known to be a Safe haven.

- The US dollar rallying and bond yields gaining amid speculation that central banks will keep interest rates elevated for longer to rein in inflation.

- Gold prices being influenced by a series of central bank meetings this week.

These factors provide a comprehensive overview of the current economic landscape affecting the XAU/USD price move. Keep in mind that these factors are subject to change as new information and events unfold.

Feds Monetary Policy

In recent weeks, the Federal Reserve’s monetary policy has significantly affected the XAU/USD prices. The hawkish stance of the Fed on interest rate outlook has led to a decline in gold prices as market participants anticipate unchanged interest rates amid a resilient US economy. The US dollar has attracted significant bids due to strong consumer spending and tight labor market conditions, which may keep excess inflation persistent.

Gold prices have also been under pressure as Fed policymakers support one more interest rate increase in the remainder of 2023, given the resilient US economy that could slow down the progress against inflation. The US dollar index has reached an 11-month high, supported by a hawkish stance from Fed policymakers, upbeat Manufacturing PMI data, and a cautious market mood.

Furthermore, gold prices have slipped as the dollar rallied and bond yields gained amid speculation that central banks will keep interest rates elevated for longer to rein in inflation. The Federal Reserve’s policy decisions and the performance of the Chinese economy have been major drivers for gold price fluctuations in recent weeks.

US Dollar Rally, Bond Yields and Central banks

The US dollar has been experiencing a surge while bond yields have been increasing due, to speculations that central banks will maintain interest rates for a period in order to control inflation. This situation carries implications for the economy the bond market and the role of banks in managing inflation. The rally of the US dollar can be attributed to a growing divergence in prospects, where the US is defying pessimistic predictions while China and Europe face faltering growth. A strong dollar can have both negative impacts on the economy. On one hand it makes imported goods more affordable benefiting consumers and businesses that rely on imports. On the hand it can pose challenges for US exporters as their products become pricier, in markets and also affect multinational companies operating in the US that need to convert their earnings into dollars.

Bond Yields and Interest Rates Relationship

Bonds and interest rates have a relationship that goes inverse. When interest rates go up usually bond prices go down and the other way around. This happens because when interest rates increase older bonds, with interest rates become less appealing to investors, which leads to a decrease, in their prices when traded in the market. As bond prices drop their yields increase, making them more competitive compared to bonds that offer interest rates. On the side when interest rates decrease the prices of existing bonds tend to rise while their yields decrease.

Central Banks and Inflation Control

Central banks utilize monetary policy to regulate economic fluctuations and attain price stability, which refers to the maintenance of low and consistent inflation rates. To counteract the rapid rise in inflation, central banks across the globe have implemented tighter monetary policies through interest rate hikes. By increasing interest rates, central banks can effectively slow down economic growth and bring inflation levels under control. Conversely, when inflation is too low, central banks typically reduce interest rates to stimulate economic activity and encourage higher inflation.

Given the current circumstances, speculations suggesting that central banks will prolong elevated interest rates in order to curb inflation indicate their commitment towards safeguarding price stability and preserving people’s purchasing power. This approach helps ensure that inflation remains within the target range established by central banks, usually around 2-3%. However, it is crucial to acknowledge that attaining lasting price stability can be quite challenging, requiring central banks to remain steadfast in their efforts to achieve their desired inflation targets.

Chinese Economy and Gold Prices

The performance of the Chinese economy has had a significant impact on gold prices in 2023. The rising gold price in China has been a key deterrent to demand recovery so far in 2023 and may continue to dampen consumer interest. While the LBMA Gold Price AM in USD declined by 0.6% in August, the Shanghai Gold Benchmark PM (SHAUPM) in RMB rose by 1.8% amid Chinese currency weakness, resulting in a sizable 13% return year-to-date and outperforming most assets. The Chinese gold price premium has surged to record levels, reaching US$121/oz on September 14, driven by local demand and supply conditions.

China’s gold price has been rising against levels in London, a trend that local traders attribute to government curbs on imports of the precious metal. The Shanghai spot price was more than $40 an ounce higher than that in London on August 14, with the gap steadily widening from late June even as consumer demand in China remained sluggish. The Chinese yuan has lost nearly 6% of its value against the U.S. dollar this year, while Shanghai-listed stocks are off about 8% from their 2023 high. Gold prices in China have soared as a result, hitting a historic relative high with a more than $100 premium per ounce over metal prices in New York or London.

Despite challenges, an improved outlook for China’s economy could provide some support for local gold demand. Various jewelry fairs and industry events may spur both manufacturers’ and retailers’ replenishing demand. Furthermore, with the National Day Holiday and Mid-Autumn Festival approaching, retailers’ inventory restocking is likely to continue. However, the record-level RMB gold price has been, and may continue to be, a key deterrent to local gold consumption.

Supply and Demand Factors

Demand for gold: Gold is highly sought after due to its multiple applications, such as in jewelry, electronics and as a reliable store of value. When there is an increase in demand for gold, it usually leads to a rise in its price.

Supply of gold: The primary source of gold supply is through mining production. Changes in production levels, mining costs and geopolitical factors can have an impact on the availability of gold. Consequently, these changes can influence the price of gold.

Central bank reserves: Central banks hold significant amounts of gold as part of their reserve assets. Their buying or selling activities can have an effect on the overall market sentiment towards gold prices. An increase in central bank reserves typically drives up prices while a decrease may result in a decline.

Inflation: Gold is often viewed as a protective measure against inflation. As inflation rates rise, investors may opt to invest in or hold onto gold as a means to preserve their wealth. This increased demand during inflationary periods tends to drive up both the demand for and price of gold.

Investor sentiment: During times characterized by economic uncertainty or geopolitical tensions, many investors perceive gold as a safe haven asset where they can protect their investments. This perception often leads to increased demand for gold during such periods.

These are some key points illustrating how various factors come together to shape the dynamics surrounding the price movements of XAU/USD based on supply and demand interactions.

During such circumstances, investors often consider gold as a reliable asset to preserve value, which leads to an increase in demand and subsequently drives up its price. Various market dynamics, combined with global events, play a role in the fluctuation of gold prices and influence the exchange rate between XAU/USD.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.