Current Factors Influencing Current Gold Prices:

US dollar & yields: The US dollar index remains near 6-week highs while yields on 10-year Treasuries are holding above 4%. This is creating headwinds for gold as it reduces the relative appeal. However, if the dollar and yields decline, it could provide tailwinds.

Economic data: Upcoming US Q4 GDP, inflation, consumer spending and PMI data could influence rate cut expectations and impact gold either way. Hawkish data dampens rate cut hopes while soft data raises expectations for cuts which benefits gold.Gold’s recent uptick finds support from softer US Producer Price Index (PPI) figures and escalating geopolitical tensions.

Geopolitical tensions: Rising tensions globally, especially between US and China/Russia, could drive safe haven demand for gold. This remains a wildcard.

Physical demand: Retail demand from top consumers like China and India could lend support, especially around the Lunar New Year, but demand remains lackluster so far.

Expectations for Next Week

Economic Data Influence on Gold Prices

- Impact of Strong US Economic Data: Strong U.S. economic data has led to a recalibration in market expectations regarding Federal Reserve rate cuts, influencing the appeal of gold. Gold prices inched lower as stronger economic data dampened hopes for early rate cuts by the Fed.On January 24, 2024, spot gold fell 0.3% to $2,023.69 per ounce, and U.S. gold futures dipped 0.1% to $2,024.50.

- Market Response: The change in market expectations is a response to recent U.S. economic data that suggests the Federal Reserve may delay lowering interest rates. This relationship between economic indicators and gold prices highlights the sensitivity of commodity prices, like gold, to macroeconomic developments.

Interest Rate Expectations and Gold Prices

- Market Pricing in Fewer Fed Rate Cuts: The market is now pricing in fewer Fed rate cuts in 2024, impacting the investment appeal of gold. Traders have pared back the timing of the first interest rate cut, initially expected in March but now seen with an 89% probability in May 2024. As of January 22, 2024, traders priced in about a 41.6% chance of a Fed rate cut in March, down from more than 70% at the beginning of the week.

- Effect on Gold Prices: Lower interest rates typically reduce the opportunity cost of holding non-yielding bullion like gold. However, with the anticipation of fewer rate cuts, there’s a potential decrease in gold’s attractiveness as a safe-haven asset. This could lead to shallower rebounds in gold prices and the prospect of further weakness if central banks continue to push back on market expectations of rate cuts.

Technical Analysis

Technical Analysis:

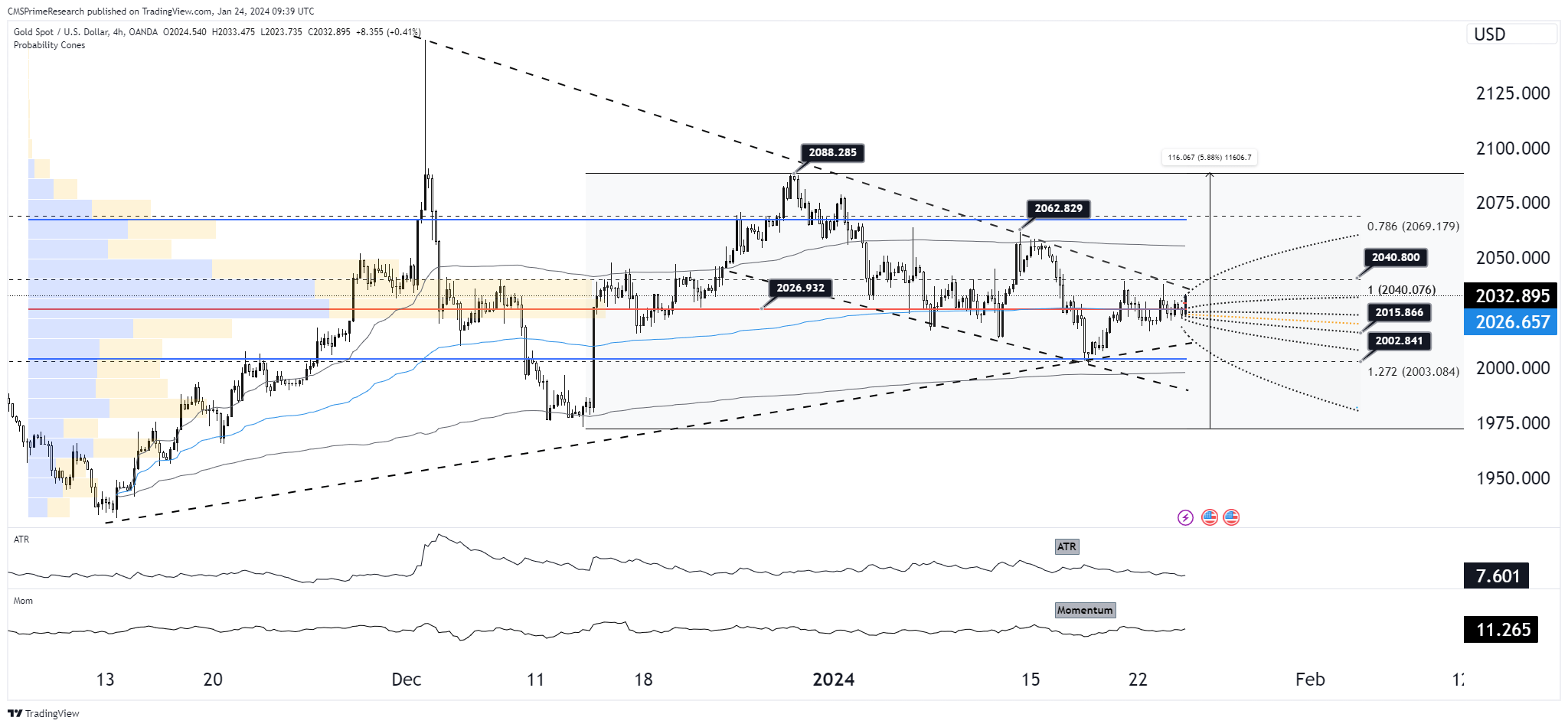

Support and Resistance Levels:

- The chart shows established support around the $2026 level, where a consolidation pattern has formed.

- Resistance is evident at the $2088 level, which has been tested but not broken.

Price Action:

- Recent price action indicates volatility, with wide price swings suggesting uncertainty among investors.

- The failure to break above resistance and the recent rejection at this level may indicate a bearish sentiment in the short term.

Indicators:

- The Average True Range (ATR) has increased, indicative of heightened market volatility.

- The Momentum indicator shows a flat trend, suggesting a lack of clear directional strength.

Fundamental Analysis:

Interest Rate Decisions:

- The ECB and Fed interest rate decisions will have a significant impact. Higher rates typically strengthen the respective currencies, which can negatively affect gold prices.

Economic Data:

- Upcoming GDP, consumer confidence, and employment data will provide insight into economic strength. Positive data may lead to a stronger dollar and potentially lower gold prices.

Market Sentiment:

- Current market sentiment is cautious, as indicated by the high impact events ahead. This could lead to increased demand for safe-haven assets like gold, especially if the data disappoints.

Combined Scenario Forecast:

Bullish Scenario:

- If the upcoming fundamental data points to economic weakness or if the central banks are dovish, gold could see an uptrend as it’s considered a safe-haven asset.

- A break above the $2040 resistance could confirm this bullish scenario, targeting the next resistance at the Fibonacci retracement level around $2069.

Bearish Scenario:

- Strong economic data and hawkish central bank tones could strengthen the dollar, pressuring gold prices.

- A break below the $2026 support level could see a move towards the lower Fibonacci retracement level at $2002,1997,1980.

Neutral Scenario:

- Mixed data or in-line central bank decisions could lead to continued consolidation within the current range, between $2026 and $2088.

Outlooks by Other Sources:

Overall Market Sentiment:

Combining the technical patterns with the anticipation of high-impact fundamental events, the sentiment analysis stands as follows:

Bullish Sentiment: Considering the safe-haven status of gold and potential dovish surprises from the central banks, there is a 35% positive sentiment.

Bearish Sentiment: The strength of the dollar and the potential for positive economic data releases contribute to a 40% negative sentiment.

Neutral Sentiment: With considerable uncertainty ahead and a current lack of a strong directional move, there is a 25% neutral sentiment.

The market sentiment reflects the cautious stance of market participants as they await clarity from upcoming economic events. In conclusion, the sentiment leans slightly bearish in the immediate term due to the resistance levels and the potential for positive economic data, which could bolster the USD against gold.

Target Levels and Analysis---2003 or 2040

2003 as a Bearish Trend Confirmation:

- If the price of gold reaches the level of 2003 and confirms a bearish trend, this could indicate a breakdown from current support levels.

- It’s a substantial move below the psychological threshold of $2000, which could trigger stop-loss orders and prompt a sell-off.

- This level may align with a Fibonacci retracement or an extension level, often indicative of continued momentum in a bearish trend.

- Fundamental factors could include strengthening of the USD, hawkish monetary policies by central banks, or a decrease in geopolitical tensions, which typically reduce the demand for safe-haven assets like gold.

2040 as a Bullish Trend Confirmation:

- In contrast, reaching and sustaining above 2040 would signal a bullish trend confirmation.

- This level could be above a key resistance, indicating strong buying pressure and potential reversal from any previous downtrend.

- Bullish fundamentals might include weakening of the USD, dovish central bank policies, or escalating geopolitical risks heightening gold’s appeal as a safe haven.

Price Behavior at 2003 and 2040

2003 Target Iteration:

- Should the bearish trend be confirmed with a strong closure below 2003, the market may look to historical support levels for the next potential floor around the 1985. The volume profile could reveal where past accumulation occurred, offering clues to where buyers might step in.

- The ATR (Average True Range) may increase as volatility typically rises in downtrends, leading to larger-than-average price movements and potentially quicker attainment of lower price targets.

2040 Target Iteration:

- A confirmed breakout above 2040 would suggest increasing bullish momentum. The next resistance levels, perhaps identified by previous local highs or psychological levels (such as 2050 or 2100), would become the new targets.

- An increase in the ATR in an uptrend would suggest strong buying interest and could signal a robust move towards higher targets.

Contradictory Signals at 2003

Contradictory Signals: Should economic data or geopolitical events suddenly favor risk-off sentiment, this could create a contradictory scenario where the price may indeed breach 2003 but then quickly reverse due to gold’s safe-haven appeal.

Interplay of Indicators: The interplay between the momentum indicator and ATR suggests increasing volatility without a clear directional bias. Thus, a breach of 2003 might not necessarily translate into a sustained bearish trend, especially if it occurs on low volume or without confirming price action.

Contradictory Signals at 2040

Economic Data Sensitivity: If the move above 2040 coincides with strong economic data, this could paradoxically weaken gold’s appeal as a non-yielding asset, especially if the data suggests potential rate hikes or a strengthening dollar.

Market Dynamics and Volume: A break above 2040 requires scrutiny of volume and price action. Without significant volume, a breakout could be less credible, suggesting a potential liquidity trap for overzealous bulls.

2003 vs. 2040 as Psychological Levels: These price levels represent more than just numbers; they are psychological battlegrounds where conflicting market narratives play out. The dichotomy lies in the market’s interpretation of each level as either a value proposition in a bearish scenario or as a momentum indicator in a bullish one. The market sentiment driving gold towards 2003 might be predicated on a risk-on environment, whereas sentiment driving towards 2040 suggests risk aversion. These opposing forces create a dichotomy that reflects the market’s struggle between fear and greed.

Conclusion

In summary, current factors influencing gold prices include the strength of the US dollar, yields on 10-year Treasuries, economic data releases, geopolitical tensions, and physical demand. The recent recalibration of market expectations regarding Federal Reserve rate cuts and a shift in interest rate predictions have also impacted gold’s appeal. Technical analysis points to resistance at $2088 and support at $2026, while fundamental factors like central bank decisions and economic data will play a significant role in shaping gold’s direction. Overall, market sentiment leans slightly bearish due to resistance levels and potential positive economic data, but contradictory signals at key price levels like 2003 and 2040 reflect the ongoing struggle between risk-on and risk-off sentiments in the market.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.