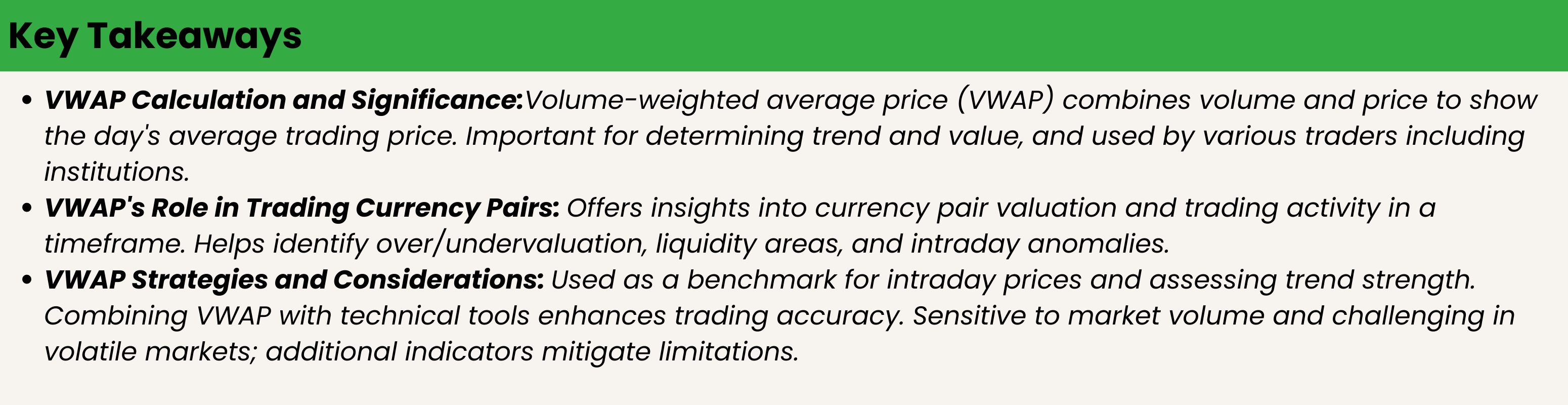

Understanding VWAP (Volume-Weighted Average Price)

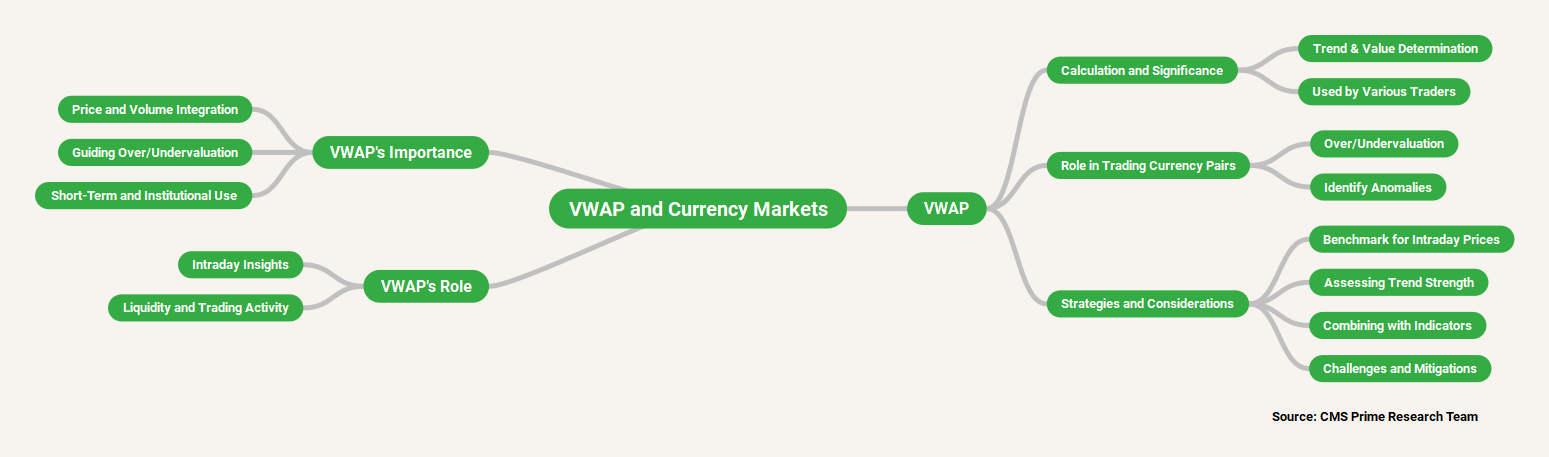

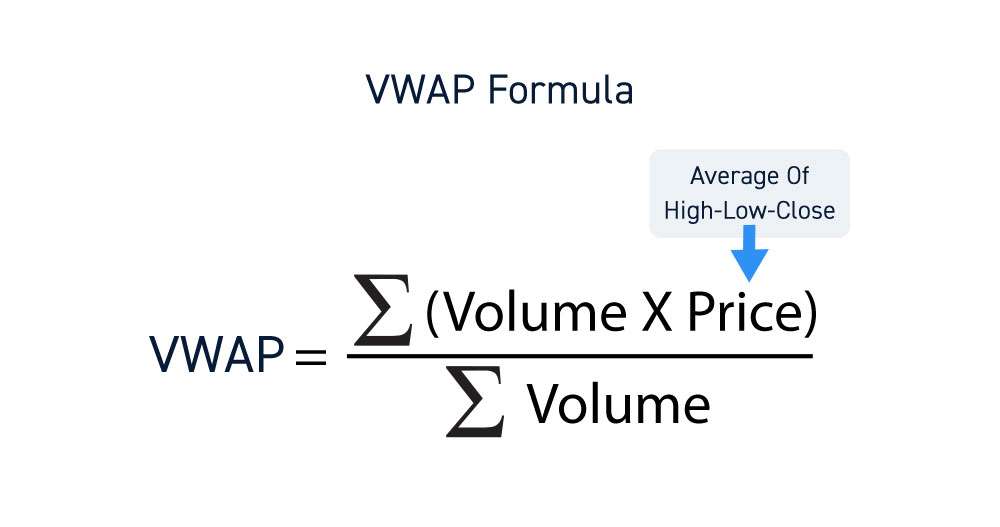

The Volume-Weighted Average Price (VWAP) is a technical analysis indicator used on intraday charts that represents the average price a security has traded at throughout the day, based on both volume and price. It is calculated by totaling the dollars traded for every transaction (price multiplied by the volume) and then dividing by the total shares traded. VWAP provides traders with pricing insight into both the trend and value of a security.

Importance of VWAP in Trading Currency Pairs

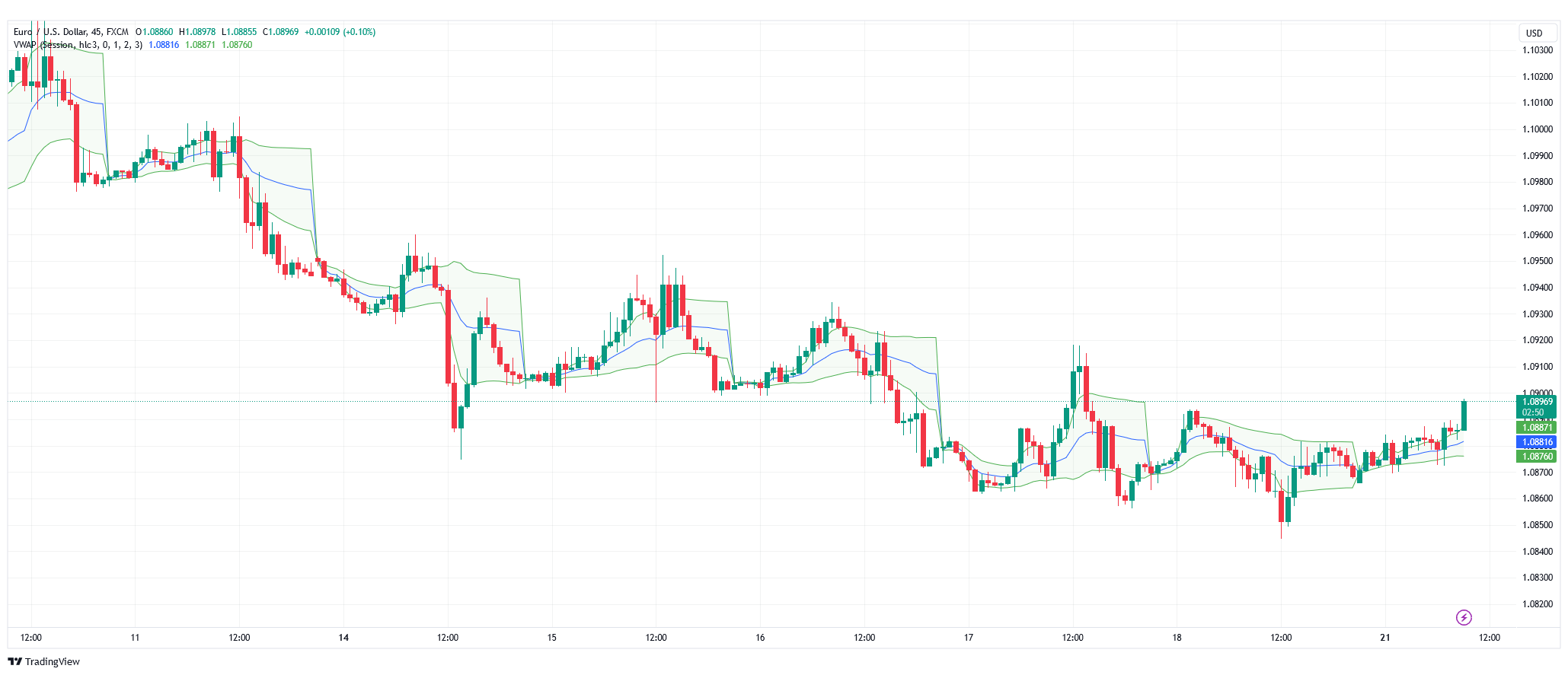

VWAP is a measure of a currency pair’s price over a period of time, reflecting the range of price levels at which different forex trades were executed and the trading activity conducted at those levels. This means that the VWAP number identifies the region on the price charts where the most trades were booked. VWAP is important in trading currency pairs because it offers an instant guide as to whether a currency pair can be considered over or undervalued in a particular timeframe. It is used by short-term speculators and day traders to identify intraday pricing anomalies and by larger institutions that want to build sizable currency positions as patiently as possible to prevent their own trading activity from driving the market price away from them.

VWAP is a measure of a currency pair's price over a period of time, reflecting the range of price levels at which different forex trades were executed and the trading activity conducted at those levels. This means that the VWAP number identifies the region on the price charts where the most trades were booked. VWAP is important in trading currency pairs because it offers an instant guide as to whether a currency pair can be considered over or undervalued in a particular timeframe.

VWAP: An Overview

Definition and Calculation of VWAP

The Volume Weighted Average Price (VWAP) is an indicator used in analysis that calculates the price of a security traded throughout a trading day. It takes into account both the volume and price of trades. VWAP is commonly used on intraday charts and resets at the beginning of each trading session. To calculate VWAP we add up the dollar value traded for each transaction (price multiplied by volume). Then divide it by the total shares traded.

Importance of Volume in VWAP Calculation

The importance of volume in VWAP calculation lies in its ability to provide a representation of a securitys average price compared to a simple arithmetic average. By factoring in volume VWAP assigns significance to trades reflecting their impact on the overall price movement. This results in a view of the trading trend throughout the day making it valuable for both day traders and institutional investors. The volume component of VWAP helps traders identify areas with liquidity and significant trading activity which can assist in making informed buying and selling decisions.

Using VWAP as a Benchmark for Intraday Prices

Using the Volume Weighted Average Price (VWAP) as a reference, for intraday prices is a practice in analysis. It offers insights into the price of a security throughout the day taking both volume and price into account. Institutional traders rely on VWAP as a benchmark to evaluate how well their orders are executed. When a buy order is filled below the VWAP value it is considered favorable while selling above the VWAP indicates a fill.

Application of VWAP in Forex Trading

Using VWAP as a Benchmark for Intraday Prices

Using the Volume Weighted Average Price (VWAP) as a reference, for intraday prices is a practice in analysis. It offers insights into the price of a security throughout the day taking both volume and price into account. Institutional traders rely on VWAP as a benchmark to evaluate how well their orders are executed. When a buy order is filled below the VWAP value it is considered favorable while selling above the VWAP indicates a fill.

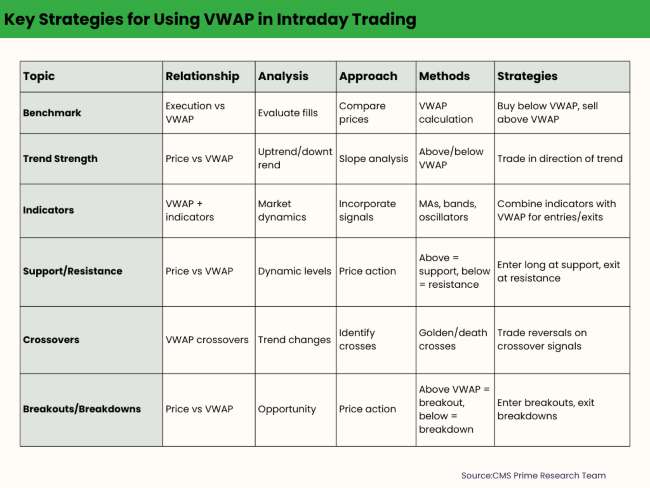

VWAP as a Tool for Identifying Trend Strength

Besides its benchmarking utility, VWAP also serves as a tool for assessing trend strength. If the price remains above the VWAP line it signifies that buyers are in control and suggests a trend. Conversely when the price falls below the VWAP line it indicates seller dominance. Implies a trend. Analyzing the slope of the VWAP line can further reveal insights into trend strength.

Table for Analysis:

Incorporating VWAP with Technical Indicators

Incorporating indicators like moving averages, trend lines or oscillators along with VWAP can provide traders with a more comprehensive understanding of market dynamics and aid in making informed trading decisions. For instance some traders may use 2 deviation bands around the VWAP to identify entry and exit points. Incorporating VWAP with indicators can offer extra signals, for confirmation and enhance trading accuracy.

Using the Volume Weighted Average Price (VWAP) as a reference, for intraday prices is a practice in analysis. It offers insights into the price of a security throughout the day taking both volume and price into account. Institutional traders rely on VWAP as a benchmark to evaluate how well their orders are executed. When a buy order is filled below the VWAP value it is considered favorable while selling above the VWAP indicates a fill

VWAP Strategies for Trading Currency Pairs

VWAP as a Support and Resistance Indicator

The Volume Weighted Average Price (VWAP) has the potential to work as an indicator, for support and resistance levels in currency pairs. If the price is higher than the VWAP it could act as a support level whereas if the price is lower than the VWAP it might function as a resistance level. These levels can be helpful for traders in determining when to enter or exit their trades.

VWAP Crossovers, Golden Cross and Death Cross

Crossovers of VWAP can assist in identifying trend reversals in currency pairs. A golden cross occurs when a term moving average crosses above a long term moving average indicating a trend. On the hand a death cross happens when a term moving average crosses below a long term moving average suggesting a downward trend. Traders can consider these crossovers as signals to make decisions about entering or exiting trades.

VWAP Breakout and Breakdown Strategies

Trading strategies based on VWAP breakout and breakdown involve taking action according to price movements either below the VWAP line. A breakout above the VWAP can indicate an opportunity to enter into a position while a breakdown below the VWAP may signify an opportunity for entry or exiting, from a long position. Traders can enhance the accuracy of their trades by employing these strategies in conjunction, with indicators, like moving averages or oscillators.

Limitations and Considerations

VWAP and its Sensitivity to Market Volume

The Volume Weighted Average Price (VWAP) considers both price and volume to calculate the average price of a security. It is sensitive to market volume, which has both advantages and limitations. On one hand, it offers a more accurate representation of the average price. However, sudden changes in volume, like large trades or unexpected news events, can influence it. Traders should be aware of this sensitivity and consider using additional indicators to confirm their analysis.

Challenges of Applying VWAP in Volatile Markets

Applying VWAP in volatile markets can be challenging due to price fluctuations that make the indicator less reliable. In such conditions, traders may face increased costs and difficulties in achieving their desired VWAP benchmark. Extreme price spikes or drops can also distort the average price, making it less representative of the true market value. To overcome these challenges, traders should consider combining other technical tools and strategies with VWAP.

Avoiding Pitfalls: Combining VWAP with Other Tools

To avoid potential pitfalls associated with VWAP usage, traders should combine it with other technical indicators and tools. This helps provide a more comprehensive perspective on the market and enhances trading decision accuracy. For instance, traders have the option to utilize moving averages, trend lines or oscillators in conjunction with VWAP to pinpoint levels of support and resistance, assess the strength of trends and determine potential entry and exit points. By incorporating a variety of indicators, traders can effectively navigate the intricacies of the market and make well informed decisions.

Conclusion:

In the dynamic world of forex trading, where precision and informed decision-making are paramount, the Volume-Weighted Average Price (VWAP) emerges as a powerful tool for traders seeking an edge in analyzing and navigating currency pairs. Through this comprehensive exploration of VWAP’s role in currency pair trading, it becomes evident that VWAP transcends its origins in equities trading and extends its influence into the realm of forex.

VWAP’s ability to account for both price and volume provides traders with a unique perspective on market trends, helping them decipher the underlying market sentiment and potential price directions. As demonstrated through a variety of strategies, including its role as a support/resistance indicator, its crossovers, and breakout strategies, VWAP proves its versatility across different trading styles and timeframes.

However, it’s important to acknowledge VWAP’s limitations, such as its sensitivity to volume fluctuations and the challenges it faces in volatile markets. Adapting VWAP insights alongside other technical and fundamental tools is essential to mitigating these limitations and making more informed decisions.