USD/JPY Hits New Yearly Low as Risk-Off Flows Favor Yen

USD/JPY has fallen to a new year-to-date low, pressured by falling Treasury yields, slumping oil prices, and growing risk aversion. The pair dropped below its December low of 148.65 amid a broad risk-off sentiment that has been exacerbated by weaker U.S. consumer confidence and concerns over potential government budget cuts. Inflation breakevens in the U.S. and Europe continue to decline, reinforcing fears of slowing global growth, while Japan’s five-year breakeven inflation remains elevated at 1.93%, surpassing Germany’s. This contrast in inflation expectations has driven demand for the yen as a safe-haven currency, with risk reversals shifting further in favor of yen strength. Additionally, the broader decline in risk-sensitive assets, including AUD/JPY, further supports the yen’s recent rally.

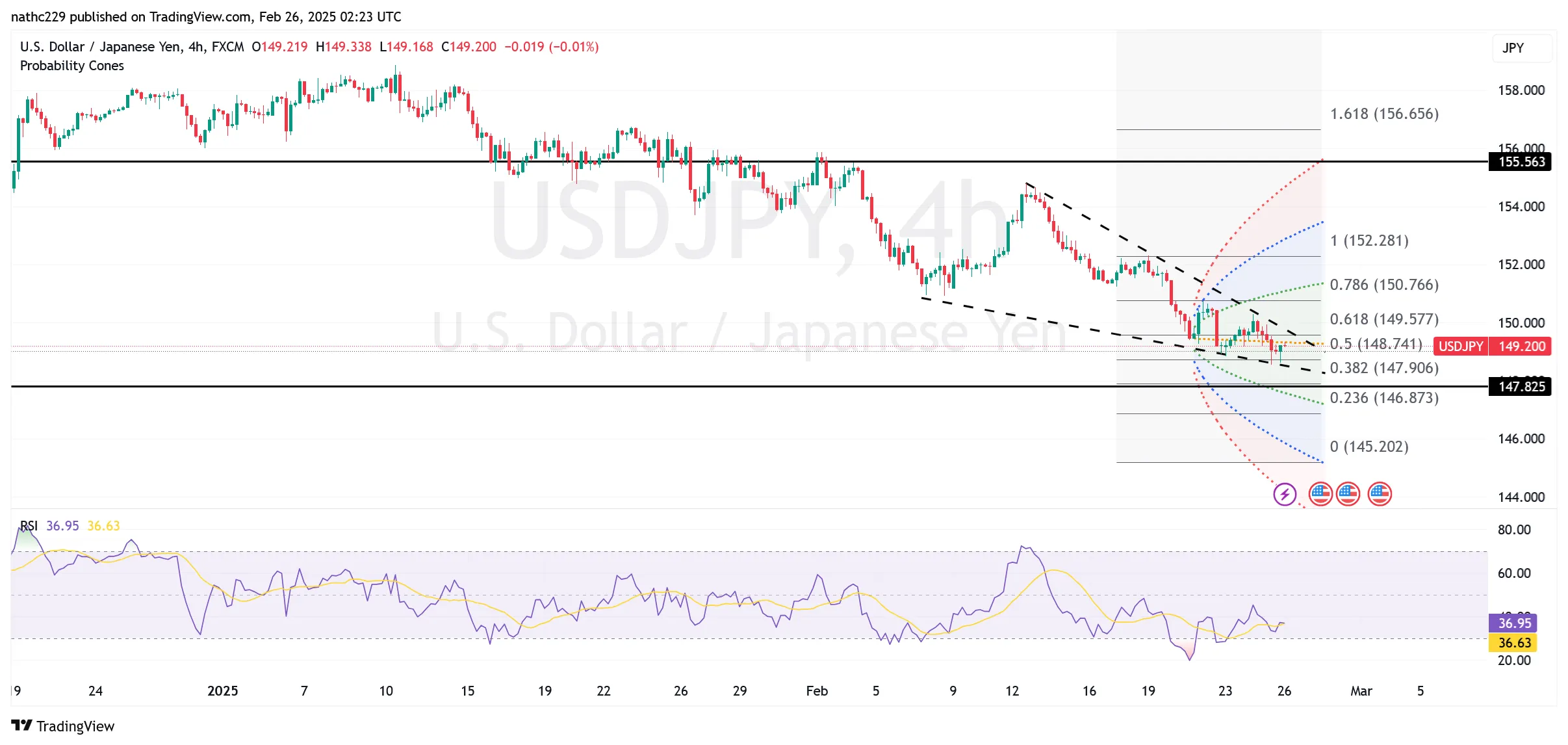

Technically, USD/JPY is nearing key support levels, with the 100-week moving average at 148.55 and the lower Bollinger Band at 148.42 providing near-term downside barriers. A deeper move lower could see the pair test 147.20, the September 3 high. However, losses may decelerate near these levels, as bearish momentum indicators suggest an oversold condition. Resistance is seen at 150.93 (February 7 low) and 151.11 (weekly cloud bottom), which would need to be breached for any significant recovery. Given the widening of risk reversals across tenors and the one-year risk reversal reaching its most bearish level since October, the market bias remains in favor of continued yen appreciation.

Looking ahead, the combination of lower U.S. yields, potential tariff implementations, and ongoing risk-off sentiment could keep USD/JPY under pressure. However, given the approach of key technical support, a consolidation phase or a short-term corrective rebound cannot be ruled out. Traders will closely watch the Fed’s next policy moves, particularly in light of growing market expectations for a May rate cut. If economic data continues to disappoint, further downside could emerge for USD/JPY, potentially accelerating losses below 148.42 toward the 147.20 support zone.