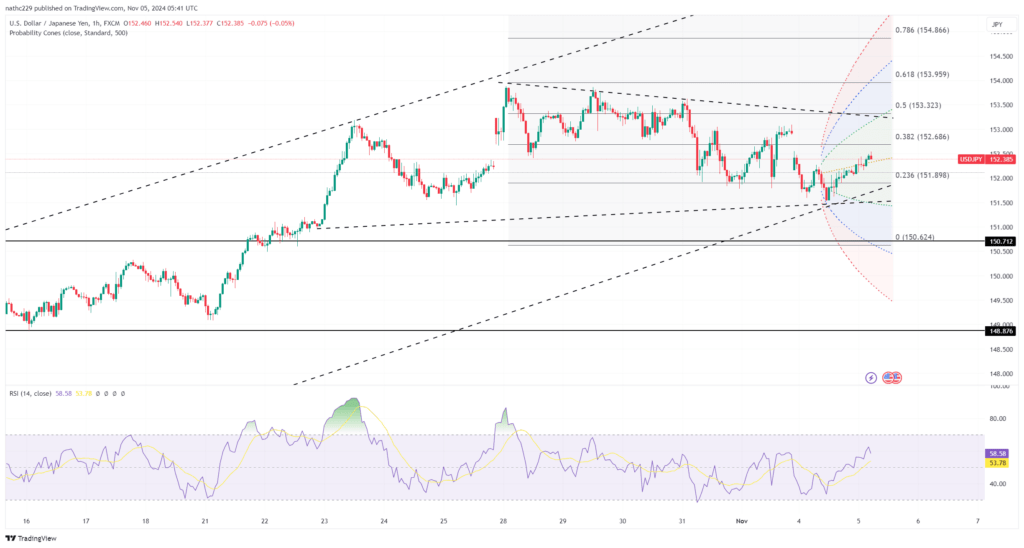

USD/JPY stabilized above its 200-day moving average at 151.57, rebounding slightly after an initial dip driven by softer U.S. Treasury yields. Trading volumes remained low within a range of 151.54 to 152.95 on EBS, with markets on edge ahead of Tuesday’s U.S. election and the upcoming FOMC policy announcement. Implied one-week volatility for USD/JPY surged to above 18.0%, the highest in three months, reflecting heightened anticipation of potential election and policy-related turbulence. Despite the stabilization, USD/JPY faces resistance at last week’s double-top near 153.87-88 and the key psychological level at 154.

Technically, USD/JPY remains in a cautious uptrend while holding above the 200-day moving average. However, upside momentum could be capped by 153.87-88, which has proven a strong resistance area. Immediate support lies at the October 23 low of 151.04, with further downside protection offered by the October 21 high of 150.88 and the 100-day moving average at 150.37. A break below these support levels could signal a shift in momentum to the downside, though for now, the technical structure supports a cautiously bullish bias as long as the pair remains above 151.57.

Looking ahead, USD/JPY’s path is likely to be influenced by both election outcomes and Fed signals regarding the pace of future rate cuts. If the U.S. election results or FOMC rhetoric favor risk-off sentiment, USD/JPY could see increased pressure, potentially testing support levels. Conversely, a supportive policy tone from the Fed, or election results favoring a strong economic outlook, could drive the pair toward the upper resistance near 153.87-88. Traders should watch for volatility spikes as the market digests these key events, with USD/JPY poised for directional cues based on upcoming news.