USD/JPY ended Wednesday near the middle of its daily range, fluctuating between 141.895 and 143.95, buoyed by rising U.S. Treasury yields and gains in equity markets. The yen remained under pressure as risk sentiment improved, commodities strengthened, and the U.S. Treasury yield curve steepened. This ongoing support for yen crosses has kept the pair well-positioned, though USD/JPY traders remain cautious, as reflected by the lack of a decisive push higher.

The broader market sentiment for USD/JPY is heavily influenced by U.S. economic data and treasury yields, but traders are also looking at the policy direction of the Bank of Japan (BOJ). Despite expectations that the BOJ will leave its interest rates unchanged at 0.25% in Friday’s meeting, attention is focused on August’s core Consumer Price Index (CPI) data, which is forecast to increase to 2.8%. With little change in monetary policy anticipated from the BOJ, the yen may continue to weaken, especially with ongoing discussion surrounding rate divergence between Japan and China, as the People’s Bank of China (PBOC) is expected to cut its rates soon.

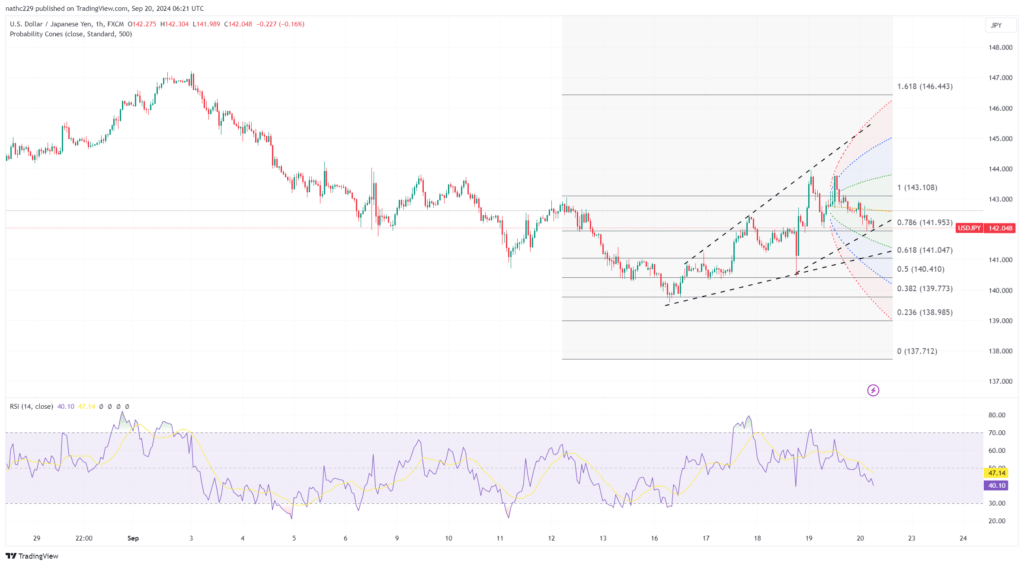

Technically, USD/JPY finds near-term support at the session low of 141.895 and further down at the weekly Ichimoku cloud bottom around 141.31. On the upside, resistance is seen at 143.95, the day’s high, with additional resistance at 144.20/22, corresponding to the early August payrolls high.

Recent charts show that USD/JPY buyers remain hesitant to make significant moves, and the pair’s rise since it touched its year-to-date low of 139.58 on September 16 appears to be part of an oversold correction. The next target is the lower boundary of an expanding Ichimoku cloud, now at 148.62. This climb has been marked by sharp and sporadic gains, often triggered by U.S. economic data, but the ascent has been uneven due to a combination of expectations for a Bank of Japan rate hike and dollar selling during Asian trading hours.

For USD/JPY bulls to see a smoother upward trend, volatility needs to decrease, and optimism around the U.S. dollar must rise further. Strong U.S. economic data expected later this week could provide the necessary boost for dollar demand, while market expectations surrounding BOJ policy could play a key role in driving yen weakness. Analysts anticipate that the BOJ will maintain its dovish stance until after the ruling Liberal Democratic Party’s leadership election on September 27, keeping the yen under pressure.

Looking ahead, the ongoing negative real interest rates in Japan should help curb enthusiasm for the yen, especially as custody bank data shows a slowdown in yen buying, and option accounts are beginning to scale back on dollar weakness. However, for USD/JPY to truly shift momentum toward the bulls, it will need to break above the key 145 level. Such a move could occur in the coming sessions, particularly if short-term moving averages start to align in favor of higher levels for USD/JPY.