USD/JPY is trading near the top end of its daily range between 147.35 and 148.36, supported by gains in U.S. equity markets and a steepening Treasury yield curve. The rise in U.S. shares has bolstered risk appetite, favoring the dollar, while the steeper yield curve reflects ongoing strength in U.S. economic conditions. The pair remains in a relatively narrow trading range with moderate volumes, staying below the 20-day upper Bollinger Band at 148.83. Despite recent strength, implied volatilities have declined, with some skew levels hitting a four-month low as demand for dollar call options continues to dominate. A 4% drop in oil prices also provides some support to the yen, as lower energy costs reduce Japan’s trade deficit.

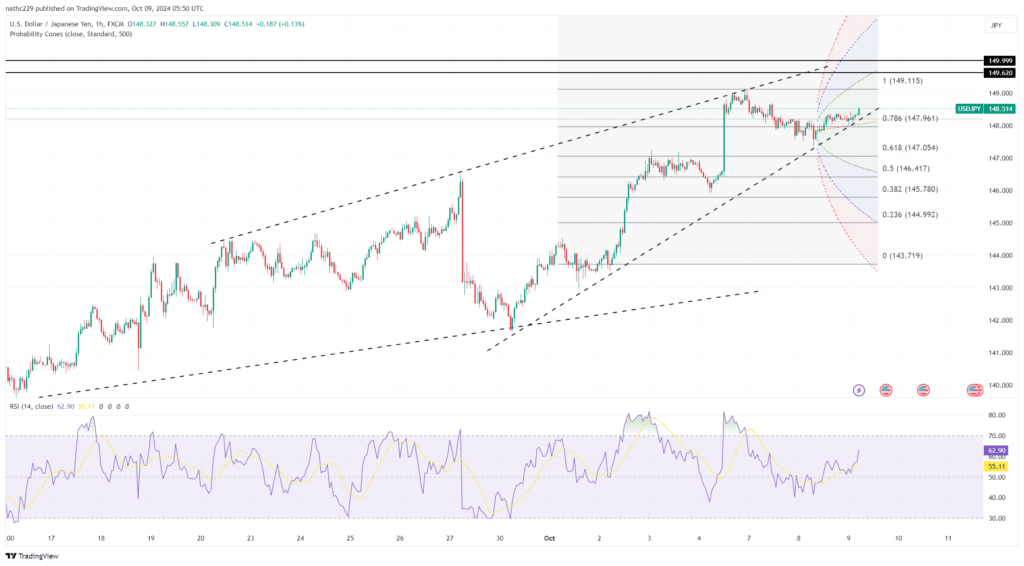

From a technical perspective, USD/JPY faces key resistance at 149.40, the high from August 15, while the bottom of the Ichimoku cloud around 146.89 provides critical support. The broader trading range between 140 and 150 remains intact, with the pair hovering near the upper end of this band. A breakout above the 148.83 level could signal further gains towards 149.40, but a failure to sustain momentum above current levels might see the pair retreat to test support near 146.89. Market participants will closely watch any movements in Treasury yields following remarks from Fed officials Collins and Jefferson, as their comments could provide clues on future Fed policy shifts.

Looking ahead, the outlook for USD/JPY is mixed, as potential shifts in Bank of Japan (BOJ) policy could introduce fresh volatility. While the yen has weakened amid expectations of ongoing Fed rate hikes and Chinese economic stimulus, there remains uncertainty about Japan’s monetary stance. Recent comments from Japanese Economy Minister Akazawa support the BOJ’s decision-making autonomy, but mixed messages from Prime Minister Ishiba suggest that a more hawkish shift is possible. The market currently assigns a 60% probability to a 25 basis point BOJ rate hike at the December 19 meeting, according to LSEG’s IRPR page. Should those odds rise, USD/JPY could slip below 146.89 and retest the key psychological support at 145.