USD/JPY has seen its upward momentum stall near the critical 150 level as traders engage in profit-taking and heed warnings from Japan’s Ministry of Finance. The pair briefly hit a fresh low of 149.51 during a wave of risk-off sentiment but remains capped by modest selling pressure above the psychological 150 mark. Comments from Japan’s top currency diplomat, Atsushi Mimura, about excessive yen volatility were largely downplayed by the market, but they added to the cautious tone. Speculative accounts have been building long USD/JPY positions since the pair topped 147, with the yen’s slide largely driven by widening U.S.-Japan yield differentials. However, concerns over potential intervention by the Bank of Japan (BOJ) loom large as the pair approaches key resistance levels.

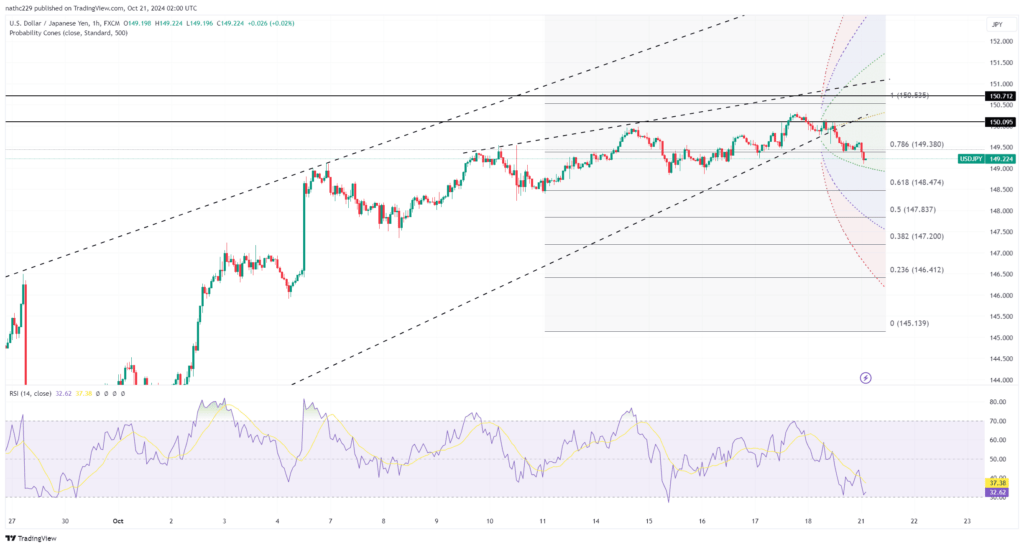

Technically, USD/JPY is facing strong resistance from multiple key levels, including the 100-day moving average (DMA) at 150.83, the Ichimoku cloud top at 151.04, and the 200-DMA at 151.37. These levels will be critical in determining whether the pair can sustain its bullish momentum or face a deeper correction. Short-term support is seen at the 9-day exponential moving average (EMA) at 149.03, followed by the conversion line at 148.83. A break below 148.20, which marks the October 8 doji close, would signal a shift to a more bearish outlook, potentially triggering further downside toward the 147 handle. Traders may also focus on BOJ Governor Ueda’s speech at the IMF’s “Governors Talk” session on Thursday, with any hints of a hawkish policy shift potentially adding downside pressure to the pair.

Looking ahead, USD/JPY remains vulnerable to volatility, especially as speculation around potential BOJ intervention grows. Traders are also eyeing the U.S. elections and broader geopolitical developments, which could influence risk sentiment and support safe-haven buying of the yen. The broader bullish sentiment around the dollar may keep traders interested in dip-buying opportunities near support levels until a clear break below 148.83 occurs. However, a breach of the key 152 level could spark more intense selling pressure, especially if BOJ officials become more vocal about the yen’s weakness and signal a potential rate hike in upcoming sessions.